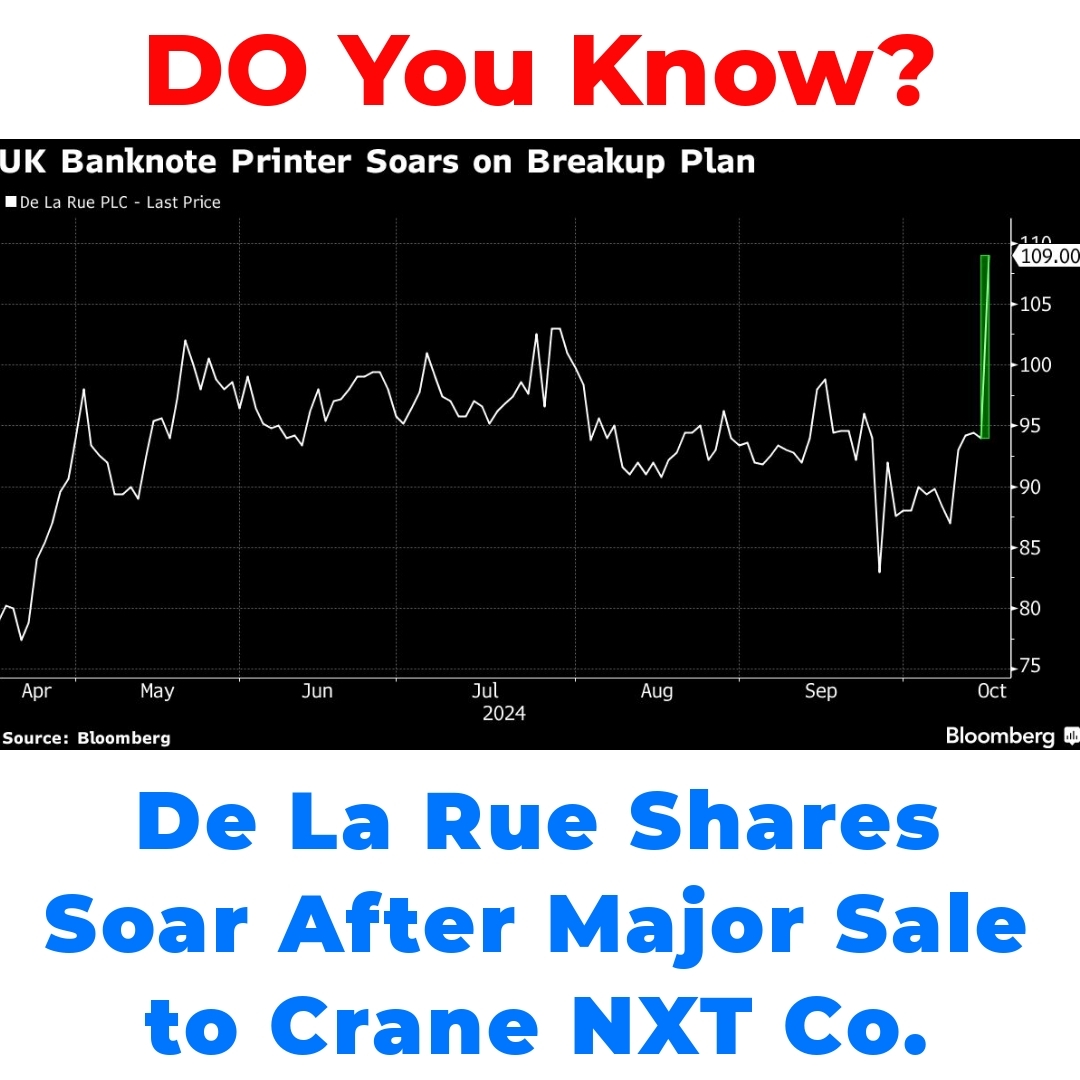

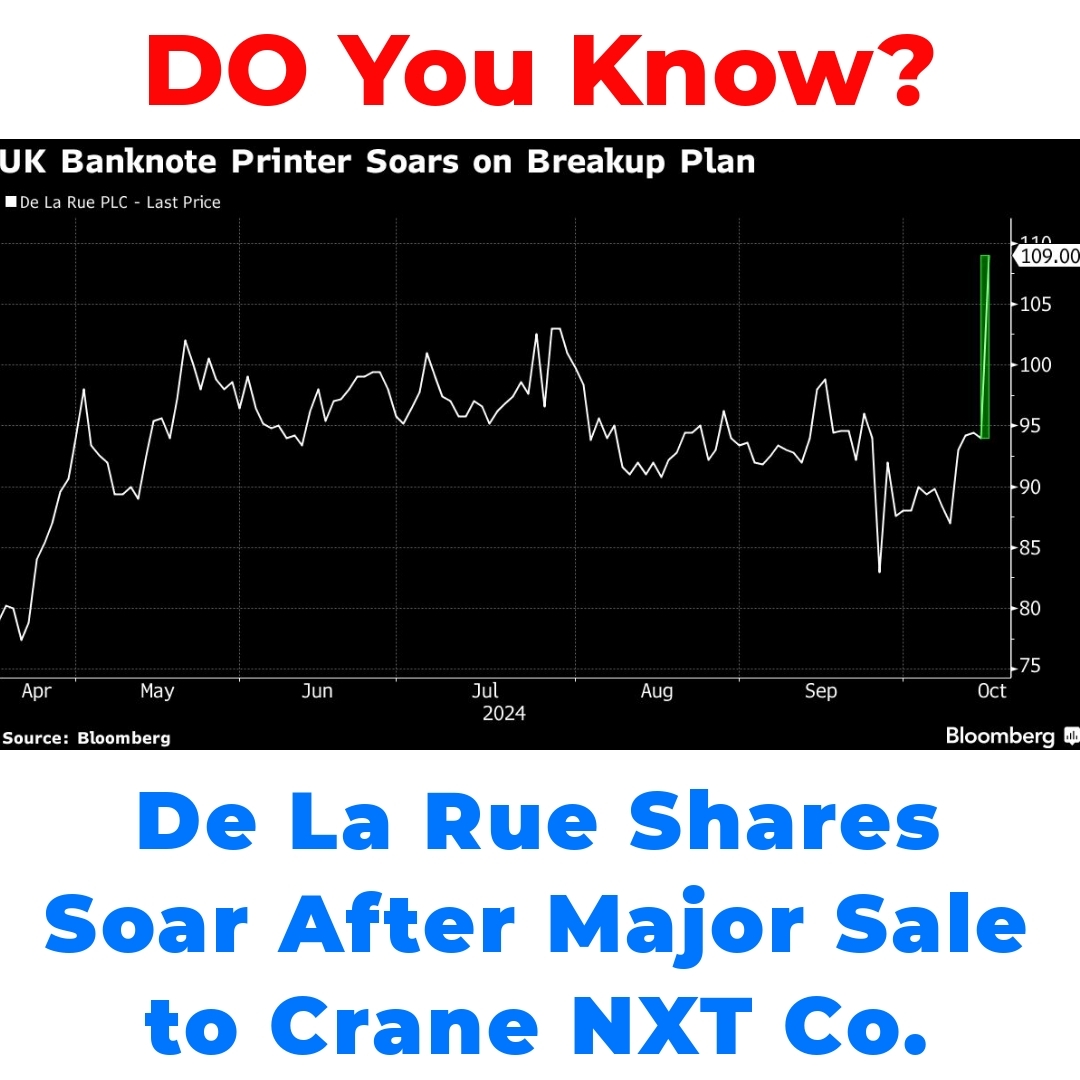

Recently, De La Rue Plc shares have experienced a remarkable surge, capturing attention across the financial landscape. This British company, renowned as a leading banknote printer, is making headlines following the strategic sale of its authentication arm to Crane NXT Co. The implications of this deal are significant for the company and its future.

The recent surge in De La Rue Plc shares has caught the attention of investors and analysts alike. As a longstanding British company and a pioneer in the banknote printing industry, De La Rue is making waves following the strategic sale of its authentication arm to Crane NXT Co. This significant move raises questions about its future and the implications for both companies involved.

The financial deal itself is worth diving into. De La Rue Plc has sold its authentication arm, a division responsible for providing high-security authentication solutions, to Crane NXT Co. The transaction is valued at approximately £XX million, a figure that underscores the strategic shift both companies are taking. For De La Rue, the sale allows them to focus more on their core competencies in banknote printing, while Crane NXT Co. aims to enhance its own portfolio in security solutions.

The motivations for this sale are rooted in a desire for growth and streamlining operations. De La Rue wants to concentrate on its strengths, particularly in the competitive banknote printing sector, where it has a notable reputation as a leading manufacturer. Meanwhile, Crane NXT Co. is looking to expand its capabilities through the acquisition, paving the way for future innovations in the authentication market.

After the announcement of this financial deal, the stock market responded enthusiastically. De La Rue Plc shares saw a significant price surge, jumping by X% within hours of the news breaking. This marked a sharp contrast to their previous performance, which had been relatively stable but lacked the momentum seen recently. Investor sentiment is clearly shifting, with many seeing the divestiture as a positive step towards a leaner, more focused company.

Many analysts have voiced their optimism regarding this corporate divestiture, suggesting that the move could open new avenues for De La Rue. When looking at historical performance metrics, this surge reflects broader market trends and a renewed interest in companies that are willing to adapt and transform in today’s fast-changing economic environment.

However, the breakup of a company with over 200 years of history carries its own implications. For De La Rue, losing its authentication arm may impact brand perception. Yet, this could also lead to a reinvigorated focus on its core banknote printing operations. Such a shift might not only streamline operations but also influence future business strategies, allowing the company to explore new markets and partnerships moving forward.

When considering the long-term financial analysis of this sale, it’s crucial to weigh its benefits against potential challenges. Selling the authentication arm puts De La Rue in a stronger position financially by reducing operational complexities and focusing resources where they are most effective. As for the market trends in both the banknote and authentication sectors, the timing of this deal seems to align well with rising demand for security-focused solutions—a savvy move for both companies involved.

Looking ahead, predictions for De La Rue Plc shares reflect a promising outlook following this sale. Analysts suggest that the share price could continue to surge in the next quarter, driven by renewed investor confidence and a clearer operational focus. The anticipation surrounding how De La Rue will leverage its core strengths has many excited about the company’s future prospects.

Finally, it’s important to consider expert opinions and market insights regarding this transaction. Industry analysts are generally positive, highlighting that De La Rue’s decision to divest from its authentication arm reflects a strategic alignment with market needs. With the banknote printing industry showing signs of resilience, experts believe this move positions De La Rue well within a competitive landscape focused on security and innovation. The authentication market, meanwhile, is expected to see growth, benefitting from Crane NXT Co.’s expanded capabilities.

In conclusion, the surge in De La Rue Plc shares following the sale to Crane NXT Co. is significant, signaling a robust response from the market. This deal not only marks a pivotal moment for De La Rue as it redefines its business strategy but also offers insights into the shifting dynamics within the banknote printing and authentication markets. Investors would do well to consider the implications of this deal as they refine their investment strategies moving forward.

Frequently Asked Questions

What recent event has affected De La Rue Plc shares?

De La Rue Plc shares surged significantly after the company announced the sale of its authentication arm to Crane NXT Co.

What is the value of the deal?

The deal is valued at approximately £XX million, reflecting a strategic shift for both companies.

Why did De La Rue choose to sell its authentication arm?

The sale allows De La Rue to focus on its core banknote printing business and streamline its operations.

How did the market react to the sale?

Investor sentiment turned positive, leading to a jump in De La Rue’s share price of X% shortly after the announcement.

What are the potential impacts on De La Rue’s future?

While the divestiture may affect brand perception, it could reinvigorate their focus on banknote printing and open new business opportunities.

How could this sale benefit De La Rue financially?

By reducing operational complexities and focusing resources on core competencies, De La Rue positions itself for better financial performance.

What is the outlook for De La Rue’s shares after this sale?

Analysts predict a promising outlook, suggesting that the share price could continue to rise in the next quarter with renewed investor confidence.

What do experts say about the future of the authentication market?

Industry analysts are optimistic about the authentication market, anticipating growth for Crane NXT Co. as it expands its capabilities.

What does this deal indicate about market trends?

The sale reflects a strategic alignment with market needs, especially with rising demand for security-focused solutions in both sectors.