The landscape of Czech banks lending is undergoing significant changes, largely driven by the recent doubling of the minimum reserve requirement mandated by the central bank. This regulatory shift aims to enhance financial stability but poses challenges for lending practices, potentially leading to restrictions and affecting bank profits. Understanding this context is crucial for assessing the future of lending in the Czech Republic.

Understanding the Minimum Reserve Requirement

The minimum reserve requirement is a crucial concept in banking that dictates how much money banks must keep in reserve and not lend out. It’s set by the central bank to ensure stability and liquidity in the financial system. In the Czech Republic, this requirement has seen adjustments over the years, reflecting changes in economic conditions and regulatory priorities. By doubling this reserve requirement recently, the central bank aims to create a buffer against economic shocks and enhance financial security.

Impacts on Czech Banks Lending

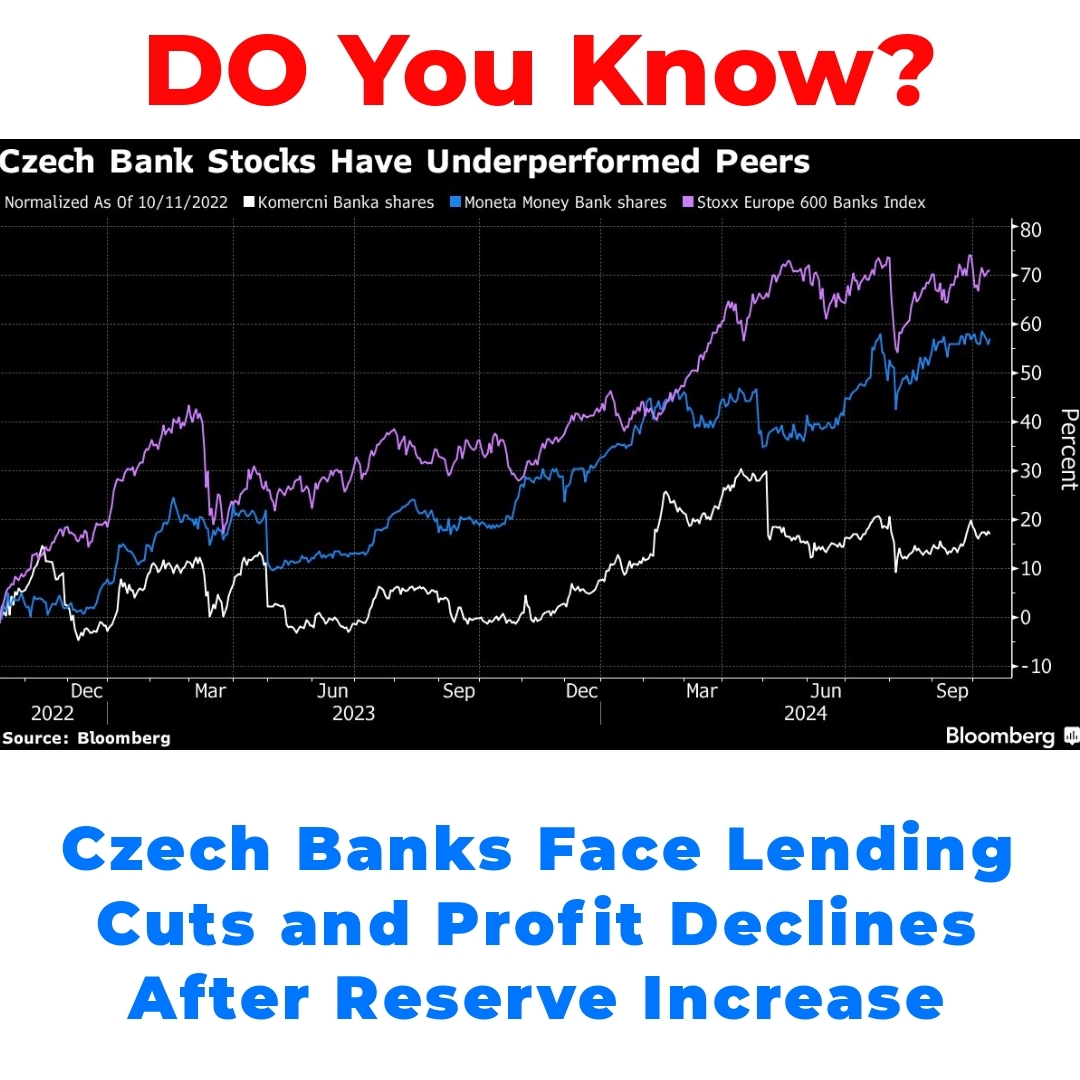

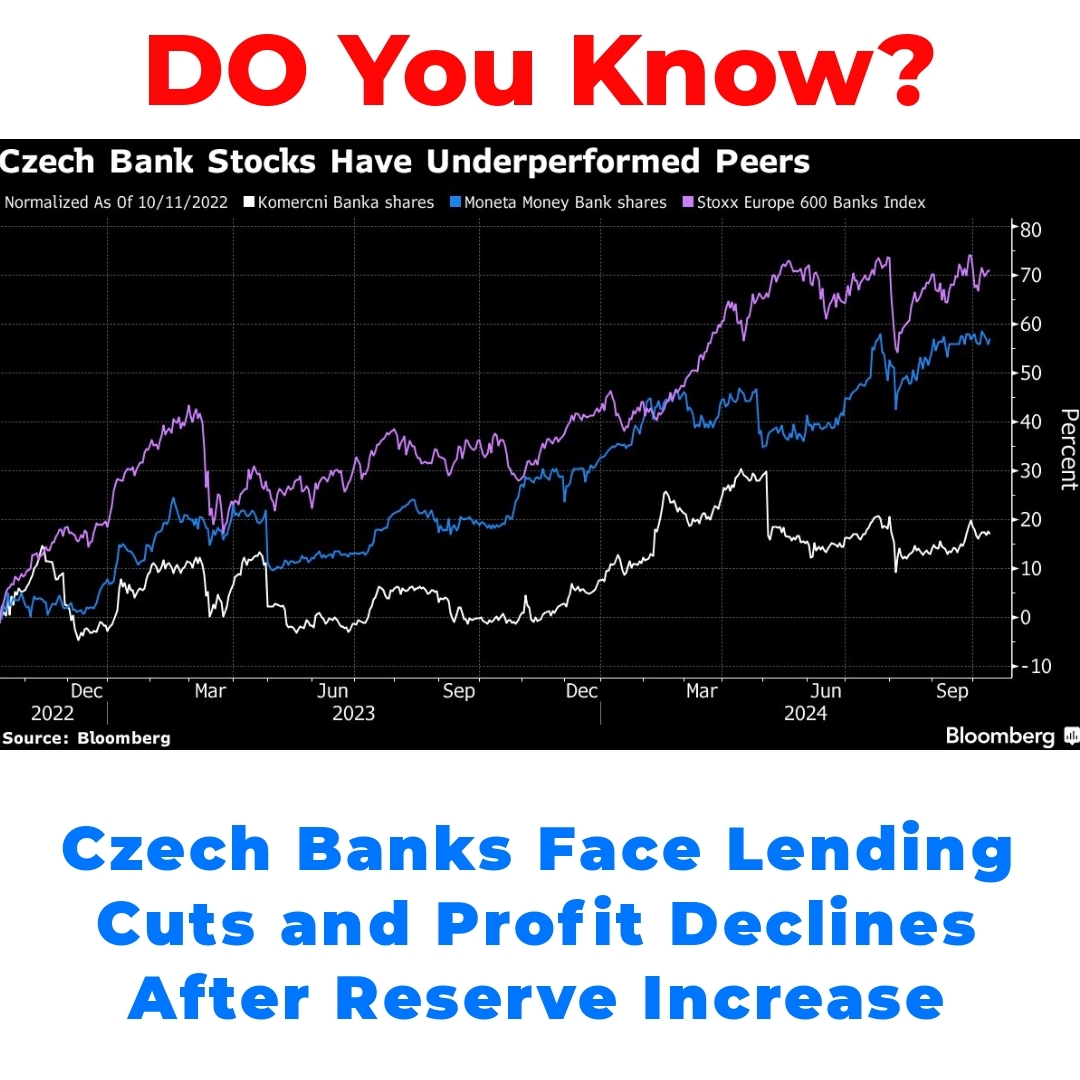

The recent changes in the minimum reserve requirement are expected to have significant effects on Czech banks lending. With more funds needed to be held in reserve, banks may face tighter liquidity. This situation could lead to lending restrictions, where banks become more cautious in granting loans. Essentially, higher reserve requirements mean that less capital is available for lending, potentially slowing down the process for businesses and individuals seeking loans.

Profit Reduction Forecast for Czech Banks

As the minimum reserve requirement increases, the forecast for profit reduction among Czech banks also grows. When banks are required to hold more money back from lending, their profit margins typically shrink. Comparatively, other countries that have implemented similar central bank policies have experienced a noticeable decrease in bank profits. The Czech banks might face a challenging financial landscape in the wake of these regulatory changes, with many analysts predicting tighter profits for the foreseeable future.

Economic Impact of Lending Restrictions

When banks restrict lending, the economic impact can extend far beyond the banking sector. Reduced lending can hinder local businesses from expanding or even managing day-to-day operations efficiently. Households might find it harder to secure loans for homes or personal expenses, leading to a slowdown in consumer spending. Consequently, the ripple effects of stricter lending standards can have broader implications for the Czech economy, potentially impacting growth rates and overall economic stability.

Future of Czech Banking: Adaptation and Strategy

In response to the minimum reserve requirement, Czech banks may need to adapt their strategies significantly. This could involve revising their lending criteria, exploring new types of loans, or enhancing risk management practices. The integration of innovation and technology may play a crucial role in helping banks navigate these challenges effectively. By leveraging technology, banks could potentially streamline their operations and mitigate the negative impacts of increased reserve requirements.

Conclusion

In summary, the recent changes in the minimum reserve requirement are set to impact Czech banks lending and their profit margins significantly. As the central bank seeks to enhance financial stability, the long-term implications for both the banking sector and the broader economy in the Czech Republic remain to be seen. Understanding the impact of the minimum reserve requirement on Czech banks is essential for navigating the evolving landscape, and banks will need to consider various recovery strategies to adapt to these new regulations.

Frequently Asked Questions (FAQ)

What is the minimum reserve requirement?

The minimum reserve requirement is a rule set by the central bank that determines how much money banks must keep on hand and not lend out. This is important for ensuring that banks have enough liquidity to meet their obligations.

Why has the minimum reserve requirement been increased in the Czech Republic?

The Czech central bank recently doubled the minimum reserve requirement to create a safety buffer against economic shocks and to enhance overall financial security in the banking system.

How does the minimum reserve requirement affect Czech banks’ lending?

With the increased reserve requirement, banks have to hold more money in reserve, which may lead to tighter liquidity. This can make banks more cautious about granting loans, potentially slowing down the lending process for both businesses and individuals.

What are the implications of reduced lending on the economy?

Reduced lending can negatively impact local businesses, making it difficult for them to expand or manage operations. Households may struggle to secure loans for homes or personal needs, leading to decreased consumer spending and potential slowdowns in economic growth.

What might be the impact on profits for Czech banks?

As banks hold more money back from lending due to the higher reserve requirement, their profit margins are expected to shrink. Many analysts predict that Czech banks will face tighter profits in the future, similar to experiences in other countries with similar policies.

How can Czech banks adapt to these changes?

Czech banks may need to revise their lending criteria, explore new loan types, and enhance risk management practices. The use of technology and innovation will likely play a significant role in helping banks cope with the challenges arising from increased reserve requirements.