The banking industry is constantly evolving, presenting both challenges and opportunities for major financial institutions. This article delves into the Commerzbank takeover, focusing on Commerzbank AG’s strategic planning as it anticipates a potential acquisition by UniCredit SpA. Understanding the implications of this situation is crucial for stakeholders in the financial sector.

Understanding Commerzbank AG’s Current Position

Currently, Commerzbank AG holds a significant position in the financial services sector. With a network reaching across Europe and a client base that includes both individuals and businesses, Commerzbank plays a vital role in the banking landscape. However, like many banks, it faces several challenges. These include tighter regulations, fierce market competition, and changing customer preferences.

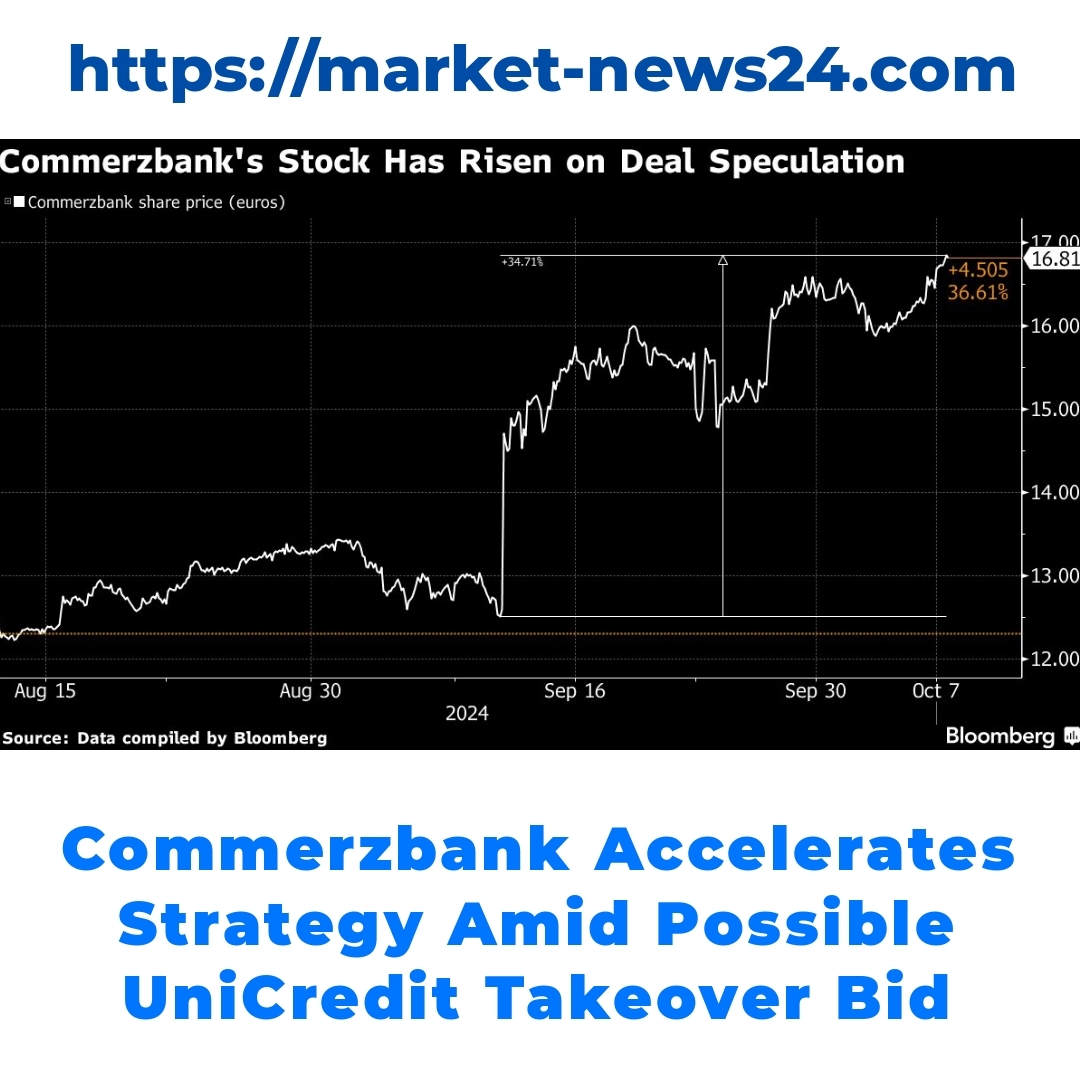

Strategic planning is essential for banks, especially in the atmosphere of corporate acquisitions. Commerzbank AG needs to ensure it has a clear roadmap not only to maintain its market standing but also to navigate potential takeover scenarios effectively. In this context, the idea of a Commerzbank takeover by a rival, such as UniCredit SpA, becomes increasingly relevant.

The Role of UniCredit SpA in the Potential Takeover

Turning our focus to UniCredit SpA, it is important to recognize its prominence within the banking industry. This Italian bank has been expanding its operations, making it a significant player in the European financial market. With its interest in a Commerzbank takeover, UniCredit could significantly alter the future of Commerzbank.

UniCredit’s motivations behind this potential takeover could stem from several factors. They might want to enhance their market share or penetrate different regions within Europe. Additionally, acquiring Commerzbank could provide them with valuable assets and a broader customer base, all of which might be part of their long-term growth strategy.

Strategic Planning at Commerzbank AG

When discussing the Commerzbank takeover, it’s crucial to explore how Commerzbank AG is preparing for potential takeover scenarios through strategic planning. The bank has been deploying various strategies to strengthen its position against rivals like UniCredit SpA.

Some key strategies include:

– **Cost Management:** Commerzbank has focused on streamlining operations and reducing costs to improve profitability.

– **Digital Transformation:** Investing in technology to enhance customer experience and operational efficiency has become a priority.

– **Customer Engagement:** Developing more tailored products and services to meet diverse customer needs is another strategy.

With these strategies, Commerzbank aims to not only bolster its defenses against potential acquisitions but also to remain competitive in an ever-evolving banking environment.

Implications of a UniCredit Takeover on Commerzbank

Now, let’s explore what a UniCredit takeover could mean for Commerzbank. The potential effects are multifaceted, influencing everything from operational structures to market presence.

If UniCredit successfully acquires Commerzbank, several outcomes could unfold:

– **Operational Changes:** Integration of the two banks may lead to operational efficiencies or disruptions.

– **Customer Relations:** There could be a shift in how customers perceive the brand, which may affect loyalty and trust.

– **Product Offerings:** A combined entity might either expand or narrow the range of products offered, which could be advantageous or detrimental to existing customers.

However, such a takeover could also present significant risks and opportunities. While there’s potential for market growth and improved resources, challenges like cultural integration and maintaining customer trust will be critical.

Conclusion

To wrap things up, the implications of the Commerzbank takeover are far-reaching, not just for the banks involved but for the entire banking industry. It’s a scenario that calls for informed strategic planning from Commerzbank AG, especially as UniCredit SpA expresses interest in the acquisition.

In navigating these waters, Commerzbank must remain agile and ready to adapt to the competitive pressures and complexities of a potential takeover. As we’ve seen, strategic planning is not just essential; it’s a lifeline in ensuring stability and success, should they face the reality of a Commerzbank takeover.

The financial landscape is ever-changing, and how Commerzbank maneuvers in light of these developments will inevitably shape its future in the financial services sector.

FAQ

What is Commerzbank AG’s current position in the financial sector?

Commerzbank AG holds a significant position in the financial services sector, with a broad network across Europe serving a diverse client base of individuals and businesses. However, it faces challenges such as tighter regulations, stiff competition, and shifting customer preferences.

What are the key strategies Commerzbank AG is implementing to strengthen its position?

- Cost Management: Streamlining operations and reducing costs to boost profitability.

- Digital Transformation: Investing in technology to improve customer experience and operational efficiency.

- Customer Engagement: Creating tailored products and services to meet a variety of customer needs.

What role does UniCredit SpA play in the potential takeover of Commerzbank?

UniCredit SpA is interested in acquiring Commerzbank, which could significantly affect Commerzbank’s future. This interest might come from UniCredit’s aim to increase market share and gain access to new regions and valuable assets.

What could happen if UniCredit successfully acquires Commerzbank?

- Operational Changes: There may be operational efficiencies or disruptions due to integration.

- Customer Relations: Perception of the brand might change, impacting customer loyalty and trust.

- Product Offerings: The range of products available could expand or narrow, which could benefit or disadvantage current customers.

What are the risks and opportunities associated with a potential takeover?

A takeover could present market growth and improved resources, but also challenges like cultural integration and maintaining customer trust. The outcome will depend on how well these aspects are managed.