The landscape of Chinese stocks has seen significant changes, with a notable rally fueled by investor optimism. Recent stimulus measures from Beijing have impacted sentiment positively, leading to a surge in investments. Exchange-traded funds (ETFs) have attracted record inflows, reflecting growing interest in this dynamic market.

The State of Chinese Stocks

The current trends in Chinese stocks show a fascinating picture. Over the past few months, we’ve seen a remarkable stock market rally that has captured the interest of many investors. This rally is significant, as it reflects a strong turnaround in sentiment. Thanks to a combination of positive economic indicators and renewed investor optimism, there’s been a bullish sentiment driving the market forward. Investors are feeling more confident as they look toward the future, and this is boosting the performance of Chinese stocks across the board.

Record Inflows into Exchange-Traded Funds (ETFs)

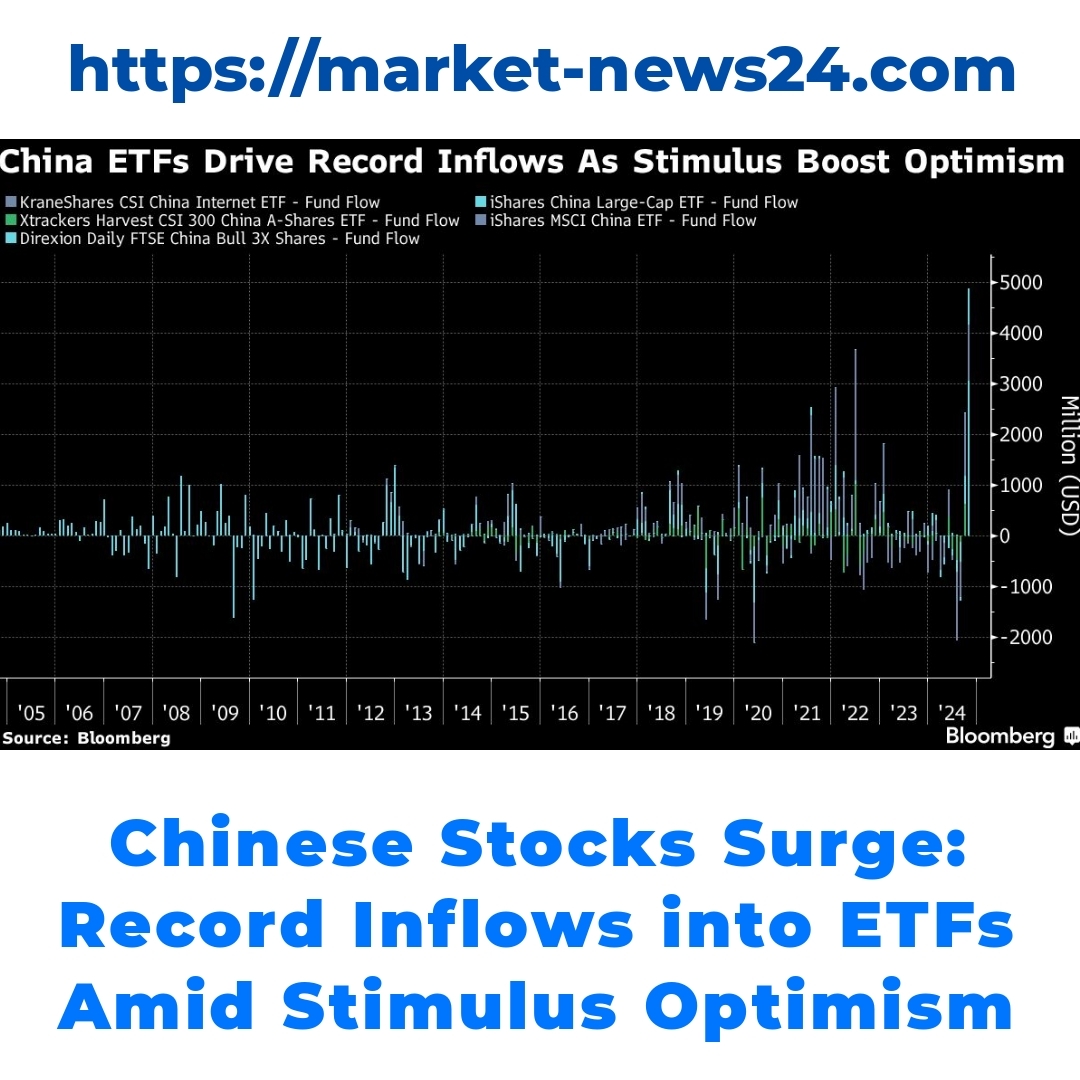

Now, let’s talk about exchange-traded funds, often referred to as ETFs. These are investment funds that are traded on stock exchanges, similar to individual stocks. They allow investors to gain exposure to a basket of assets, which can be a smart way to diversify their holdings. Recently, we’ve seen record inflows into key Chinese stock ETFs, and that’s something worth noting.

Statistics show that inflows have reached impressive levels, with billions of dollars pouring into these funds. Some of the leading funds attracting significant investments include well-known ETFs that focus specifically on Chinese equity markets. The interest in these funds highlights how investors are eager to tap into the potential of Chinese stocks.

The Role of Beijing’s Stimulus Measures

When we look at what’s driving this positive momentum, Beijing’s stimulus measures come into play. The government has implemented a series of policies aimed at boosting the economy, and these measures are having the intended effect. By supporting various sectors and providing liquidity, these policies are encouraging capital inflow into Chinese stocks.

There’s a clear correlation between these stimulus initiatives and the recent stock market upswing. Investors are responding to the proactive steps taken by Beijing, which in turn is reinforcing their bullish sentiment toward Chinese stocks.

Investing in Chinese Stocks through ETFs

For those considering how to invest in Chinese stocks, utilizing exchange-traded funds can be a smart strategy. One of the biggest benefits of using ETFs is that they provide a simple way to gain exposure to the Chinese market without needing to pick individual stocks.

However, it’s important to be aware of the risks and considerations involved. While there’s great potential, the market can also be volatile. Investors should carefully research and stay informed about the economic landscape, including any changes in Beijing’s policies or shifts in investor sentiment.

The Future Outlook for Chinese Stocks

Looking ahead, many experts are optimistic about the future of Chinese stocks. Predictions suggest that if current trends continue and the government maintains its supportive policies, we could see even more growth. However, potential challenges remain, including global economic factors and domestic issues that could impact the market.

Anticipating these challenges is essential for investors looking to navigate the landscape of Chinese stocks effectively. Staying informed will be crucial to making the right investment decisions moving forward.

Conclusion

In conclusion, there’s a compelling interplay happening between Beijing’s stimulus measures, rising investor optimism, and the growing popularity of exchange-traded funds. As we see record inflows into these ETFs and a positive market outlook, it’s clear that opportunities in Chinese stocks are becoming increasingly attractive.

For anyone interested in investing, now could be a prime time to consider the potential within this dynamic market. Being proactive and informed can lead to great opportunities as conditions evolve.

Call to Action

To keep up with the latest trends in financial markets, especially regarding Chinese stocks and ETFs, make sure to stay informed. Subscribe for updates on investment funds and market analysis, and dive into the exciting world of investing in Chinese stocks.

FAQ Section

What factors are contributing to the recent rally in Chinese stocks?

The rally in Chinese stocks is primarily due to:

- Positive economic indicators

- Renewed investor optimism

- Government stimulus measures designed to support the economy

What are exchange-traded funds (ETFs)? How are they relevant to Chinese stocks?

ETFs are investment funds that trade on stock exchanges like individual stocks. They allow investors to diversify their portfolios by gaining exposure to a variety of assets, including Chinese stocks. Recently, key Chinese stock ETFs have seen record inflows, indicating strong interest from investors.

How have Beijing’s stimulus measures influenced the stock market?

Beijing’s stimulus measures have been crucial in boosting the economy, which in turn has positively affected investor sentiment. These policies support various sectors, encouraging capital inflow into Chinese stocks and contributing to the recent market upswing.

What are the risks of investing in Chinese stocks through ETFs?

While investing in ETFs can provide exposure to the Chinese market, risks include:

- Market volatility

- Changes in government policies

- Shifts in global economic conditions

What is the outlook for Chinese stocks in the future?

Experts are generally optimistic about the future of Chinese stocks, anticipating growth if current trends and supportive government policies continue. However, investors should stay informed about potential challenges that could affect the market.

How can investors stay updated on Chinese stocks and ETFs?

Investors can keep up with the latest trends by:

- Subscribing to financial news platforms

- Following market analysis reports

- Engaging in investment forums and communities