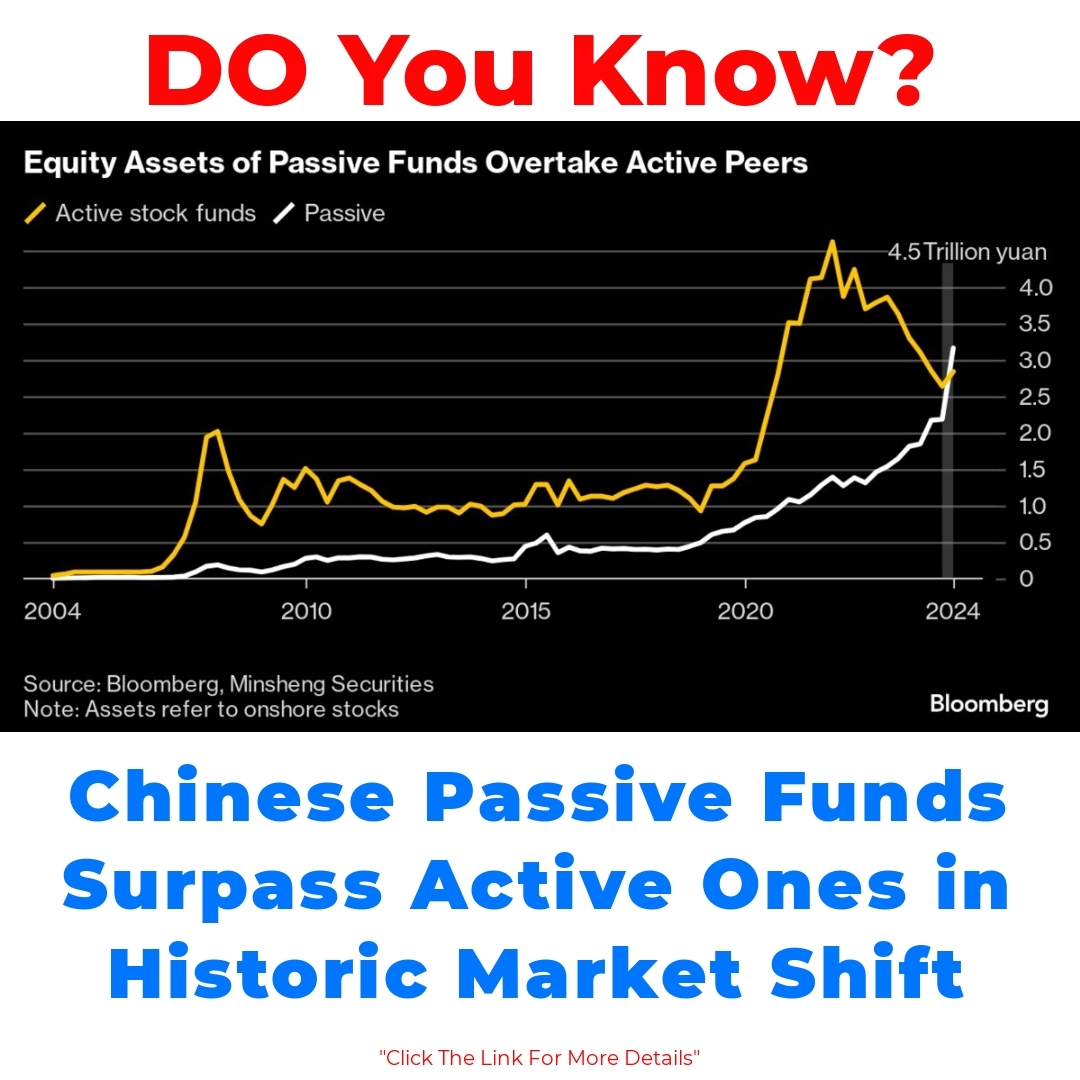

The Chinese stock market has witnessed remarkable growth, becoming a pivotal player in global finance. A significant milestone has been reached, as passive funds have now surpassed actively-managed peers in this evolving landscape. Understanding this shift in investment strategies is crucial for navigating the future of Chinese stocks and global investment trends.

Understanding Passive Funds vs. Actively-Managed Peers

When we talk about investment strategies, it’s essential to understand the difference between passive funds and actively-managed peers. Passive funds are investment funds that aim to replicate the performance of a specific index. They typically involve less active management, which means lower costs and fees for investors. In contrast, actively-managed peers have fund managers who make specific investment decisions to try and beat the market.

One key difference here is in their performance and costs. Passive funds usually have lower fees because they don’t require extensive research or trading like actively-managed funds do. Over time, lower fees can lead to better net returns for investors. Now, when it comes to **Chinese stocks**, both types of funds are increasingly recognizing the unique opportunities that this dynamic market has to offer, making it crucial for investors to weigh their options carefully.

The Growth of Passive Funds in China

In recent years, the growth of passive funds in China has been nothing short of remarkable. Reports indicate that the total assets managed by passive funds have surged significantly, reflecting a change in investor preferences. For example, in 2019, passive funds accounted for just a small fraction of the market, but by 2023, that number has grown dramatically.

Several factors are fueling this growth. Investors are becoming more cost-conscious, seeking out options that offer better returns without the hefty fees associated with active management. Additionally, as **global passive investment** trends gain traction, Chinese investors are following suit, embracing the advantages that passive funds provide in terms of diversification and ease of management.

Market Trends in China: A Shift Towards Passive Management

As we delve into market trends in China, it’s evident that a significant shift toward passive management is underway. This transition is reshaping the dynamics of the Chinese stock market and influencing how investors approach their strategies. With more investors opting for passive funds, we’re seeing a growing confidence in the stability and potential of **Chinese stocks**.

This shift isn’t just about convenience; it represents a deeper change in investor mindset. People are beginning to recognize the long-term benefits of passive investing, and this is having a substantial impact on market behavior. As institutions and individual investors alike steer their money into passive funds, we can expect a ripple effect throughout the market, leading to increased stability and potentially reduced volatility in **Chinese stocks**.

Comparison of Passive and Active Fund Performance in China

Now let’s look into how passive funds stack up against actively-managed peers in terms of performance specifically in the context of **Chinese stocks**. Studies have shown that while actively-managed funds may outperform in certain conditions, many passive funds have delivered competitive or even superior returns over the long term.

For instance, a notable case is the growth of exchange-traded funds (ETFs) focused on **Chinese stocks**. These ETFs have provided particularly impressive returns, indicating that passive strategies can indeed thrive in the rapidly changing Chinese market. Experts believe this trend will continue as more investors seek out low-cost options that can still provide satisfactory returns without requiring constant management.

The Impact of Passive Management on the Chinese Stock Market

The rise of passive management has significant implications for the Chinese stock market, particularly regarding liquidity and volatility. As more funds join the passive investing wave, there’s potential for enhanced market liquidity. This influx of capital can lead to more stable prices, crucial for long-term investors.

Moreover, the impact on corporate governance and investment behaviors is another area worth considering. Passive funds usually require less active engagement in terms of shareholder activism compared to actively-managed peers. Therefore, this could influence how companies on the Chinese stock market align their strategies, potentially affecting long-term growth and innovation.

Conclusion

In summary, the rise of passive funds in China marks an exciting shift in the investment landscape. As these funds continue to gain popularity, they are reshaping how investors approach **Chinese stocks** and influencing broader market dynamics. This trend speaks to a growing recognition of the benefits that passive investing can offer, not just in terms of cost-effectiveness but also in aligning with global investment trends.

Looking ahead, it’s clear that passive funds are set to play an increasingly pivotal role in the investment landscape of Chinese stocks. For investors, staying informed on these ongoing trends and strategies will be crucial for navigating this evolving market. Embracing this shift could unlock new opportunities in the journey of investment.

Additional Resources

For those interested in further reading on the topic, here are some valuable resources and studies that provide deeper insights into **global passive investment** and its impacts across different markets:

– [Study on the Impact of Passive Funds Globally](#)

– [Article on Investment Strategies for Chinese Stocks](#)

Exploring these resources will not only enhance your understanding of passive investing but also help you navigate the complex world of **Chinese stocks** more effectively.

FAQ

What are passive funds?

Passive funds are investment funds that aim to replicate the performance of a specific index. They require less active management, resulting in lower costs and fees for investors.

How do actively-managed funds differ from passive funds?

Actively-managed funds have fund managers who make specific investment decisions with the goal of beating the market. This typically involves higher fees due to the extensive research and trading required.

What are the performance differences between passive and active funds in China?

While actively-managed funds may outperform in certain conditions, many passive funds have provided competitive or even superior returns over the long term, especially in the context of Chinese stocks.

Why are passive funds gaining popularity in China?

- Investors are becoming more cost-conscious and are seeking lower fees.

- The global trend towards passive investment is influencing Chinese investors.

- Passive funds offer diversification and ease of management.

What impact do passive funds have on the Chinese stock market?

The rise of passive management can enhance market liquidity and lead to more stable prices. Additionally, the lower level of shareholder engagement required from passive funds could influence company strategies and long-term innovation.

How have exchange-traded funds (ETFs) performed in the context of Chinese stocks?

ETFs focused on Chinese stocks have provided impressive returns, showcasing that passive strategies can thrive in this rapidly changing market.

What should investors keep in mind regarding the ongoing trends in passive investing?

Investors should stay informed about the growth of passive funds and how they are reshaping the landscape of Chinese stocks. Embracing this trend could unlock new investment opportunities.