China’s fiscal stimulus plays a crucial role in addressing current economic challenges and fostering recovery. As the country faces various obstacles, the implementation of robust fiscal policies is essential for boosting economic confidence, increasing government spending, and driving sustainable growth. This article explores the significance and impact of China’s fiscal measures.

Understanding China’s Fiscal Policy

China’s fiscal policy encompasses various government strategies and measures aimed at managing the economy effectively. Essentially, this policy involves the government’s use of spending and taxation to influence overall economic activity. Historically, China has implemented fiscal stimulus packages to jumpstart growth during challenging times.

In prior years, we witnessed significant fiscal stimuli, particularly during the 2008 global financial crisis. At that time, the Chinese government introduced a massive 4 trillion yuan package, which significantly boosted infrastructure projects and consumer spending. This approach not only helped stabilize China’s economy but also laid the groundwork for sustained growth in the following years.

The Scale of the Current Fiscal Stimulus

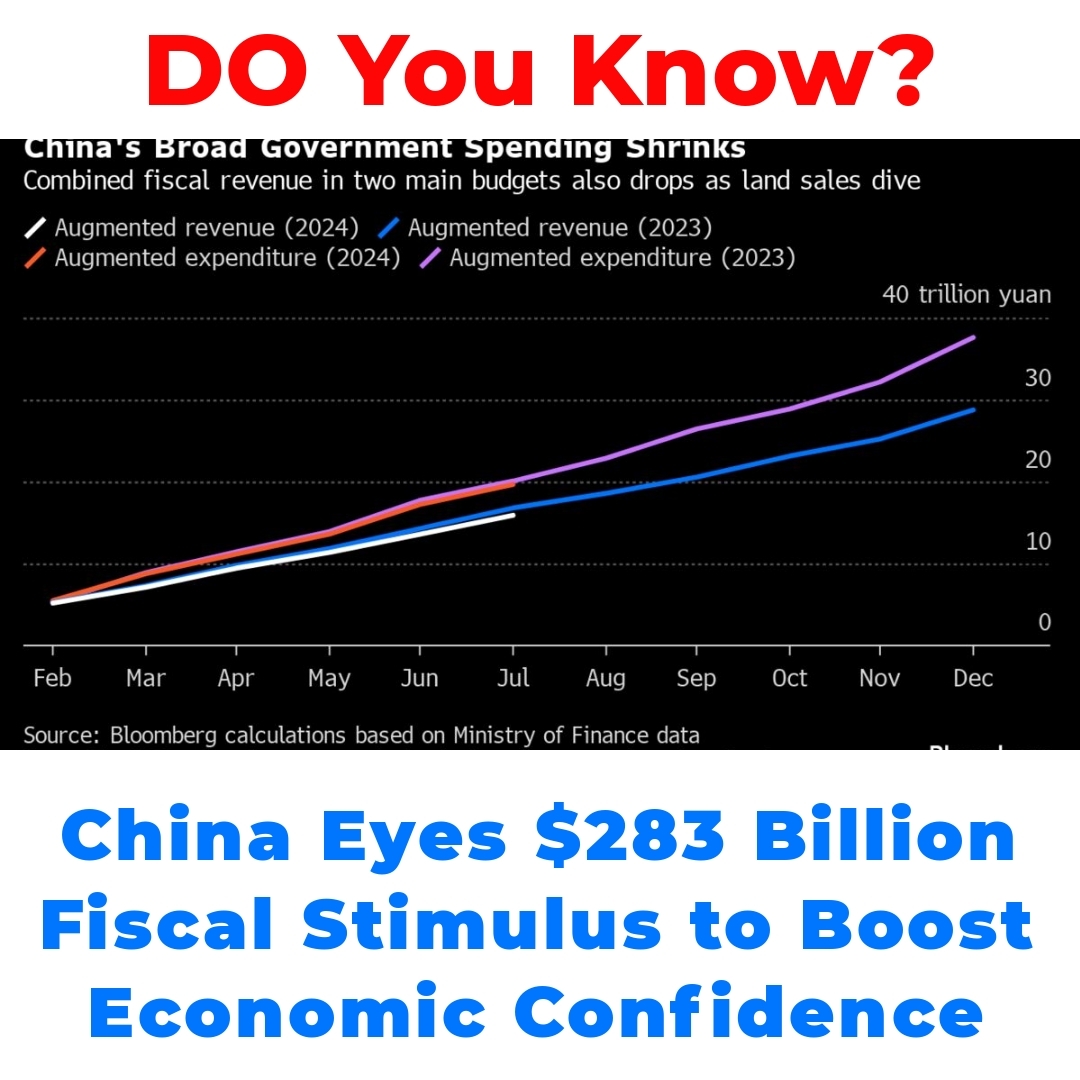

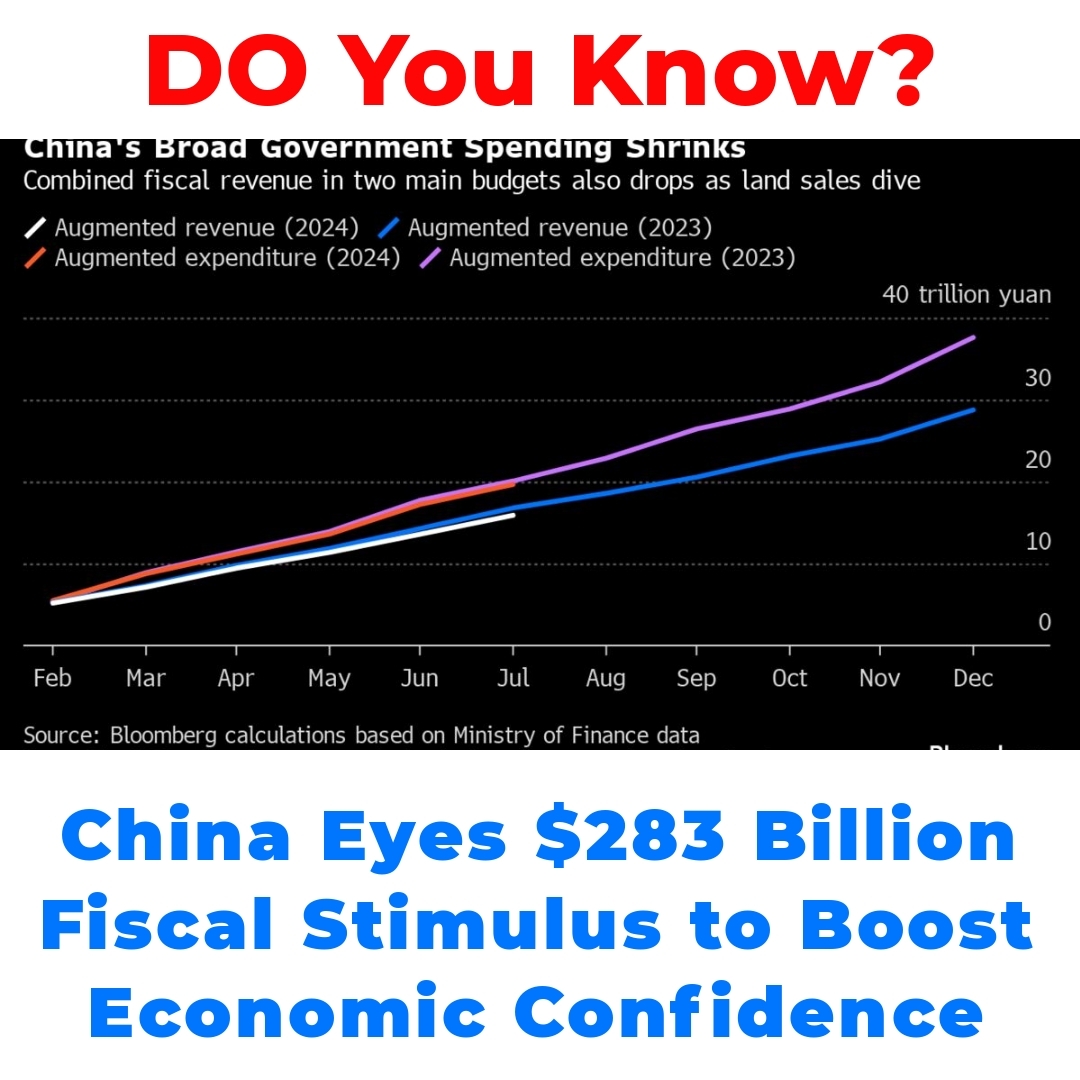

Recently, China announced an ambitious fiscal stimulus plan with a staggering 2 trillion yuan, equivalent to about $283 billion. This substantial package is designed to address the pressing economic challenges faced by the nation. The proposed government spending will focus on several key areas, including infrastructure development, healthcare improvements, and support for small and medium-sized enterprises.

Here’s a quick breakdown of the proposed government spending in China:

– Infrastructure projects: Expanding roads, railways, and urban development.

– Healthcare enhancements: Investments to improve healthcare facilities and services.

– Support for businesses: Financial assistance programs for small and medium enterprises.

This fiscal stimulus represents a proactive approach, showcasing China’s determination to revive its economy.

Objectives of China’s Fiscal Stimulus

The main objective of China’s fiscal stimulus is to strengthen economic confidence in China. By injecting capital into the economy, the government hopes to assure citizens and investors alike that it is committed to fostering economic growth despite global uncertainties. This stimulus is crucial for preventing a potential slowdown in investment in China, thereby keeping momentum alive in the domestic market.

Furthermore, the stimulus aims to stimulate consumer spending and encourage businesses to invest in growth. With additional funds flowing into the economy, confidence levels among consumers and investors are expected to rise, leading to increased economic activity.

Expected Outcomes of the Fiscal Stimulus

So, what can we expect from this 2 trillion yuan fiscal stimulus? The anticipated outcomes are significant for the Chinese economy. First and foremost, we expect a considerable boost in economic activity across various sectors, from manufacturing to services.

Here are some of the projected effects:

– Increased employment rates as businesses expand.

– A rise in consumer confidence, leading to higher spending.

– Revival of investment in infrastructure projects.

Overall, the expected outcomes of this fiscal stimulus hold the promise of revitalizing China’s economy and paving the way for sustainable growth moving forward.

Impact on Global Economy

China’s fiscal stimulus doesn’t just affect its own economy. The impact of China’s fiscal stimulus on the global economy is substantial. As one of the world’s largest economies, changes in China inevitably resonate around the globe. Increased Chinese consumer demand can lead to a surge in imports, which benefits exporting countries.

Moreover, this stimulus is likely to create a ripple effect in trade and investment dynamics worldwide, boosting economies that rely on Chinese demand for their goods and services. Countries that export raw materials and machinery can expect increased orders as China ramps up its manufacturing and construction activities.

Implications for Investors

For investors, understanding how China’s new stimulus package affects the market is vital. The fiscal stimulus is likely to create sector-specific impacts, offering diverse investment opportunities. For instance:

– Infrastructure and construction sectors may see significant growth due to increased government spending.

– Technology and healthcare industries could also stand to benefit from enhanced funding and support.

By keeping an eye on these key areas, investors can strategically position themselves to capitalize on opportunities arising from this economic recovery.

China’s Strategy for Economic Recovery Through Fiscal Measures

China’s strategy for economic recovery through fiscal measures hinges on balancing short-term relief with long-term growth initiatives. The government understands that quick fixes are not enough; a sustainable model must be in place to ensure continued progress.

This involves prioritizing investments in innovation and development while also providing immediate stimulus to struggling sectors. By focusing on both aspects, China aims to create a robust framework that supports immediate recovery and encourages ongoing economic expansion.

Conclusion

In conclusion, the pivotal role of China’s fiscal stimulus in shaping the economic landscape cannot be understated. With a comprehensive strategy in place, this stimulus is poised to bolster economic confidence, drive economic recovery in China, and influence the global economy significantly. The future prospects for economic recovery in China and beyond look optimistic, especially with the implementation of robust fiscal measures.

Call to Action

Stay informed about fiscal policies and investment strategies related to China’s ongoing economic recovery efforts. Keeping up with these developments will empower you to make well-informed decisions in an ever-evolving economic landscape.

What is China’s fiscal policy?

China’s fiscal policy includes government strategies to manage the economy through spending and taxation. It aims to influence overall economic activity, often using fiscal stimulus packages during challenging economic times.

What was the 4 trillion yuan stimulus package?

This package was introduced during the 2008 global financial crisis to boost infrastructure projects and consumer spending, stabilizing China’s economy and promoting growth in subsequent years.

What is the current fiscal stimulus plan?

The current fiscal stimulus plan includes a 2 trillion yuan package (around $283 billion) aimed at addressing economic challenges. Key focus areas are:

- Infrastructure development

- Healthcare improvements

- Support for small and medium-sized enterprises

What are the objectives of this fiscal stimulus?

The main goals include:

- Strengthening economic confidence

- Stimulating consumer spending

- Encouraging business investment

What outcomes can we expect from the fiscal stimulus?

Some expected outcomes include:

- Increased employment rates

- A rise in consumer confidence and spending

- Revived investment in infrastructure

How will this stimulus affect the global economy?

China’s fiscal stimulus can significantly impact the global economy, including:

- Increased Chinese consumer demand leading to higher imports

- Ripple effects on trade and investment dynamics

- Boosted economies that rely on Chinese demand

What are the implications for investors?

Investors should note sector-specific impacts, such as:

- Growth in infrastructure and construction sectors due to increased spending

- Benefits for technology and healthcare industries from enhanced funding

What is China’s strategy for economic recovery?

China’s strategy combines short-term relief with long-term growth, focusing on:

- Investments in innovation and development

- Immediate stimulus for struggling sectors