The landscape of investments is evolving rapidly, with China ETFs emerging as a prominent player. As gateways to capitalize on the robust Chinese market, these funds have attracted billions from both domestic and foreign investors. Understanding the surge of interest in China ETFs is essential for savvy investors today.

Factors Driving Investments in China

Economic Stability and Growth

Chinese economic growth is a significant factor that’s attracting interest from various sectors. With a consistent increase in GDP and robust industrial growth, the appeal of China’s economy remains strong. Recent statistics show that China is expected to continue growing, which positions it as a hotbed for investment opportunities. Investors from around the globe are recognizing that tapping into this market can lead to substantial returns. The promise of high growth rates motivates both individual and institutional investors to explore the potential within China ETFs.

Increased Market Access

Another driver behind the surge in investments in China is increased market access. Recent government policies have made it much easier for foreign and domestic investors to participate in the Chinese market. Initiatives aimed at relaxing restrictions and enhancing transparency have opened the gates for more robust investment options. This shift has led to a more vibrant and diverse investment landscape, further encouraging interest in China ETFs.

Domestic vs. Foreign Investments in China

Overview of Domestic Investments in China

Domestic investments in China have significantly surged, with many local investors turning to China ETFs as a preferred investment vehicle. This growing market participation illustrates a shift in investor behavior, as more individuals seek to leverage the opportunities presented by the expanding Chinese economy. As investors become more educated about ETFs, they start recognizing the potential benefits, translating into higher investments in China ETFs.

The Rise of Foreign Investments in China

On the other hand, foreign investments in China are also on the rise. International investors are looking to diversify their portfolios, and what better way to do it than through China ETFs? The combination of strong economic indicators and favorable investment conditions makes China a lucrative option for those outside its borders. By expanding their investment horizons, foreign investors are tapping into the unique market opportunities that China ETFs offer.

ETF Performance in China

Analyzing Current Trends

The performance of various China ETFs has been trending positively, reflecting strong underlying market dynamics and investor confidence. As investors review the ETF performance in China, they’re greeted with diverse options that cater to different investment strategies. Certain sectors, particularly technology and consumer goods, have seen substantial gains, indicating strong interest from both domestic and foreign markets in these areas. Understanding these trends is essential for making informed investment decisions.

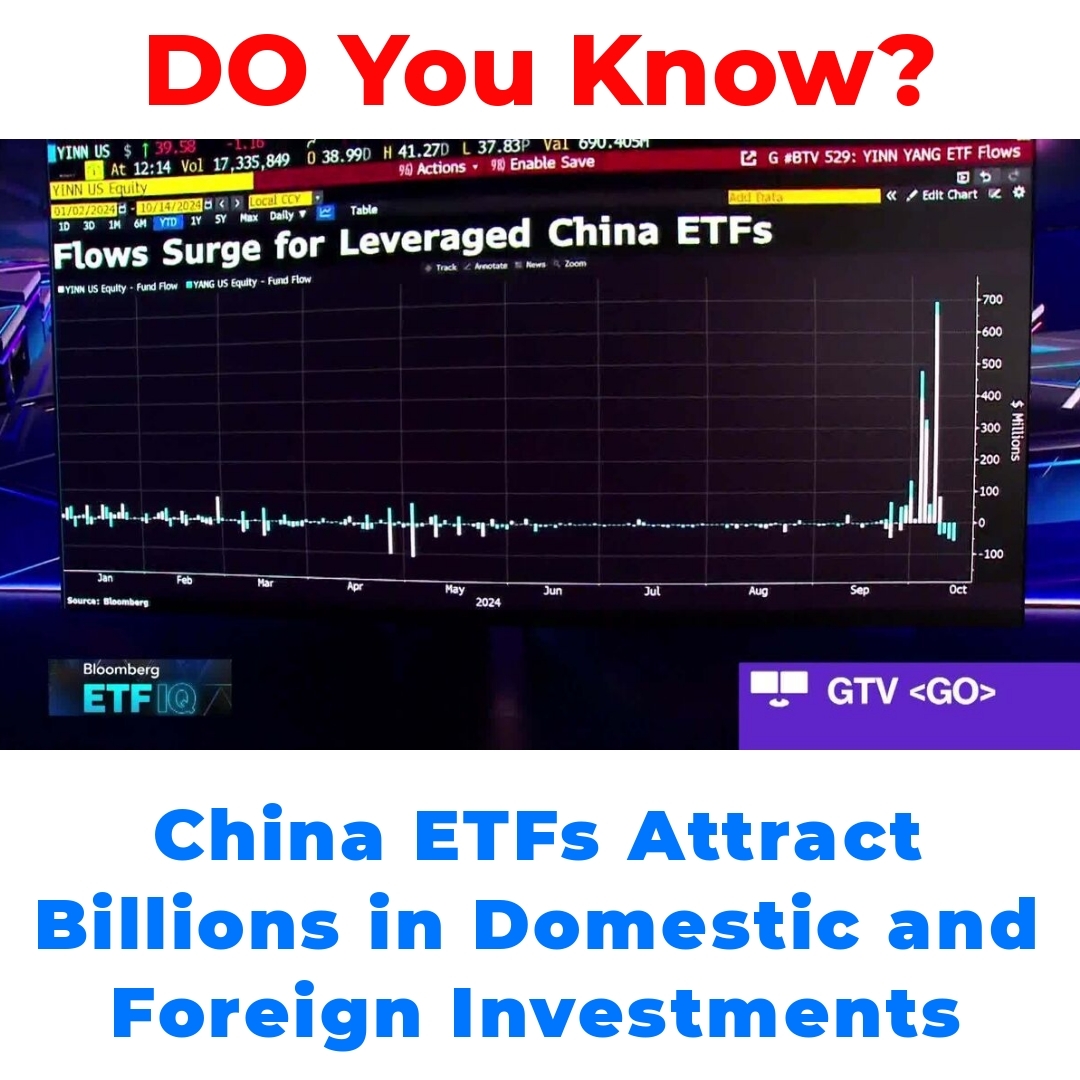

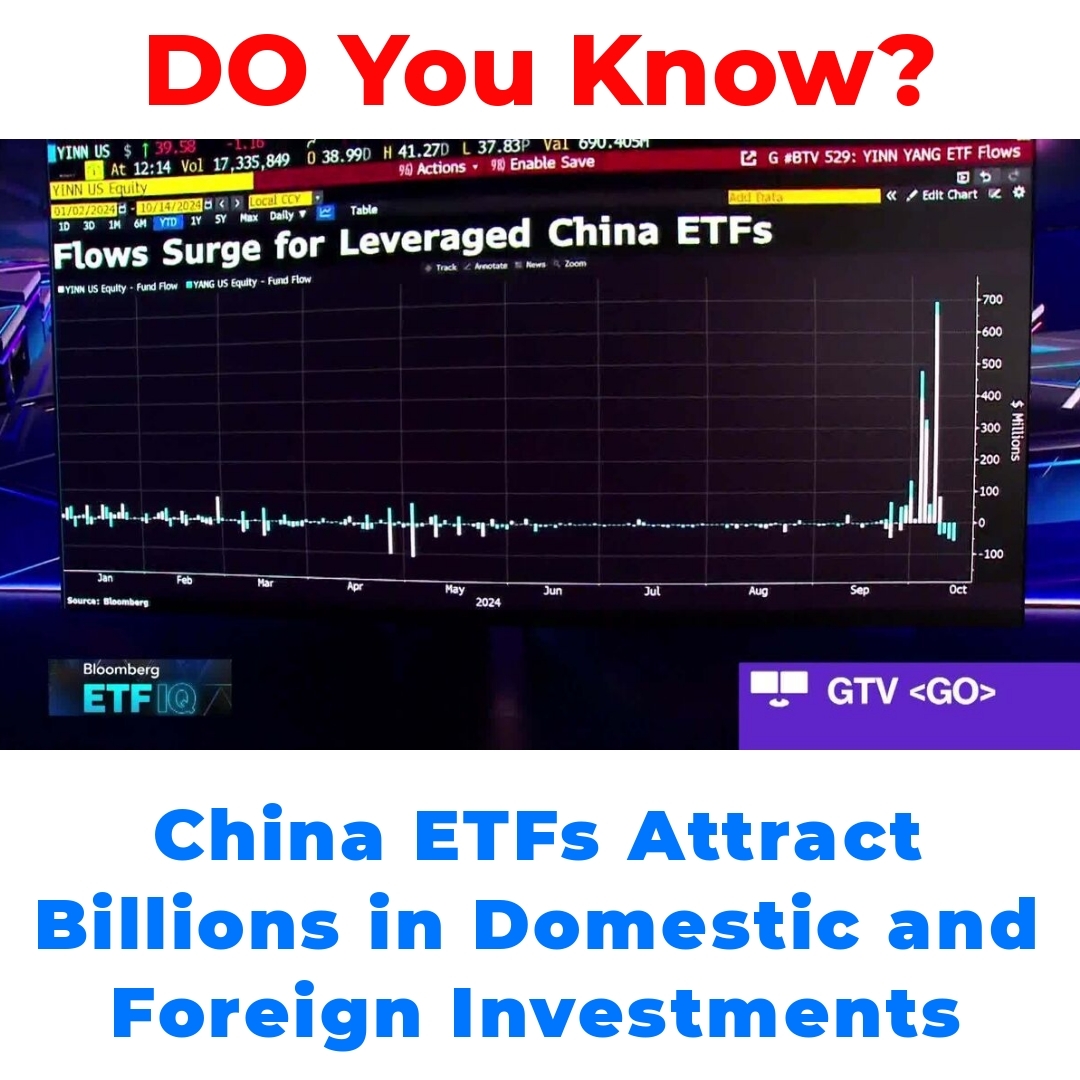

Capital Inflows into China

Recent capital inflows into the China stock market have been substantial, contributing to the overall growth of ETFs. With increasing interest from investors around the world, the influx of capital has bolstered market performance, translating into higher real returns for ETF investors. This positive sentiment can help sustain the momentum for China ETFs, making them an attractive choice for those looking to invest.

Strategies for Investing in China ETFs

Understanding Market Dynamics

For investors looking to harness market opportunities, understanding market dynamics is crucial. Monitoring China’s economic indicators, policies, and sector performance can guide investment strategies effectively. Keeping a watch on consumer trends and corporate earnings within China can also provide valuable insights into when to enter or exit the market. Developing an informed perspective can help investors maximize their gains from China ETFs.

Benefits of Investing in China ETFs

There are numerous benefits of investing in China ETFs. These options provide diversification, allowing investors to spread their risk across various sectors within the fast-growing Chinese economy. Additionally, they offer liquidity, making it easy to buy or sell shares according to market conditions. By engaging in investments through China ETFs, individuals can gain access to potentially lucrative opportunities without having to invest directly in individual Chinese companies.

Comprehensive Analysis of the China ETF Market

Market Performance Snapshot

A thorough analysis of China ETF market performance reveals a positive trajectory, driven by strong economic fundamentals and investor optimism. Tracking the analysis of China ETF market performance allows investors to identify which ETFs are performing best and why. With consistent growth seen in various sectors, this is a space to watch closely, as it continues to evolve.

Future Outlook

Looking ahead, the future outlook for China ETFs remains promising, although there are potential challenges on the horizon. Economic factors, geopolitical issues, and regulatory changes could impact the investment climate. However, if the current trends remain favorable, China ETFs could see even more growth as investors continue seeking opportunities in this vibrant market. Staying informed and adaptable will be essential for anyone involved in these investment vehicles.

Conclusion

In summary, China ETFs play a crucial role in today’s investment landscape, serving as a reliable vehicle for both domestic and international investors. The combination of strong economic growth, increased market access, and the surge of investments—both foreign and domestic—marks China as a key player in the global investment arena. For investors looking to diversify their portfolios, considering China ETFs could be a smart move.

With many opportunities still on the horizon, now is a great time to explore how China ETFs attract foreign investments. By understanding the dynamics at play, both seasoned and novice investors can position themselves for success in this thriving market.

Additional Resources

For those interested in delving deeper into the world of China ETFs and investment strategies, consider checking out the following resources:

– Financial news websites specializing in market analysis

– Investment forums discussing China ETFs

– Educational platforms offering courses on international investing

These resources can provide you with more insights and guidance as you navigate your investment journey in China ETFs.

What factors are driving investments in China?

Investments in China are primarily driven by:

- Economic stability and growth, characterized by consistent GDP increases.

- Increased market access due to relaxed government policies and enhanced transparency.

How are domestic investments changing in China?

Domestic investors are increasingly turning to China ETFs as they recognize the opportunities presented by the growing economy. This shift reflects a change in behavior, with more individuals becoming educated about ETFs and their potential benefits.

What is the trend for foreign investments in China?

Foreign investments are rising as international investors seek to diversify their portfolios. The strong economic indicators and favorable investment conditions in China make it an attractive option for global investors.

What are the performance trends of China ETFs?

The performance of China ETFs has been positively influenced by strong market dynamics and increased investor confidence. Certain sectors, like technology and consumer goods, are gaining significant traction.

What are the recent capital inflows into China’s market?

Recent capital inflows have been substantial, enhancing the market performance of China ETFs. This influx reflects a growing interest from investors worldwide, which can lead to higher returns for ETF investors.

What strategies should investors consider for China ETFs?

To maximize gains from China ETFs, investors should:

- Monitor economic indicators and policy changes.

- Track consumer trends and corporate earnings.

- Understand market dynamics to make informed entry and exit decisions.

What are the benefits of investing in China ETFs?

Investing in China ETFs offers multiple benefits including:

- Diversification across various sectors in a fast-growing economy.

- Liquidity, providing ease of buying or selling in response to market conditions.

- Access to potential investment opportunities without direct investment in individual companies.

What is the current outlook for the China ETF market?

The outlook for China ETFs is promising, though potential challenges such as economic factors, geopolitical issues, and regulatory changes could impact the investment climate. Continuous monitoring will be vital for investors.