The economic outlook for China in 2023 is crucial, especially concerning the “China economic targets” set by the government. Despite the emphasis on growth, many investors are feeling uneasy due to the absence of significant stimulus measures, raising questions about the potential impacts on global markets.

Understanding China’s Economic Growth Goals

China’s economic targets for 2023 have been set with a clear focus on growth, aiming for a range of about 5 to 5.5%. These targets reflect the government’s commitment to sustainable economic development, which is crucial given the challenges facing the global economy. Historically, China’s growth strategies have relied on substantial investment in infrastructure and export-led growth, but there’s an increasing emphasis on balance, shifting to domestic consumption and technological innovation.

The importance of these “China economic targets” can’t be understated. They provide a roadmap for the nation’s future but also set expectations in the global market. As China’s economic policies evolve, understanding their growth goals is key for investors and businesses worldwide, who want to align their strategies accordingly.

The Role of Stimulus Measures in Economic Support

Stimulus measures are vital for boosting economic activity, especially during times of economic slowdown. In 2023, China has implemented various strategies to support its economy, including targeted tax cuts and increased government spending. These measures aim to provide immediate relief and encourage growth, but they do have to align with the broader “China economic targets.”

China’s approach to economic support is to find a balance—stimulating growth without creating excessive debt. However, there is ongoing debate over whether the current measures are sufficient to meet these targets, especially when considering the potential challenges in consumption and investment.

Market Performance and Investor Confidence

There’s a clear connection between China’s economic growth, its stimulus measures, and the performance of stock markets globally. When economic indicators suggest growth, investors typically respond favorably, leading to a stock market rally. However, recent announcements from the Chinese government regarding its economic plans have left investor confidence shaky.

Many investors are closely monitoring how the lack of significant stimulus might affect market performance. This uncertainty can lead to volatility, especially if there’s a perceived disconnect between government actions and the overarching economic policies aimed at achieving these ambitious targets.

Disappointment Among Investors

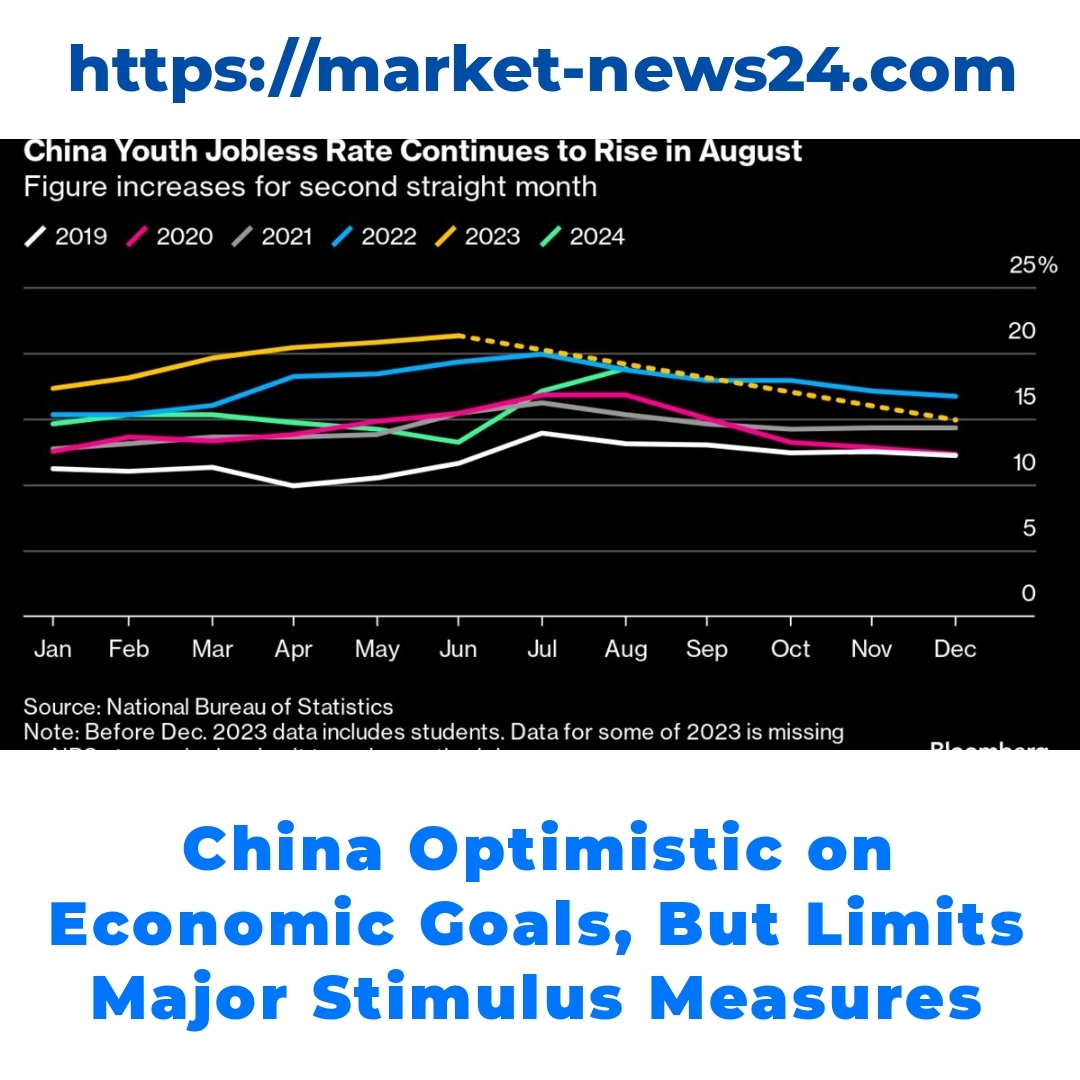

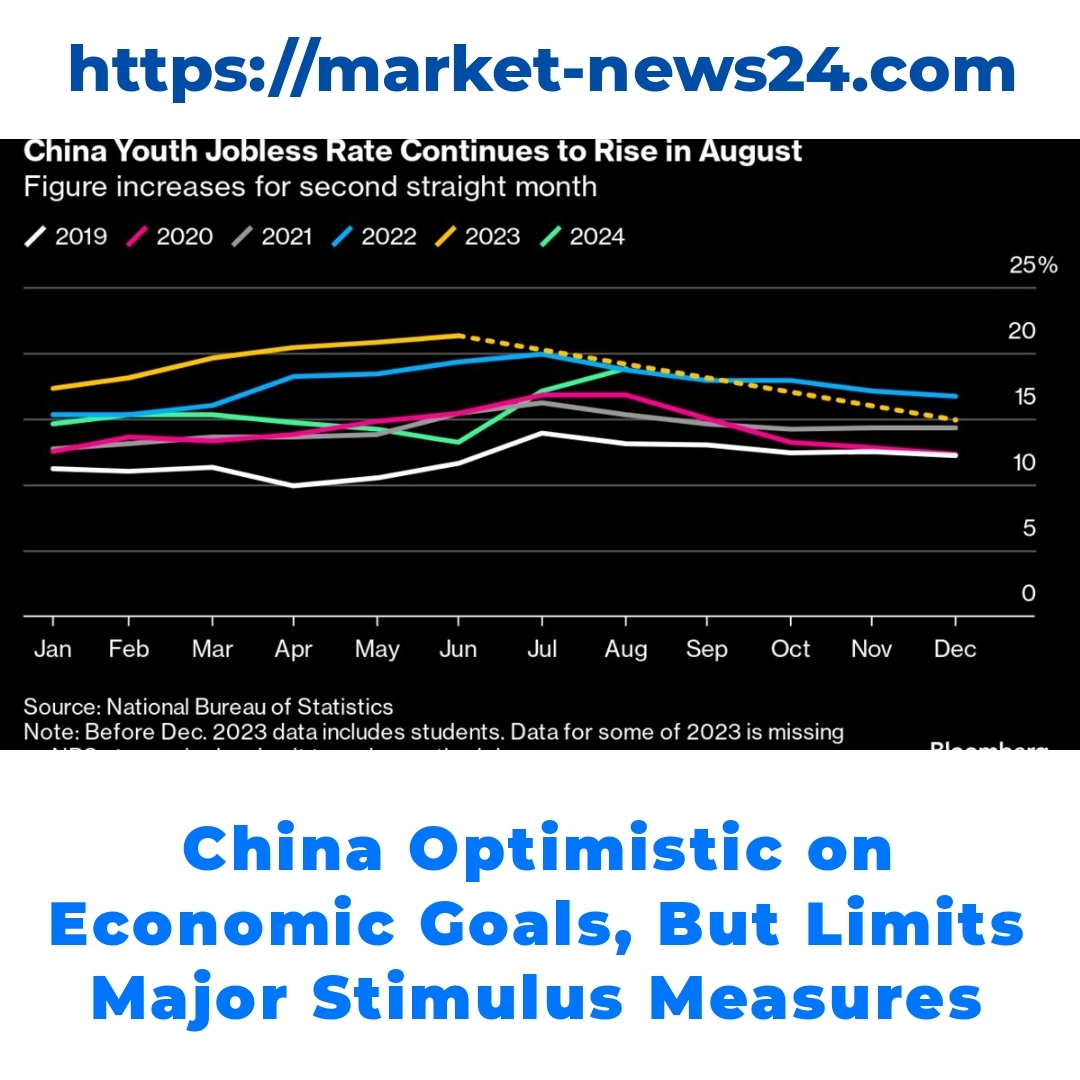

Recent trends show that investors are disappointed by China’s lack of major stimulus. This sentiment has grown as many feel the government isn’t doing enough to stimulate the economy amidst rising challenges such as high unemployment and slackening demand. Such disappointment raises concerns about the feasibility of meeting “China economic targets.”

This discontent isn’t just a passing sentiment; it could have serious implications for market sentiment in general. A prolonged period of uncertainty could deter investors, leading to lower investment levels, which in turn, could hinder the achievement of set economic goals.

Implications of China’s Economic Policies on Global Markets

The implications of China’s economic policies extend well beyond its borders, impacting global market dynamics significantly. As one of the largest economies, any shifts in China’s approach can send ripples through other markets, affecting everything from commodity prices to equity valuations.

As investors analyze these policies, there’s a growing concern about how hesitant approaches to stimulus may affect not only China but also the global economy. Predictions are being reevaluated based on the current economic strategies, urging investors to consider the broader context of “implications of China’s economic policies on global markets.”

Conclusion

In conclusion, despite mixed reactions to the lack of significant stimulus measures, China remains confident in achieving its economic targets for 2023. The “China economic targets” serve as a crucial foundation for both national growth and global economic health. Balancing necessary stimulus with sustainable growth strategies will be key in ensuring economic stability moving forward. Key stakeholders, from investors to policymakers, should keep a close eye on these developments, as the outcome will undoubtedly shape the global economic landscape.

FAQ

What are China’s economic growth targets for 2023?

China aims for an economic growth range of about 5 to 5.5% for 2023. This reflects their commitment to sustainable economic development despite global challenges.

How does China plan to achieve its economic targets?

China has historically relied on infrastructure investment and export-led growth. Now, there’s a greater focus on:

- Domestic consumption

- Technological innovation

What role do stimulus measures play in China’s economy?

Stimulus measures, such as targeted tax cuts and increased government spending, are crucial for boosting economic activity, especially during slow periods. They aim to provide immediate relief while staying aligned with economic targets.

Why are some investors disappointed with China’s economic approach?

Many investors feel that the current stimulus measures are insufficient in addressing challenges like:

- High unemployment

- Decreased demand

This discontent raises concerns about whether China can meet its growth targets.

How do China’s economic policies affect global markets?

As a major global economy, changes in China’s economic policies can significantly impact:

- Commodity prices

- Equity valuations

Investors are concerned about how hesitant stimulus measures may influence not just China, but the global economy as a whole.

What should investors watch for regarding China’s economic development?

Investors should closely monitor:

- Government actions and their alignment with economic targets

- Market performance in response to economic indicators

These factors will shape both China’s economic landscape and global market dynamics.