Renowned investor Warren Buffett is making waves in the stock Market by selling off a large portion of his Apple stock. The reason behind this unexpected move is truly eye-opening. Find out more about Buffett’s latest decision and how it could impact the tech giant’s future.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Warren Buffett and his team at Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) have been closely associated with Apple (NASDAQ: AAPL) ever since they invested in the stock back in 2014. The investment turned out to be profitable, but Berkshire has recently started selling off its Apple stock, reducing its stake in the company.

One major reason for Berkshire’s decision to sell off some of its Apple shares is the potential increase in taxes. Long-term capital gains tax rates for corporations are currently at 21%, and with the possibility of taxes increasing in the future, Berkshire is taking preemptive action to capture some of its gains before facing higher tax liabilities.

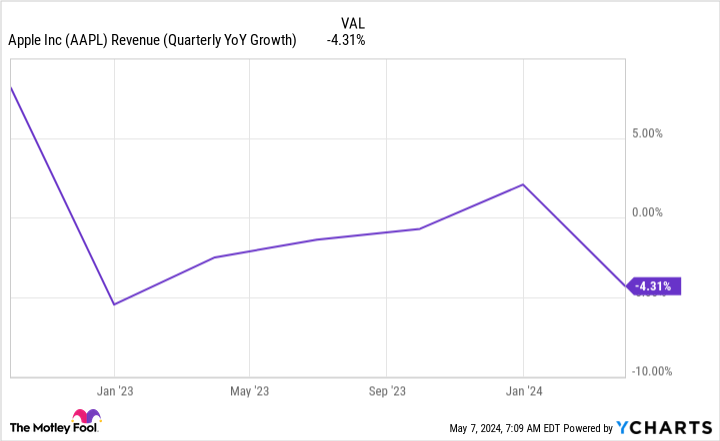

Despite Berkshire’s decision to sell, Buffett has stated that Apple will remain its largest holding. However, the recent decline in Apple’s revenue and struggles in launching new hit products may be causing concern. iPhone sales are down, and the Apple Vision Pro virtual reality headset isn’t performing as expected.

While Apple’s core business is facing challenges, the company’s stock continues to trade at a premium valuation. With the Market holding Apple in high esteem, some investors may be considering selling their Apple stock until the company’s fundamental business improves.

If you’re thinking of investing in Apple, it’s worth considering the opinions of analysts at Motley Fool’s Stock Advisor, who have identified 10 other stocks with high growth potential. Keep in mind that past recommendations from Stock Advisor have generated substantial returns for investors who followed their advice.

In conclusion, while Berkshire’s decision to sell Apple stock may be influenced by tax considerations, individual investors may want to evaluate Apple’s business performance before making investment decisions. The current challenges facing Apple’s core business may impact its stock performance in the future.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Why is Warren Buffett selling Apple stock?

– Warren Buffett is selling Apple stock because he believes the company is now overvalued and wants to make a profit by selling at a high price.

2. What does Buffett’s decision to sell Apple stock tell us about the Market?

– Buffett’s decision suggests that he may be cautious about the current Market conditions and sees better investment opportunities elsewhere.

3. What impact will Buffett’s sale of Apple stock have on the company?

– While Buffett’s sale may cause some short-term fluctuations in Apple’s stock price, it is unlikely to have a major impact on the company’s long-term prospects.

4. Should investors follow Buffett’s lead and sell their Apple stock?

– It ultimately depends on your own investment strategy and goals. It’s always a good idea to consider your own financial situation and consult with a financial advisor before making any decisions.

5. What other stocks is Buffett investing in currently?

– Buffett’s investment decisions are closely watched by investors. Some of the other stocks he currently holds in his portfolio include Coca-Cola, Bank of America, and American Express.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators