Bitcoin has recently surged to its highest level in two weeks, driven by speculator interest and external economic factors. This article explores how China’s stimulus efforts are influencing not just the cryptocurrency landscape, but also a notable shift in investment focus from traditional stocks to Bitcoin. Understanding these dynamics is crucial for navigating today’s volatile markets.

Understanding Bitcoin’s Recent High

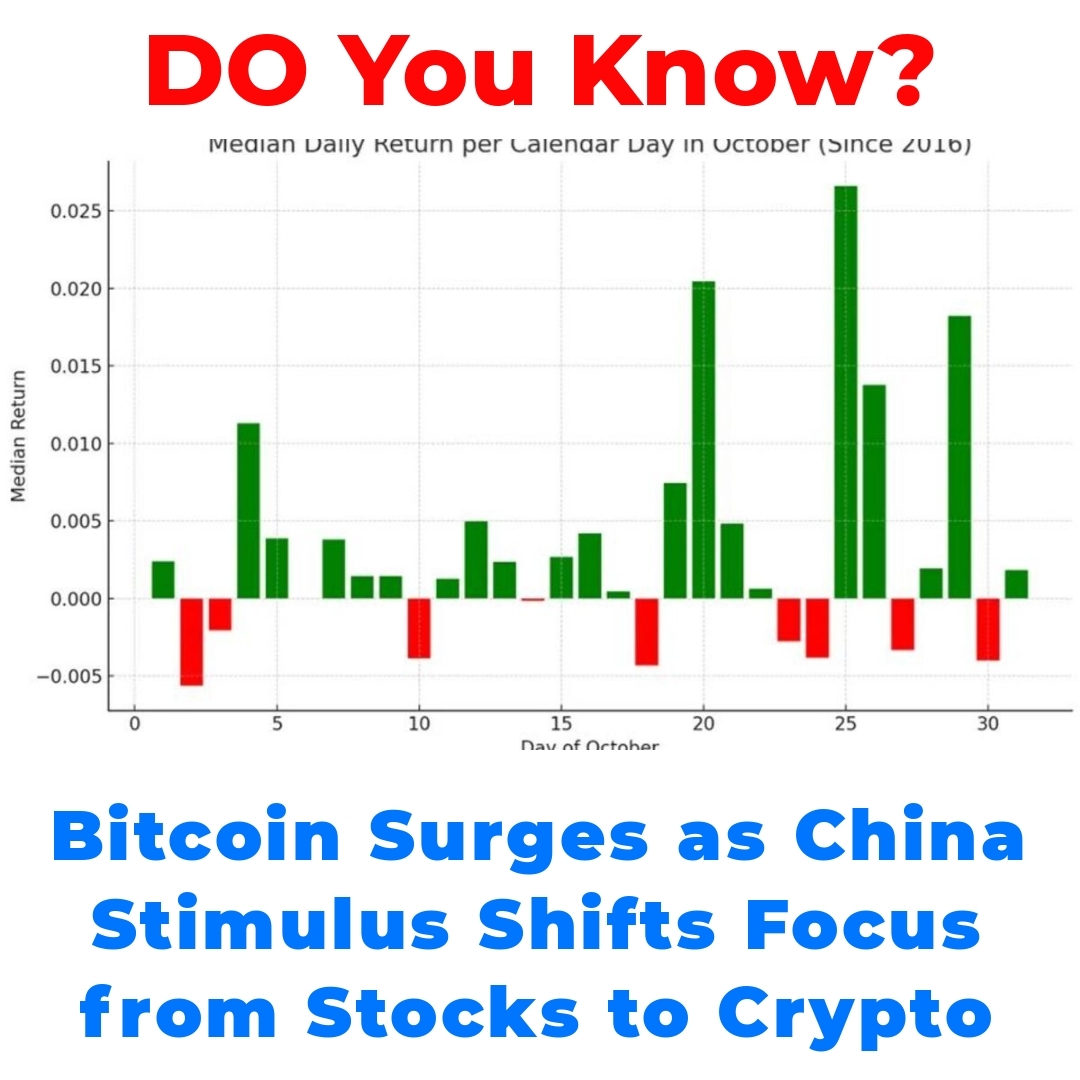

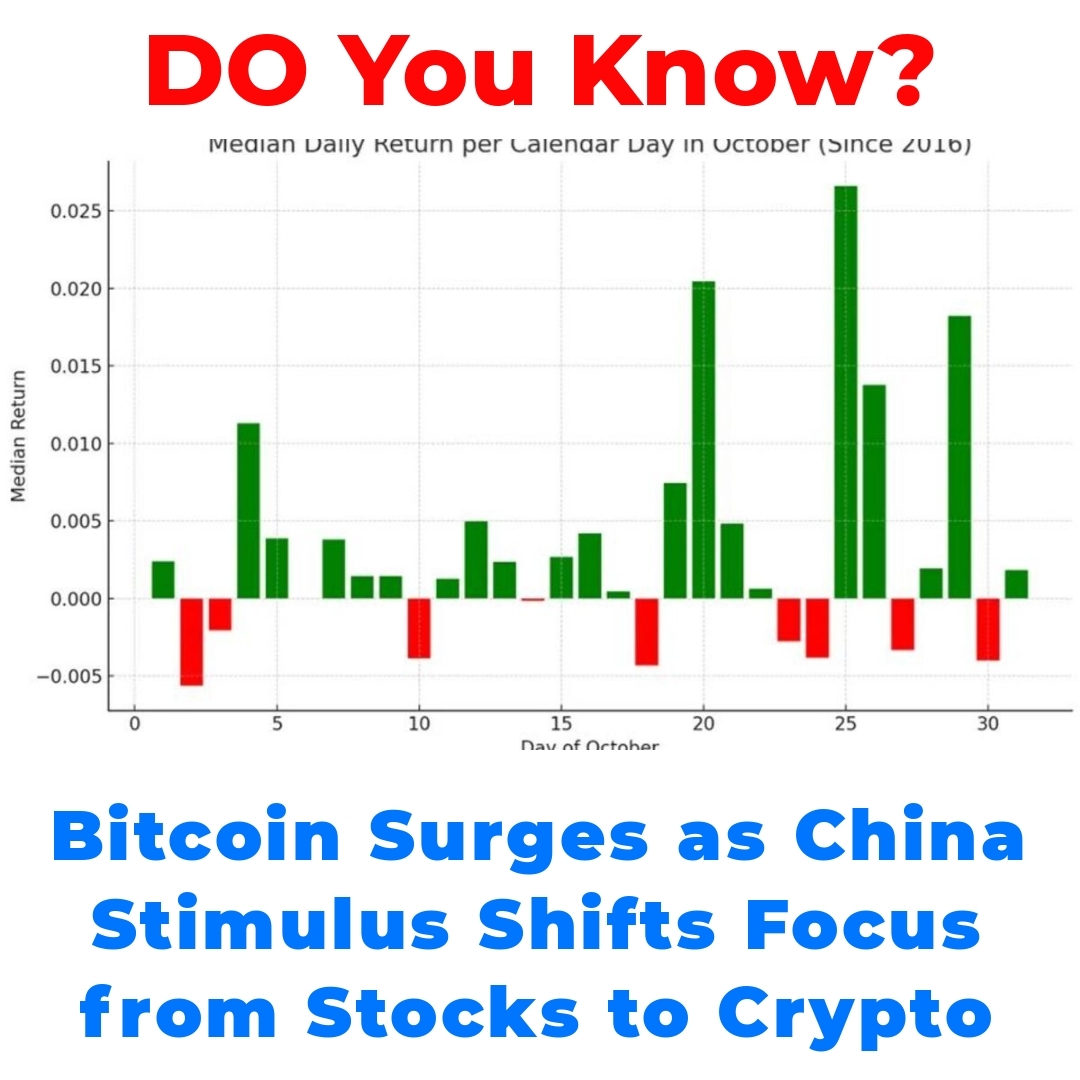

Bitcoin has seen quite a bit of excitement recently, climbing to its highest price in two weeks. This surge can be linked to various market dynamics, including increased speculator interest. As of now, the Bitcoin price is fluctuating around significant resistance levels. Investors are buzzing about the potential for future gains, especially as Bitcoin continues to capture attention.

Several factors are contributing to this recent high for Bitcoin. Primarily, speculators have been particularly active in the market, driving demand. The excitement around Bitcoin’s price movement suggests that many are searching for opportunities in cryptocurrency as traditional stocks show signs of volatility.

The Role of Market Speculation

Market speculation plays a critical role in the cryptocurrency scene. Essentially, this refers to the actions taken by investors looking to profit from future price movements, rather than long-term value investments. In the context of Bitcoin, this kind of speculation can lead to rapid price increases, as we’ve been seeing lately. Investors are clearly looking for a safe haven for their funds amid uncertainties in other financial markets, further powering the surge.

Impact of China’s Stimulus on Financial Markets

Now, let’s dive into how China’s stimulus efforts have impacted not just Bitcoin, but the broader financial landscape. Recently, China has announced a series of stimulus measures aimed at bolstering its economy. These efforts are intended to stimulate spending and investment across various sectors. However, the ripple effects extend beyond China, reaching global financial markets.

When China implements its stimulus, it impacts investor sentiment worldwide. In particular, this has led many speculators to turn their attention towards cryptocurrencies like Bitcoin. This shift can be attributed to the appeal of Bitcoin as a hedge against inflation and market insecurity, which tends to rise in fluctuating economic landscapes. When traditional stocks appear uncertain, Bitcoin often becomes an attractive alternative.

The Ripple Effects on Cryptocurrency

With China’s economic maneuvers, the effects on the crypto market, especially Bitcoin, are noticeable. Some investors view Bitcoin as a more stable asset in an unstable financial environment. As more people consider crypto investments, it drives demand higher and gives Bitcoin a significant advantage over stocks amidst economic transformations. This behavior hints at a growing confidence in Bitcoin and its potential stability in uncertain times.

The Shift from Stock Market to Bitcoin

So, why are speculators increasingly turning to Bitcoin instead of sticking with the stock market? Numerous reasons influence this trend. Firstly, investors are attracted to Bitcoin due to its decentralized nature and potential for higher returns compared to traditional stocks. As fears about stock market volatility arise, Bitcoin has become a beacon of hope for many investors looking to diversify their assets.

Additionally, cryptocurrency’s inherent potential for significant gains even in short time frames is appealing. Many believe that Bitcoin can outperform traditional investments, mainly as central banks, including China’s, stimulate their economies. This situation creates an opportunity for savvy investors who are aware of the shifting financial trends.

The Future of Bitcoin Amidst Global Financial Trends

Looking ahead, the future of Bitcoin appears promising, especially as ongoing economic changes unfold. With the current focus on cryptocurrencies being heightened, speculators are likely to continue placing bets on Bitcoin. The potential for Bitcoin price increases remains strong, provided that the current global economic climate evolves positively.

Conclusion

To sum it all up, Bitcoin’s recent rise can be attributed to a mix of market speculation and the influence of China’s stimulus measures. We’ve seen a significant shift from stock market investments towards Bitcoin as investors seek shelter from economic uncertainties. Understanding these dynamics can help current and prospective investors make informed decisions in the evolving world of cryptocurrency.

Lastly, it’s essential for anyone interested in investing in Bitcoin to stay informed about ongoing financial trends and changes. Keep an eye on the shifting landscape as both cryptocurrency and the global economy influence one another continually.

Call to Action

What do you think about Bitcoin’s prospects in light of China’s stimulus? Share your thoughts in the comments section below! If you want to stay updated on cryptocurrency trends and Bitcoin developments, don’t forget to subscribe for the latest insights.

Frequently Asked Questions

What has caused Bitcoin’s recent price surge?

Bitcoin’s recent climb can be attributed to increased market speculation and growing interest from investors, particularly as traditional stocks demonstrate volatility. As a result, many are seeking opportunities in cryptocurrency.

How does market speculation influence Bitcoin’s price?

Market speculation involves investors trying to profit from anticipated price movements. In Bitcoin’s case, this speculation has led to rapid price increases, as more individuals view it as a safe haven in uncertain financial times.

What impact do China’s stimulus measures have on Bitcoin?

China’s stimulus efforts have boosted global investor sentiment, shifting attention towards cryptocurrencies like Bitcoin. As investors look for alternatives amid economic fluctuations, Bitcoin’s appeal as a hedge against inflation increases.

Why are investors shifting from stocks to Bitcoin?

Investors are increasingly drawn to Bitcoin due to its decentralized nature, potential for higher returns, and ability to act as a buffer against stock market volatility. This shift is further fueled by the current economic landscape.

What does the future hold for Bitcoin?

The future of Bitcoin looks positive, especially with ongoing economic changes. As interest in cryptocurrencies remains high, speculators are likely to continue investing in Bitcoin, which may lead to further price increases.

How can I stay informed about Bitcoin trends?

To stay updated on Bitcoin and cryptocurrency trends, it’s essential to follow financial news, subscribe to market analysis platforms, and engage with online communities focused on cryptocurrency discussions.