Two major US banks, J.P. Morgan and Wells Fargo, have recently announced that they have started offering access to Bitcoin for their clients. This move comes as a surprise to many, as traditional banks have been wary of the volatile cryptocurrency in the past. So, what has sparked their sudden interest in Bitcoin? Let’s dive into why these financial giants are now embracing the world of digital currency.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

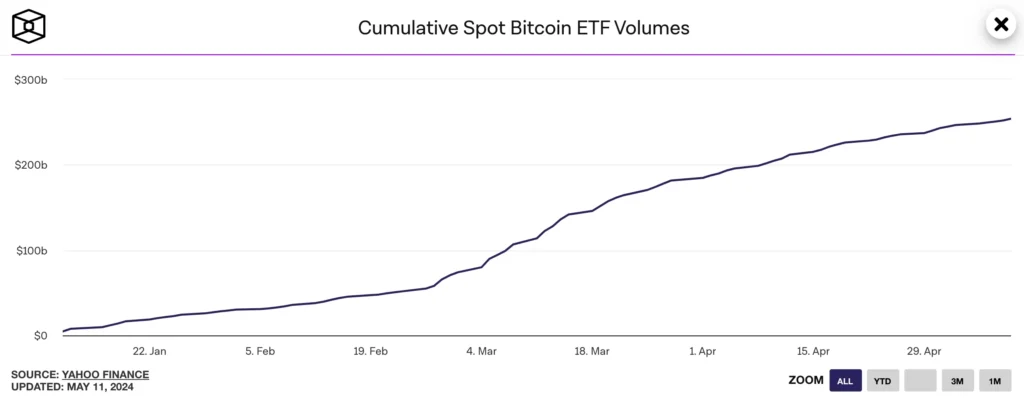

Recently, there has been a significant shift in the investment strategies of traditional banks towards Bitcoin, indicating a changing perspective on cryptocurrencies. For instance, J.P. Morgan disclosed an investment of $731,246 in spot Bitcoin ETF on behalf of its clients, with a majority of that amount allocated to various Bitcoin-related funds like IBIT, BITB, FBTC, and GBTC.

Interestingly, Wells Fargo, another major US bank, also joined the trend by acquiring 2,245 shares of GBTC valued at $121,207. This move reflects a growing interest among institutional investors towards Bitcoin despite its recent price fluctuations.

Moreover, Europe’s BNP Paribas recently purchased over a thousand IBIT shares, further highlighting the evolving attitudes towards digital assets within the banking sector. This level of involvement from prominent financial institutions signifies a significant shift in their stance on Bitcoin as a viable investment option.

Furthermore, the US House passing a bill to ease SEC guidelines regarding cryptocurrencies demonstrates a broader acceptance of digital assets within the regulatory framework. Despite historical resistance from banks towards crypto-assets, the Biden Administration has pledged to veto the legislation if it reaches the Senate, citing concerns about potential financial stability risks.

Overall, these developments signify a turning tide in the traditional financial sector’s perception of cryptocurrencies, with more banks and institutions recognizing the value and potential of Bitcoin as an investment vehicle. As the crypto Market continues to evolve, it will be interesting to see how these institutions navigate the changing landscape of digital assets.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Why are J.P. Morgan and Wells Fargo interested in Bitcoin?

Both companies see the potential for Bitcoin to increase in value and become a mainstream form of digital currency.

2. Are J.P. Morgan and Wells Fargo fully embracing Bitcoin as a form of payment?

While they are holding Bitcoin as an investment, they are not currently using it for everyday transactions.

3. Will J.P. Morgan and Wells Fargo offer Bitcoin services to their customers?

At this time, both companies are focusing on holding Bitcoin as an investment and have not announced plans to offer Bitcoin services to customers.

4. How will holding Bitcoin benefit J.P. Morgan and Wells Fargo?

By holding Bitcoin, both companies have the potential to diversify their investment portfolios and capitalize on the growing popularity of cryptocurrencies.

5. Is there a risk involved for J.P. Morgan and Wells Fargo in holding Bitcoin?

Like any investment, there is always a risk involved in holding Bitcoin. The value of Bitcoin can be volatile and subject to Market fluctuations.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators