BHP Group Ltd. stands as a pivotal player in the global mining industry, renowned for its vast resources and operational excellence. Recently, a report revealed a 2% surge in the company’s iron ore output during the first quarter compared to last year. This production increase raises important questions about potential market oversupply, especially as other major miners also ramp up their output.

BHP Group Iron Ore Production Increase Q1

BHP Group Ltd. reported a notable 2% increase in iron ore output for the first quarter compared to the same time last year. The specific figures show that BHP produced approximately 66 million tons of iron ore during this period. This represents a positive shift not just from the figures of the previous quarter, but also highlights the company’s consistent performance over time.

The improvement in production isn’t merely a stroke of luck. BHP has strategically implemented operational efficiencies and invested in new technologies that have enhanced their mining processes. By introducing automated machinery and optimizing logistics, BHP has managed to ramp up output without compromising safety or quality. These efforts are crucial in ensuring that the company maintains its competitive edge in a crowded market.

Impact of Major Miners on Iron Ore Supply

In the broader context of the mining industry, major players like BHP Group Ltd. have a significant influence on iron ore supply. As these companies increase their production, it can lead to a shake-up within the market. When you consider how major miners influence iron ore supply, it’s clear that coordinated moves among these big players can create both opportunities and challenges.

For example, if other major miners also ramp up their output, BHP could face increased competition. This means that while BHP is enjoying a growth phase, there’s a risk that market oversupply could overshadow these gains. Each miner’s decisions ripple through the market, affecting everything from pricing to future production strategies.

Effects of Increased Iron Ore Production on Market

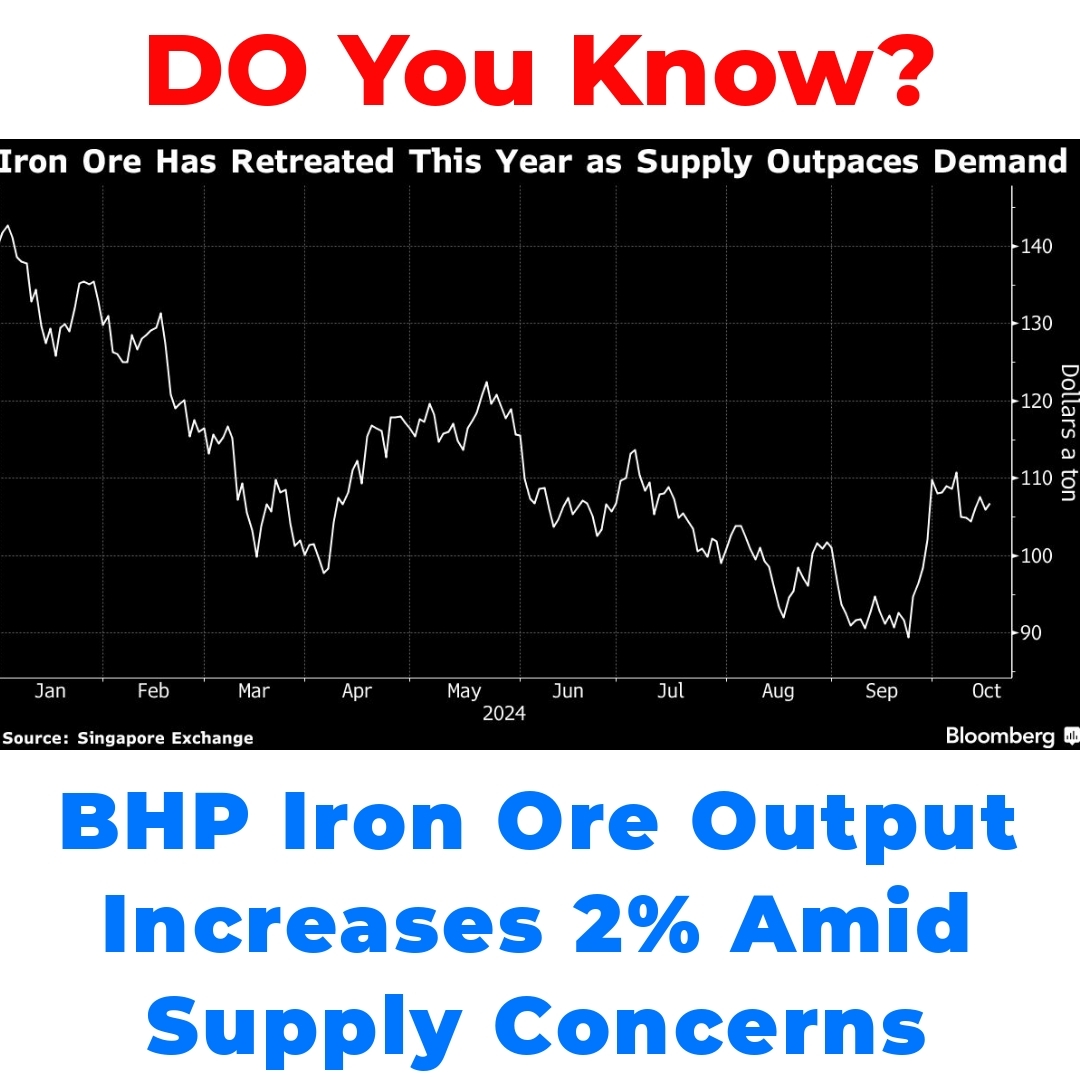

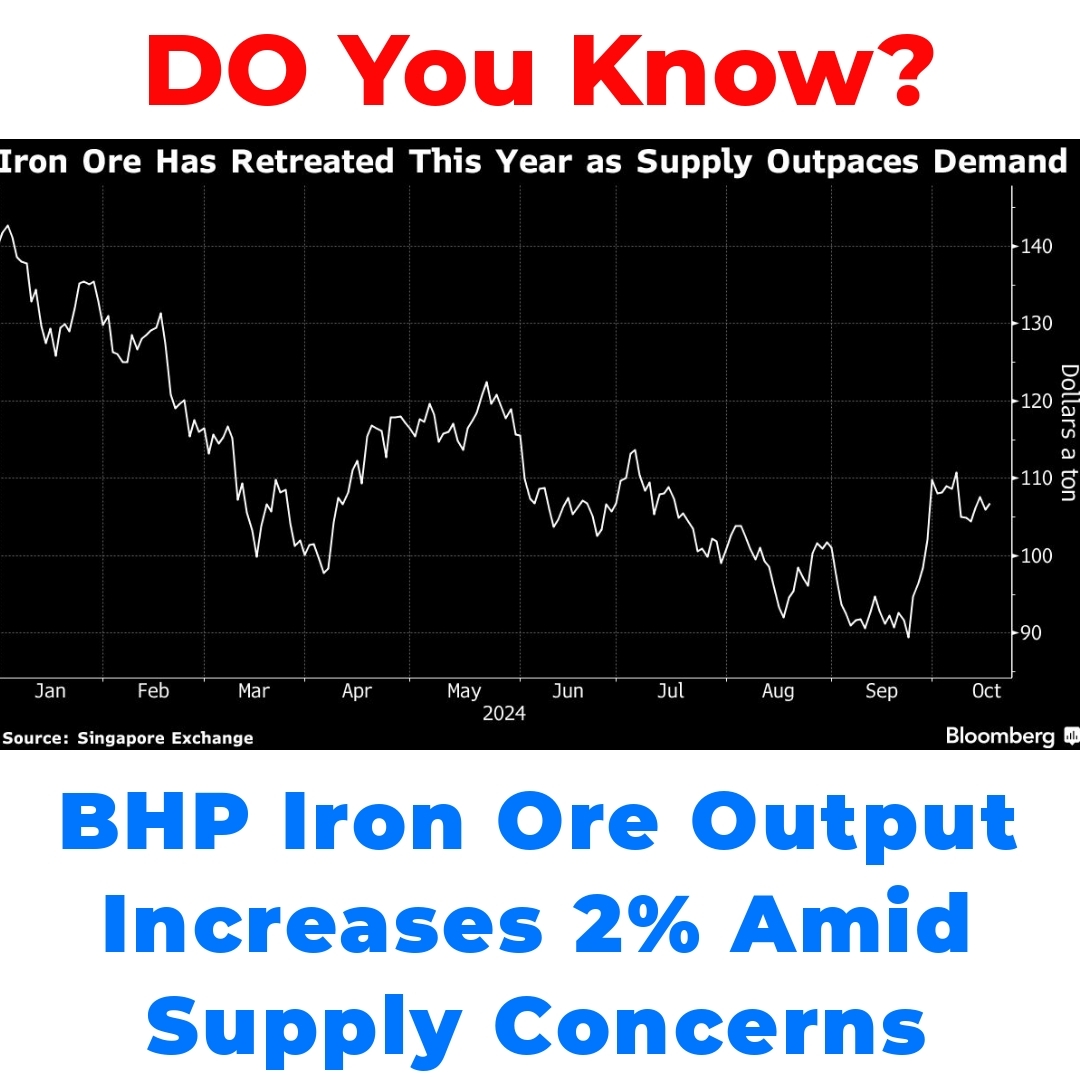

A rise in iron ore production is often a double-edged sword. On one side, increased supply can lead to lower commodity prices, which can benefit consumers and industries reliant on steel production. However, there’s a real concern about the risks of market oversupply. As BHP Group Ltd. and other major miners increase their output, the delicate balance between supply and demand can tip, leading to potential price declines.

These dynamics are crucial for anyone watching BHP’s performance in the market. Understanding how rising production impacts commodity prices provides insight into the broader economic landscape. As prices fluctuate, so too does the financial viability of mining operations, making it essential for these businesses to stay ahead of the curve.

Long-Term Perspectives on Iron Ore Output and Market Demand

Looking ahead, the future of the iron ore market remains uncertain. Sustained increases in production from companies like BHP Group Ltd. could continue if market conditions are favorable. However, various factors will impact demand, such as global economic trends and the needs of key industries.

As the world transitions to greener technologies, demand for iron ore may see shifts depending on the needs of industries pivoting toward sustainability. Understanding these long-term trends is vital for grasping the overall effects of increased iron ore production on the market. BHP and its competitors will have to adapt to these changes to maintain their positions.

Conclusion

In summary, BHP Group Ltd.’s recent iron ore output growth is a significant development within the mining industry. As the company charts its course through a landscape of increasing production trends and fluctuating market dynamics, it’s vital to reflect on how these factors will shape the future.

Staying informed about BHP Group Ltd. and its production strategies will give you valuable insights into the broader market for iron ore. Keep an eye on industry developments, as they could have lasting implications for commodity prices and the mining sector overall.

Call to Action

What are your thoughts on the production increases by BHP Group Ltd. and other major miners? Join the conversation and share your opinions! If you want to stay updated on the mining industry and commodity trends, consider subscribing for more insights.

FAQ

1. What was BHP Group’s iron ore production in Q1?

BHP Group produced approximately 66 million tons of iron ore in the first quarter, marking a 2% increase compared to the same period last year.

2. How has BHP achieved this increase in production?

BHP has implemented operational efficiencies and invested in new technologies. This includes the introduction of automated machinery and optimizing logistics, which have all contributed to the increased output.

3. What impact does BHP’s production increase have on the iron ore market?

The increase in iron ore production can lead to both opportunities and challenges. While it may lower commodity prices benefiting consumers, there’s also a risk of market oversupply that could negatively impact pricing.

4. How do major miners influence the iron ore market?

Major miners like BHP can significantly affect iron ore supply. If multiple big players increase their production simultaneously, it may lead to intensified competition and adjustments in the market, affecting prices and future production strategies.

5. What factors might influence future demand for iron ore?

Future demand for iron ore could be influenced by global economic trends, shifts toward sustainability in industries, and the overall pivot to greener technologies. These changes will be crucial for mining companies to adapt to in order to maintain their market position.

6. Why is it important to monitor BHP’s production strategies?

Monitoring BHP’s production strategies is essential for understanding the broader dynamics of the iron ore market. Changes in production can impact commodity prices and the overall health of the mining sector.