The recent decline of Asian tech stocks has stirred significant concern in financial circles, highlighting their impact on global equity markets. As these stocks falter, the ripple effects extend all the way to Wall Street, particularly affecting key Silicon Valley companies. Understanding this interconnectedness is crucial for grasping the current market dynamics.

Understanding the Decline of Asian Tech Stocks

So, what’s been happening with Asian tech stocks lately? A mix of economic indicators and market sentiment has played a big role in their recent downturn. Investors are getting jittery due to rising interest rates, slowing economic growth in major Asian economies, and escalating geopolitical tensions. All of these factors create an environment where confidence in these stocks is wavering, leading to substantial selling pressure.

On top of that, we’ve seen some significant regulatory changes across regions like China, causing further uncertainty. The implications of these issues aren’t just confined to the Asian markets. When selling pressure mounts in Asia, it sends ripples that can adversely affect other global equity markets. Investors around the world feel the jitters, and when Asian tech stocks stumble, it often spells trouble for markets everywhere.

Impact on Global Equity Markets

Now let’s talk about how Asian tech stocks relate to the larger picture of global equity markets. There’s a strong correlation between these markets, meaning that when one suffers, the others often follow suit. This interconnectedness highlights how a downturn in Asian shares can lead to increased volatility and declines on Wall Street, directly impacting major Silicon Valley companies and their performance.

For Wall Street, the selling pressure can be significant. Investors tend to become more cautious and look to pull back on risky assets, which can hurt tech giants that rely heavily on global markets. This creates a cycle of decline that impacts not only equity values but also investor sentiment. Additionally, it’s important to consider the role of the bond and currency markets, which may provide a counterbalance during such turbulent times. A steady bond market can offer safety to investors fleeing from equities, while currency fluctuations can further complicate the financial landscape.

The Bigger Picture: US Jobs Data and Market Reactions

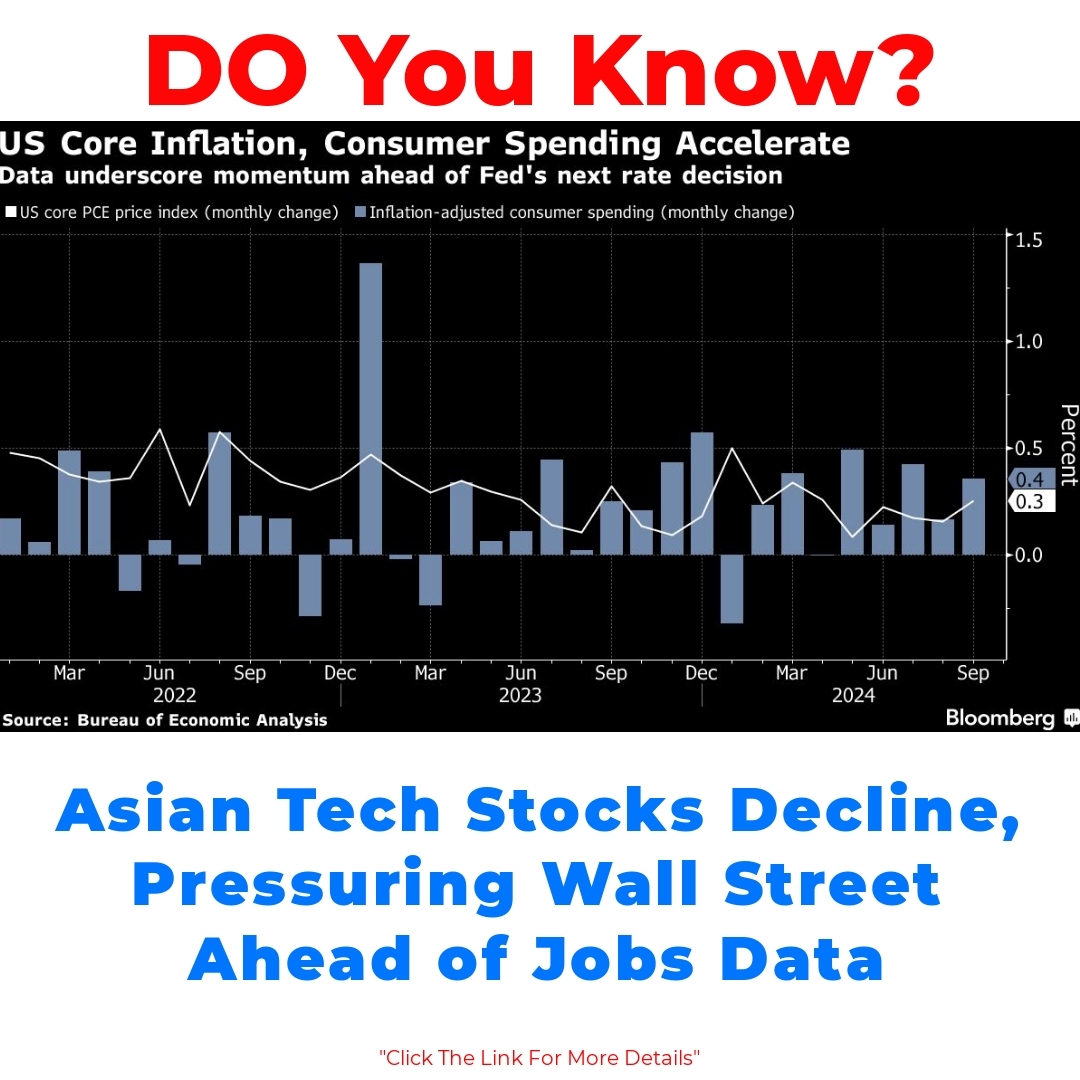

With all this said, we can’t ignore how US jobs data can influence the tech sector and overall markets. As we look ahead, anticipation surrounding this data can affect investor behavior significantly. If the jobs report points to a robust economy, it might lead to a more favorable view of tech stocks, including those in Asia.

There’s also a historical dimension to consider. In previous instances, we’ve seen how a positive jobs report has led to upticks in tech stocks, while disappointing data has resulted in declines. Asian tech stocks have shown similar patterns, indicating that they’re not isolated from US economic conditions. The implications of US jobs data stretch far beyond our borders and can have profound effects on the tech landscape across Asia.

Conclusion

To wrap things up, the decline in Asian tech stocks plays a significant role in shaping both regional and global financial markets. The impact of Asian tech stocks on global equity markets cannot be understated, particularly considering the selling pressure on Silicon Valley companies due to these declines. Moreover, the implications of US jobs data on tech stocks provide an added layer of complexity that investors must carefully evaluate.

In today’s interconnected financial world, understanding how these markets influence one another is crucial. As investors navigate this landscape, staying informed about the conditions affecting Asian tech stocks will be essential in predicting movements not only in Asia but also across Wall Street and beyond.

FAQ

What are the main reasons for the decline of Asian tech stocks?

The decline in Asian tech stocks can be attributed to several factors, including:

- Rising interest rates

- Slowing economic growth in key Asian economies

- Escalating geopolitical tensions

- Regulatory changes, especially in China

How do Asian tech stocks affect global equity markets?

There is a strong correlation between Asian tech stocks and global equity markets. When Asian stocks decline, it can lead to:

- Increased volatility in other markets

- A decline in investor confidence globally

- Difficulties for major tech companies in the US that rely on global markets

What role does US jobs data play in the tech sector?

US jobs data significantly influences investor behavior and can impact tech stocks in the following ways:

- A strong jobs report may lead to a positive outlook for tech stocks, including those in Asia.

- A weak jobs report often results in declines for tech stocks.

Are there other markets that can impact Asian tech stocks?

Yes, the bond and currency markets can also play a role. For instance:

- A stable bond market can provide a safe refuge for investors.

- Currency fluctuations can complicate the economic landscape.

What should investors keep in mind about Asian tech stocks?

Investors should be aware of:

- The interconnectedness of global markets

- How domestic issues in Asia can affect international markets

- The ongoing impact of economic indicators, such as US jobs data