A recent survey by the Federal Reserve has revealed that overdue bills and debt delinquencies are on the rise in the United States. As the economy continues to struggle, more and more Americans are falling behind on their payments, signaling potential financial distress for many households. Stay informed on the latest developments regarding the growing problem of debt in the country.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

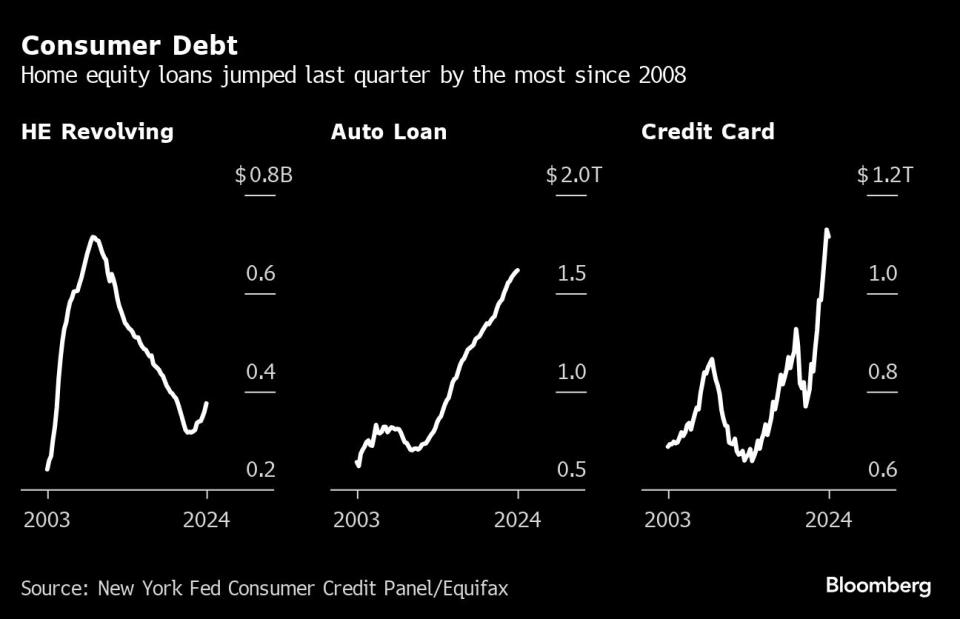

US household debt has hit a new all-time high, with more borrowers struggling to make ends meet. The Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit revealed that overall US household debt has climbed to $17.7 trillion, increasing by $184 billion from the previous quarter.

The rising costs of essentials like food and rent have forced many Americans to rely on credit cards to cover their basic needs. Since the start of the pandemic, consumers have taken on an additional $3.4 trillion in debt, much of which comes with higher interest rates.

Credit card debt reached $1.12 trillion in the first quarter of 2024, slightly down from the previous quarter but up nearly 25% from pre-pandemic levels. With inflation and interest rates expected to remain high, experts predict that credit card balances will continue to rise throughout the year.

Federal Reserve Chair Jerome Powell cautioned that it will take longer than anticipated for the central bank to address inflation concerns and consider lowering interest rates. As a result, more consumers are maxing out their credit cards and falling behind on payments, leading to increased delinquency rates.

Delinquency rates on credit cards have returned to more typical levels after pandemic-related assistance programs artificially lowered them. However, current delinquency levels surpass those seen prior to the pandemic, indicating a worsening trend in financial stress among borrowers.

Younger and lower-income borrowers are particularly vulnerable to financial strain, with millennials experiencing higher delinquency rates than other age groups. As borrowers utilizing more than 60% of their available credit face faster delinquency rates, experts warn of a potential surge in credit card balances in the coming months.

Auto loan delinquencies are also on the rise, with the average monthly car payment reaching $738 in 2023. Home equity loans are seeing increased popularity as homeowners tap into their accumulated equity, with $16 billion in new loans originated last quarter alone.

Despite the challenges, housing debt remains the largest category of household debt, performing well overall. Outstanding student loan debt, however, has remained relatively stable at $1.60 trillion, with the full impact of missed payments yet to be reported.

As financial pressures continue to mount, borrowers are urged to seek assistance and explore repayment options to avoid falling further into debt. Stay informed with the latest updates on household debt and credit trends as the economic landscape evolves.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Why are overdue bills and US debt delinquencies on the rise?

– Due to economic strain caused by the pandemic, many people are struggling to make payments on time.

2. How does the Federal Reserve track US debt delinquencies?

– The Fed conducts surveys to gather data on late payments and outstanding debt across the country.

3. How can I avoid falling behind on my bills?

– Budget carefully, prioritize essential expenses, and communicate with creditors if you need assistance.

4. What are the consequences of debt delinquencies?

– Late fees, a damaged credit score, and potential legal actions are all possible outcomes of not paying bills on time.

5. Is there help available for individuals struggling with overdue bills?

– Yes, there are resources such as debt counseling services, payment plans, and financial assistance programs that can help manage and reduce debt.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators