The 10-year yield plays a crucial role in the bond market, influencing interest rates and economic outlook. A discussion between Richard Bernstein Advisors’ Michael Contopoulos and Bloomberg’s Ira Jersey explores how the election outcomes of Kamala Harris or Donald Trump could significantly impact fixed income markets and interest rate trends.

Understanding the 10-Year Yield

The 10-year yield is an important benchmark in the bond market, serving as a key indicator for interest rates and overall economic health. Essentially, it reflects the interest rate paid by the U.S. government on its Treasury bonds that mature in ten years. This yield is not just a number; it plays a significant role in shaping borrowing costs across the economy—from mortgages to corporate loans.

Interest rates are heavily influenced by the bond market. When demand for bonds goes up, yields tend to fall, and vice versa. The 10-year yield is often seen as a reflection of investor sentiment regarding inflation and economic growth. Additionally, Treasury securities help set the economic outlook, as they provide a safe investment option and are considered risk-free since they’re backed by the U.S. government.

Political Landscape and Its Economic Impact

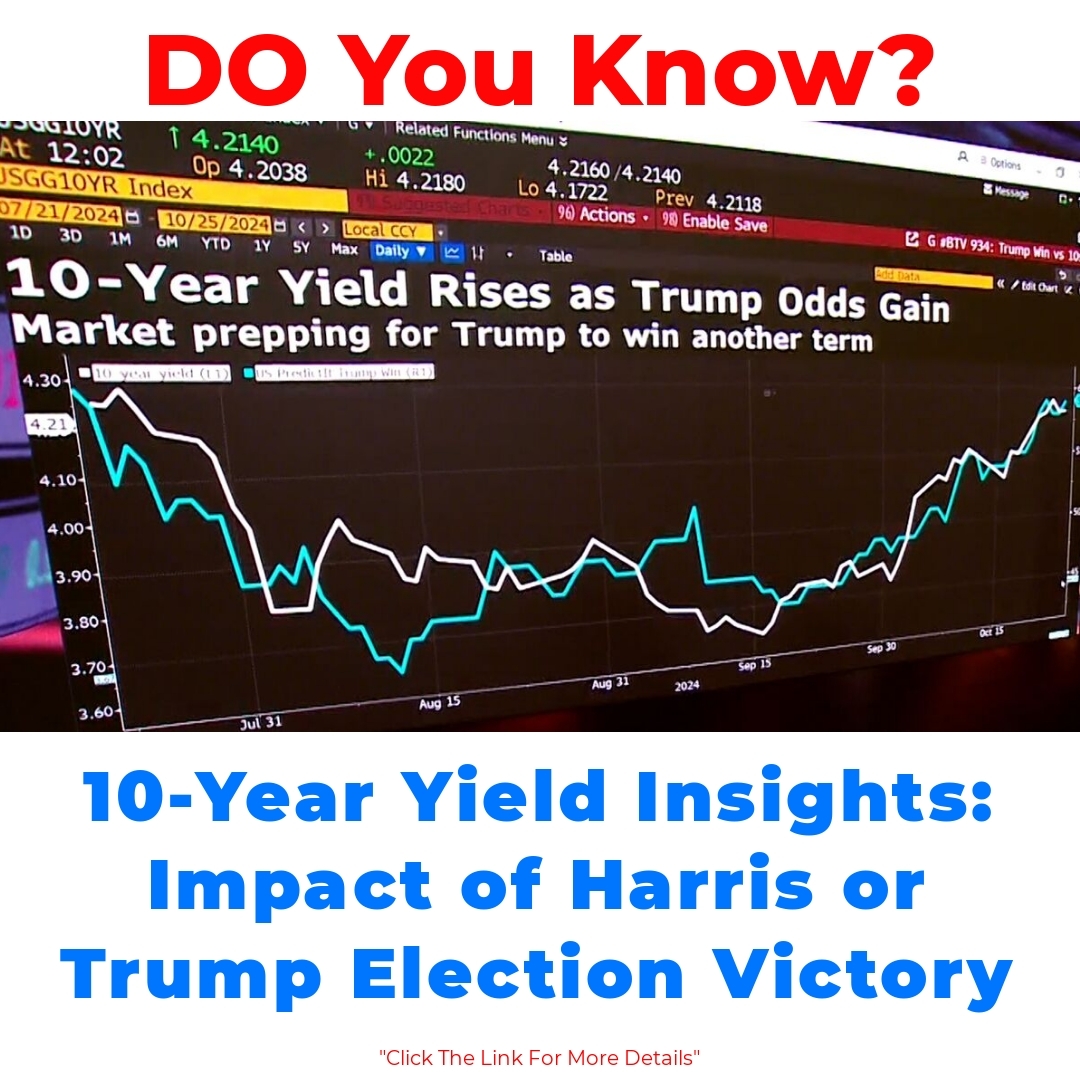

Elections have a profound influence on market volatility and financial markets. The uncertainty around potential policy changes can cause fluctuations in bond yields. Historically, during major elections, we’ve seen noticeable shifts in the 10-year yield. For example, yields can spike or dip based on the political climate and expected changes in economic policy.

When big names in politics, like Kamala Harris and Donald Trump, are on the ballot, investors pay close attention. The political landscape can greatly affect how investors perceive risk and, consequently, influence the 10-year yield.

Impact of Kamala Harris’s Election Win on the 10-Year Yield

Economic Policies and Fixed Income

If Kamala Harris were to win the election, we could anticipate certain economic policies that could affect the fixed income market. Her administration might focus on increased fiscal spending, including investments in infrastructure and social programs. This could lead to a change in interest rates, pushing the 10-year yield higher as investors expect inflation to rise.

The fixed income market reacts to these expected policies, as higher anticipated spending often translates to more borrowing, driving yields up. Additionally, if interest rates rise, bond prices typically fall, which is critical for investors to consider in a shifting political landscape.

Analyzing the 10-Year Yield Transition

How might the 10-year yield react to a Kamala Harris victory? There are case studies and recent data that suggest we could see an upward trend in the 10-year yield. For example, during significant policy announcements or changes in administration, we have often observed similar patterns in bond yields. Analysts predict that if her policies are perceived to be inflationary, the yield could rise, reflecting investors’ expectations.

Looking at previous election cycles, we noticed similar reactions where bond yields increased or decreased based on the anticipated economic direction. This makes it crucial to explore how the 10-year yield could adjust during Kamala Harris’s term.

Consequences of a Donald Trump Election Win on the Fixed Income Market

Expected Economic Strategies

If Donald Trump were to win again, his proposed economic strategies would likely center around tax cuts and deregulation. These policies could have distinct implications for the bond market. For instance, tax cuts may stimulate economic growth, which could lead to an increase in interest rates as demand for capital rises.

A Trump administration might prioritize reducing the deficit through economic growth, but it could also prompt the Federal Reserve to increase rates to counteract inflation, influencing the 10-year yield significantly.

Analyzing the 10-Year Yield Post-Trump Election

Following a Trump victory, we can expect potential shifts in the 10-year yield. Historical data from his first term indicates that yields often fluctuated based on his administration’s announcements and policy directions. During his presidency, the 10-year yield experienced both highs and lows, driven by market reactions to his tax reforms and spending plans.

Investors will want to analyze these trends to gauge potential outcomes for the 10-year yield, especially as they align with Trump’s previous economic decisions that shaped the bond market.

How Elections Affect Bond Yields

There’s a clear relationship between political outcomes and bond yields. Elections can significantly sway the 10-year yield based on the anticipated economic policies. Key factors influencing these changes include:

– **Market Sentiment**: How confident investors feel about the elected leader’s policies.

– **Economic Indicators**: Predictions about inflation and economic growth can drive yields up or down.

– **Monetary Policy Outlook**: The stance of the Federal Reserve in reaction to new leadership can also play a role.

Understanding these dynamics is essential for both individual investors and institutional players in the bond market.

Investment Strategies in a Shifting Political Landscape

For investors, adapting strategies in response to political events is crucial. Here are some tips to consider:

– **Stay Informed**: Keep an eye on election outcomes and proposed policies, as these can have immediate effects on the bond market.

– **Diversification**: Spread investments across different assets to mitigate risks associated with market volatility that elections can trigger.

– **Long-Term Perspective**: Focus on long-term trends rather than reacting to short-term fluctuations caused by political events.

Understanding the nuances of the bond market amid political changes is vital for successful investment planning.

Conclusion

In summary, the potential influences of both Kamala Harris and Donald Trump on the 10-year yield are substantial. Each candidate’s economic policies could lead to different outcomes in the fixed income market. As political developments unfold, it’s important for investors to remain vigilant and ready to adjust their strategies accordingly. Keeping an eye on the 10-year yield will provide important insights into the broader economic landscape shaped by these political changes.

If you want to stay updated on the bond market and investment strategies in light of political changes, subscribe for future insights!

FAQ

What is the 10-year yield?

The 10-year yield is the interest rate that the U.S. government pays on its Treasury bonds that mature in ten years. It serves as a key benchmark in the bond market and reflects overall economic health and borrowing costs.

How do elections impact the 10-year yield?

Elections can create uncertainty about future economic policies, causing fluctuations in the 10-year yield. Changes in political leadership often lead to adjustments in market sentiment, which can influence bond yields.

What happens to the 10-year yield if Kamala Harris wins the election?

If Kamala Harris were to win, we might see policies that increase fiscal spending. This could lead to higher interest rates and an upward trend in the 10-year yield as investors anticipate inflation.

How did the 10-year yield react during Donald Trump’s presidency?

During Donald Trump’s first term, the 10-year yield fluctuated significantly based on his tax reforms and spending plans. Analysts expect similar trends if he wins again, with possible increases in yields as economic policies are implemented.

What are some factors that influence the 10-year yield?

- Market sentiment regarding the elected leader’s policies.

- Predictions about inflation and economic growth.

- The Federal Reserve’s monetary policy stance in response to new leadership.

What investment strategies should I consider in a changing political landscape?

- Stay informed about election outcomes and proposed policies.

- Diversify investments to manage risks associated with volatility.

- Maintain a long-term perspective rather than react to short-term market changes.