Meta Platforms is positioned for significant growth, with the increasing use of artificial intelligence (AI) in the digital advertising space. Recent forecasts suggest that generative AI in advertising could skyrocket from $57 million in 2022 to $192 billion by 2032. Despite a dip in stock after reporting strong third-quarter earnings, Meta’s investments in AI infrastructure are expected to enhance advertising effectiveness. With Meta’s daily active user base growing and advertisers seeing higher returns using AI tools, the company could see its stock price rise by 53% over the next three years. This positions Meta to potentially join the $2 trillion club, making it an attractive stock for investors.

The Rise of AI in Advertising Boosts Meta’s Growth Prospects

As artificial intelligence (AI) becomes increasingly widespread across various sectors, its impact on the advertising industry is especially significant. Meta Platforms, the social media giant formerly known as Facebook, is poised to benefit greatly from this trend. According to Bloomberg Intelligence, the generative AI Market is projected to explode from $40 billion in 2022 to a staggering $1.3 trillion by 2032, with ad spending utilizing this technology anticipated to grow by an incredible 125% annually.

Meta reported impressive financial results for the third quarter of 2024, with revenue climbing 10% year-over-year to reach $40.6 billion. Non-GAAP earnings per share surged by 37% to $6.03, surpassing Wall Street’s expectations. This growth was fueled by a rise in ad impressions and an increase in ad prices, indicating that Meta’s investments in AI are starting to deliver results. The company saw a 7% increase in ad impressions and an 11% increase in the average price per ad.

Although Meta’s stock dipped by 4% after releasing these results due to increased capital spending plans, the company’s long-term outlook remains bright. CEO Mark Zuckerberg emphasized the necessity of substantial investment in AI infrastructure, noting that these advancements are expected to bolster Meta’s core ad business, ultimately leading to higher returns on investment for advertisers.

With over 3.29 billion daily active users, Meta’s platform continues to attract advertisers eager to tap into its vast audience. Marketers leveraging Meta’s AI-driven tools have reported significant gains, including a 32% increase in returns on ad spending through automated campaigns.

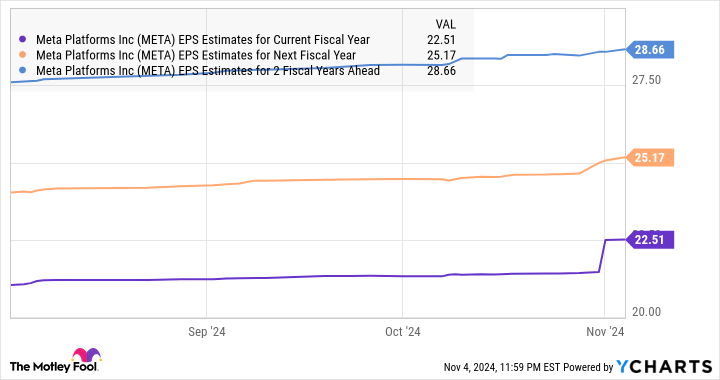

Analysts are optimistic that Meta will experience robust earnings growth over the next few years, potentially moving towards a $2 trillion valuation. As AI technology continues to evolve, Meta’s ability to harness it effectively could lead to significant increases in ad impressions and pricing. Current estimates predict that Meta could achieve earnings of $28.66 per share by 2026, making it an attractive investment for those looking to capitalize on the AI revolution in advertising.

In conclusion, the ongoing integration of AI into Meta’s advertising strategy positions the company for substantial growth, making it an exciting prospect for investors in the coming years.

Tags: Meta Platforms, artificial intelligence, advertising industry, earnings growth, stock Market, generative AI, digital Marketing.

-

What is the AI stock being talked about?

This AI stock is a company that focuses on artificial intelligence technology and is expected to grow significantly in value over the next few years. -

Why do experts think this stock could reach a $2 trillion valuation?

Experts believe that as AI technology becomes more popular and is used in various industries, this company’s growth will increase its value significantly. -

How long will it take for the stock to hit $2 trillion?

Analysts predict that it could take about three years for this stock to reach a $2 trillion valuation, depending on Market conditions and company performance. -

Is it a good time to invest in this AI stock?

Many investors see this stock as a good opportunity, but it’s important to do your own research and consider your investment strategy before making a decision. - What are the risks involved in investing in AI stocks?

Like all investments, there are risks, including Market volatility, competition in the AI space, and changes in technology. It’s crucial to be aware of these risks before investing.