Intel’s decision nearly two decades ago to turn down a partnership with Apple for mobile chips paved the way for Arm to dominate the mobile phone chip Market, now worth $500 billion. Arm’s energy-efficient designs are gaining traction in the booming AI sector, as companies like Microsoft and OpenAI invest heavily in data centers. Recently, Arm’s stock surged following its public debut, and its CEO is optimistic about future growth fueled by AI. However, tensions are rising with Qualcomm over licensing issues, which could affect Arm’s relationships with other clients. Amid SoftBank’s ambitions to expand Arm’s role, competition with Nvidia for AI chip dominance is heating up, marking a significant shift in the tech landscape.

Almost 20 years ago, Intel made a pivotal decision that affected the future of computing. In 2005, when Apple began using Intel chips in its Mac computers, Steve Jobs proposed a secret plan to Intel’s then-CEO, Paul Otellini, for entering the mobile phone Market. Intel declined, missing the chance to be part of what would become the iPhone, effectively giving UK-based Arm an upper hand in mobile chip designs. This decision allowed Arm to dominate the mobile chip Market, worth around $500 billion, now larger than the computer industry.

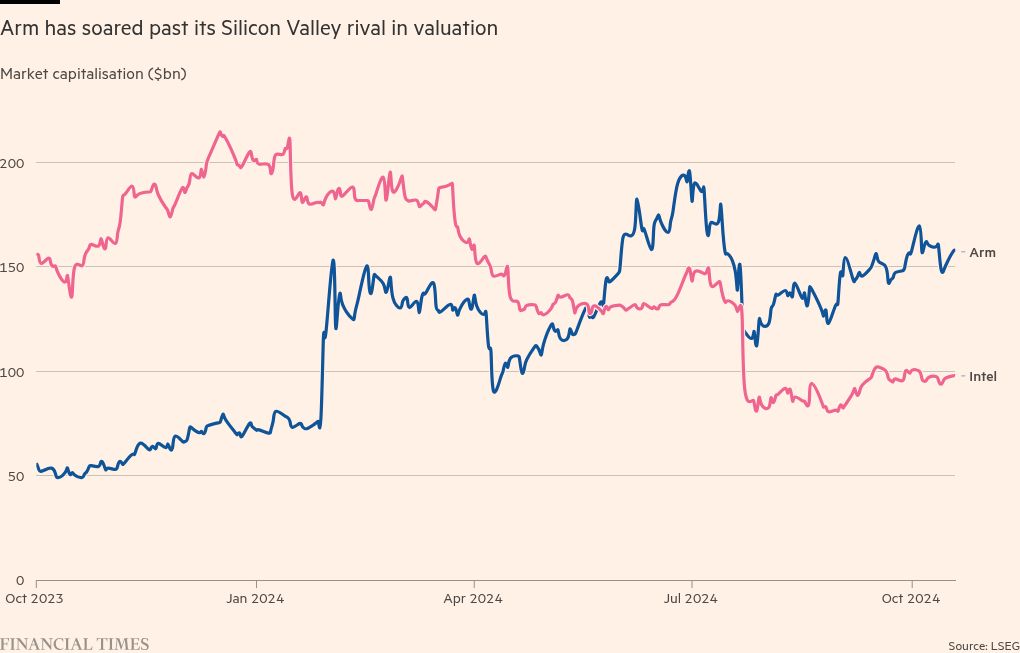

Now, Arm is leveraging its energy-efficient technology to lead in the booming field of artificial intelligence. With tech giants investing heavily in power-hungry data centers, Arm’s capabilities are more crucial than ever. Since going public last year, Arm’s shares have skyrocketed by nearly three times, bringing its valuation to approximately $157 billion, surpassing Intel’s during the summer.

Arm CEO Rene Haas believes the AI revolution is just beginning. Drawing parallels to past technological shifts, he cautions skeptics against underestimating AI’s potential. As demand for more capable processors rises, Arm is currently partnering with Nvidia to power AI data centers, while also eyeing the possibility of creating its own AI chips.

Despite its historic strengths and significant Market presence, Arm is navigating complex relationships with clients like Qualcomm while seeking to shift from a licensing model to potentially developing its own chips. This shift raises concerns among its long-term partners about Arm’s role in the industry.

With major tech firms like Google and Microsoft creating their server chips, Arm is entering competitive territory but remains optimistic about the future. The company aims to harness the growth of AI and data centers, recognizing that its technology is critical in modern computing.

As it evolves, Arm is determined to seize opportunities in a rapidly changing Market, proving that its journey from humble beginnings to industry leader is far from over.

-

Why is Arm important in the AI investment boom?

Arm designs tiny and efficient chips that power many devices. These chips are becoming essential for running AI applications, making Arm a key player in this technology. -

How does Arm’s technology differ from others?

Arm focuses on making chips that use less energy while still being powerful. This is important for AI, where efficiency and speed can make a big difference. -

What advantages does Arm have over its competitors?

Arm licenses its designs to many companies instead of making chips itself. This allows a wide range of products to use its technology and fuels its growth in the AI field. -

Are there any challenges Arm might face?

Yes, Arm faces competition from other chip makers and the need to keep innovating. Plus, the demand for AI can change quickly, so staying ahead is crucial. - How could Arm benefit from the growing AI Market?

As more devices and applications use AI, the demand for efficient chips will increase. If Arm can meet this demand, it could see significant growth and success in the Market.