C3.ai, an AI software specialist, has struggled since its IPO nearly four years ago, with shares down 72%. Although it saw a brief spike in early 2023, its performance has declined again. However, the company operates in a rapidly growing Market, poised to reach $153 billion by 2028, which could allow for a turnaround. C3.ai recently shifted to a pay-as-you-go model, leading to increased customer engagement and pilot projects. Analysts expect revenue growth in the double digits and predict the company might achieve profitability in a couple of years. With an attractive valuation compared to its competitor Palantir, C3.ai could be a solid investment for future gains.

C3.ai: Can This AI Software Company Bounce Back?

C3.ai has been making headlines recently, but not necessarily for the right reasons. Since its initial public offering nearly four years ago, the company has seen its stock price fall by a staggering 72%. Although there was a brief spike in its price earlier this year due to growing interest in artificial intelligence, the stock has since struggled, even declining by 8% in 2024. In contrast, competitor Palantir Technologies has enjoyed a 162% increase in its stock price this year, fueled by strong demand for its AI software platforms.

So, can C3.ai turn things around and become a solid investment in the next few years? The potential is certainly there. The AI software Market is expected to grow at a remarkable annual rate of nearly 41% over the next five years. Experts predict that the Market size will rise from $28 billion last year to $153 billion by 2028. This growth could open doors for C3.ai to regain its footing and improve its performance.

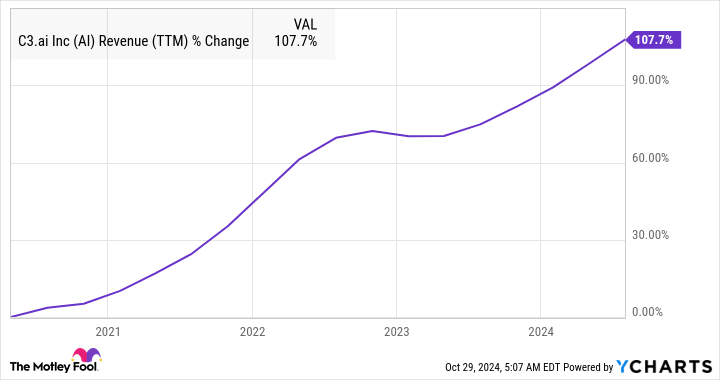

The company’s recent struggles stem from its shift to a new business model in August 2022, changing from a subscription-based service to a consumption-based model. While this transition initially impacted growth, recent earnings reports indicate positive changes. In the fiscal first quarter of 2025, C3.ai reported a 21% year-over-year revenue increase to $87.2 million, and it anticipates further growth in revenues.

Moreover, the consumption-based model has made it easier for customers to adopt C3.ai’s services, leading to increased interest. The number of pilot projects has jumped from 24 to 52 year over year, and the company secured 71 new deals in the last quarter, compared to just 32 from the previous year. Notably, more than 30% of its new bookings now come from federal agencies, marking a significant development for the company.

As analysts remain optimistic about C3.ai’s growth prospects, the company is expected to achieve profitability in the coming years. While it may face an adjusted loss this fiscal year, predictions show improvement in its earnings for the next fiscal year and an expectation of non-GAAP profitability in the future.

In summary, C3.ai has the potential to bounce back and deliver solid gains for investors over the next five years, thanks to its newfound growth drivers and reasonable valuation compared to its competitors. Investors may want to keep an eye on this AI specialist as it navigates the challenges ahead.

Tags: C3.ai, stock Market, AI software, investment, Palantir Technologies, business model, consumption-based model, revenue growth, profitability.

What is C3.ai?

C3.ai is a company that provides artificial intelligence software for businesses to help them make better decisions and work more efficiently.

What factors will influence C3.ai’s stock price in five years?

The stock price could be affected by the company’s growth, the demand for AI technology, competition, and general Market trends.

Is C3.ai expected to grow in the coming years?

Many analysts believe that C3.ai has potential for growth, especially as more companies adopt AI solutions.

What should investors watch for regarding C3.ai?

Investors should keep an eye on C3.ai’s earnings reports, new contracts, partnerships, and developments in AI technology.

Can anyone predict exactly where C3.ai’s stock will be in five years?

No one can predict stock prices with complete certainty, as they are influenced by many unpredictable factors.