C3.ai is looking to recover from a challenging few years after a disappointing initial public offering that saw its stock drop 72%. Despite a surge in early 2023 due to AI excitement, the company is down again this year. However, the AI software Market is expanding rapidly, expected to grow from $28 billion to $153 billion by 2028. C3.ai’s recent shift to a pay-as-you-go business model seems to be attracting more customers, with increased pilot projects and a growing number of deals, especially with U.S. federal agencies. Analysts are optimistic about their revenue growth, and the company could achieve profitability in a few years, suggesting it may become a worthwhile investment in the long run.

Can C3.ai Turn Around Its Poor Performance?

C3.ai, a company specializing in artificial intelligence software, has faced significant challenges since it went public almost four years ago. Since its initial public offering (IPO), its stock has plummeted by 72%. Despite a brief surge in early 2023, driven by growing interest in AI technology, the stock has struggled to maintain its momentum, showing an 8% decline this year. In contrast, rival Palantir Technologies has seen a remarkable 162% increase in its stock price, fueled by rising demand for its AI-related services.

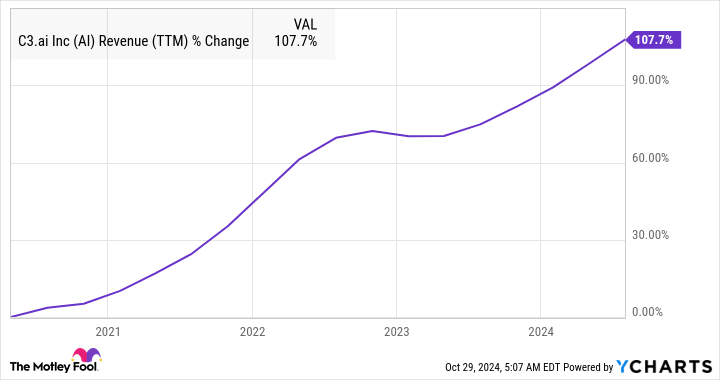

However, there’s reason to believe that C3.ai may be on the path to recovery. The Market for AI software platforms is expected to grow rapidly, with projections indicating it could reach $153 billion by 2028, up from just $28 billion last year. This growth potential is encouraging for C3.ai, especially as it adapts its business model from a subscription-based approach to a pay-as-you-go system. This shift, initiated in 2022, is designed to lower barriers for customers and has already led to an increase in pilot projects and contracts.

In its recent quarterly results, C3.ai reported a 21% increase in revenue compared to the previous year, a sign that the new business model is gaining traction. The company anticipates additional revenue growth for the current fiscal year, with expectations of hitting between $370 million to $395 million.

Moreover, C3.ai is making headway in securing contracts with federal agencies, which now account for over 30% of its bookings. This move could pose a strong advantage as it competes in the AI Market. Analysts remain optimistic about C3.ai’s future, with expectations of solid revenue growth and potential profitability in the coming years.

In summary, while C3.ai has faced hurdles in the past, its recent performance improvements and the overall growth of the AI Market suggest that it could become a worthwhile investment for the future.

Tags: C3.ai, AI software, stock Market, investment, business model, revenue growth, federal contracts, Market analysis.

What is C3.ai’s business focus?

C3.ai focuses on providing artificial intelligence software solutions for businesses. They help companies analyze data and improve their operations.

What factors could affect C3.ai’s stock price in five years?

Factors like company growth, competition in the AI field, and overall Market conditions can all impact C3.ai’s stock price over the next five years.

Is C3.ai likely to grow in the coming years?

C3.ai has potential for growth due to the increasing demand for AI technology, but it will depend on how well they compete and innovate in the Market.

Should I invest in C3.ai for long-term gains?

Investing in C3.ai could be beneficial, but like any investment, it comes with risks. It’s important to research and consider your financial goals before making a decision.

Where can I find updates on C3.ai’s stock performance?

You can find updates on C3.ai’s stock performance through financial news websites, stock Market apps, and the company’s official announcements.