Hedge funds investing in the dollar have gained notable attention as the US presidential election nears. This surge is driven by a growing demand for haven assets amid political uncertainty. As investors reposition their strategies, understanding the dynamics of this market trend becomes crucial for navigating the impending volatility.

Understanding Hedge Funds and Their Role in Currency Markets

Hedge funds are investment vehicles designed to maximize returns, often using a range of sophisticated strategies. They typically cater to high-net-worth individuals and institutional investors, aiming to generate high returns regardless of market conditions. One of the critical areas they operate in is the currency market, where they can leverage different trades to capitalize on fluctuations in currency values.

Speculative traders play a vital role in this dynamic. These traders actively buy and sell currencies based on their predictions of future market movements. Their actions can lead to significant shifts in the market, especially during crucial periods like an election. As the upcoming US presidential election looms, hedge funds investing in the dollar are keenly aware of how these speculative pressures can influence currency strength.

The Rising Demand for Haven Assets

Haven assets are investments considered low-risk and typically retain value during periods of economic uncertainty. Common examples include government bonds and precious metals. As we approach the presidential election, the demand for these safe-haven assets has surged. Political instability and economic fluctuations lead investors to seek safety, driving interest in the dollar as a stable investment.

Several factors contribute to this heightened demand. Market uncertainty, driven by possible changes in policies and governance, often propels investors to secure their capital in assets perceived as safe. The impending US presidential election further accentuates this trend, as investors become increasingly cautious, reflecting their concerns about potential volatility in the stock and currency markets.

Market Speculation and the Anticipated Currency Rally

Currently, there’s substantial speculation in the market about the strength of the dollar. Many traders are positioning themselves for a possible dollar rally, betting that it will appreciate in value as the election approaches. Hedge funds investing in the dollar are particularly focused on the narratives shaping public sentiment and market trends.

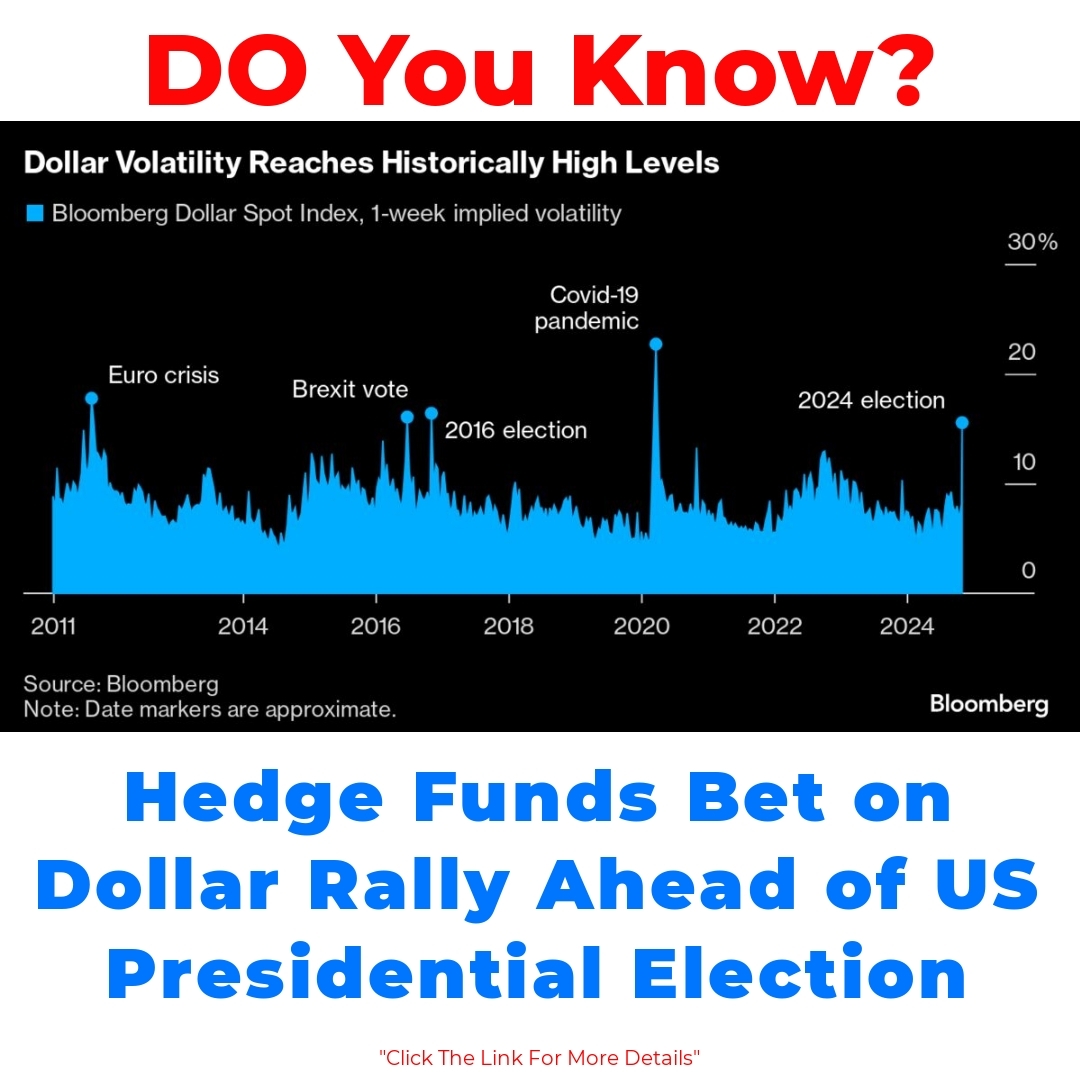

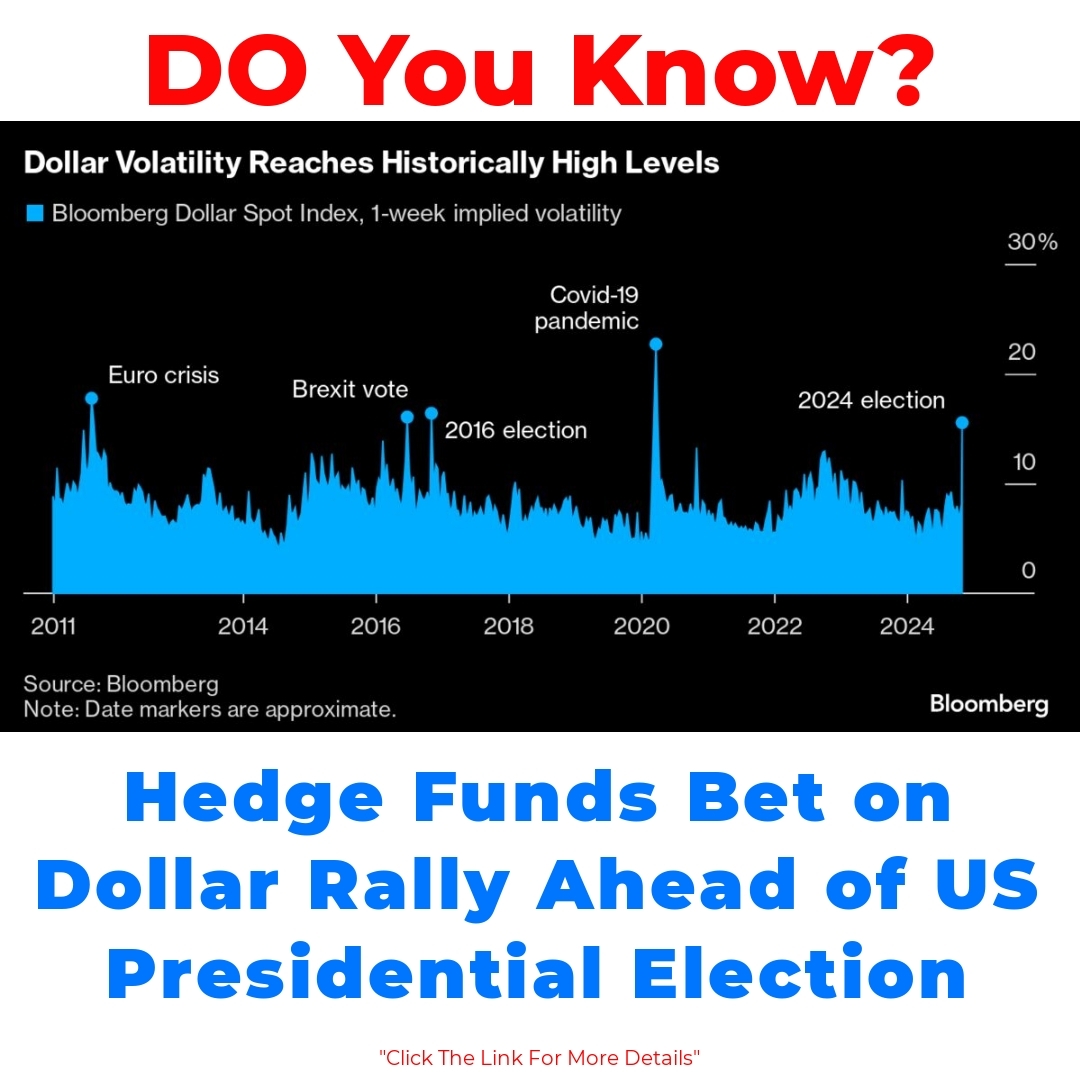

Historically, elections have had notable effects on currency values. For instance, uncertainty around election outcomes can cause traders to favor the dollar over other currencies, leading to fluctuations in its value. Analyzing previous elections provides insights into how political shifts can correlate to currency strength and investor behavior, shaping current market speculation.

Strategies Hedge Funds Are Using to Position for a Dollar Rally

To capitalize on the anticipated rally, hedge funds are employing a variety of strategies. One common tactic is taking long positions on the dollar, essentially betting that its value will rise. This approach makes sense in a landscape marked by election volatility, as traders anticipate movements influenced by electoral results and political outcomes.

However, with potential gains come inherent risks. The same market conditions that create opportunities can also lead to unpredictable fluctuations. Hedge funds must balance their strategies carefully, blending courage in their investments with a calculated understanding of market realities as they prepare for the dollar’s performance during and after the elections.

The Impact of Speculative Trading on Dollar Demand During Elections

The relationship between speculative trading and dollar demand becomes even more pronounced during election cycles. Historically, events like presidential races can create considerable market disruptions, leading to heightened demand for the dollar.

For example, during previous elections, traders reacted to pre-election polls and announcements with significant volatility. The dollar often strengthened as panic set in among investors wary of potential shifts in leadership. Such patterns underline the importance of understanding how speculative trading interacts with broader market dynamics, particularly during uncertain times.

Safe-Haven Investments and Their Importance in Times of Uncertainty

Safe-haven investments are vital during periods of uncertainty. These investments are characterized by their resilience in turbulent markets, often sought after by investors looking to safeguard their capital. In light of the upcoming elections, hedge funds are diversifying their portfolios by incorporating these assets.

By investing in safer options, they can mitigate risks associated with potential swings in market sentiment. This diversification reflects a broader strategy to balance risk and return, ensuring that even in volatile elections, hedge funds can navigate challenges effectively.

Conclusion

In summary, hedge funds investing in the dollar are responding to a complex landscape shaped by the upcoming US presidential election. Their strategies reflect a keen awareness of market speculation, the demand for haven assets, and the potential risks associated with election volatility. As political climates shift, staying informed becomes essential for investors navigating these turbulent waters.

With the ongoing demand for haven assets and the anticipated currency rally, the next few months will significantly impact how hedge funds position themselves. Engaging with market trends and understanding speculative dynamics will be crucial, especially as we inch closer to the election.

FAQ

What is a hedge fund?

A hedge fund is an investment vehicle aimed at maximizing returns through advanced strategies. They primarily serve high-net-worth individuals and institutional investors and strive for high returns regardless of market performance.

How do hedge funds impact currency markets?

Hedge funds participate actively in currency markets, using various trading strategies to profit from fluctuations in currency values. They can influence market movements, especially during significant events like elections.

What are haven assets?

Haven assets are low-risk investments that maintain value during economic uncertainty, such as government bonds and precious metals. Investors seek these during volatile times to protect their capital.

Why is demand for haven assets increasing before elections?

As elections approach, political instability and economic uncertainties drive investors to seek safety in stable assets. This heightened demand is particularly strong for the dollar during these periods.

What strategies are hedge funds using for a potential dollar rally?

Hedge funds are taking long positions on the dollar, betting on its appreciation in value as elections approach. They balance potential gains with the risks associated with market fluctuations.

How does speculative trading affect dollar demand during elections?

Speculative trading often leads to increased demand for the dollar during elections, as traders react to pre-election polls and news. This can result in significant fluctuations in the dollar’s value.

What role do safe-haven investments play for hedge funds?

During election cycles, hedge funds use safe-haven investments to mitigate risks associated with market volatility. Diversifying portfolios with these assets helps them safeguard capital against unpredictable market changes.