Bitcoin currently stands at a pivotal moment in the cryptocurrency market, drawing attention not just for its price movements but also for external influences like politics. This article explores the intriguing connection between Bitcoin’s performance and Donald Trump’s election odds, particularly how his pro-crypto stance as the Republican nominee may impact the cryptocurrency landscape.

The State of Bitcoin and Its Market Significance

Bitcoin has been making waves recently with its price movements that have captured the attention of both seasoned investors and newcomers alike. As the leading cryptocurrency, Bitcoin holds a critical position in the cryptocurrency market, often serving as a benchmark for others. For instance, recent statistics indicate that Bitcoin’s market cap remains significantly higher than that of its closest competitors, which underscores its dominance. The current trends show that many investors are closely monitoring Bitcoin’s resilience and potential to break previous records.

Understanding Bitcoin’s performance helps investors gauge the overall health of the cryptocurrency market. With its fluctuating price often influenced by economic factors, the correlation between political events and Bitcoin’s value has become an area of keen interest. The ongoing discussions around regulation and the crypto landscape, especially with the potential for candidates like Donald Trump to shape these regulations, add an intriguing layer to the investment narrative.

Donald Trump: Pro-Crypto Republican Nominee

Donald Trump has emerged as a significant figure in the cryptocurrency discussion due to his pro-crypto stance. His nomination as the Republican candidate could bring pivotal changes to cryptocurrency regulations. For investors, Trump’s policies, which lean towards favoring cryptocurrencies like Bitcoin, could signal a more favorable environment for cryptocurrencies. This pro-crypto sentiment aligns with the growing popularity of digital currencies, potentially leading to a bullish outlook for Bitcoin’s price.

By examining Trump’s past actions and statements regarding cryptocurrencies, we can better understand how his policies might influence market perceptions. Trump’s approach to digital assets could encourage institutional investment, thereby boosting Bitcoin’s value further. As he pivots towards becoming a pro-crypto advocate, it’s essential for investors to consider how Trump’s nomination could shape their investment strategies.

Election Odds and Betting Markets: Correlation with Bitcoin Prices

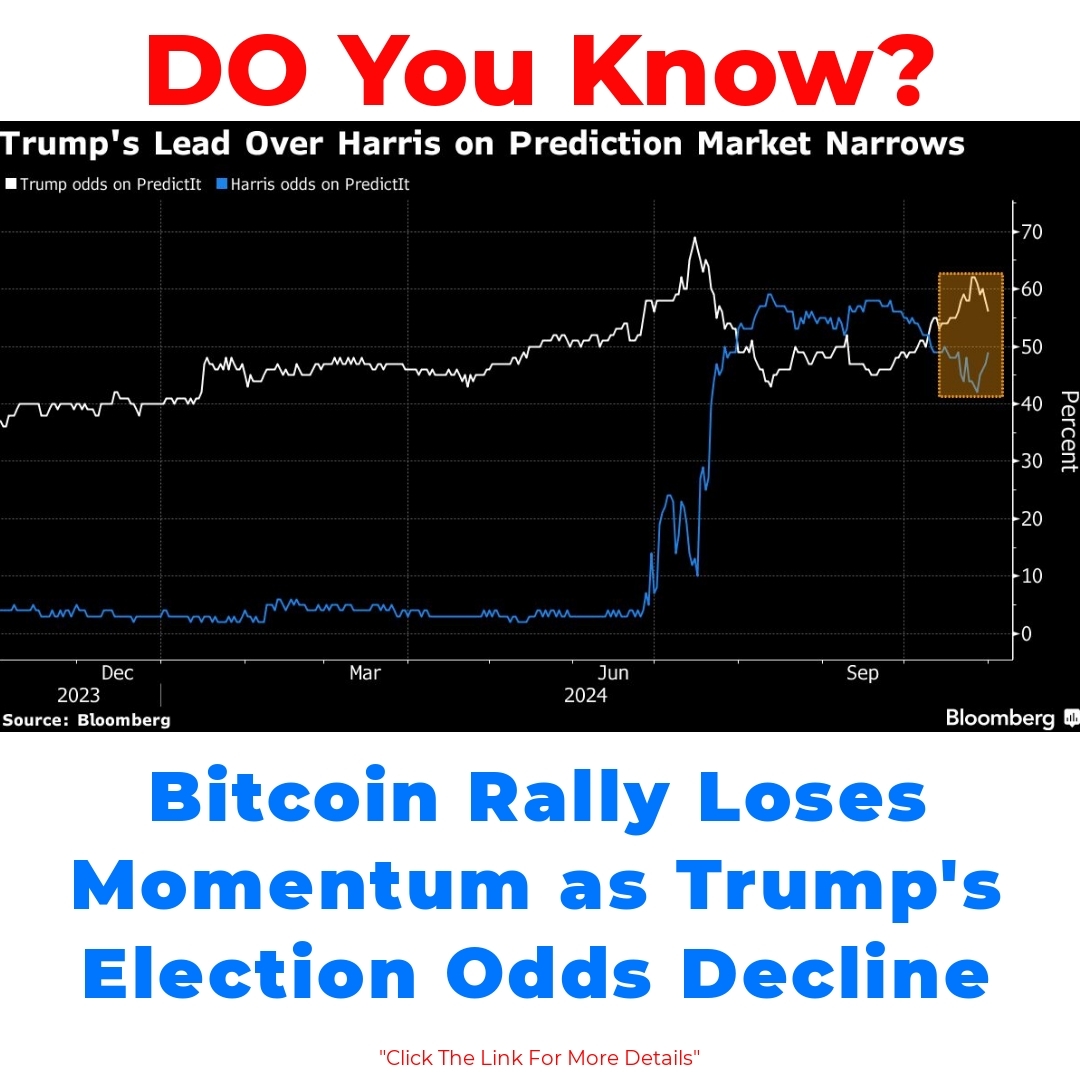

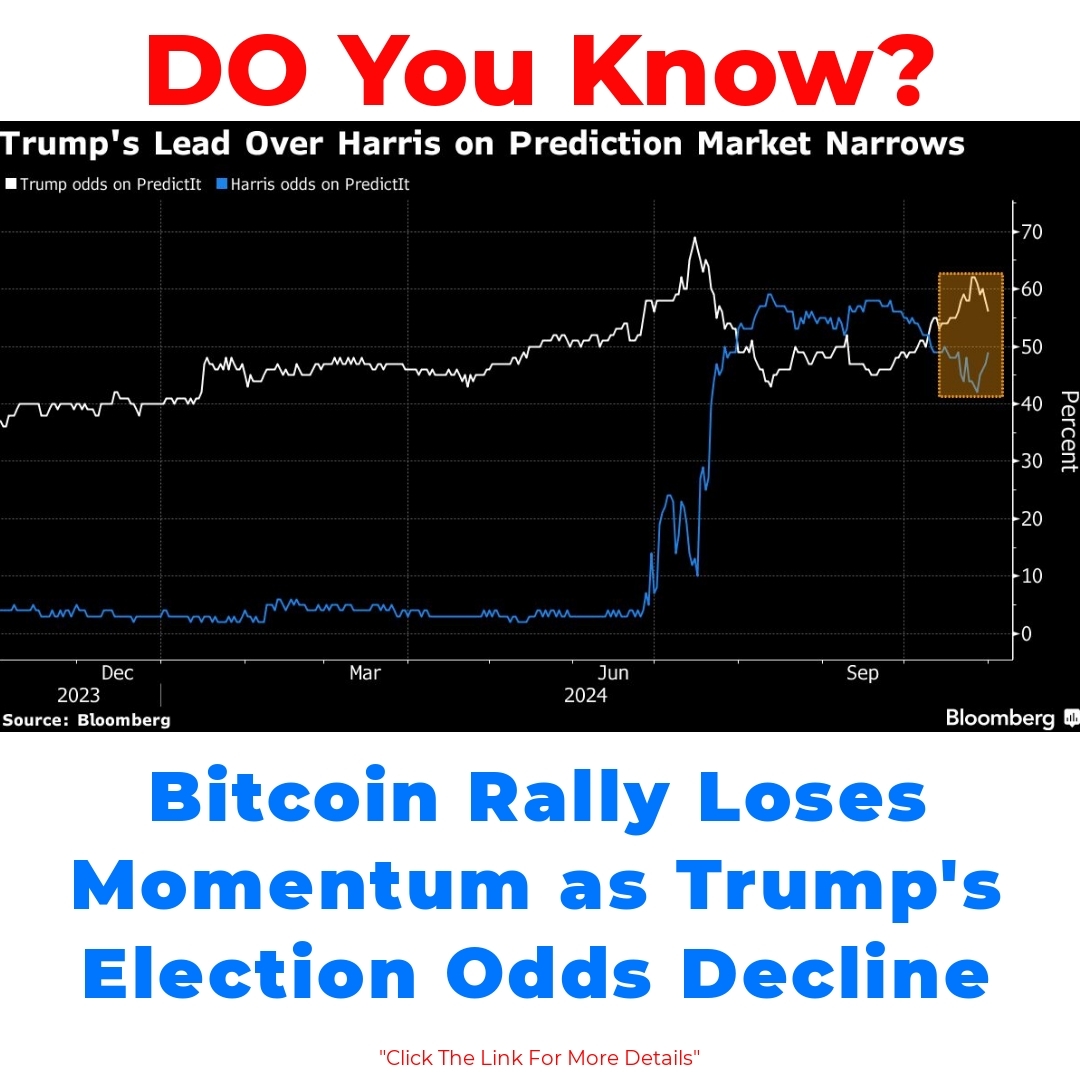

The current betting markets on Trump’s election odds present another layer of complexity. As his odds fluctuate, they may also have a direct impact on Bitcoin prices. For instance, when Trump’s chances of securing the Republican nomination seem to increase, there often follows an uptick in Bitcoin’s value. This correlation suggests that the confidence in a pro-crypto candidate can bolster investor sentiment in cryptocurrencies.

Looking back at previous presidential elections, we see that political developments have frequently aligned with trends in the cryptocurrency market. Notably, events that bring about promising regulatory changes tend to result in market rallies. These patterns are worth considering as investors adjust their portfolios based on Trump’s political trajectory.

The Political Influence on the Cryptocurrency Market

Political candidates undoubtedly shape the cryptocurrency landscape. Their policies can either usher in new regulations that favor the market or impose restrictions that could hamper growth. For instance, Republican policies surrounding cryptocurrencies often favor innovation and foster an environment conducive to technological advancements in this space.

In historical context, we can trace the rise and fall of Bitcoin’s value during various elections and political events. Election outcomes have consistently played a role in shaping market sentiment, demonstrating that when crypto-friendly candidates gain traction, Bitcoin often experiences positive momentum.

Long Tail Keyword Insights: How Trump’s Candidacy Affects Bitcoin Value

As we look ahead, several scenarios could unfold regarding Bitcoin prices and election outcomes. Notably, if Trump secures the nomination and continues to maintain his pro-crypto stance, we could see Bitcoin reach record highs. The market sentiment is already buzzing with discussions about “how Trump’s candidacy affects Bitcoin value,” indicating that investors are keenly aware of the political climate.

Community reactions to Trump’s potential nomination have varied, but there seems to be an underlying optimism among pro-crypto advocates. Predictions are rolling in regarding how Bitcoin’s record highs could correlate with the upcoming presidential elections, suggesting that political dynamics will remain a critical factor influencing market trends.

Conclusion

In summation, the relationship between Bitcoin’s market performance and Donald Trump’s political journey is complex and multifaceted. As political developments unfold, they will undoubtedly influence not only Bitcoin’s price but also the broader cryptocurrency market. With election season approaching, it’s vital for investors to stay tuned to both Bitcoin price trends and political updates, as they could define the future landscape of the cryptocurrency sector.

As we navigate this intersection of politics and cryptocurrency, it’s clear that understanding these dynamics can help inform investment decisions. Keeping an eye on how political events shape Bitcoin’s trajectory will be essential for anyone looking to engage in this exciting market.

Call to Action

Stay informed about Bitcoin and political developments that may influence your investments. Following cryptocurrency news outlets and monitoring betting market trends can provide you with valuable insights into where the market might be headed next. Don’t miss out on the opportunity to capitalize on the exciting intersection between politics and cryptocurrencies!

What is the current state of Bitcoin in the market?

Bitcoin is currently the leading cryptocurrency, maintaining a significant market cap higher than its nearest competitors. Its performance is often used as a benchmark for the entire cryptocurrency market.

How do political events influence Bitcoin’s value?

Bitcoin’s price can fluctuate based on economic factors and political events. Regulatory discussions, particularly those involving notable political figures like Donald Trump, have been shown to impact Bitcoin’s value.

What role does Donald Trump play in Bitcoin’s future?

Donald Trump has expressed a pro-crypto stance, which could lead to more favorable regulations for cryptocurrencies like Bitcoin. His nomination as the Republican candidate may positively affect investor sentiment toward Bitcoin.

Is there a correlation between Trump’s election odds and Bitcoin prices?

Yes, there seems to be a direct correlation. As Trump’s chances of securing the nomination increase, Bitcoin prices often experience an uptick, which indicates that a pro-crypto candidate can bolster investor confidence.

How should investors respond to political developments surrounding Bitcoin?

- Stay informed about Trump’s political trajectory and related news.

- Monitor election outcomes and regulatory changes that could affect the crypto landscape.

- Adjust investment strategies based on insights from market trends and political events.

What historical patterns exist between elections and Bitcoin’s value?

Historically, Bitcoin’s value has risen during elections when crypto-friendly candidates gain traction. Regulatory changes often lead to market rallies, making political outcomes significant for investors.

What are some predictions for Bitcoin and the upcoming elections?

If Trump maintains his pro-crypto stance and secures the nomination, Bitcoin could potentially reach new record highs. Investors are actively discussing how these political shifts may influence Bitcoin’s value.

How can I stay updated on Bitcoin and political influences?

Follow cryptocurrency news outlets and keep an eye on betting market trends. Staying informed about both Bitcoin price movements and relevant political developments can provide valuable insights for your investments.