The economic landscape of China is showing signs of rejuvenation in 2023, particularly following recent stimulus measures aimed at bolstering growth. This article delves into key China economic indicators, exploring recovery in the manufacturing sector, shifts in the housing market, and broader economic recovery trends. Join us as we analyze the vital statistical hints of progress in this crucial global economy.

Understanding China’s Recent Economic Recovery Indicators (2023)

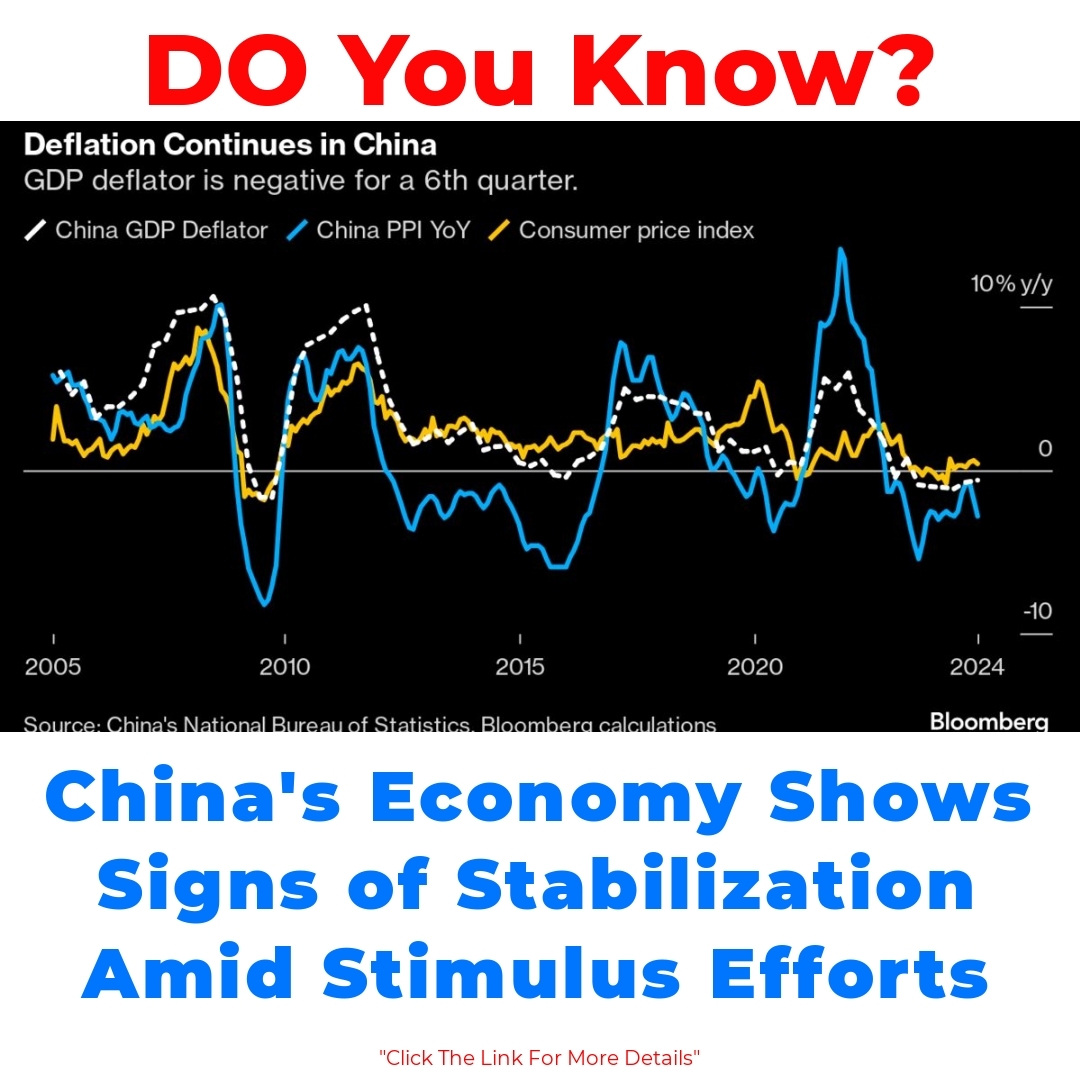

The landscape of China’s economy has been shifting since the government announced various stimulus measures earlier this year. These measures aim to revive growth and improve the overall economic situation that had seen a slowdown recently. When we talk about **China’s recent economic recovery indicators 2023**, we are looking at several key metrics that signal the health and stability of the economy. Before these measures, many sectors faced significant challenges, making it crucial to analyze the signs of stability now emerging across key areas.

Tentative Signs of Stabilization in the Manufacturing Sector

One area where we can observe promising trends is the manufacturing sector. Indicators of **manufacturing sector recovery** are becoming evident, especially post-stimulus. According to recent data on **industrial production in China**, there’s been a noticeable uptick since these economic policies were put into action. For instance:

– **Industrial output** has increased, reflecting a rise in factory activity.

– **Consumer confidence** is also on the rebound, which is pivotal for stimulating demand in this sector.

With specific industries like electronics and machinery showing notable growth, it’s clear that revitalization is underway, painting a hopeful picture for China’s manufacturing future.

Developments in the Housing Market in China

Another crucial aspect of China’s economic indicators is the housing market. The **housing market in China** has traditionally been a barometer for economic health, and current developments suggest a positive shift. Recent analyses indicate:

– A rise in **property prices** as buyers return to the market, driven by improved consumer sentiment.

– Increased sales volume in key cities indicates growing **buyer sentiment**.

The government’s stimulus measures have clearly played a role in firing up the real estate sector. These initiatives often include incentives for first-time home buyers and reduced mortgage rates, which have contributed to a market rebound and heightened investment interest.

The Broader Picture: Economic Recovery in China

Taking a step back, the picture of **economic recovery in China** extends beyond individual sectors. It’s about how these indicators combine to illuminate a path toward sustainable growth. Signs of recovery from the manufacturing and housing sectors indicate:

– Economic growth signs are becoming more pronounced, creating a robust atmosphere for overall recovery.

– Confidence is returning, not just among consumers but also among investors, further fueling economic activities.

When we consider these interconnections, they foster a more optimistic economic outlook, suggesting that China may be on the right track to regain its pre-slowdown momentum.

Impact of Government Stimulus on China’s Economy

The role of **China stimulus measures** in this situation cannot be overstated. These actions are designed to boost the economy in both the short and long term. In analyzing their impact, we can see:

– Immediate improvements in consumer spending and industrial output following stimulus announcements.

– Long-term effects include a reinvigorated economic landscape, characterized by increased investment and consumer trust.

As these stimulus measures continue to take effect, we can expect a more stable economic environment, with indicators increasingly reflecting this newfound stability.

Conclusion

In summary, the latest **China economic indicators** provide a comprehensive glimpse into the current state of the economy. We’ve discussed how signs of recovery are emerging in the manufacturing and housing sectors, hinting at a potential turnaround facilitated by government initiatives. The implications of this data might suggest a bright future for China’s economic landscape, encouraging ongoing observation of developments in these critical areas as they evolve.

Call to Action

What do you think about China’s economic outlook based on the indicators we’ve explored? Share your thoughts and insights about the path forward for China’s economy in the comments below. Understanding these dynamics is crucial as we navigate this important economic landscape together.

Frequently Asked Questions

What are the key indicators of China’s recent economic recovery in 2023?

The key indicators of China’s economic recovery include:

- Increased industrial output reflecting higher factory activity.

- Improved consumer confidence boosting demand in various sectors.

- Rising property prices indicating a rebound in the housing market.

- Increased sales volumes in major cities showing growing buyer sentiment.

How has the manufacturing sector shown signs of recovery?

The manufacturing sector has shown signs of recovery through:

- A noticeable uptick in industrial production numbers since the implementation of government stimulus measures.

- Growth in specific industries like electronics and machinery.

- Increased consumer confidence, which is essential for stimulating demand.

What developments have taken place in the housing market in China?

Recent developments in the housing market include:

- A rise in property prices as buyers re-enter the market.

- Increased sales volume reported in key urban areas.

- Government initiatives like incentives for first-time home buyers and reduced mortgage rates supporting the market comeback.

How do these recovery indicators contribute to the broader economic picture?

The recovery indicators combine to show a potential path for:

- More pronounced economic growth signs, suggesting a robust recovery effort.

- Improved confidence among consumers and investors, driving further economic activity.

What role does government stimulus play in China’s economic recovery?

Government stimulus measures impact China’s economy by:

- Providing immediate improvements in consumer spending and industrial output.

- Encouraging long-term investment and rebuilding consumer trust.

- Creating a more stable economic environment as recovery indicators become increasingly positive.