The current landscape of US Treasuries is marked by rising market volatility and shifting investor sentiment. With an impending employment report and the Federal Reserve’s policy decision on the horizon, it’s crucial for investors to comprehend these dynamics. Understanding market fluctuations and effective hedging strategies is imperative for successful navigation in this environment.

Understanding US Treasuries

What are US Treasuries?

US Treasuries are debt instruments issued by the U.S. Department of the Treasury to finance government spending. There are several types, including Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds), each varying in terms of maturity and interest payments. These securities play a pivotal role in the financial system, often considered one of the safest investments.

The Relationship Between US Treasuries and Interest Rates

Understanding the connection between US Treasuries and interest rates is crucial. When the Federal Reserve changes interest rates, it directly affects the yields on these treasury securities. In today’s market, interest rates are on the rise, and forecasts suggest that further hikes might be coming. This can lead to a decrease in bond prices as yields increase, impacting how investors perceive the value of US Treasuries.

The Importance of Economic Indicators

Key Economic Indicators Influencing US Treasuries

Economic indicators like inflation rates and employment data heavily influence US Treasuries. For instance, rising inflation often leads to higher interest rates, impacting treasury yields. Investors need to keep a close watch on these indicators, as they provide insights into market trends and potential shifts in Federal Reserve policies.

The Upcoming Employment Report

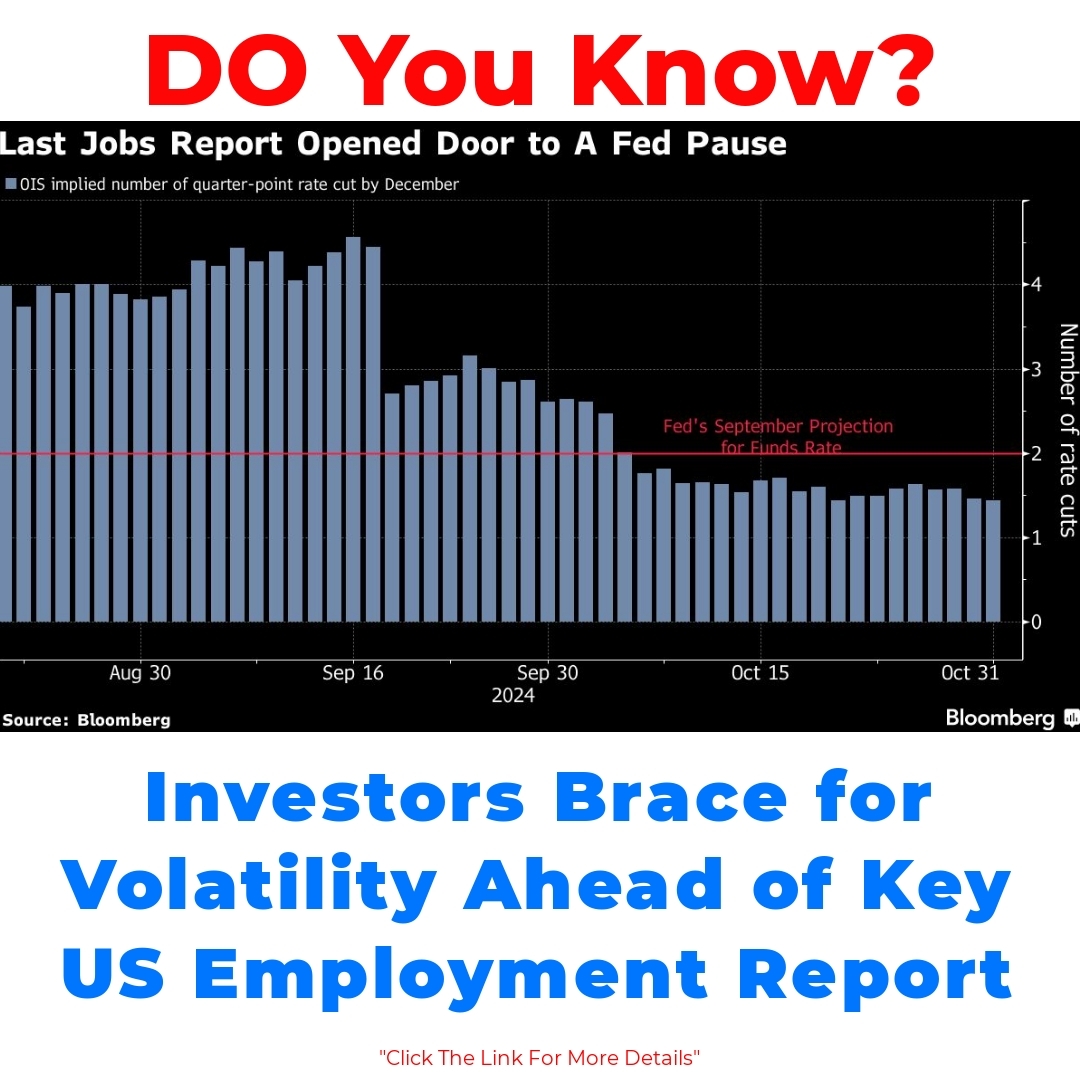

One event on the horizon is the upcoming employment report. This report details job creation, unemployment rates, and wage growth, all vital for understanding economic health. Historically, previous employment reports have resulted in significant market volatility. For example, better-than-expected job growth can result in heightened concerns about inflation, leading to potential changes in Federal Reserve policy. This is why the impact of the employment report on Federal Reserve decisions is crucial for investors to monitor.

Market Sentiment and Volatility

Current Market Dynamics

Investor sentiment is currently uneasy, with rising concerns about selloffs in US Treasuries. Many hedge funds are reevaluating their strategies, attempting to navigate this turbulent environment. As interest rates rise, investors are weighing the risks of holding onto their treasury securities, leading to a mixed overall sentiment in the market.

Preparing for Volatility

With the market showing signs of volatility, preparing is essential. Investors are increasingly looking towards hedging techniques to safeguard against a potential selloff in US Treasuries. This can include diversifying their bond portfolios or employing options strategies to manage risk effectively. By being proactive, investors can better navigate the uncertainties in the US bond market.

The Federal Reserve Policy Decision

Overview of the Federal Reserve’s Role

The Federal Reserve plays a crucial role in shaping economic conditions and, by extension, market volatility. Decisions made by the Fed regarding interest rates influence confidence in US Treasuries and can resonate throughout financial markets. Understanding their framework helps investors anticipate potential moves that might impact their investment strategies.

Anticipated Outcomes from the Upcoming Policy Decision

As we approach the Federal Reserve’s policy decision, there are several expectations in play. Analysts predict potential interest rate changes that could significantly affect US Treasuries. A decision to raise rates could lead to declines in bond prices, increasing volatility across broader financial markets. Thus, this upcoming decision is pivotal for anyone invested in US Treasuries or the bond market in general.

Implications for Investors

The Intersection of Labor Market Data and Bond Market

The bond market is intricately linked to labor market data. Strong job growth typically translates into increased consumer spending and economic expansion. This, in turn, can lead to higher interest rates and affect movements in US Treasuries. Investors must understand this connection to make informed decisions about their bond holdings.

Navigating the Stock Market Volatility

With potential volatility impacting both the bond and stock markets, investors need clear strategies. Diversifying investment portfolios can help mitigate risks associated with market fluctuations. Combining fixed-income securities like US Treasuries with equities might provide a balanced approach to navigation through uncertain times, which many analysts recommend.

Conclusion

In summary, investors need to pay attention to the dynamics surrounding US Treasuries, the upcoming employment report, and the Federal Reserve policy decision. Each of these elements plays a crucial role in shaping investment strategies and understanding market movements. Staying informed and being prepared for market changes is essential for anyone looking to invest successfully in the current climate.

Call to Action

For those interested in the latest updates on market trends and insights related to US Treasuries and critical economic indicators, be sure to subscribe for ongoing updates. Staying ahead of the curve can make a substantial difference in your investment outcomes.

What are US Treasuries?

US Treasuries are essentially loans made to the U.S. government. When you buy one, you are lending money to the government in exchange for regular interest payments. There are three main types:

- Treasury Bills (T-bills): Short-term securities that mature in a year or less.

- Treasury Notes (T-notes): Medium-term securities that mature in 2 to 10 years.

- Treasury Bonds (T-bonds): Long-term securities that take 30 years to mature.

How do interest rates affect US Treasuries?

Interest rates directly influence the yields on US Treasuries. When the Federal Reserve raises interest rates, it generally causes treasury prices to fall, as new bonds will offer higher returns. This relationship means that understanding interest rate trends is crucial for anyone considering investing in Treasuries.

What economic indicators should investors watch?

Several key economic indicators can impact US Treasuries:

- Inflation Rates: Higher inflation can lead to increased interest rates.

- Employment Data: Job growth and wage increases suggest a strengthening economy, which might prompt interest rate hikes.

Why is the upcoming employment report significant?

The employment report can cause significant fluctuations in the bond market. Strong job growth might raise concerns about inflation, affecting Federal Reserve policies. Thus, monitoring this report is vital for investors in US Treasuries.

What should investors know about market sentiment and volatility?

Currently, there is a sense of unease among investors regarding US Treasuries due to rising interest rates. Many are reassessing their strategies, which adds to market volatility. Being aware of this sentiment can help investors make better decisions.

How can investors prepare for potential volatility?

To safeguard against potential selloffs in US Treasuries, investors should consider:

- Diversifying their bond portfolios.

- Employing options strategies to manage risk.

What role does the Federal Reserve play in the bond market?

The Federal Reserve influences economic conditions through its interest rate decisions, which affect confidence in US Treasuries. Understanding the Fed’s framework helps investors predict potential market changes.

What outcomes can be anticipated from the upcoming Federal Reserve policy decision?

Analysts are speculating about possible interest rate changes that could lead to declines in bond prices and increased volatility. Following these developments is crucial for anyone invested in US Treasuries.

How does labor market data interact with the bond market?

Labor market data like job growth impacts consumer spending and economic expansion, potentially leading to higher interest rates. This connection is important for investors to understand as they manage their bond holdings.

What strategies can help navigate stock market volatility?

Investors facing volatility in both bond and stock markets should consider:

- Diversifying their investment portfolios.

- Combining fixed-income securities like US Treasuries with equities for a balanced approach.