Advanced Micro Devices (AMD) plays a crucial role in the semiconductor industry, known for its innovation and competition with major players. Recently, AMD’s earnings report has drawn attention, highlighting analysts’ expectations for its revenue. This analysis will explore AMD’s revenue forecast, the dynamics of its artificial intelligence sales growth, and the broader trends affecting its performance.

AMD’s Revenue Forecast: A Missed Opportunity

AMD recently provided its latest revenue forecast, which unfortunately missed the mark set by analysts. The company projected revenues of around $5.6 billion for the upcoming quarter, but this number was significantly lower than what many expected, which was closer to $6.1 billion. This discrepancy has raised concerns among investors, as a missed revenue forecast can often signal underlying issues within the company or its market performance.

The implications of this miss extend beyond just numbers. For stakeholders, it might mean a reevaluation of AMD’s growth potential in the highly competitive semiconductor industry. Investors are keenly watching how this will affect AMD’s stock performance going forward, as expectations play a huge role in shaping market sentiment.

Artificial Intelligence Sales Dynamics

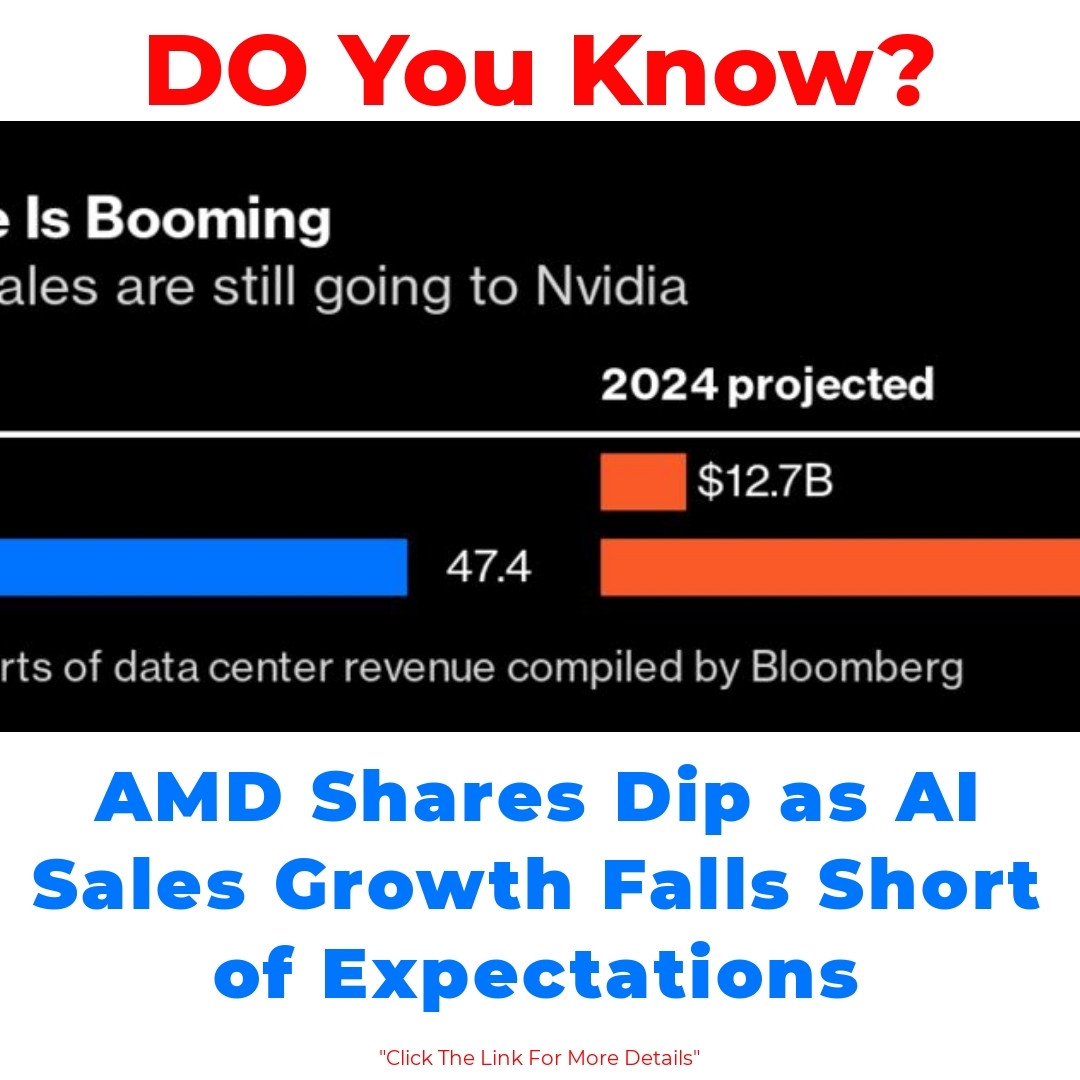

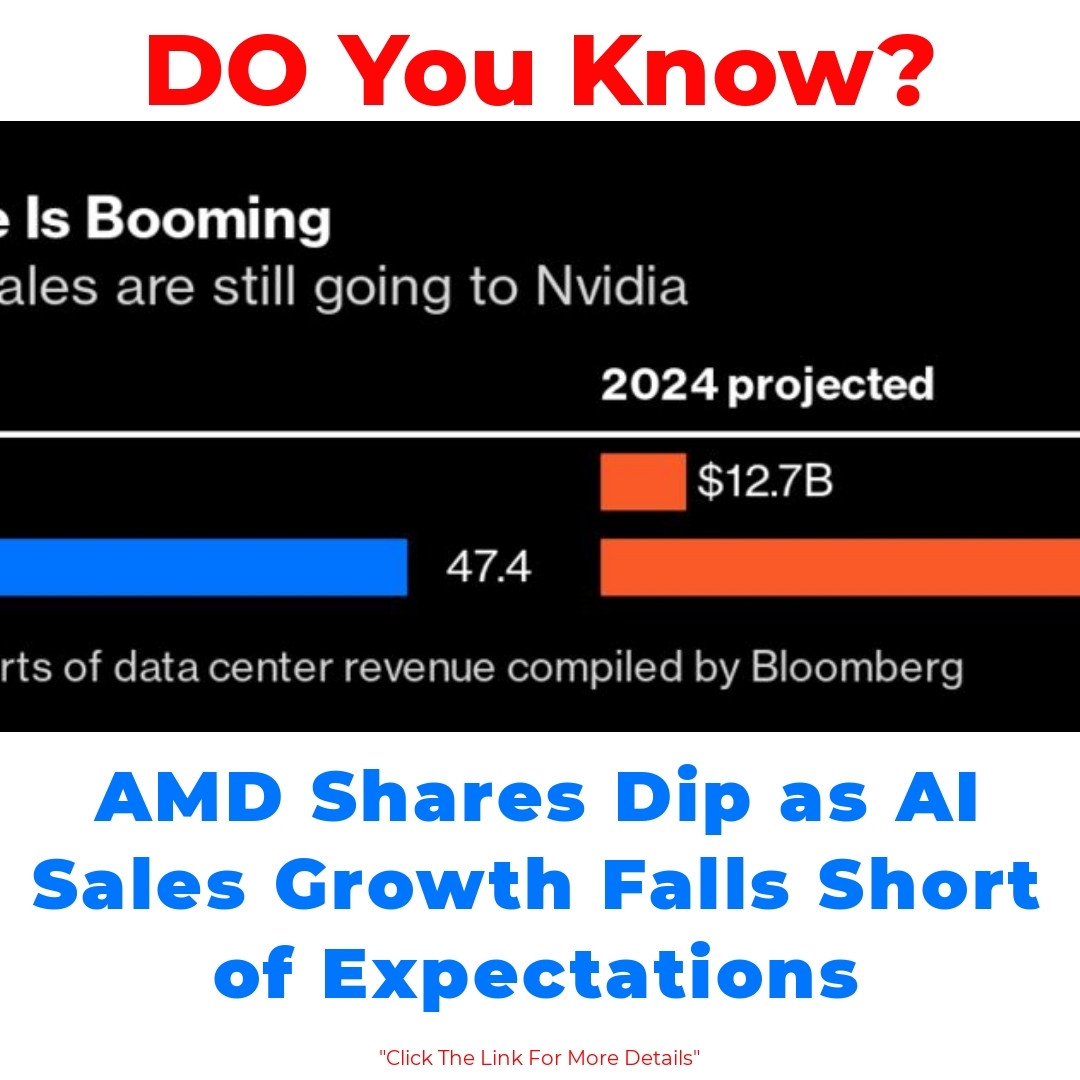

Turning to AMD’s artificial intelligence sales, it’s clear that this segment has not experienced the explosive growth that many had anticipated. While AI is a major trend in technology, AMD’s sales in this category have been slower than expected, contributing to the overall performance issues outlined in their recent earnings report.

One potential factor for this slower growth could be the intense competition in the AI space, particularly from other chipmakers who are also vying for market share. For AMD, the challenge lies in differentiating its AI offerings and demonstrating their value to customers. Without robust growth in artificial intelligence sales, AMD may struggle to meet its broader revenue goals, which is crucial for investors looking for positive signals in the tech landscape.

Trends in the Semiconductor Industry

When examining AMD’s performance, it’s important to consider the wider trends in the semiconductor industry. Right now, the sector is experiencing fluctuations as demand for chips varies across different markets. Issues such as supply chain constraints and shifting consumer preferences are heavily influencing how tech companies, including AMD, position themselves.

Broader market expectations have also played a role. For instance, investors are keen on tech stocks, but they are increasingly discerning about which companies they choose to back. This scrutiny can lead to volatility in AMD’s stock performance, particularly if the market perceives that the company isn’t keeping pace with its competitors.

As the semiconductor industry evolves, changes will undoubtedly affect AMD’s future revenue estimates. The ability to adapt to these trends will be crucial for the company as it seeks to regain momentum after falling short on forecasts.

Conclusion

Looking at AMD’s current stock performance, it’s clear that the implications of its recent revenue forecast misses are significant for stakeholders. Investors are understandably concerned about what this means for their investments in the company. With artificial intelligence sales not growing as rapidly as hoped, AMD needs to find ways to redefine its strategies to bolster revenue.

Moving forward, expectations around AMD’s AI growth remain cautious but hopeful. If the company can leverage its technology to tap into AI opportunities, there may yet be room for recovery. However, understanding these dynamics is essential for investors who aim to navigate the complexities of the tech landscape effectively. Staying informed about AMD’s performance, the trends in the semiconductor industry, and shifts in artificial intelligence sales will be key to making educated investment decisions.

FAQ

What was AMD’s recent revenue forecast and how did it compare to analysts’ expectations?

AMD projected revenues of around $5.6 billion for the upcoming quarter. This was significantly lower than the expected $6.1 billion, raising concerns among investors.

Why is a missed revenue forecast concerning for investors?

A missed revenue forecast can indicate underlying issues within the company or its market performance, which might lead to worries about AMD’s growth potential in the semiconductor industry.

How are AI sales impacting AMD’s overall performance?

AMD’s artificial intelligence sales have not experienced the expected growth, contributing to the company’s performance challenges. This slower growth may hinder AMD’s ability to meet its broader revenue goals.

What are the current trends in the semiconductor industry affecting AMD?

- Fluctuations in demand for chips across different markets.

- Supply chain constraints.

- Shifting consumer preferences.

How does market scrutiny affect AMD’s stock performance?

Investors are becoming more discerning about which tech stocks to invest in. If the market perceives that AMD is not keeping up with its competitors, it can lead to volatility in AMD’s stock performance.

What should investors do to navigate the complexities around AMD?

Investors should stay informed about:

- AMD’s performance.

- Trends in the semiconductor industry.

- Shifts in artificial intelligence sales.

This knowledge will help them make educated investment decisions amidst the changing landscape.