As the Sino-American trade spat continues to unfold, its ramifications echo throughout global markets, making investors more cautious yet opportunistic. With higher tariffs and the looming US presidential election shaping investor sentiment, understanding the shifting landscape of trade relations becomes crucial for strategic investment in Chinese assets.

The Current State of Sino-American Trade Relations

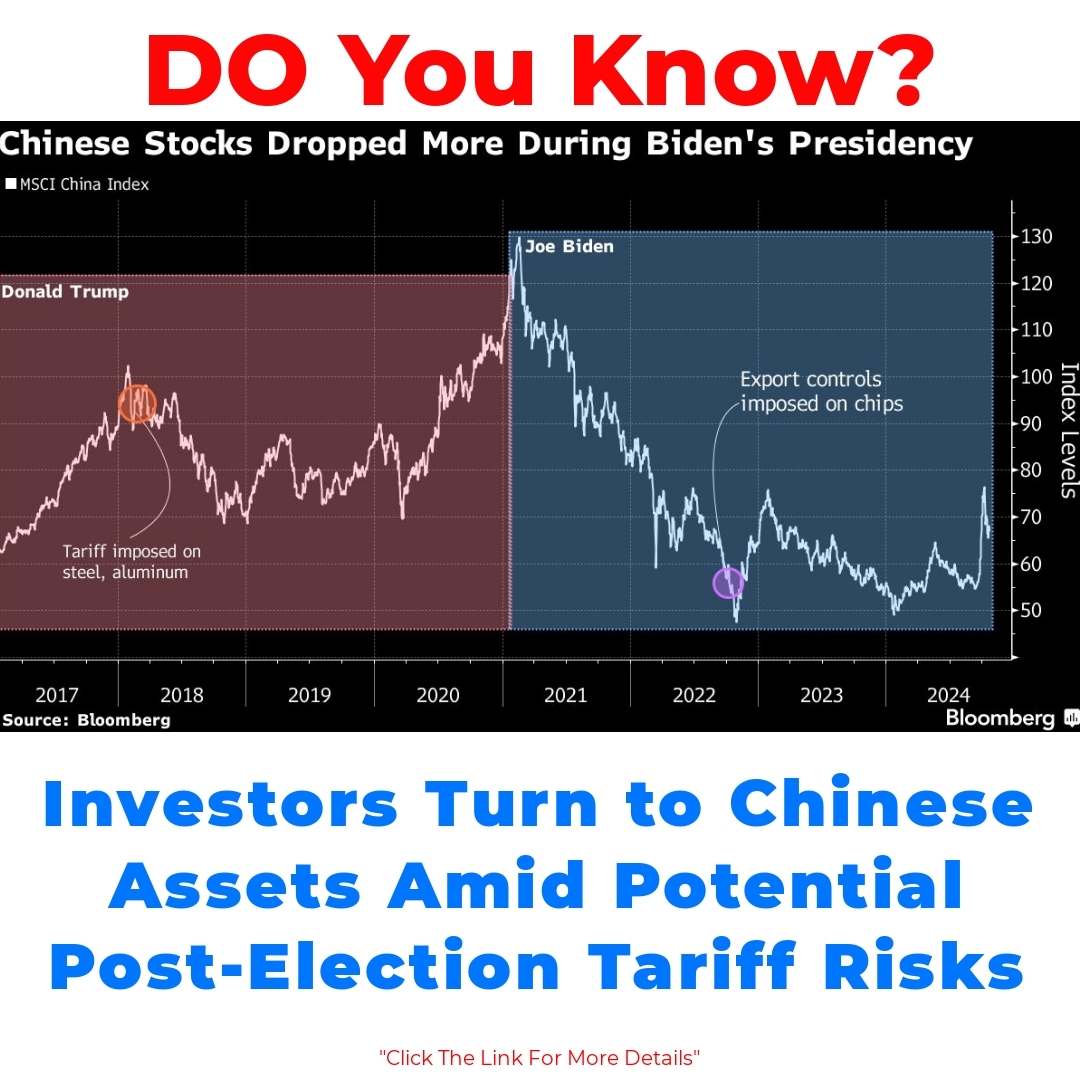

The ongoing Sino-American trade spat has a rich history, filled with rising tensions and complex negotiations. Dating back a few years, we’ve seen a series of tariffs and trade barriers that have reshaped the landscape of bilateral trade. Currently, the imposition of higher tariffs by the United States has created significant friction in trade relations. For instance, the increased costs on imports not only impact businesses but ripple through to consumers as well, causing implications for the overall market.

As we look at market trends, it’s clear that investor sentiment has shifted. Many investors are becoming cautious as they navigate these turbulent waters. However, this new cautiousness is not without opportunity. Some are looking for paths that lead to potential growth despite the challenges posed by the trade tensions.

Investor Outlook Post-US Presidential Election

With the US presidential election on the horizon, many are wondering about what the outcomes might mean for the future of Sino-American trade. Depending on who takes the reins, we could see dramatic shifts in trade policy. If a more trade-friendly administration comes into power, we might witness a reduction in tariffs and a warming of relations between the two nations.

Conversely, a continuation of current policies or an escalation could translate into prolonged uncertainty and additional barriers. Therefore, how the election unfolds could very well dictate the dynamics of trade relations moving forward, significantly impacting investor strategies.

Evaluating the Risk: Higher Tariffs and Investor Strategy

Understanding the reality of higher tariffs is crucial for any investor looking at the market during this time. Increased tariffs not only represent added costs for businesses but also elevate investment risk, complicating considerations about potential returns. Many investors are facing a tough decision: stick it out and hope for a resolution, or shift their strategies to mitigate risk.

Despite the storm of uncertainty, some investors are feeling brave. They’re finding ways to navigate through these challenges, whether by diversifying their portfolios or by focusing on sectors that might benefit in a tariff-driven market. Adapting strategies is key as they weigh their options against the backdrop of fluctuating trade dynamics.

The Appeal of Chinese Assets

Despite the challenges associated with the Sino-American trade spat, there are several factors driving interest in Chinese assets. Economic stimulus measures introduced by the Chinese government are one of the main incentives for investors looking at this market. These measures are designed to boost the economy and can potentially counteract some of the negative effects of tariffs.

In addition, investors are exploring the long-term potential of Chinese assets, weighing them against short-term risks. While the immediate landscape may appear daunting, they believe that the overall growth story of China could ultimately outshine these tariff challenges.

Betting on Economic Stimulus

When it comes to investor decisions, economic stimulus plays a critical role. Many believe these measures will provide much-needed support in overcoming the adverse effects of higher tariffs. By bolstering domestic consumption and spurring investment, economic stimulus can act as a buffer for investors.

Looking ahead, the long-term outlook on Chinese assets can be quite optimistic, especially with the ongoing economic stimulus in mind. Investors who analyze potential growth and recovery scenarios can make more informed decisions about navigating this complex trading environment.

Conclusion

In conclusion, the intertwined nature of the Sino-American trade spat with the looming US presidential election creates a complex environment for investors. The key themes we’ve discussed—higher tariffs, evolving investor sentiment, and the allure of Chinese assets—are critical in navigating these turbulent waters. Understanding these market trends is essential for investors who wish to make informed decisions as they chart their paths through the evolving landscape of trade relations.

FAQ

What are the main issues affecting Sino-American trade relations?

The primary issues include the imposition of higher tariffs by the United States, creating friction in trade. This has affected businesses and consumers alike, subsequently impacting the overall market.

How have tariffs impacted investors?

Higher tariffs increase costs for businesses, which adds investment risk. Investors face tough decisions about whether to maintain their current strategies or to adapt and mitigate risk in a changing market.

What should investors consider in light of the US presidential election?

The outcomes of the election could lead to dramatic shifts in trade policy. A more trade-friendly administration may reduce tariffs, while a continuation of current policies could lead to prolonged uncertainty.

Are there opportunities in Chinese assets despite trade tensions?

Yes, there are several factors driving interest in Chinese assets. Economic stimulus measures from the Chinese government are designed to boost the economy, which can counter some negative effects of tariffs.

How does economic stimulus impact investor decisions?

Economic stimulus measures can act as a buffer by bolstering domestic consumption and spurring investment, helping investors navigate the adverse effects of higher tariffs.

What are the long-term prospects for investors in this climate?

While the current landscape might be challenging, many investors remain optimistic about the long-term growth potential of Chinese assets, focusing on recovery scenarios that could unfold over time.

What strategies can investors use to navigate these challenges?

- Diversifying portfolios to spread risk

- Focusing on sectors that may benefit from tariff-driven dynamics

- Staying informed on market trends and government policies