France’s credit rating has recently come under scrutiny as Moody’s Ratings issued a negative outlook, highlighting concerns over the nation’s financial stability. This alert reflects a deterioration in public finances, raising important questions about the implications for France’s economic future and investor confidence.

France’s credit rating is a key factor in understanding the nation’s financial health and economic outlook. Recently, Moody’s Ratings issued a negative outlook for France’s credit standing, indicating growing concerns over the country’s public finances. This move raises alarm bells for investors and economists alike, as it suggests potential challenges ahead for the French economy.

Understanding France’s Credit Rating

To grasp the implications of this recent development, it’s essential to define what a credit rating is. A credit rating serves as a benchmark for determining a country’s risk in repaying debts. For nations, a strong credit rating is crucial for maintaining investor confidence, as it influences borrowing costs and overall economic stability. Credit rating agencies, such as Moody’s Ratings, play a significant role in this evaluation process. Their assessments help investors make informed decisions regarding risky assets, including government bonds.

The credit rating of a country has broad implications for its economic outlook. A higher rating generally means lower interest rates on debt, which can stimulate economic growth. Conversely, a negative rating or outlook can lead to higher borrowing costs and decreased investment, raising red flags about a nation’s financial health.

Moody’s Ratings Issues a Negative Outlook

Recently, Moody’s Ratings expressed concerns about France’s creditworthiness, clearly stating, “France’s credit rating downgraded by Moody’s.” This warning signifies that the agency believes France is facing significant challenges that could impact its ability to manage its debt obligations effectively. The implications of this negative outlook are substantial; it can shake investor confidence, leading to reduced investments in the country.

Looking back through history, France has experienced various changes in its credit ratings, often influenced by shifting economic conditions and public finance management. Each downgrade has typically been connected to elevated risks regarding governmental debt or economic performance, reminding us how closely tied a nation’s credit rating is to its fiscal health.

The Deterioration of Public Finances

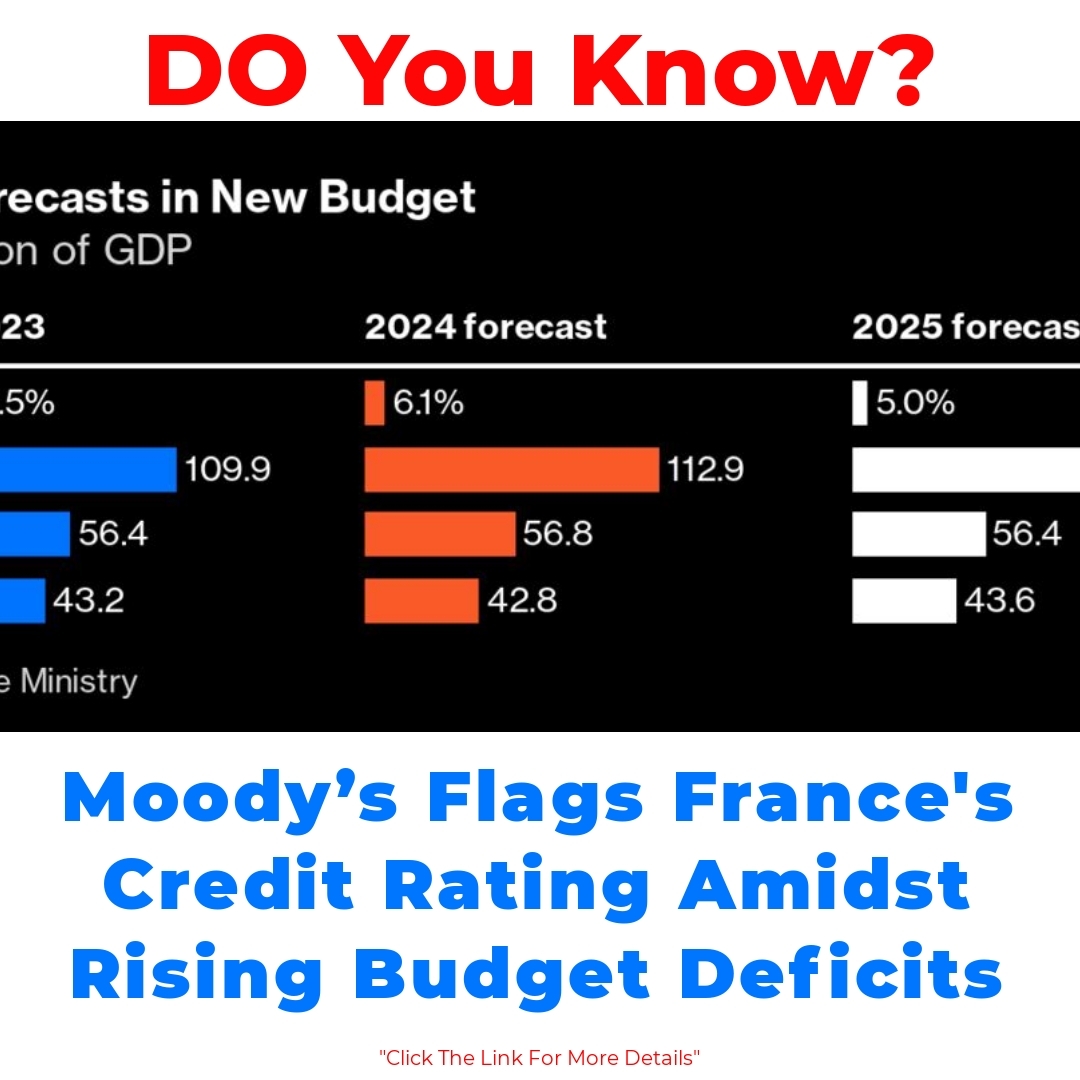

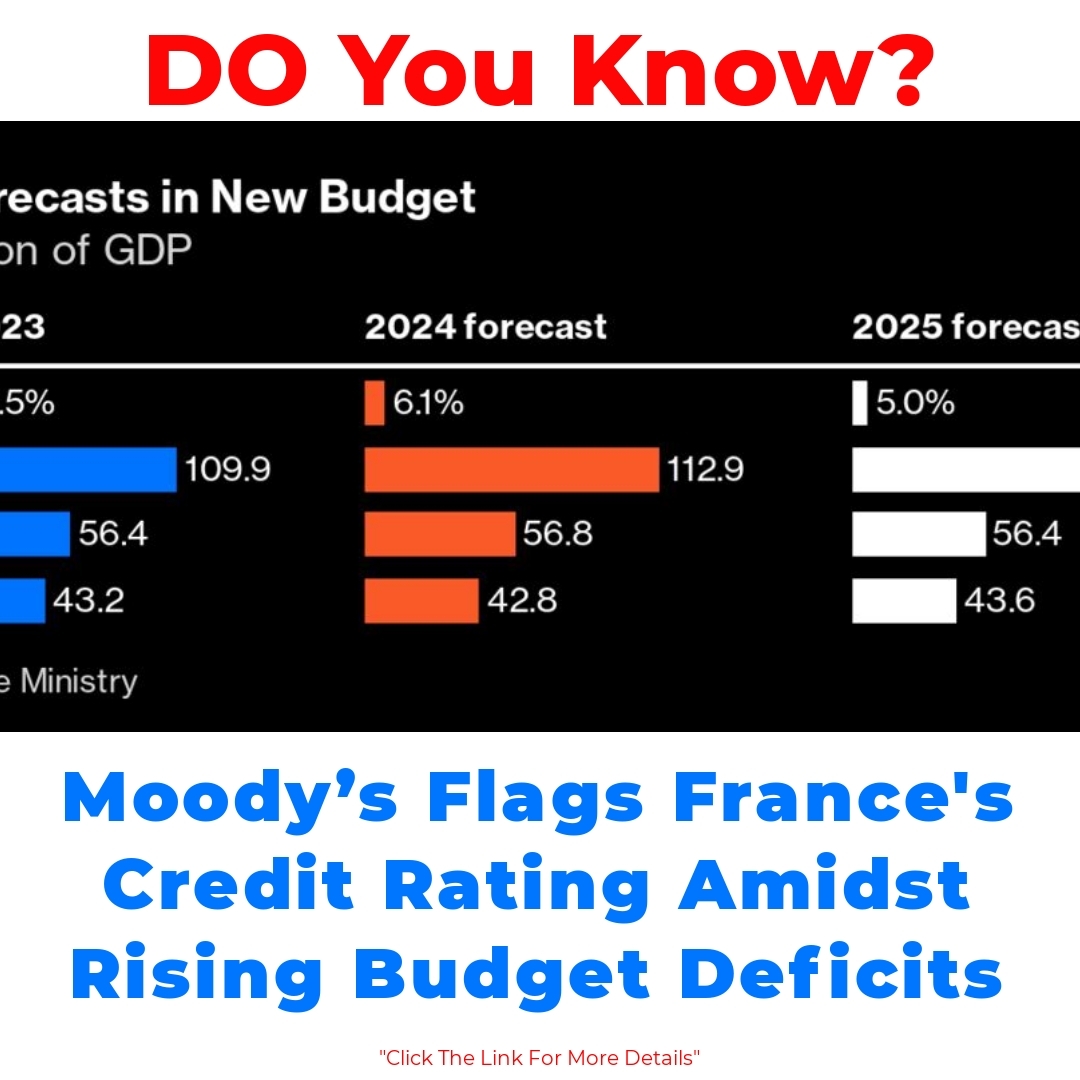

Currently, the state of France’s public finances is a significant concern. With rising budget deficits observable in recent years, the government finds itself under immense pressure to stabilize its financial position. The impact of budget deficits on France’s credit rating cannot be overstated; consistently high deficits may undermine the country’s creditworthiness and lead to unfavorable evaluations from agencies like Moody’s.

Political Challenges Affecting Financial Stability

Political challenges also play a crucial role in the financial stability of France, further complicating the path to fiscal recovery. Ongoing political debates and potential instability can hinder effective policy-making, leading to prolonged budgetary concerns. These political factors intertwine with broader themes of fiscal policy and governmental debt, creating a daunting challenge for France’s economic planners.

Consequences of the Negative Outlook on France’s Economy

The consequences of Moody’s negative outlook ripple through various sectors of the economy. It hampers the government’s ability to implement necessary fiscal reforms aimed at curbing deficits and stabilizing finances. The long-term ramifications for France’s economy are considerable, as a negative rating can lead to higher borrowing costs and diminished investments across all economic sectors.

Conclusion

In summary, France’s credit rating has come under scrutiny, following Moody’s Ratings issuing a negative outlook. This situation underscores the urgent need to address public finances and political challenges facing the country. By stabilizing its credit rating, France can work towards restoring investor confidence and fostering economic growth. Moving forward, it’s essential to monitor future developments regarding France’s credit rating, especially in light of the ongoing fiscal challenges and political landscape.

FAQ

What is France’s credit rating?

France’s credit rating is an assessment of the country’s ability to repay its debts. It helps investors determine the risk of investing in French government bonds. A strong credit rating usually means lower interest rates and greater economic stability, while a poor rating can lead to higher borrowing costs.

Why did Moody’s issue a negative outlook for France?

Moody’s issued a negative outlook due to rising concerns about France’s public finances and budget deficits. This suggests that there may be challenges ahead for the French economy and its ability to manage debt obligations effectively.

How does a negative credit rating affect the economy?

A negative credit rating can lead to:

- Higher borrowing costs for the government

- Reduced investor confidence

- Decreased investments in various economic sectors

What are the current issues with France’s public finances?

France is facing rising budget deficits, which pressure the government to stabilize its financial situation. Consistently high deficits can adversely affect the country’s creditworthiness.

How do political challenges impact France’s financial stability?

Political challenges can create uncertainty and hinder effective policy-making, making it harder for the government to implement necessary fiscal reforms to fix budgetary issues.

What can France do to improve its credit rating?

To improve its credit rating, France needs to address public finance issues, reduce budget deficits, and establish political stability to encourage effective economic policies.