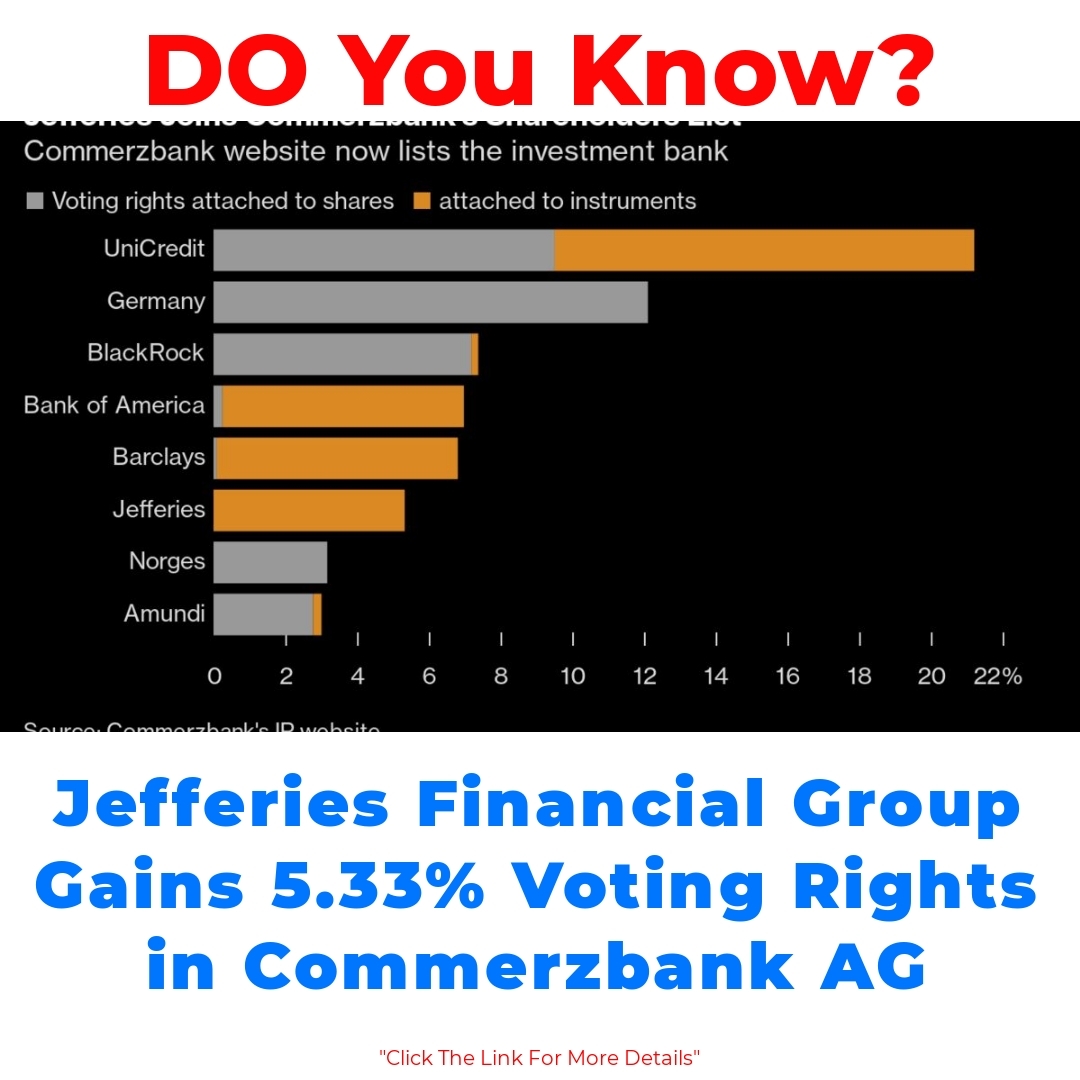

Commerzbank AG stands as a significant player in the financial market, particularly in Germany. Recently, Jefferies Financial Group Inc. disclosed its substantial stake of 5.33% in Commerzbank’s voting rights. This announcement highlights the vital role of financial disclosures in the investment banking sector, impacting both companies’ strategies and governance.

Understanding Commerzbank AG

Commerzbank AG is a major German lender that plays a pivotal role in the European financial landscape. With its roots tracing back to the early 19th century, Commerzbank has established itself as a key player in providing various banking services including corporate banking, retail banking, and investment solutions. Currently, it serves millions of clients and operates in numerous countries, but its primary focus remains on the German market.

The historical context of Commerzbank is fascinating, as it has navigated through various economic cycles, regulatory changes, and market innovations. Today, it stands as one of the leading banks in Germany, positioning itself strategically in a competitive market. Its operations are bolstered significantly by investment banks, which assist in underwriting, mergers and acquisitions, and providing liquidity.

Profile of Jefferies Financial Group Inc.

Jefferies Financial Group Inc. is recognized as a prominent investment bank in the global financial sector. With a diverse portfolio of services, Jefferies specializes in capital markets, asset management, and financial advisory. The firm has gained respect for its commitment to delivering high-quality service to its clients, including institutions and corporations across the globe.

In terms of investment strategy, Jefferies has always focused on building significant stakes in companies with strong growth potential or strategic alignment. Their recent disclosure about controlling 5.33% of Commerzbank AG’s voting rights adds a new dimension to their investment portfolio. This stake not only reflects Jefferies’ confidence in Commerzbank’s prospects but also amplifies its ability to influence corporate governance at the bank.

Impact of Jefferies Financial Instruments on Commerzbank AG

Analyzing the financial instruments held by Jefferies in Commerzbank reveals how these investments can potentially impact the German lender’s direction. By acquiring voting rights, Jefferies can influence decisions on critical issues like mergers, acquisitions, and the overall strategy of Commerzbank. The interplay between Jefferies’ investment decisions and the operational strategies of Commerzbank will be essential to watch in the coming months.

This influence can manifest in both short-term and long-term effects. In the short term, Jefferies may advocate for strategies that enhance profitability or streamline operations, which could provide immediate benefits. Conversely, the long-term implications of this stake might lead to deeper changes in Commerzbank’s governance and operational framework, aligning more closely with the interests of Jefferies and shareholders.

Voting Rights and Control

Voting rights play a crucial role in corporate governance, allowing shareholders to influence key decisions within a company. Jefferies Financial Group Inc.’s 5.33% stake in Commerzbank AG means it holds substantial influence over shareholder meetings and critical votes.

Jefferies can exercise its voting rights in various ways, including supporting or opposing management proposals, which can significantly shape the bank’s strategic direction. When we compare Jefferies with other investment banks that control voting rights in Commerzbank, we see a competitive landscape where each player strives to amplify their influence and align the bank’s policies with their investment strategies.

Market Shares and Financial Disclosure

The market shares involving Commerzbank AG and various investment banks highlight the dynamics of the financial sector. Transparency through financial disclosures is vital for maintaining trust among investors and clients alike. Companies like Commerzbank must navigate these waters carefully to ensure they communicate their financial health and strategic intentions adequately.

Regulatory bodies play an essential role in overseeing these investment stakes. They ensure that financial disclosures are both timely and accurate, promoting accountability among investment firms like Jefferies Financial Group Inc. This scrutiny helps maintain a level playing field, encouraging all players to act in accordance with market regulations.

Conclusion

The significance of Jefferies Financial Group Inc.’s stake in Commerzbank AG cannot be understated. This investment has potential implications for both firms as they navigate the complexities of the financial landscape. As more investment banks assert their influence on major institutions like Commerzbank, it reshapes the strategies and governance structures within the market.

Looking ahead, the relationship between Jefferies and Commerzbank could evolve further, influencing not only their operational strategies but also impacting the broader financial market. Understanding these dynamics is crucial for anyone interested in the evolving landscape of investment banking and its effects on major players like the German lender, Commerzbank AG.

Call to Action

Stay informed about investment banking trends and financial disclosures concerning significant institutions like Commerzbank AG and Jefferies Financial Group Inc. Being aware of these changes can enhance your understanding of the market and help you make informed decisions in your investment journey.

FAQ

What is Commerzbank AG?

Commerzbank AG is a major German bank that offers a range of banking services, including corporate and retail banking, as well as investment solutions. It has a significant presence in the European financial market, primarily focusing on the German market.

When was Commerzbank founded?

Commerzbank has its roots in the early 19th century, making it one of the long-established banks in Germany.

What is Jefferies Financial Group’s connection to Commerzbank AG?

Jefferies Financial Group Inc. is an investment bank that recently acquired a 5.33% stake in Commerzbank AG, allowing it to have a say in some of the bank’s corporate governance decisions.

How can Jefferies influence Commerzbank’s operations?

With its voting rights, Jefferies can support or oppose management proposals related to mergers, acquisitions, and other critical strategic decisions, potentially impacting Commerzbank’s future direction.

What role do voting rights play in corporate governance?

Voting rights allow shareholders like Jefferies to influence important decisions made in shareholder meetings, thereby playing a significant role in the governance of companies such as Commerzbank.

Why are financial disclosures important?

Financial disclosures are essential for maintaining transparency and trust between companies and their investors. They help ensure that stakeholders are informed about the banks’ financial health and strategic intentions.

What regulatory role exists in overseeing investments like that of Jefferies?

Regulatory bodies oversee the financial disclosures related to investments, ensuring they are timely and accurate to promote accountability and fairness in the market.

What should investors keep an eye on regarding Commerzbank AG?

Investors should monitor the relationship between Jefferies and Commerzbank, as their interactions may influence operational strategies and the broader financial market dynamics.