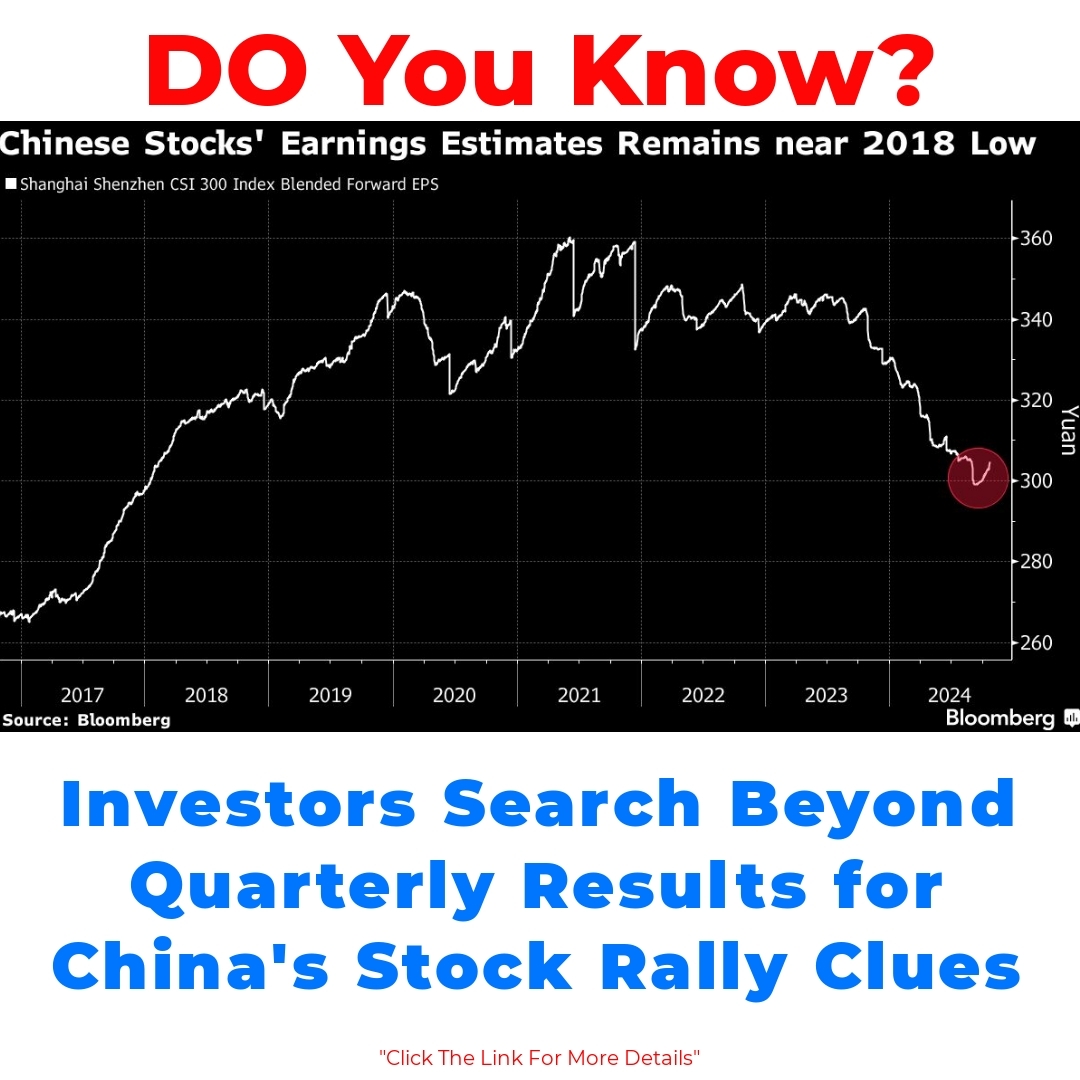

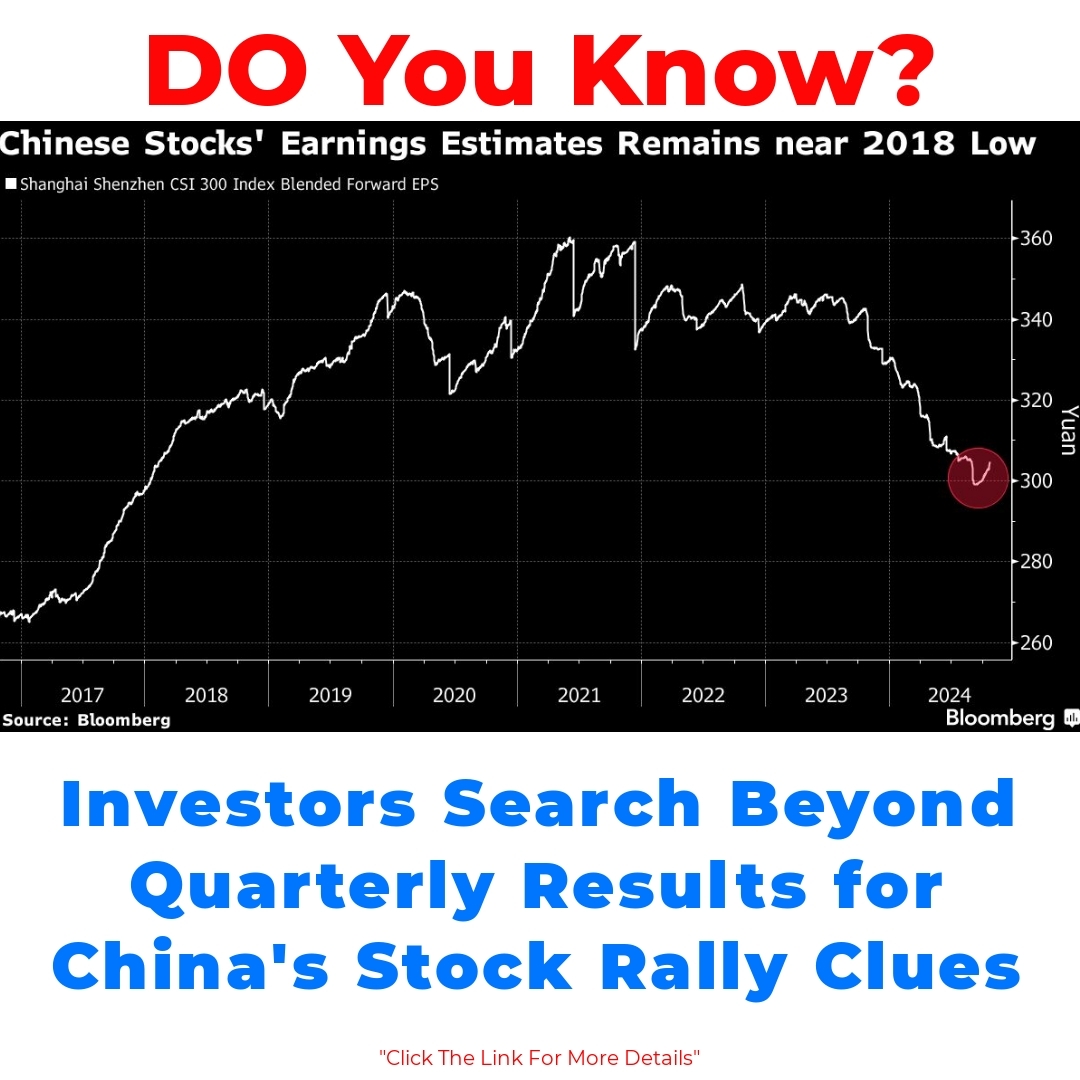

The China stock rally is currently capturing the attention of investors, as corporate results hold the key to shaping market expectations. Despite challenges from a slowing economy and limited stimulus efforts, the potential for strong corporate earnings could reignite momentum in the Chinese stock market.

The current economic landscape in China is complex, with several challenges that investors must navigate. Key economic indicators like GDP growth and unemployment rates show a slowing economy, which has raised concerns among market participants. Historically, China’s economy has been a powerhouse, but recent trends indicate a shift, leading to fluctuating investor sentiments. Factors such as reduced consumer spending and weakened manufacturing output have added to the uncertainty.

As the economy struggles, corporate results become increasingly significant. The impact of corporate earnings on China’s stock market cannot be understated. Quarterly earnings reports are pivotal moments for investors. When companies report better-than-expected earnings, it can lead to a surge in stock prices and heightened investor confidence. Conversely, disappointing results can trigger a sell-off, reflecting the delicate relationship between corporate performance and market expectations.

Recent examples of substantial corporate results have dramatically influenced market movements. For instance, tech giants and consumer goods companies have reported robust earnings, creating optimism among investors. Looking ahead, investors should pay close attention to upcoming earnings reports, especially from major corporations in key sectors. Indicators like revenue growth, profit margins, and future guidance are vital in assessing how these reports will shape overall market performance.

Another essential aspect to consider is the current stimulus efforts in China. While the government has implemented various policies to stimulate economic recovery, there are constraints on how effective these measures can be. Recent efforts have included interest rate cuts and targeted fiscal policies aimed at supporting struggling sectors. However, the limitations of these strategies, particularly in the context of a slowing economy, have led to questions about their ability to restore investor confidence fully.

When comparing past stimulus strategies, it becomes clear that previous measures had more immediate impacts on the China stock rally. For instance, during times of rapid economic growth, robust stimulus initiatives often led to significant market rallies. In contrast, the current context requires a more cautious approach, making the link between stimulus efforts and market performance a vital consideration for investors.

While quarterly results hold importance, looking beyond them is essential for understanding China’s stock performance in the long run. Investors should focus on foundational aspects such as market positioning, sector strength, and broader economic trends rather than just quarterly earnings. Long-term strategies contribute to sustained growth in the China stock rally and can help investors make informed decisions in a volatile market.

Investor sentiment plays a crucial role in the performance of the stock market. Currently, there seems to be a cautious optimism among investors, driven by recent corporate results. However, ongoing concerns regarding the economy and the effectiveness of stimulus measures may temper this optimism. Predictions for future stock market performance depend heavily on economic indicators and the outcomes of upcoming corporate earnings reports. Analysts will be closely monitoring these factors to forecast trends in the China stock rally.

In summary, the relationship between corporate results, economic health, and stimulus efforts is intertwined and significantly impacts the China stock rally. Investors must stay informed and navigate the complexities of the Chinese stock market by keeping an eye on both immediate results and long-term indicators. By doing so, they can better position themselves to capitalize on opportunities as the market evolves.

FAQ

What are the main challenges currently facing China’s economy?

China’s economy is experiencing a slowdown, with key indicators like GDP growth and unemployment rates raising concerns. Reduced consumer spending and weakened manufacturing output contribute to the uncertainty in the economy.

How do corporate earnings affect the stock market in China?

Corporate earnings are crucial for the stock market. When companies report better-than-expected earnings, stock prices often rise, boosting investor confidence. On the other hand, disappointing results can trigger a sell-off in the market.

What should investors look for in upcoming earnings reports?

Investors should pay attention to key indicators such as:

- Revenue growth

- Profit margins

- Future guidance

These factors will help assess the overall market performance.

What measures has the Chinese government taken to stimulate the economy?

The government has introduced various policies, including interest rate cuts and targeted fiscal policies, to support struggling sectors. However, there are limitations to how effective these measures can be in restoring investor confidence.

How does current stimulus compare to past strategies?

Previous stimulus measures yielded immediate impacts during times of rapid growth, leading to significant market rallies. Currently, a more cautious approach is needed, affecting the link between stimulus efforts and market performance.

What long-term strategies should investors consider?

Investors should look beyond quarterly results and focus on:

- Market positioning

- Sector strength

- Broader economic trends

These foundational aspects contribute to sustained growth in the stock market.

What is the current investor sentiment in China?

Investor sentiment is cautiously optimistic, influenced by recent corporate results. However, ongoing economic concerns and questions about stimulus effectiveness may temper this optimism.

What factors will influence future stock market performance?

Future performance will depend heavily on:

- Economic indicators

- Upcoming corporate earnings reports

Analysts will be monitoring these aspects closely to forecast trends in the China stock market.