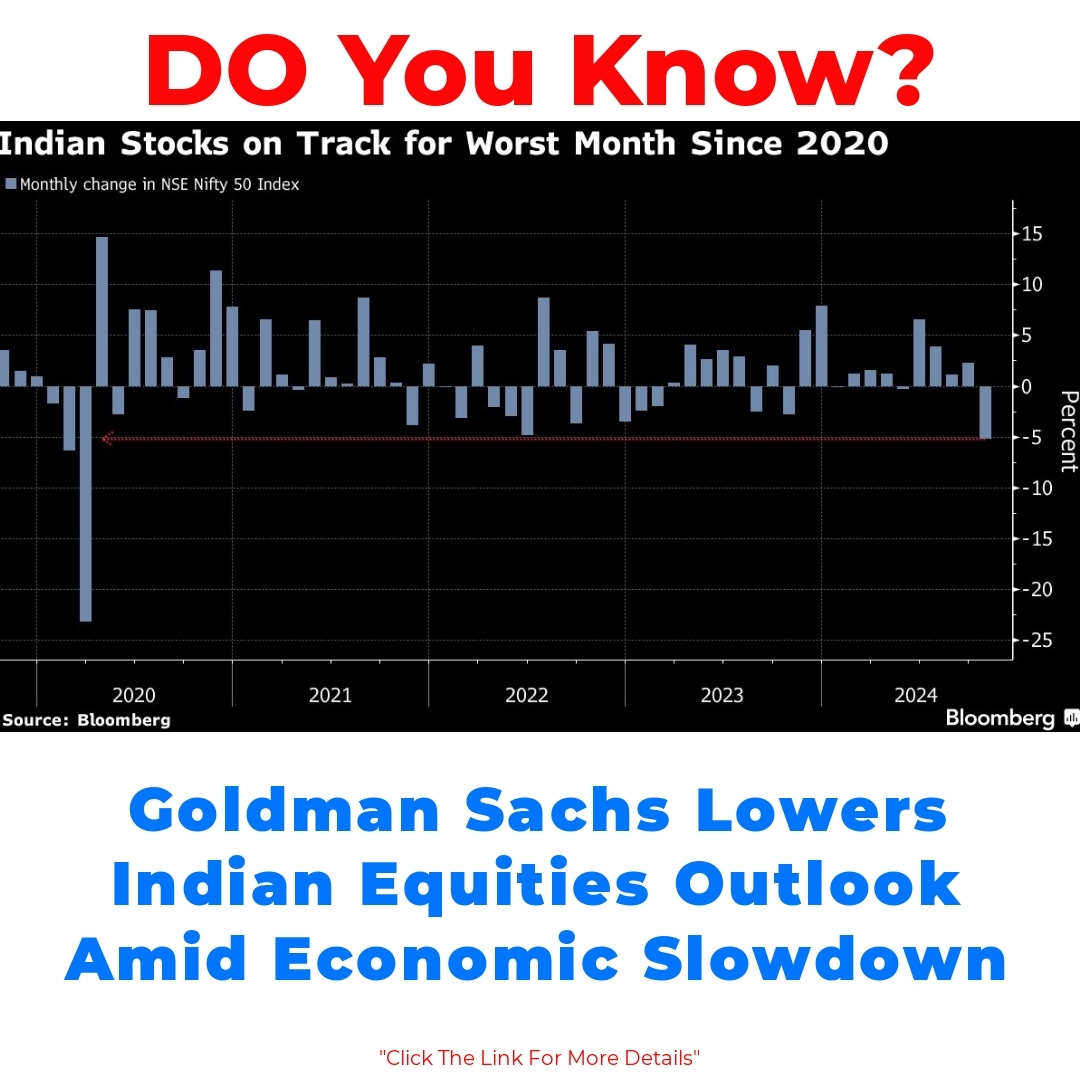

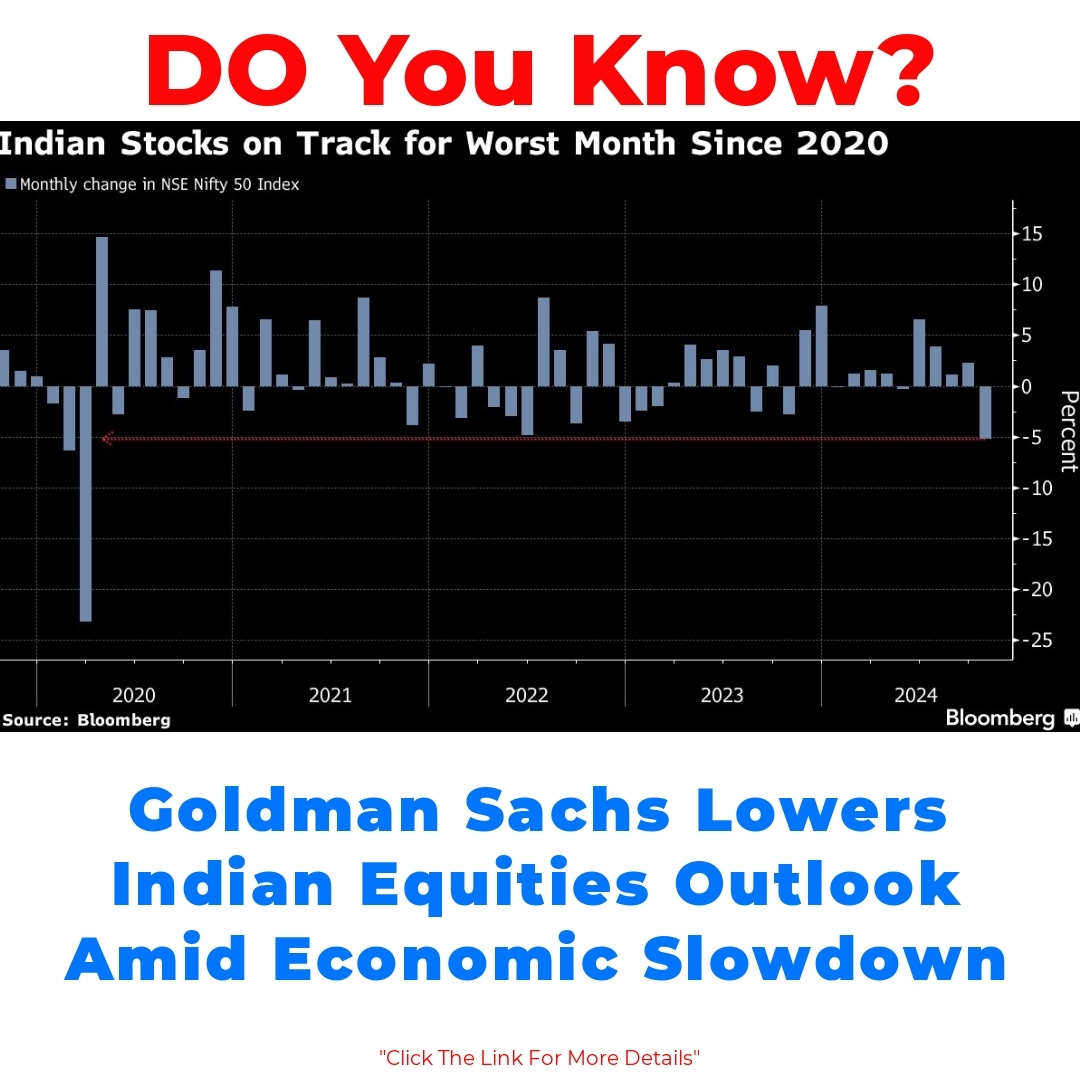

The landscape of Indian equities is shifting as Goldman Sachs revises its outlook amidst slowing economic growth. The investment firm’s downgrade to a neutral stance raises important questions about the correlation between economic performance and corporate earnings. Understanding these dynamics is crucial for investors navigating the evolving market environment.

Overview of Goldman Sachs’ Rating Change

Goldman Sachs has made headlines recently by changing its stance on Indian equities from an overweight position to a more cautious neutral one. This shift is quite significant, as the firm was previously optimistic about the potential of Indian stocks. So, why has Goldman Sachs decided to recalibrate its outlook?

Several factors have contributed to this downgrade. Key among them are slowing economic indicators and revised projections for corporate earnings. Goldman Sachs is taking a close look at how these metrics can impact investor confidence and the overall market.

Impact of Slowing Economic Growth on Indian Equities

When economic growth slows down, the equity market often feels the pinch. In India, this slowing growth can lead to reduced corporate earnings, which is a concern for investors. There’s a strong correlation between economic performance and corporate profits. Simply put, when the economy isn’t growing fast, companies typically struggle to meet earnings expectations.

As of late, India has experienced fluctuations in key economic performance indicators. For instance, GDP growth rates have shown signs of deceleration. This slower pace can lead investors to rethink their strategies regarding Indian equities, as many may choose caution over aggression.

Goldman Sachs Indian Equities Outlook 2023

Looking ahead, Goldman Sachs has offered insights into its forecast for Indian equities in 2023. While the earlier upbeat outlook has dimmed, the firm still believes in the underlying strength of the Indian market. However, they have tempered their expectations for corporate earnings in the upcoming quarters.

Goldman Sachs anticipates that there may be some challenges in the stock market, which could lead to subdued growth in equities. The market trends they predict suggest that investors need to be vigilant and strategic in their approaches, especially with all the uncertainties surrounding economic performance.

Corporate Earnings Forecast for Indian Stocks

When diving into corporate earnings estimates, one must consider various sectors within India’s economy. Some sectors may face struggles due to the broader economic slowdown, while others might present potential opportunities.

For instance, sectors such as technology and healthcare could outperform in the current environment. Meanwhile, traditional industries like manufacturing may experience headwinds. Investors should keep a close eye on these fluctuations and take note of which companies are likely to adapt better to the changing economic landscape.

Investment Strategies for Indian Markets in a Slowing Economy

Given Goldman Sachs’ new market neutral stance on Indian equities, it’s crucial for investors to refine their investment strategies. Financial experts recommend diversification as a key way to mitigate risks in uncertain times.

Here are some strategies investors might consider:

– **Diversify**: Don’t put all your eggs in one basket. Look into different sectors and asset classes.

– **Focus on Quality**: Invest in companies with strong balance sheets and reliable management, even if they face short-term challenges.

– **Watch Trends**: Pay close attention to economic indicators and adjust your strategy accordingly, as this can help you stay ahead of the curve.

Conclusion

In summary, Goldman Sachs’ analysis of Indian equities and their downgrade to a neutral position reflect larger economic uncertainties. It’s essential for investors to take stock of future opportunities while being mindful of potential challenges in corporate earnings.

The outlook for Indian equities remains complex, but understanding these dynamics may aid investors in navigating the shifting financial landscape. As the economy evolves, so too should your investment strategies.

Call to Action

Stay informed about the ever-changing market dynamics surrounding Indian equities. Consider subscribing to financial news outlets to receive the latest updates on stock market analysis, corporate earnings forecasts, and more. Knowledge is key in making informed investment decisions, especially in today’s climate.

Frequently Asked Questions

Why did Goldman Sachs change its outlook on Indian equities?

Goldman Sachs shifted its outlook from an overweight position to a neutral one due to factors like slowing economic indicators and revised projections for corporate earnings. This recalibration reflects concerns about investor confidence and market performance.

What impact does slowing economic growth have on Indian equities?

Slowing economic growth can lead to reduced corporate earnings, as there is a strong correlation between economic performance and profits. When growth slows, companies may struggle to meet earnings expectations, prompting investors to adopt a more cautious approach.

What is Goldman Sachs’ forecast for Indian equities in 2023?

While Goldman Sachs remains optimistic about the underlying strength of the Indian market, they have tempered their expectations for corporate earnings in the coming quarters. They warn of potential challenges leading to subdued growth in equities.

Which sectors may perform well in the current economic environment?

Sectors like technology and healthcare may outperform due to their resilience. In contrast, traditional industries such as manufacturing could experience difficulties. Investors should be aware of these dynamics and focus on sectors that are likely to adapt better.

What investment strategies should investors consider in a slowing economy?

Investors can refine their strategies by considering the following:

- Diversify: Spread investments across different sectors and asset classes to reduce risk.

- Focus on Quality: Invest in companies with strong fundamentals and effective management, even amid challenges.

- Watch Trends: Keep an eye on economic indicators and adjust investment strategies accordingly.