The landscape of European equities is currently experiencing a notable uplift, largely influenced by strategic moves in the Chinese market. These market boosts are positively impacting several key sectors in Europe, particularly benefiting miners, automakers, and luxury goods firms. Analyzing this relationship reveals essential insights into the interconnectedness of global financial markets.

The recent dynamic movements in the European equities market have captured many investors’ attention, particularly due to the influence of China’s strategic market boosts. These strategies are not just statistics; they hold real weight for various sectors within Europe. Major players such as miners, automakers, and luxury goods firms are all feeling the positive ripple effects of China’s economic policies.

China’s role in global markets is profound, and its recent market strategies have reshaped the landscape not only in Asia but across the world. By focusing on economic recovery, China has introduced policies aimed at stimulating growth, which in turn has made waves in European equities. This interplay of economies highlights how China’s actions directly impact the stock market performance in Europe, contributing to an overall positive market sentiment.

Considering the specific sectors, let’s start with miners gains. European mining companies have historically relied on China for the demand for raw materials. Recently, as China’s economic activity surges, the demand for commodities has seen a significant spike. Companies like Glencore and Rio Tinto are prime examples of miners benefitting from this trend, experiencing notable stock price increases. This connection reinforces how crucial the Chinese market is to European equities, particularly in the mining sector.

Shifting gears to automakers growth, this sector is experiencing a renaissance, too. With China’s middle class expanding, the demand for vehicles has soared. Top automotive brands like Volkswagen and BMW are witnessing substantial boosts in their stock performance as they cater to this growing market. The optimism from these developments is reflected in the market sentiment surrounding European automakers, showcasing how vital China is to their success.

Luxury goods firms are thriving, riding the wave of recovery from challenging times. The Chinese consumer market has become essential for brands like LVMH and Gucci, which rely heavily on Chinese consumers if they want to maintain robust growth. As the market conditions improve, the investment climate for luxury goods has also seen a positive shift. Increased consumer confidence translates to more sales and, ultimately, better stock performance.

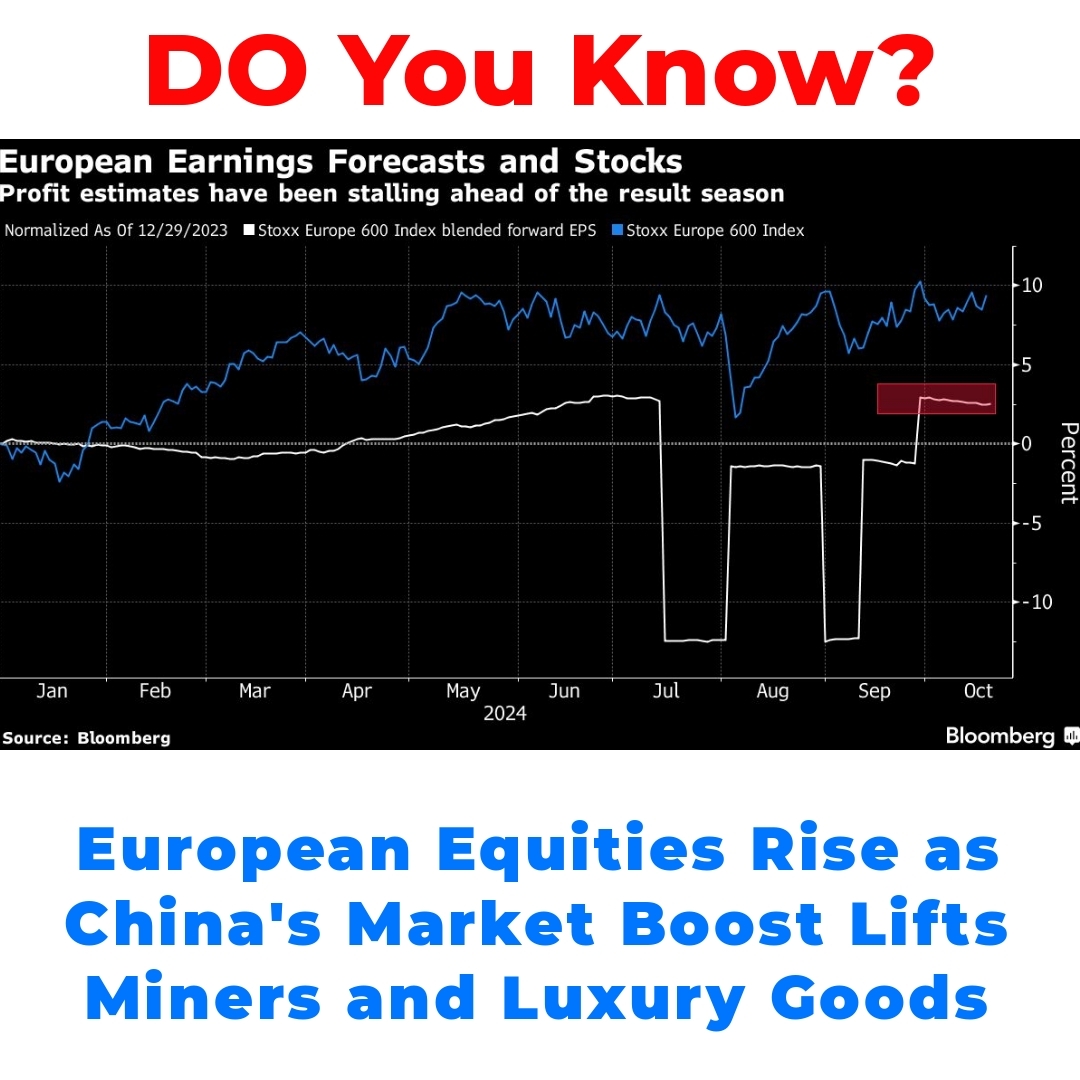

However, it’s important to note the mixed signals coming from earnings reports across various sectors. While some companies are celebrating high performance, others have reported lackluster earnings, creating a contrast within the overall optimistic outlook for European equities. Despite this variance, the underlying trends in sectors like mining, automotive, and luxury goods are driving a generally positive market mood. As we look to the future, understanding earnings performance and external market conditions will be crucial in framing European equities’ trajectory.

In summary, the current landscape of European equities is clearly being buoyed by favorable market conditions, largely influenced by China’s economic strategies. This interrelation between China market boosts and European equities performance emphasizes the significance of keeping an eye on Chinese economic decisions. For investors, monitoring this relationship can provide valuable insights into making informed investment strategies.

To stay ahead in the constantly changing market, it’s essential to remain informed about the trends affecting European equities. By subscribing to updates on financial news, especially those focusing on international markets, you can better navigate your investments. Keeping an eye on the impact of China’s strategies will aid in making smart decisions in your financial journey.

Frequently Asked Questions

1. How is China’s economic strategy affecting European equities?

China’s recent economic strategies have led to increased demand for various sectors in Europe, particularly in mining, automotive, and luxury goods. As China’s economy recovers, it directly influences European stock performance.

2. Which sectors in Europe are benefiting from China’s market boosts?

- Mining: Companies like Glencore and Rio Tinto are experiencing stock increases due to rising demand for raw materials from China.

- Automotive: Brands such as Volkswagen and BMW are seeing boosts in stock performance as more consumers in China demand vehicles.

- Luxury Goods: Companies like LVMH and Gucci are thriving as Chinese consumers drive sales and overall market confidence.

3. Are all companies in Europe experiencing positive earnings in this climate?

No, there’s a mix of performances. While some sectors and companies report high earnings, others might have less favorable results. Understanding these variances is key for investors.

4. Why is it important to follow China’s market trends for European investors?

Monitoring China’s economic moves helps investors gauge potential impacts on European equities. Understanding these trends can guide better investment decisions.

5. How can investors stay updated on these market changes?

Investors should subscribe to financial news updates, particularly those focusing on international markets, to stay informed about the ongoing changes and trends affecting European equities.