Japan’s currency officials have issued a cautionary note regarding the Japanese yen’s decline, warning about its potential drop beyond 150 per dollar. Understanding the dynamics of this weakening is crucial, particularly the role of currency intervention and the broader implications of such fluctuations on both the domestic and global economies.

Current State of the Japanese Yen

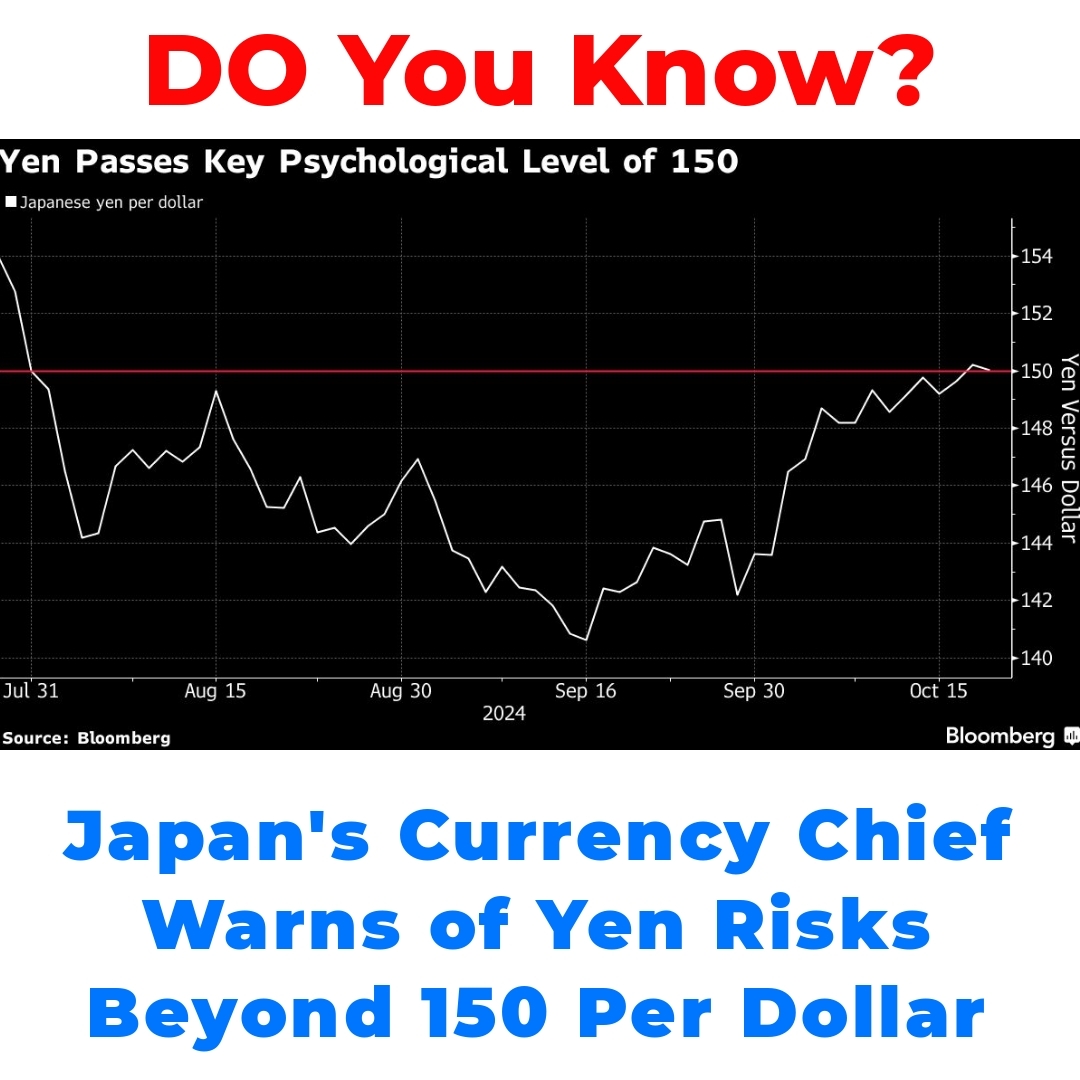

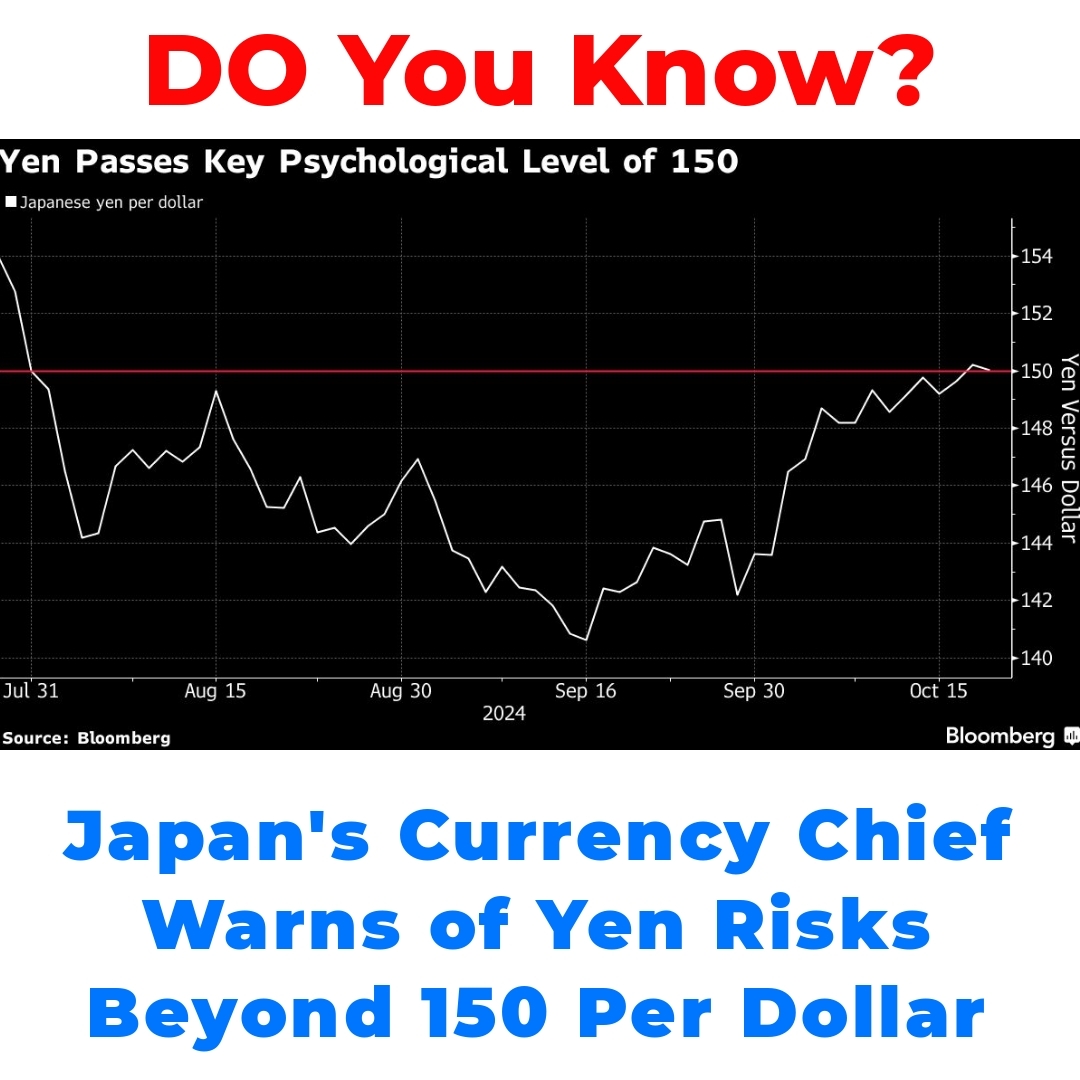

The Japanese yen has recently experienced notable fluctuations in the Forex market. As currency officials keep a close eye, the yen’s value against the dollar has become a significant concern. If we look back at historical trends, we can see that this isn’t the first time the yen has faced pressure against the USD to JPY exchange rates. However, the current situation, where we’re poised on the edge of the 150 per dollar mark, is particularly alarming.

Overview of Recent Currency Trends

Recently, we’ve seen the yen weakening consistently amid a backdrop of complex global economic changes. Analysts are keen on the currency trends observed in the Forex market because they hint at investor sentiment and economic stability. Historically, the yen has served as a safe-haven currency, but cracks are beginning to form in that reputation as the exchange rates slip.

Factors Influencing Yen Weakening

The reasons behind the yen’s recent weakening are multifaceted. Domestically, Japan’s economy is grappling with low interest rates and sluggish growth. Internationally, factors such as the U.S. Federal Reserve’s monetary policy and fluctuating global economic conditions significantly impact the strength of the Japanese yen. Such global economic trends introduce volatility, affecting everything from trade balances to consumer pricing in Japan.

Japan’s Currency Intervention Strategies

Understanding Currency Intervention

Currency intervention is a critical tool that Japan’s monetary authorities can use to stabilize the Japanese yen. This involves direct market actions by the Bank of Japan, buying or selling yen to influence its value. Past interventions have had varying success, showcasing the complex interplay between government actions and market reactions.

Japan’s Recent Intervention Efforts

In light of the ongoing yen depreciation, Japan has stepped up its intervention efforts. Recently, monetary policy responses have sought to stem the tide of currency fluctuations. By adjusting interest rates or actively engaging in the Forex market, the aim is to reassure investors and provide stability to the Japanese economy. Yet, the effectiveness of these interventions remains a topic of debate among economists and market analysts.

Implications of Yen Weakening Beyond 150 per Dollar

Economic Impact of a Weak Yen

A significant concern surrounding the yen’s weakening is its impact on the Japanese economy. A weak yen often makes imports more expensive, which could further strain inflation rates. Additionally, Japan’s trade balance could be adversely affected as the cost of purchasing foreign goods increases. On a global scale, countries engaged in trade with Japan may also react to these currency shifts, potentially creating further economic ripple effects.

Risks of Further Yen Depreciation

The risks of continued yen depreciation cannot be understated. For businesses and investors, currency risk management becomes crucial to mitigate losses associated with currency fluctuations. It’s essential to consider strategies such as hedging, which can provide a buffer against the adverse impacts of a deteriorating yen. If the trend continues, it could spark uncertainty within the Forex market, amplifying the need for robust risk management practices.

Strategies for Currency Risk Management

Tools for Managing Currency Risks

There are several tools available for businesses to manage currency risks associated with the Japanese yen’s fluctuations. Companies can implement hedging strategies, including currency options and forward contracts, to lock in exchange rates and protect profit margins. Additionally, diversifying portfolios can help distribute risk across different currencies, softening the blow of potential yen declines.

The Role of Monetary Policy in Currency Management

Monetary policy will play a pivotal role in supporting the yen in these unpredictable times. Analysts are closely monitoring potential adjustments in Japan’s monetary policy as a way to bolster the currency. By fine-tuning interest rates and other economic measures, Japan can navigate the choppy waters of currency fluctuations, aiming to stabilize the Japanese yen.

Conclusion

As we reflect on the challenges facing the Japanese yen amidst its recent weakening, it’s clear that understanding currency intervention and effective currency risk management strategies is becoming increasingly critical. With implications ranging from domestic economic stability to global trade dynamics, investors and businesses must remain vigilant in navigating this evolving market scenario. The future of the Japanese yen will undoubtedly depend on the strategies implemented by both Japan’s government and market participants alike.

What is the current state of the Japanese yen?

The Japanese yen is currently facing notable fluctuations in the Forex market, particularly concerning its value against the U.S. dollar. The yen is approaching the 150 per dollar mark, raising significant concerns among analysts and currency officials.

What factors are contributing to the yen’s weakening?

Several factors contribute to the yen’s weakening:

- Low interest rates and sluggish growth in Japan’s economy.

- U.S. Federal Reserve’s monetary policy affecting global currency values.

- Fluctuating global economic conditions introducing volatility in the Forex market.

How does the weakening yen impact Japan’s economy?

A weakened yen can lead to increased import costs, potentially straining inflation rates. It may also negatively affect Japan’s trade balance as purchasing foreign goods becomes more expensive.

What are Japan’s currency intervention strategies?

Japan’s monetary authorities engage in currency intervention, which involves buying or selling yen in the market to stabilize its value. Recent interventions aim to reassure investors and stabilize the economy, although their effectiveness is still debated.

What are the risks associated with further yen depreciation?

Further yen depreciation poses several risks:

- Increased currency risk for businesses and investors.

- Potential losses due to currency fluctuations without effective risk management.

- Heightened uncertainty in the Forex market.

What strategies can businesses use for currency risk management?

Businesses can adopt several strategies to manage currency risks, including:

- Hedging strategies, such as currency options and forward contracts, to lock in exchange rates.

- Diversifying their portfolios to distribute risk across different currencies.

How will monetary policy affect the yen’s future?

Monetary policy will be crucial in supporting the yen during these unpredictable times. Analysts are monitoring potential adjustments in interest rates and economic measures that may stabilize the currency.