European stocks have recently captured the attention of investors as they navigate through changing market dynamics. The European Central Bank (ECB) plays a crucial role, particularly following its latest decision to implement a rate cut. This article explores the implications of this move on the stock market and the technology sector.

The Role of the European Central Bank in the Stock Market

The European Central Bank (ECB) significantly influences the performance of European stocks through its monetary policy. When the ECB changes interest rates, it sends ripples through the entire market. A rate cut typically makes borrowing cheaper, encouraging spending and investment. This can boost corporate earnings, leading to higher stock prices.

Recently, the ECB has decided to implement a rate cut to stimulate the economy amidst various challenges. This decision is expected to impact European stocks in multiple ways, particularly in sectors like technology. Investors are keenly watching how this change will affect their portfolios, especially with the focus on the impact of the ECB rate cut on the technology sector.

Analyzing the Recent ECB Rate Cut

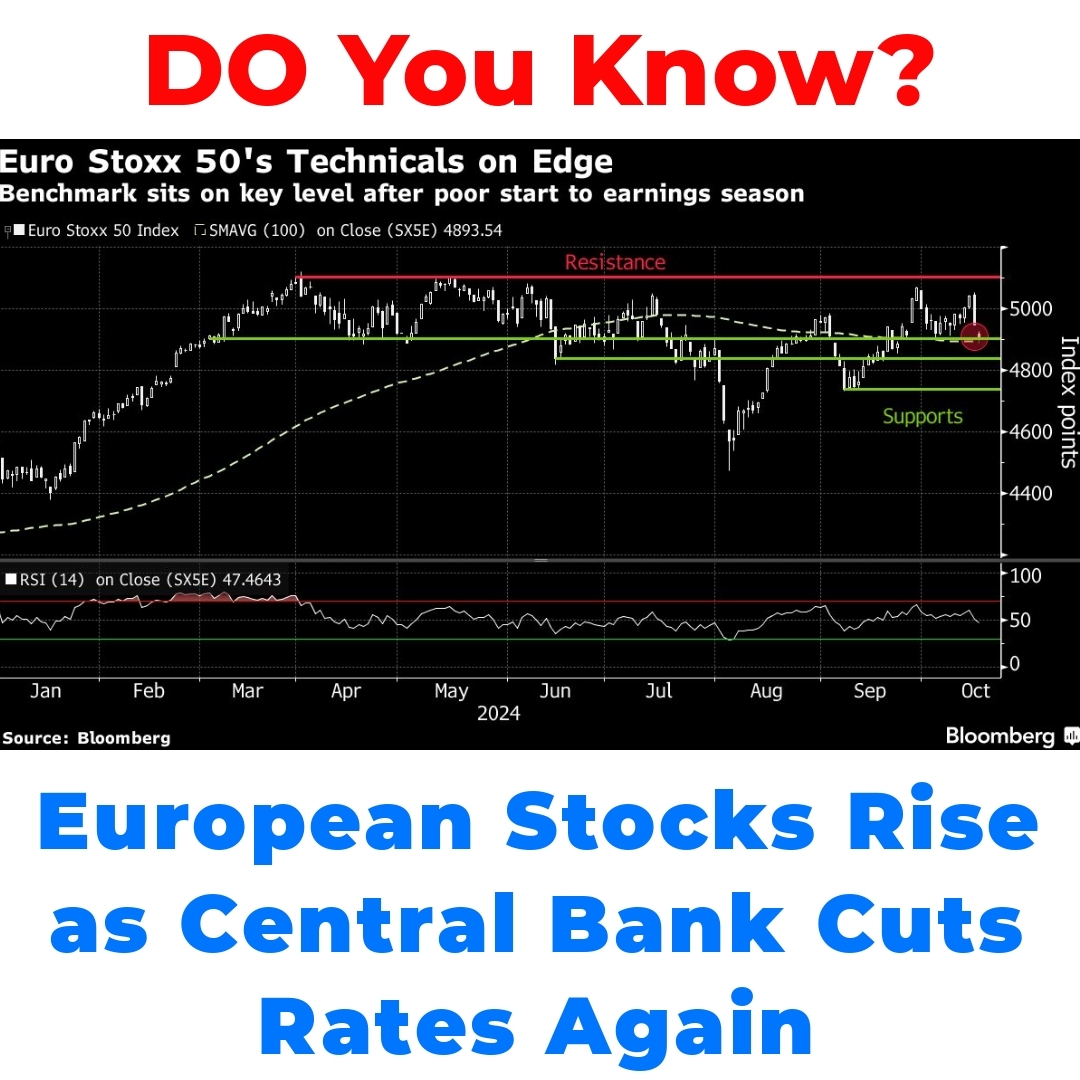

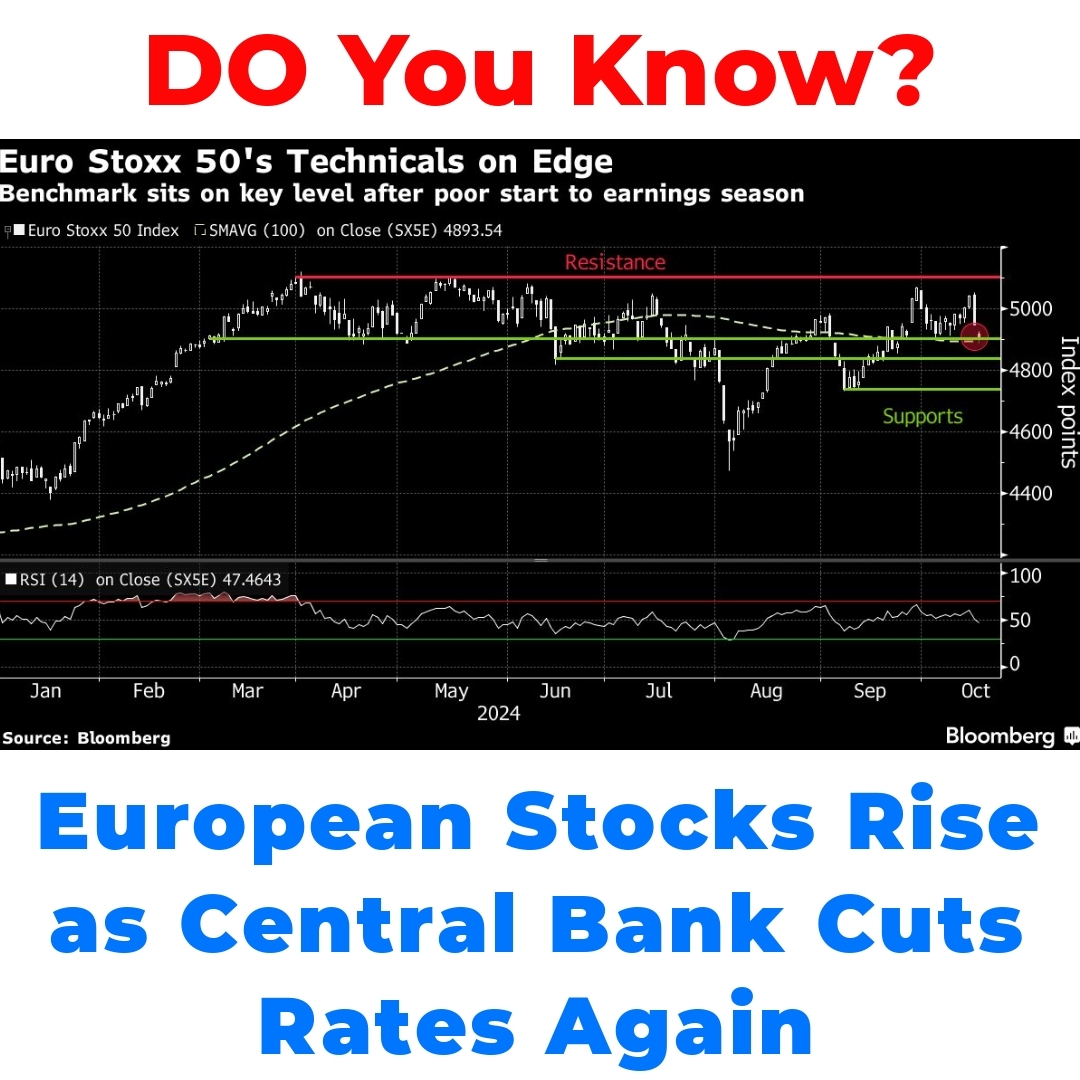

The recent announcement of the ECB’s rate cut came with thorough reasoning. The central bank aims to tackle inflation while spurring economic growth as uncertainties loom within the market. Following this announcement, European stocks gained momentum, reflecting a broader market trend of recovery after such policy adjustments.

Interest rate changes like these play a critical role in economic recovery. A cut encourages borrowing and spending, which can invigorate the economy. For many investors, the European stocks gain after the ECB rate cut is a clear indication that the market is responding positively to these efforts.

Stabilization of the Technology Sector

After experiencing some losses, the technology sector has shown signs of stabilization shortly after the ECB’s rate cut. The decision to lower interest rates has provided a much-needed boost, helping to alleviate investor concerns and restoring confidence in tech stocks. In many cases, this stabilization reflects the overall sentiment in the stock market recovery.

The ECB’s actions have a direct effect on how companies within the technology sector perceive their future growth. With cheaper loans and increased consumer spending, tech companies can invest more in innovation and expansion, positively impacting their stock prices.

Broader Market Reactions and Trends

The overall response of the stock market to the ECB’s recent actions has been quite encouraging. Investors seem optimistic, reflecting confidence in European stocks. Many analysts are currently assessing the market’s trends in relation to the ECB’s monetary policy.

Investor sentiment has consistently improved following the announcement, suggesting that they believe the ECB’s measures will aid economic stability. This growing confidence in the market is essential, especially in navigating potential challenges ahead while analyzing the European Central Bank’s monetary policy.

Conclusion

In summary, the recent actions of the ECB regarding the rate cut have begun to play a significant role in the performance of European stocks. The technology sector, in particular, has shown resilience and stabilization thanks to the environment created by the ECB’s monetary decisions. Looking ahead, ongoing interest rate adjustments will likely remain a focal point for investors trying to gauge the future of the European stock market.

As developments unfold, it remains crucial for investors to stay informed about market trends and ECB decisions, especially concerning the technology sector.

Call to Action

To keep up with the ever-changing landscape of European stocks and the effects of central bank decisions, make sure to follow future developments related to the European Central Bank and the technology sector. Staying informed is key to adapting and thriving in today’s financial environment.

FAQ

What is the role of the European Central Bank (ECB) in the stock market?

The ECB plays a crucial role in influencing the performance of European stocks primarily through its monetary policy. Interest rate changes by the ECB can impact borrowing costs, consumer spending, and investment, affecting corporate earnings and stock prices.

How does a rate cut by the ECB affect the economy?

A rate cut typically makes borrowing cheaper. This encourages spending and investment, which can lead to increased corporate earnings, creating a more favorable environment for stock prices to rise.

What has been the recent impact of the ECB’s rate cut on European stocks?

Following the recent rate cut, European stocks gained momentum, indicating a positive response from the market. This boost reflects investor confidence in the ECB’s efforts to stimulate economic growth despite existing challenges.

Why is the technology sector important to monitor after the ECB’s rate cut?

The technology sector has shown signs of stabilization after the ECB’s rate cut. With lower interest rates, tech companies may have more access to financing for innovation and expansion, positively affecting their stock prices.

How are investors reacting to the ECB’s monetary policy changes?

Investor sentiment has improved following the ECB’s announcement of a rate cut. Many investors express optimism, believing that these measures will contribute to economic stability and positively influence European stocks.

What should investors keep an eye on regarding the ECB’s actions?

- Monitor ongoing interest rate adjustments.

- Assess the performance of the technology sector closely.

- Stay informed about market trends and ECB decisions that could affect stock prices.

How can investors prepare for future changes by the ECB?

Staying informed about developments related to the ECB and the stock market is essential. This involves following news, analyses, and trends that can provide insights into how future monetary policy changes may impact investments.