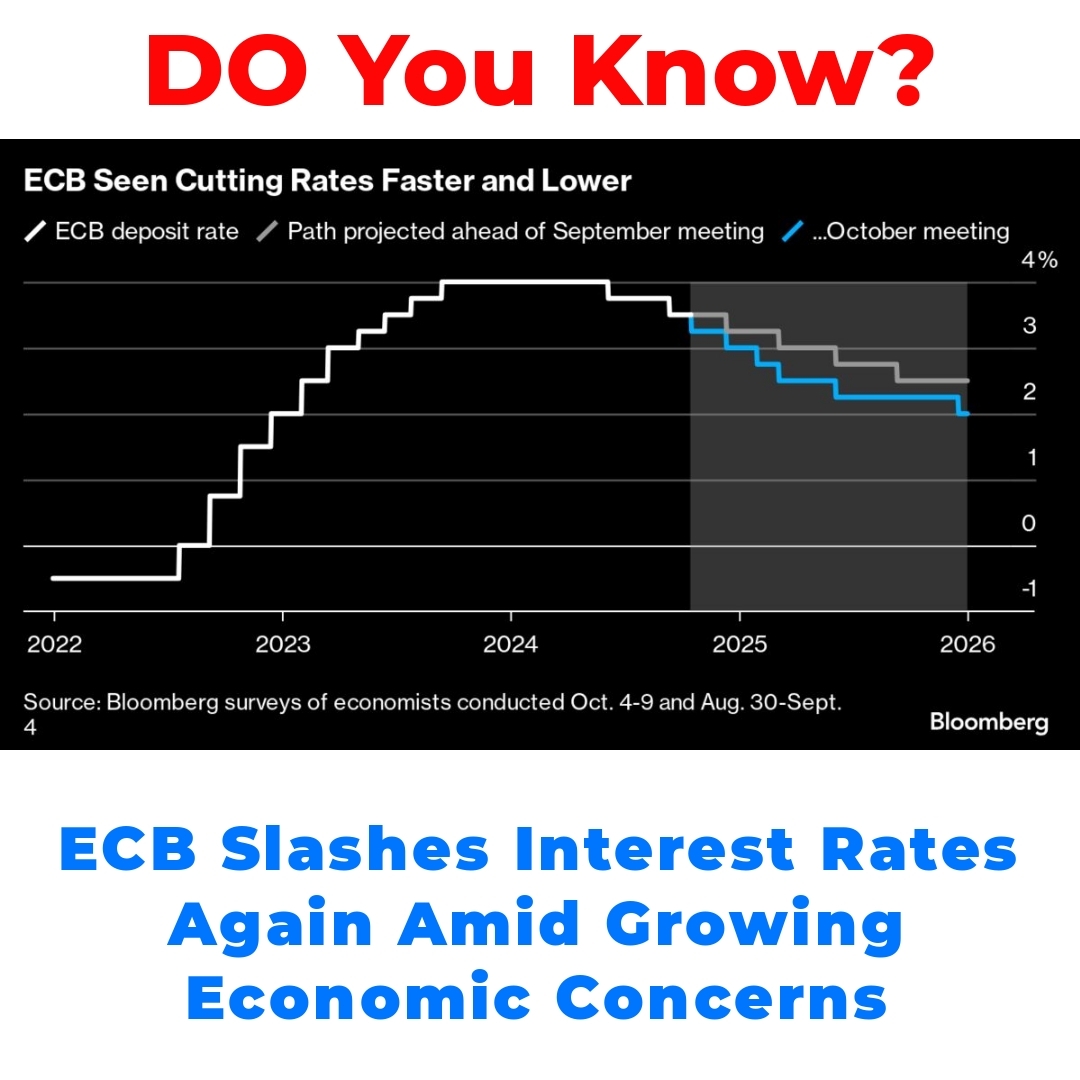

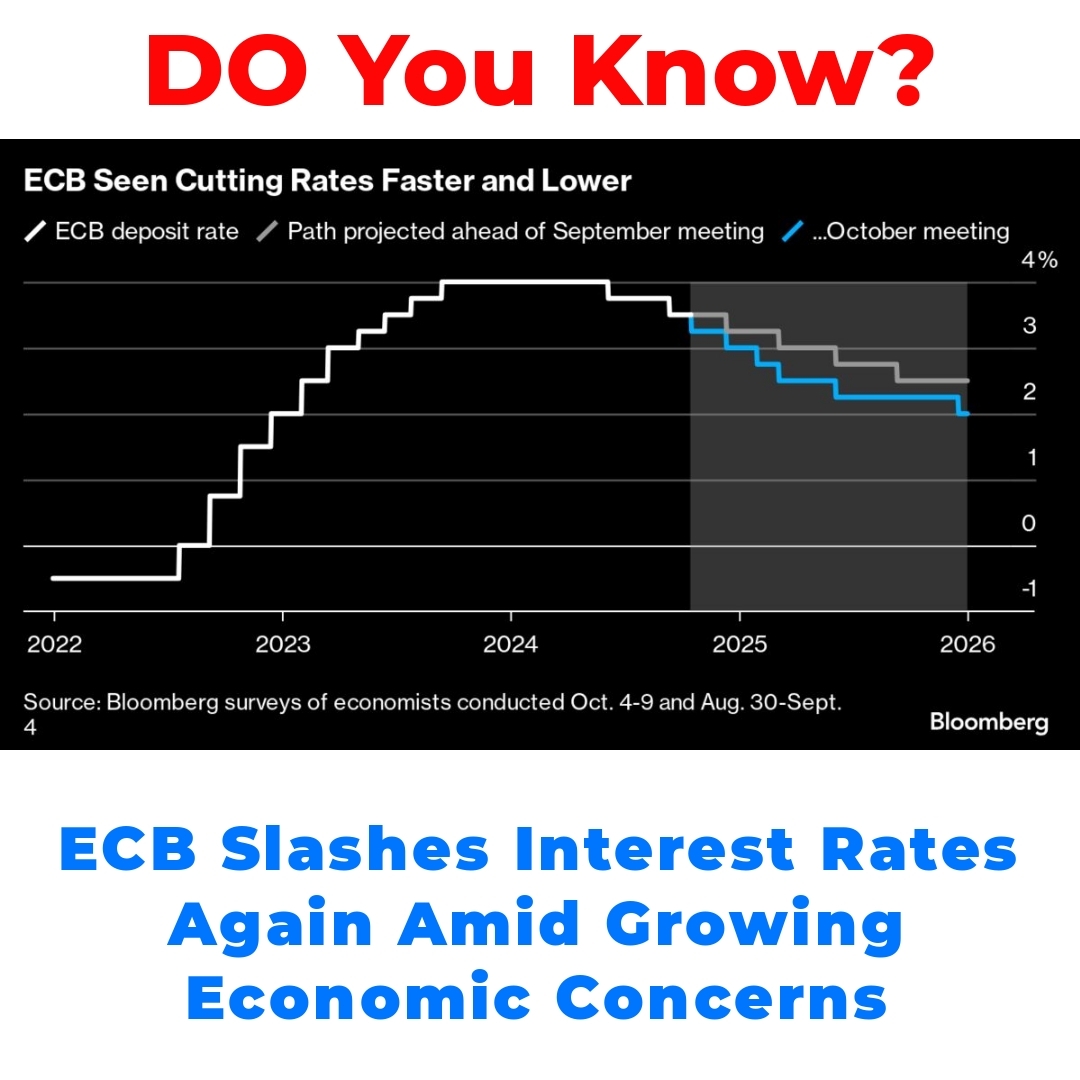

The recent decision by the European Central Bank to lower interest rates has garnered significant attention. As inflation continues to decline, understanding the implications of these changes in European Central Bank interest rates becomes crucial. This article explores the context behind the ECB’s rate cut and its potential effects on the European economy.

Understanding the ECB’s Rate Cut

The decision by the European Central Bank (ECB) to lower interest rates carries significant meaning. Essentially, a rate cut signals a shift in monetary policy aimed at stimulating economic growth. The current framework utilized by the ECB focuses on managing inflation and ensuring financial stability in the Eurozone.

Recent economic data has shown that inflation is declining, which likely influenced the ECB’s interest rate decision. In a world where consumer prices remain a key concern, understanding these adjustments is crucial for everyone, from policymakers to everyday consumers.

The Impact of ECB Interest Rate Cuts on the Economy

So, what does lowering interest rates actually mean for the European economy? First, it usually makes borrowing cheaper. This can have a ripple effect across various sectors, potentially boosting spending. When businesses can borrow more affordably, they’re likely to invest in projects, hire more employees, and even expand.

But when we look closer, we see that there could be consequences for inflation. Lower interest rates often lead to an increase in consumer spending, which could pressure prices upwards. Thus, while there’s a potential benefit for consumers and businesses in the short term, the longer-term effects on European inflation remain to be seen.

Inflation Trends and the European Economy

A closer examination of inflation trends reveals that Europe has been experiencing a gradual decline in inflation rates. This decline has not only influenced the ECB’s strategy but is also shaping its decisions on rates. As inflation reduction becomes a reality, the ECB is likely to respond proactively to maintain a balance.

Current economic data shows shifts across various sectors, and the ECB keeps a watchful eye on these changes. For instance, industries that previously faced rising costs may find relief, allowing them to stabilize prices. This interconnectedness highlights how inflation changes can directly impact central bank policies.

Long-Term Economic Consequences

As we look to the future, it’s essential to consider the long-term impacts of sustained ECB interest rate cuts. While these measures may initially boost economic activity, they come with potential risks. Continued economic deterioration could lead to a need for further adjustments in monetary policy.

Should inflation rates rise unexpectedly, the ECB might face complications. Balancing the benefits of lower interest rates with the realities of inflation is a delicate dance. Moreover, the longer interest rates remain low, the more challenging it may become for the ECB to adjust back to higher rates without disrupting the economy.

Conclusion

In conclusion, the recent decision by the European Central Bank to lower interest rates is significant, particularly amid existing economic challenges. The ECB’s approach aims to tackle inflation reduction while ensuring the health of the European economy.

This ongoing strategy highlights the importance of understanding how changes in the European Central Bank interest rates affect all stakeholders—from consumers to businesses and policymakers. Keeping an eye on inflation trends and being mindful of potential risks will be vital as we navigate the uncertain economic landscape ahead.

What does the ECB’s rate cut mean for borrowing costs?

The ECB’s interest rate cut typically makes borrowing cheaper. This can encourage businesses and consumers to take loans for investments and purchases, potentially increasing overall spending in the economy.

How might lower interest rates affect inflation?

While lower interest rates can boost spending and stimulate economic growth, they might also lead to higher inflation. Increased consumer spending can create upward pressure on prices, complicating the ECB’s efforts to manage inflation.

Why is inflation data important for the ECB’s decisions?

Inflation data is crucial for the ECB as it helps shape monetary policy. A decline in inflation may prompt the ECB to lower interest rates, while rising inflation might force them to consider raising rates to maintain stability.

What are the potential long-term impacts of sustained low interest rates?

Over time, sustained low interest rates might have risks, such as making it difficult for the ECB to raise rates later without disrupting economic activity. This could lead to complications if inflation begins to rise unexpectedly.

Who should pay attention to the ECB’s rate cuts?

All stakeholders should be aware of the ECB’s rate decisions, including:

- Consumers, who may benefit from lower borrowing costs.

- Businesses, which might find it easier to invest and grow.

- Policymakers, who need to understand the economic landscape shaped by these decisions.