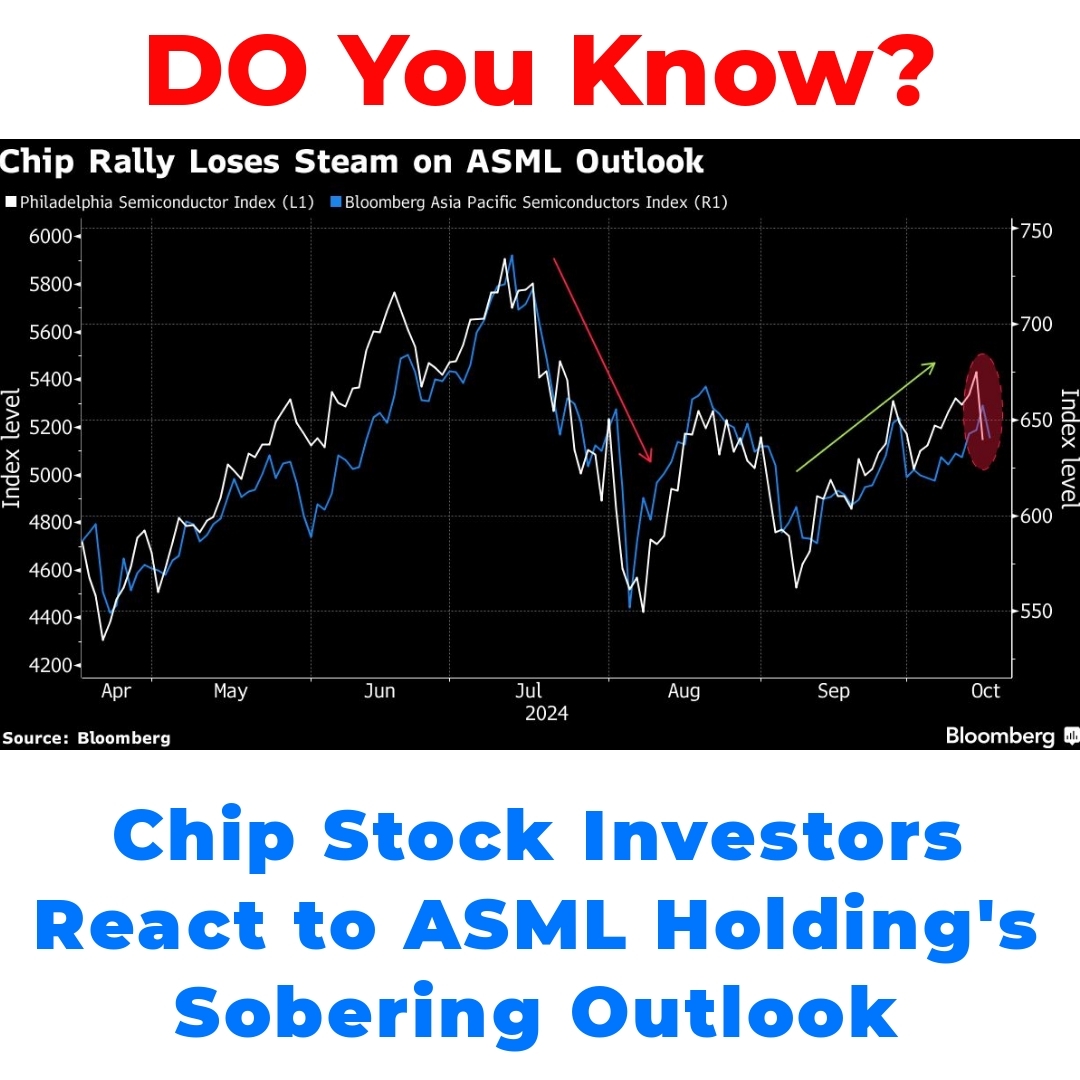

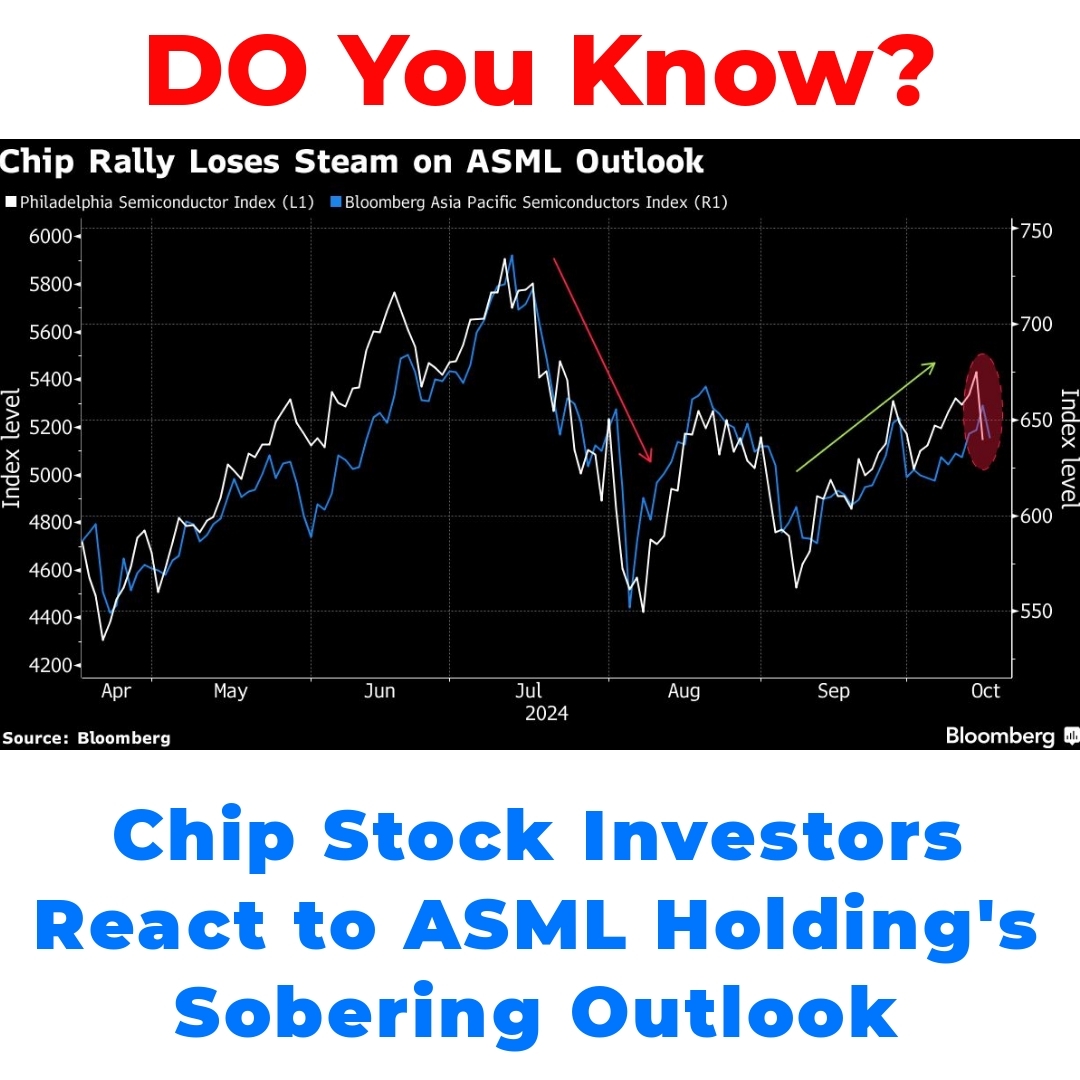

Chip stocks play a crucial role in the modern market, significantly influencing technology and manufacturing sectors. Recently, ASML Holding NV’s cautious outlook has cast a shadow over investor confidence, prompting concerns about the semiconductor industry’s future. Understanding these dynamics is vital for navigating the evolving landscape of semiconductor investments.

Understanding ASML Holding NV’s Outlook

ASML Holding NV is an essential player in the semiconductor industry. As a primary equipment supplier, the company’s performance directly impacts chip stocks worldwide. Recently, ASML provided a tepid outlook, forecasting challenges that stirred investor sentiment. This cautious projection stemmed from several factors, including increased competition and supply chain constraints that threaten the equilibrium of chip manufacturing. By examining ASML’s projections, investors gain a clearer picture of the broader market dynamics shaping the semiconductor landscape.

The Immediate Impact on Chip Stocks

Following ASML Holding NV’s outlook, investors reacted swiftly. Major chip stocks experienced notable fluctuations, as market participants reassessed the projected future of these companies. Many firms saw their stock prices dip sharply, highlighting the delicate balance of confidence in the semiconductor sector. Key statistics show that stocks like NVIDIA and Intel faced immediate sell-offs after ASML’s announcement, with percentage drops reflecting heightened concerns about future profitability.

– For instance, NVIDIA stocks dropped around 5%, while Intel saw a decline of about 3% within days of the announcement.

– This movement illustrates how closely linked chip stocks are to the fortunes of equipment suppliers like ASML.

Broader Implications for the Semiconductor Industry

The state of the semiconductor industry is now under close scrutiny following ASML’s report. A cautious outlook from such a prominent equipment supplier has broader implications, potentially signaling challenges across the entire chip manufacturing ecosystem. Global chip manufacturing could face ripple effects, as companies reevaluate their positions and strategies in an evolving market environment. Investors are particularly keen on how these changes might affect tech stocks, as many depend on a stable supply of chips for their operations.

Supply chain dynamics also come into play, with manufacturers rethinking sourcing strategies and production timelines. This situation calls for a deeper analysis of the semiconductor market outlook, particularly for those considering investments in this sector.

Future of Semiconductor Investments

Looking ahead, the future of semiconductor investments can still shine amid ASML’s cautious forecasting. While immediate reactions may appear pessimistic, strategic moves from savvy investors might reveal potential recovery signs. Identifying opportunities within this sector, particularly in niche markets such as AI or automotive chip technology, could provide avenues for profit and growth, even when faced with short-term volatility.

Emerging technologies are continuously demanding more advanced chips, and investors who recognize these trends will be best positioned to take advantage of potential growth. Companies adapting swiftly to market changes may also unlock new value in a seemingly tumultuous environment.

Navigating Investment Risks in the Semiconductor Sector

Investing in chip stocks comes with its share of risks, especially in light of ASML Holding NV’s forecast. Key risks include market volatility, shifting consumer demands, and geopolitical factors that may disrupt the delicate supply chain. To mitigate these risks, investors should consider diversifying their portfolios, staying informed about industry trends, and investing in companies with solid fundamentals and adaptive strategies.

– It’s crucial to have a risk management plan in place.

– Staying updated on news related to key industry players, especially equipment suppliers like ASML, can also provide insights for making informed decisions.

Conclusion

In summary, chip stocks play a significant role in the tech sector’s overall performance, reflecting broader economic conditions. The recent outlook from ASML Holding NV reminds investors of the inherent volatility in the semiconductor industry. While short-term challenges may arise, understanding these dynamics and staying adaptive is essential. As investors navigate the evolving semiconductor landscape, keeping an eye on long-term trends will prove valuable, ultimately paving the way for smart investment decisions despite the current market fluctuations.

FAQ

What is ASML Holding NV and why is it significant in the semiconductor industry?

ASML Holding NV is a key equipment supplier in the semiconductor industry, known for producing the machines that chip manufacturers use to create chips. Its performance can greatly influence chip stocks globally.

What was ASML’s recent outlook and how did it affect the market?

ASML provided a cautious outlook, citing challenges like increased competition and supply chain constraints. This resulted in swift reactions from investors, causing sharp declines in major chip stocks such as NVIDIA and Intel, with NVIDIA’s stock dropping around 5% and Intel’s about 3% shortly after the announcement.

What are the broader implications of ASML’s cautious forecast for the semiconductor industry?

The cautious outlook signals potential challenges for the entire semiconductor manufacturing ecosystem. Many companies may need to reassess their strategies and operations, affecting the overall market stability and tech stocks that rely on a robust supply of chips.

How can investors navigate risks in semiconductor investments following ASML’s outlook?

Investors should be aware of risks such as market volatility, shifting consumer demands, and geopolitical factors. To mitigate these risks, consider:

- Diversifying investment portfolios.

- Staying informed about industry trends.

- Investing in companies with solid fundamentals and adaptive strategies.

Are there still investment opportunities in the semiconductor sector despite the challenges?

Yes, there are still promising investment opportunities. Niche markets such as AI and automotive chip technology may offer potential growth. Investors who identify these trends and adapt swiftly may benefit from long-term recovery in the sector.