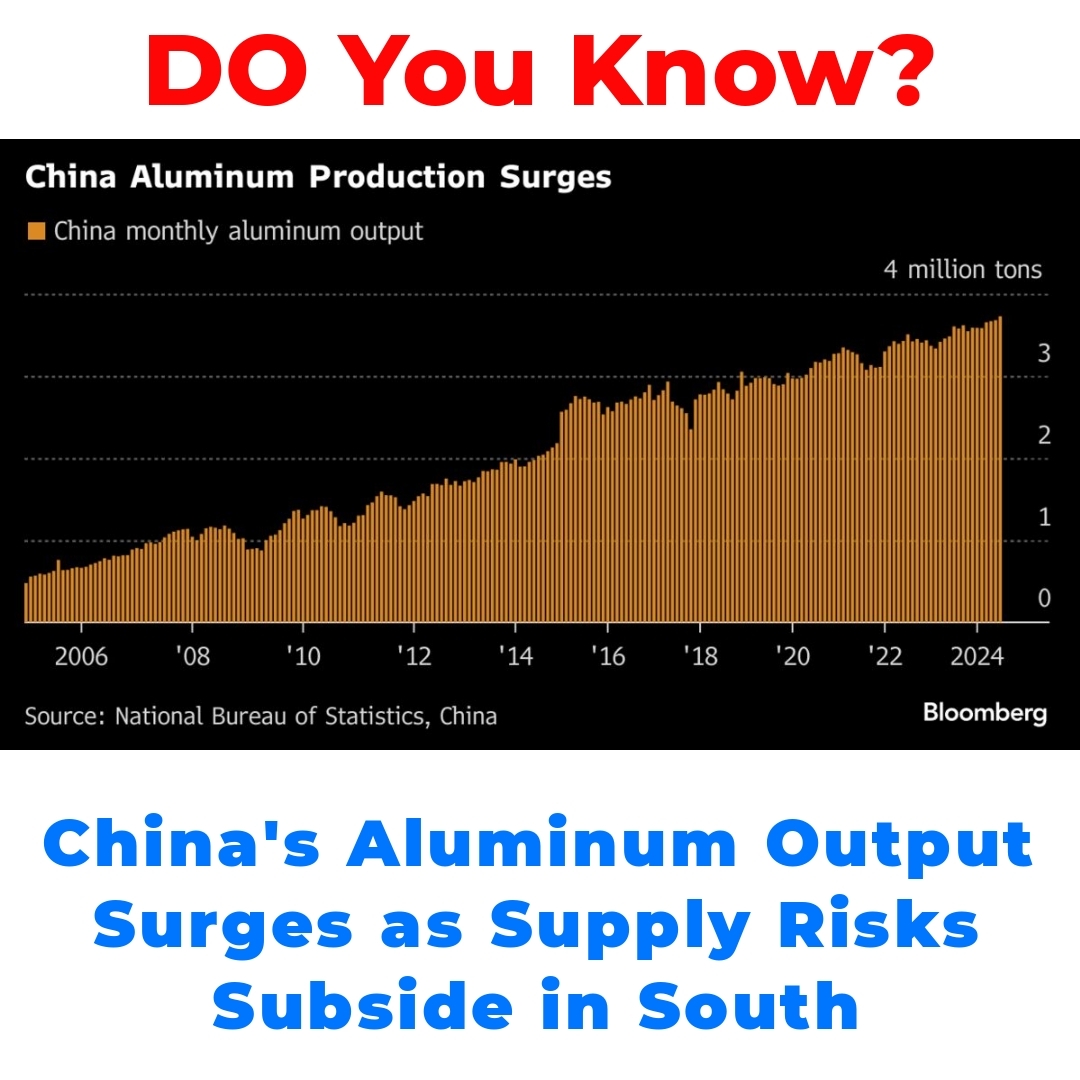

China has achieved remarkable aluminum output in 2023, setting new records that are poised to continue. This surge is driven by key production bases, particularly in southern China, and diminishing supply risks. Understanding this trend is crucial for stakeholders navigating the evolving aluminum market landscape.

Overview of China Aluminum Production

China’s aluminum production has reached new heights this year, with the country accounting for a significant portion of the global aluminum output. According to recent statistics, China’s aluminum output for 2023 has surpassed previous records, reflecting a robust growth trend that illustrates its dominance in the aluminum industry. The rise in China aluminum production underlines the importance of aluminum in a variety of sectors, from construction to manufacturing, shaping the overall market dynamics.

This increasing output is not just a number; it highlights China’s pivotal role in the global market. In recent years, while other countries have faced challenges in their aluminum production, China has managed to maintain a steady increase, which has profound implications for industries that rely heavily on aluminum.

Factors Contributing to Record Aluminum Output

Key Production Base in Southern China

One of the primary factors driving the record aluminum output is the robust production base in southern China. This region has become a powerhouse for aluminum manufacturing, thanks to its strategic location and advanced infrastructure. The technical innovations in production processes have significantly improved efficiency, leading to increased output. Investments in sustainable practices and modern technology have further solidified southern China’s status as a critical production hub.

Reduction in Supply Risks

Another contributing factor to the increased aluminum output is the reduction in supply risks. As environmental regulations are becoming more nuanced and resource availability improves, the challenges associated with sourcing raw materials are diminishing. This has allowed companies operating within the region to ramp up their production levels without the looming threat of supply chain disruptions, further supporting the elevation in aluminum output.

Impact of Southern China Production on Aluminum Supply

The effects of southern China’s booming production cannot be overstated. With several major aluminum producers establishing their operations in this region, the influence on overall aluminum supply is substantial. Companies like Hongqiao Group are examples of successful players taking advantage of southern China’s production capabilities to meet both domestic and international demand.

Sustained high levels of production in this area have significant implications for the global market as well. As China continues to increase its aluminum output, it creates a ripple effect on pricing, availability, and competition among other global producers, reshaping the aluminum supply landscape.

Aluminum Market Trends in 2023

In 2023, the aluminum market is witnessing several notable trends driven by increased output from China. Rising demand across various sectors is leading to more competitive prices and influencing investment in aluminum-related ventures. Analysts predict that these trends will likely continue to evolve throughout the year as production ramps up.

When comparing the growth of China’s aluminum production to other global producers, it’s evident that China is setting the pace. Countries trying to keep up face challenges that China has largely navigated successfully, positioning it as a leader in the aluminum industry.

Challenges Facing the Aluminum Industry in China

Despite the record levels of output, China’s aluminum industry is not without its challenges. Sustainability concerns are becoming increasingly pronounced, with regulatory frameworks tightening. This could pose a risk to future production levels if not adequately addressed. Companies must balance productivity with environmental responsibilities to maintain their standing in the market.

Additionally, fluctuations in global demand and international trade tensions could impact the aluminum supply, presenting hurdles that need careful navigation.

Future Projections for China’s Aluminum Output

Looking ahead, expert opinions suggest that China’s aluminum output might continue to rise beyond 2023. Factors like technological innovations, coupled with proactive policy changes, are likely to play a crucial role in sustaining this growth. As new methods of production are developed, the efficiency and sustainability of aluminum manufacturing could improve, further solidifying China’s place in the global market.

These projections paint a promising picture for China’s aluminum industry, making it essential for stakeholders to stay informed about changes in aluminum production trends to navigate the evolving landscape effectively.

Conclusion

In summary, China’s record-breaking aluminum output is a defining trend for 2023, driven by significant production capabilities in southern China and diminishing supply risks. As we look toward the future, understanding these dynamics is essential for anyone involved in the global aluminum market. The continuously evolving trends and projections underscore the importance of being aware of developments in China’s aluminum production, as they will undoubtedly shape the industry’s landscape for years to come.

FAQ

What is the current state of China’s aluminum production in 2023?

China’s aluminum production has reached record levels in 2023, making it a key player in the global aluminum market. The country produces a significant portion of the world’s aluminum, surpassing previous production records this year.

What factors are driving the increase in aluminum output in China?

- Strong Production Base: Southern China has established itself as a major aluminum manufacturing hub due to its location and advanced infrastructure.

- Technical Innovations: Improvements in production processes have increased efficiency and output.

- Reduced Supply Risks: Better resource availability and nuanced environmental regulations are lowering challenges related to sourcing raw materials.

How does the production in southern China affect the global aluminum supply?

The booming production in southern China leads to substantial implications for the global market, influencing pricing, availability, and competition among other producers. Major companies are capitalizing on this production capability to fulfill both domestic and international demand.

What market trends are notable in 2023 for aluminum?

Some of the key trends include:

- Increased demand across various sectors spurring competitive pricing.

- Ongoing investments in aluminum-related ventures due to rising production levels.

What challenges does the aluminum industry in China face?

- Sustainability Concerns: Stricter regulations may impact future production levels.

- Global Demand Fluctuations: Changes in demand and international trade tensions could pose hurdles for the industry.

What are the future projections for China’s aluminum output?

Experts suggest that China’s aluminum output might continue to rise in the coming years, driven by technological innovations and proactive policy changes that enhance both efficiency and sustainability in production.