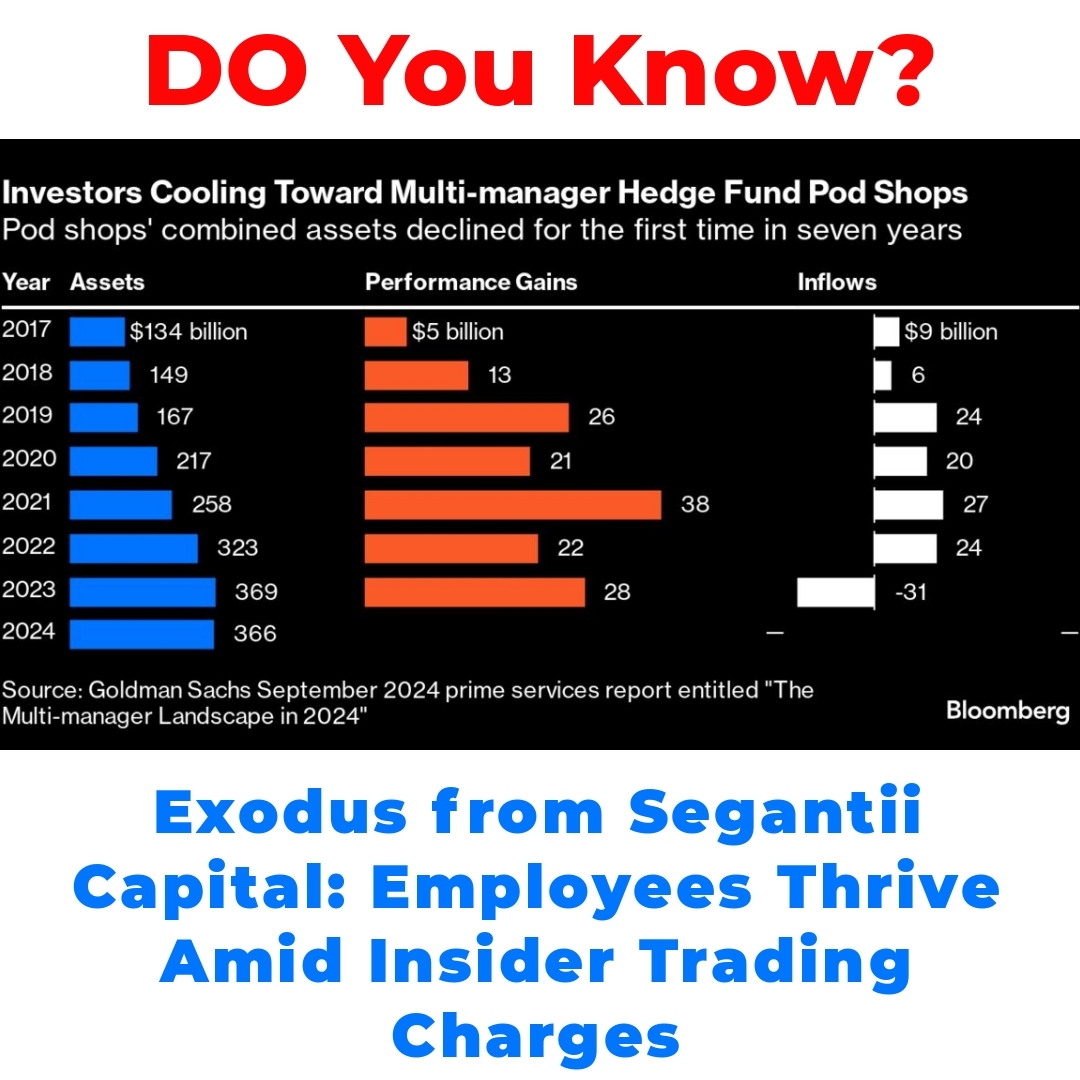

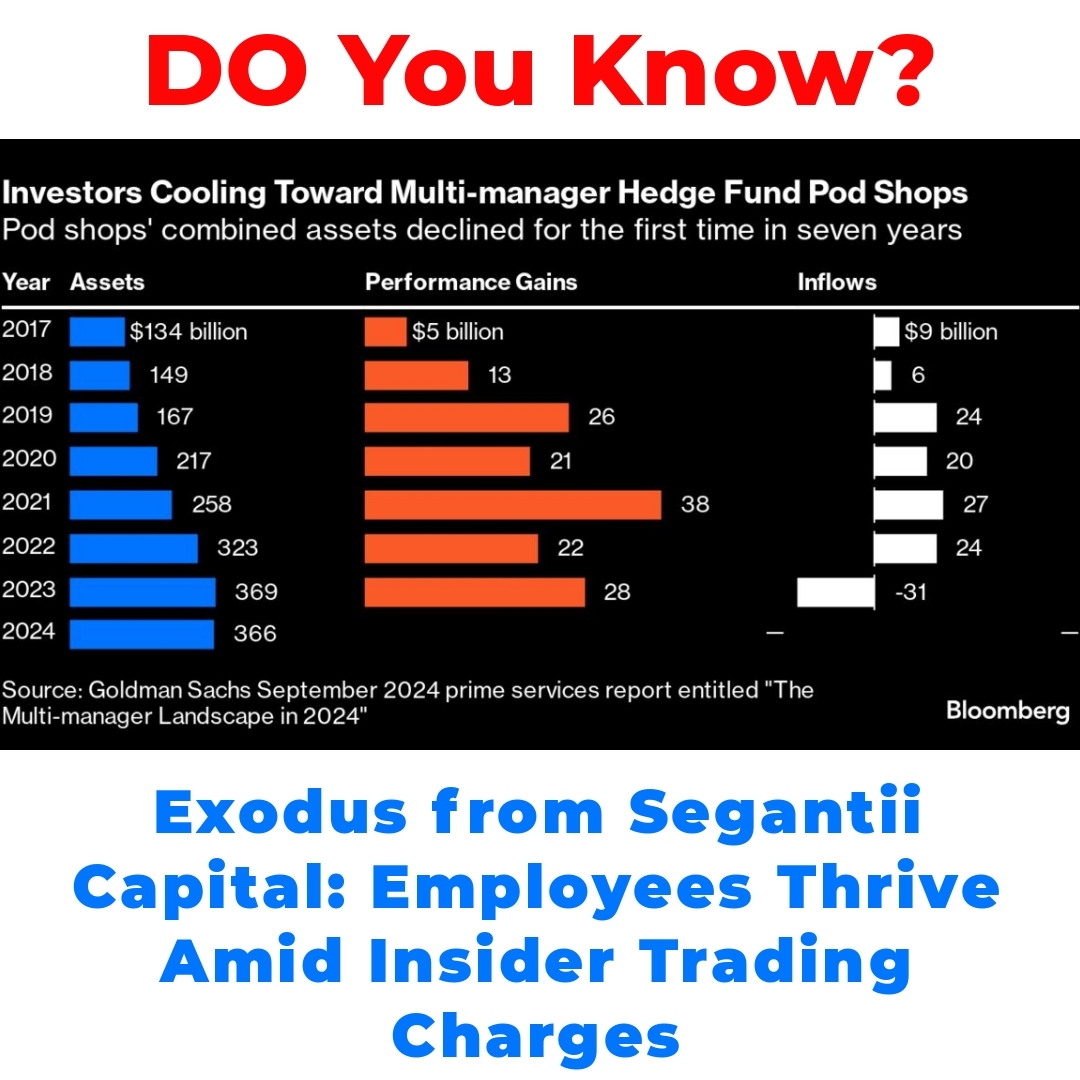

Segantii Capital Management, a prominent player in the hedge fund industry, is currently facing serious insider trading charges that have led to significant employee turnover. Since May, many Hong Kong-licensed employees have departed as they navigate a challenging job market influenced by these legal troubles. This article examines the implications of these events and the paths available for affected professionals.

Understanding Employee Turnover at Segantii Capital Management

Employee turnover is a significant aspect of any organization, but especially in the financial industry. It refers to the rate at which employees leave and are replaced within a company. High turnover can indicate dysfunction or dissatisfaction within an organization, while low turnover often suggests stability and employee engagement.

When we compare turnover rates in hedge funds like Segantii Capital Management with other sectors, the financial industry often sees higher movement. This can be attributed to various factors, including intense competition and the evolving nature of finance roles.

Since May, the scenario at Segantii Capital Management has been telling. The number of Hong Kong-licensed employees leaving the firm has surged, reflecting the anxiety created by ongoing legal challenges. Reasons for their departure range from concerns over the firm’s reputation to seeking more stable working environments amid the uncertainty of insider trading charges.

The Job Market Landscape for Hong Kong-Licensed Employees

For Hong Kong-licensed employees, the current job market presents a mix of opportunities and challenges. The finance sector is in flux, with potential openings in various areas driven by demand for skilled professionals. Sectors like fintech and compliance are growing, signaling positive shifts for those seeking new roles.

However, challenges also loom large. Many employees may face concerns stemming from the ongoing insider trading accusations against Segantii Capital Management. Potential employers might hesitate to hire someone from a firm involved in legal battles, fearing reputational risk. This hesitation can make job-seeking more daunting for those trying to pivot their careers.

Career Transition for Finance Professionals

Transitioning careers can be an opportunity for growth and reinvention, especially for Hong Kong-licensed employees moving on from Segantii Capital Management. There are several strategies they can employ to make this leap smoother.

First and foremost, networking is crucial. Building connections in the industry can open doors to new opportunities. Additionally, professionals should focus on leveraging the skills they’ve honed in hedge funds, such as analytical thinking and risk assessment, which are highly valued across various sectors.

Success stories abound among former employees of Segantii Capital Management. Many have found fulfilling roles in different fields, demonstrating how one can build a “second act” in their career. These narratives serve as inspiration and a roadmap for others navigating similar transitions.

Insider Trading Charges: Implications for the Hedge Fund Sector

The insider trading charges against Segantii Capital Management have broader implications for the hedge fund sector. Insider trading refers to the buying or selling of securities based on non-public material information, which is illegal and undermines market integrity. Such allegations can severely impact a firm’s operations and reputation.

For Segantii, these legal troubles have led to diminished employee morale, as uncertainty often creates a tense work environment. Hiring and recruitment efforts are likely to face challenges, as prospective employees weigh the risk of joining a firm with ongoing scandals.

Risk management and compliance will need to be top priorities in the wake of these charges. Hedge funds must reassess their practices to prevent such occurrences in the future and restore trust among employees and clients alike.

Conclusion

In summary, Segantii Capital Management is navigating a turbulent time marked by insider trading charges and significant turnover among Hong Kong-licensed employees. As many seek new opportunities, it’s essential for these professionals to recognize the potential for career transitions, leveraging their skills and experiences to find success in the evolving job market.

The journey may be challenging, but with determination and the right strategies, many can carve out a new path after leaving Segantii Capital Management. Now is the time to embrace change and explore the wealth of opportunities available in the finance sector. By leveraging their expertise, Hong Kong-licensed employees can successfully transition into promising new roles.

FAQ

What is employee turnover?

Employee turnover refers to the rate at which employees leave a company and are replaced. High turnover can indicate problems within the organization, while low turnover often shows employee satisfaction and engagement.

Why is turnover high in the financial industry, especially at Segantii Capital Management?

The financial industry tends to have higher turnover rates due to factors like fierce competition and the evolving nature of finance roles. At Segantii Capital Management, ongoing legal challenges, such as insider trading accusations, have significantly increased employee departures.

What challenges do Hong Kong-licensed employees face in the job market currently?

- Concerns about reputational risks associated with Segantii’s legal troubles

- Intense competition for roles in other finance areas

- Shifts in the industry that may affect job availability

What strategies can finance professionals use for a successful career transition?

- Networking to open up new job opportunities

- Leveraging skills such as analytical thinking and risk assessment that are valued across different sectors

How have former employees of Segantii Capital Management fared in finding new roles?

Many former employees have successfully transitioned to fulfilling roles in various fields, showcasing that it is possible to build a new career after leaving Segantii Capital Management.

What are the implications of insider trading charges for Segantii Capital Management?

Insider trading charges can harm a firm’s operations and reputation, leading to lower employee morale and challenges in hiring new talent.

What should hedge funds focus on after facing legal challenges?

Hedge funds need to prioritize risk management and compliance to prevent future issues and restore trust among their employees and clients.