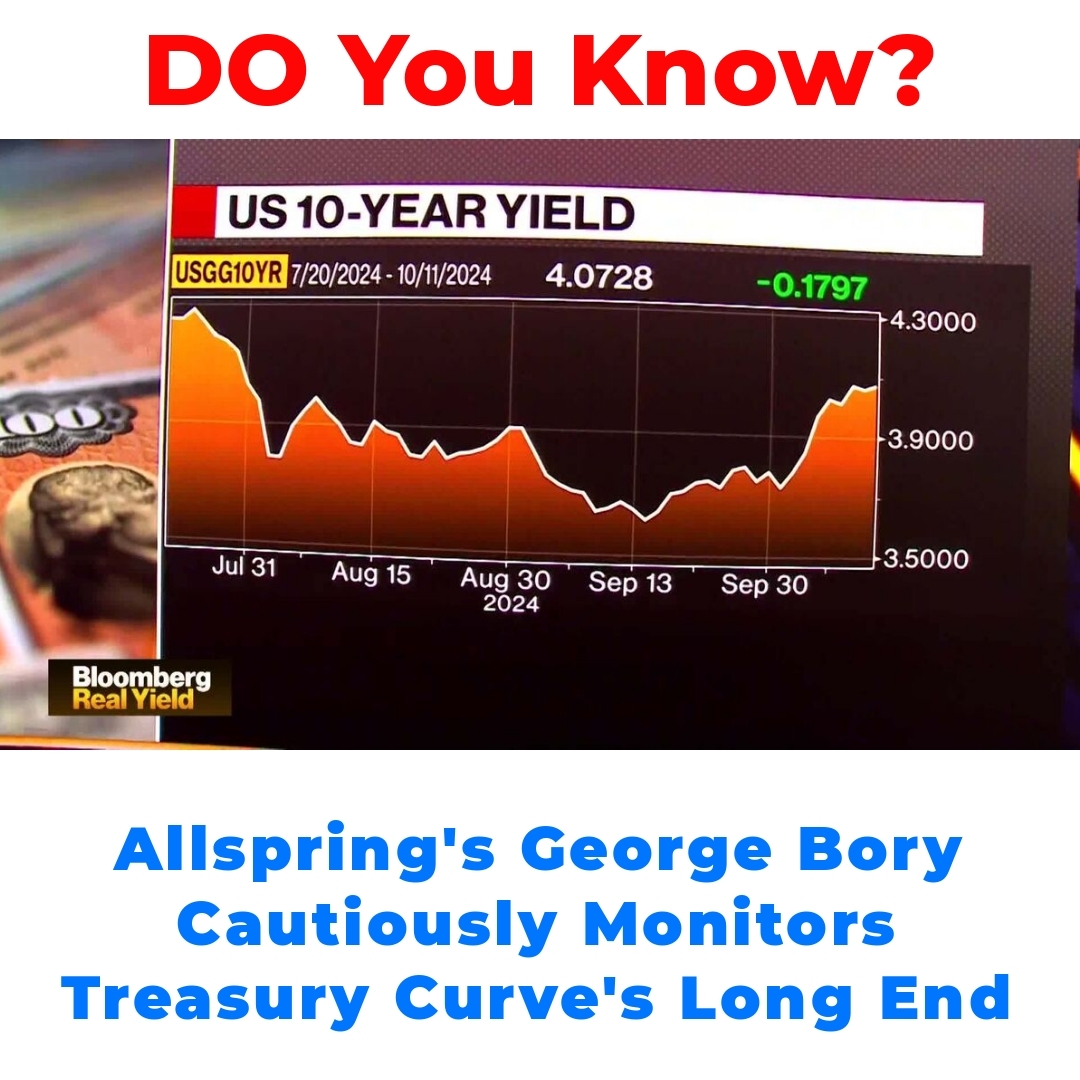

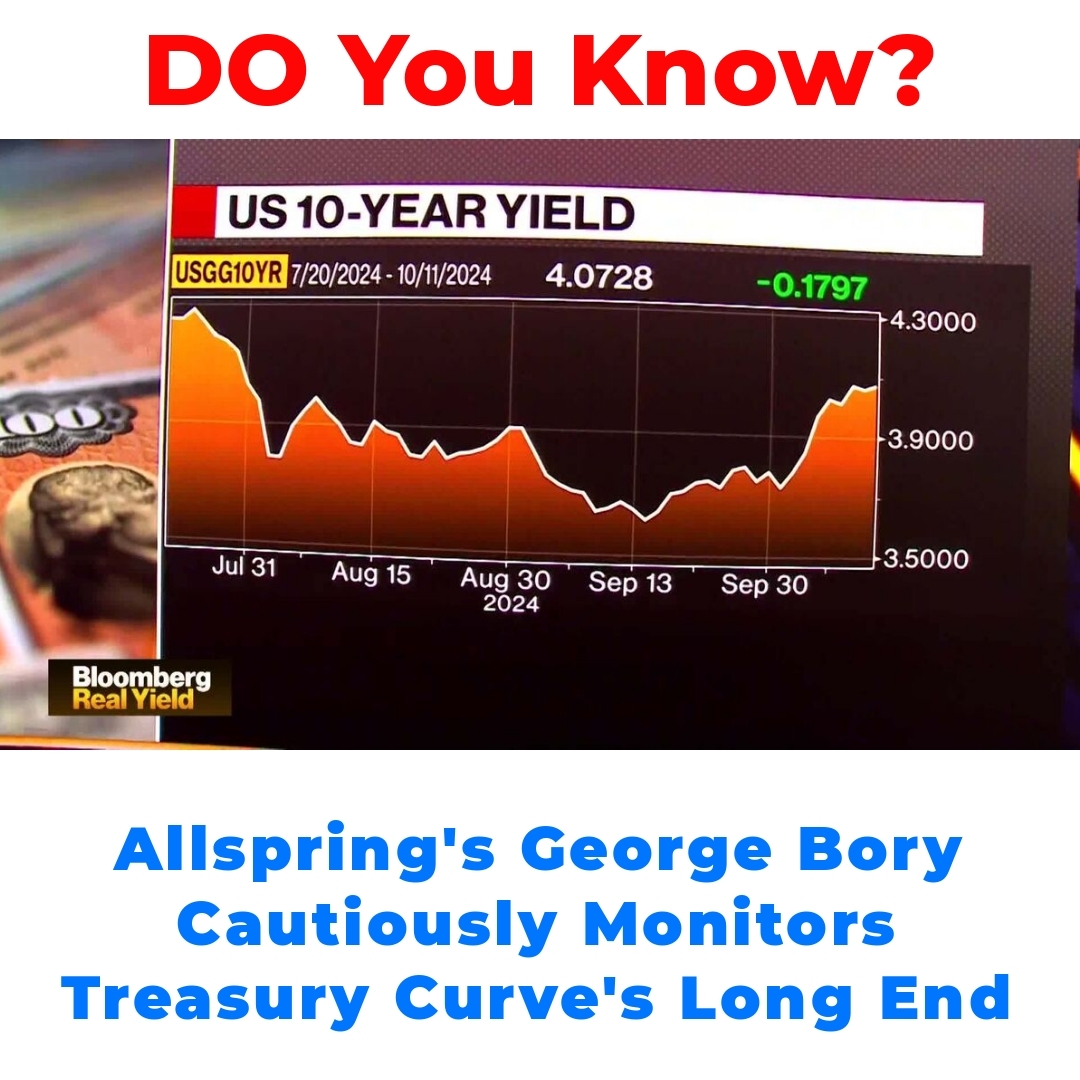

The current state of the Treasury curve reflects significant market dynamics influencing investment strategies. George Bory, the Chief Investment Strategist at Allspring Global Investments, emphasizes the importance of understanding these conditions. A cautious approach is essential for navigating the complexities of fixed income investments, especially amidst notable market volatility and interest rate changes.

Navigating the Treasury Curve: Insights on Fixed Income Investments

The Treasury curve is a vital part of understanding the financial markets today. It represents the yields on U.S. Treasury securities at various maturities, which directly impacts many aspects of investing, including interest rates and the strategies investors choose. In recent times, there have been significant shifts, especially at the long end of the curve. These movements can create uncertainty, and understanding them is crucial for anyone involved in fixed income investments.

George Bory, the Chief Investment Strategist of Fixed Income at Allspring Global Investments, brings a thoughtful approach to interpreting the current state of the Treasury curve. His insights are particularly valuable as he encourages a cautious mindset. This is important because market dynamics have been quite volatile, making it essential to assess conditions carefully before making long-term investment decisions.

Understanding the Treasury Curve

To truly grasp the significance of the Treasury curve, we need to look at what it represents. Essentially, it’s a graphical representation showing the relationship between the interest rates of U.S. Treasury securities and their respective maturities. This curve serves as a benchmark for interest rates across various types of debt and reflects the market’s expectations for future interest rates.

Recently, we’ve seen some notable shifts in the long end of the Treasury curve. These changes indicate investor sentiment and expectations regarding economic growth and inflation. The fluctuations in the Treasury curve not only reflect current market conditions but also influence interest rates on loans, mortgages, and other forms of credit, underscoring its significance in shaping investment strategies.

George Bory’s Perspective on the Treasury Curve

George Bory advocates for a cautious investment strategy regarding long-term bonds. His emphasis on caution stems from several factors, primarily driven by the current market volatility and anticipated fluctuations in interest rates. Bory believes that navigating these uncertain waters requires a reassessment of traditional investment approaches.

- Current market volatility can lead to unpredictable outcomes.

- Anticipated interest rate changes could impact bond valuations significantly.

These considerations make Bory’s insights particularly relevant for investors in fixed income investments. His perspective encourages investors to be mindful and less reactive, focusing instead on a strategic approach to their portfolios.

Investment Strategies in Response to Market Conditions

Given the complexities presented by the current state of the Treasury curve, it’s crucial to adopt a cautious approach to long-end Treasury investments. This mindset not only helps in managing risks but also aligns with the broader trend of adjusting to market volatility in fixed income. Here are a few strategies that investors might consider:

- Risk Management: It’s important to have a solid plan for managing potential losses, especially in a fluctuating market.

- Diversification: Spreading investments across different types of bonds and sectors can help mitigate risk and provide more stable returns.

By employing these strategies, investors can better navigate the current turbulent landscape and position themselves for long-term success.

The Future of Fixed Income Investments

Looking ahead, there are several predictions regarding the evolution of interest rates and the implications for the Treasury curve. As economic conditions change, investors will need to stay alert to how these dynamics can impact their long-term bond investments. A key consideration for these investors is how to align their fixed income strategies with current market trends.

As interest rates continue to fluctuate, adapting to these changes will be vital. Investors should keep an eye on indicator trends and economic forecasts to make informed decisions that reflect the evolving landscape.

Conclusion

The Treasury curve plays a pivotal role in shaping the fixed income landscape. Understanding its significance and recent shifts can empower investors to make more informed decisions. George Bory’s cautious approach serves as a valuable guide in these uncertain times, reinforcing the need to stay informed and agile when it comes to fixed income investments. As we navigate these complexities, it’s essential for investors to remain engaged with current market conditions and adjust their strategies accordingly.

In conclusion, staying updated with insights regarding the Treasury curve can provide investors with the tools they need to thrive in the ever-changing market. For those interested in fixed income investments, the call to action is clear: remain vigilant and adaptable as we move forward. The more we understand these financial dynamics, the better positioned we will be to achieve our investment goals.

We invite you to engage with this topic further. What are your thoughts on the current state of the Treasury curve? Share your insights and subscribe for more valuable content on fixed income and investment strategies!

FAQ

What is the Treasury curve?

The Treasury curve is a graph that shows the relationship between the yields of U.S. Treasury securities and their maturity dates. It helps investors understand interest rates across different types of debt.

Why are shifts in the long end of the Treasury curve significant?

Shifts at the long end indicate changes in investor sentiment regarding economic growth and inflation. These changes can affect interest rates on loans and mortgages, influencing investment strategies.

What does George Bory suggest about investing in long-term bonds?

George Bory advises a cautious approach to long-term bond investments due to market volatility and anticipated fluctuations in interest rates. He emphasizes the importance of reassessing traditional strategies.

What investment strategies can be used in response to market conditions?

- Risk Management: Have a solid plan for managing potential losses in a fluctuating market.

- Diversification: Spread investments across different types of bonds and sectors to mitigate risk.

What should investors keep an eye on regarding fixed income investments in the future?

Investors should monitor interest rate trends and economic forecasts to adapt their fixed income strategies as conditions evolve. Staying informed is crucial for making smart investment decisions.