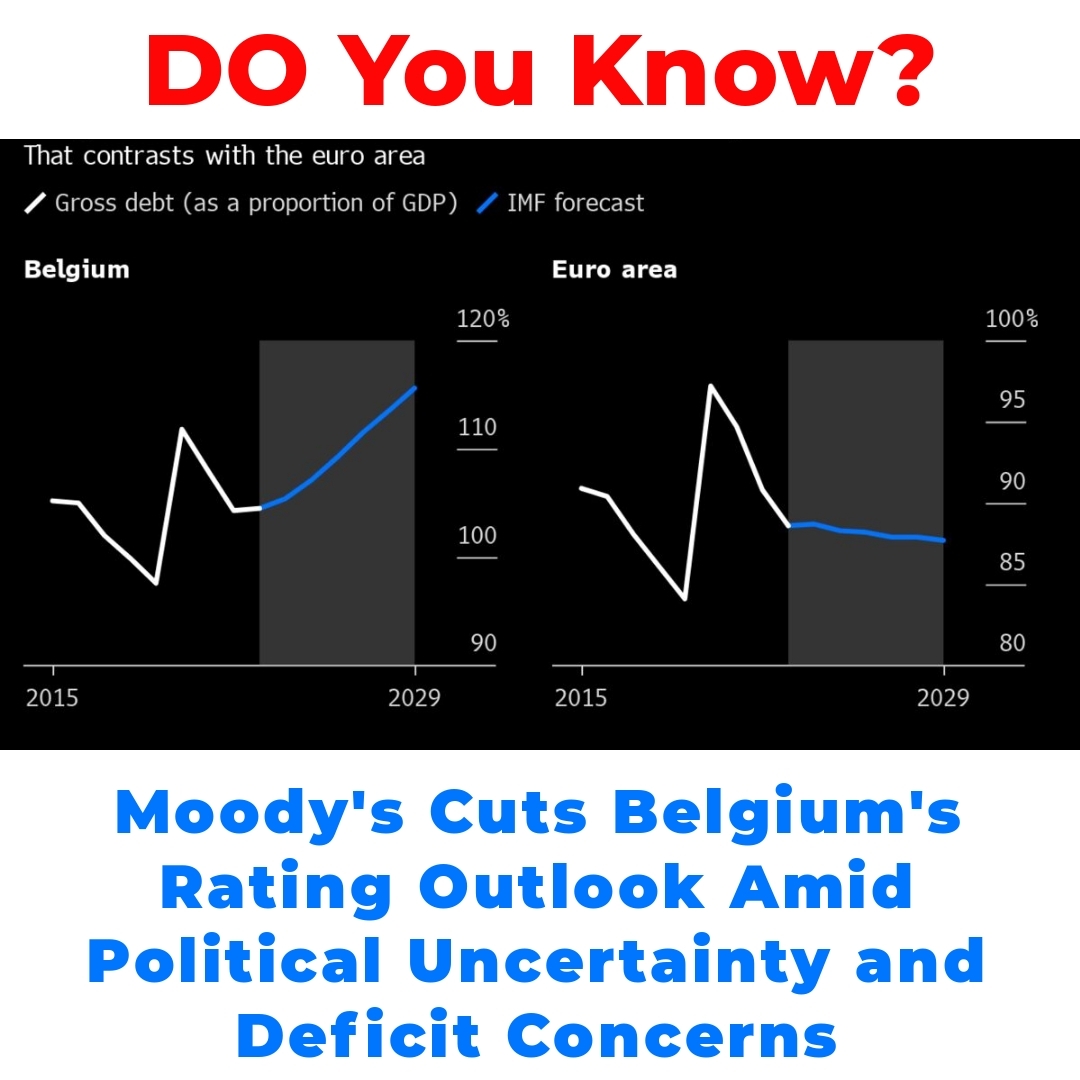

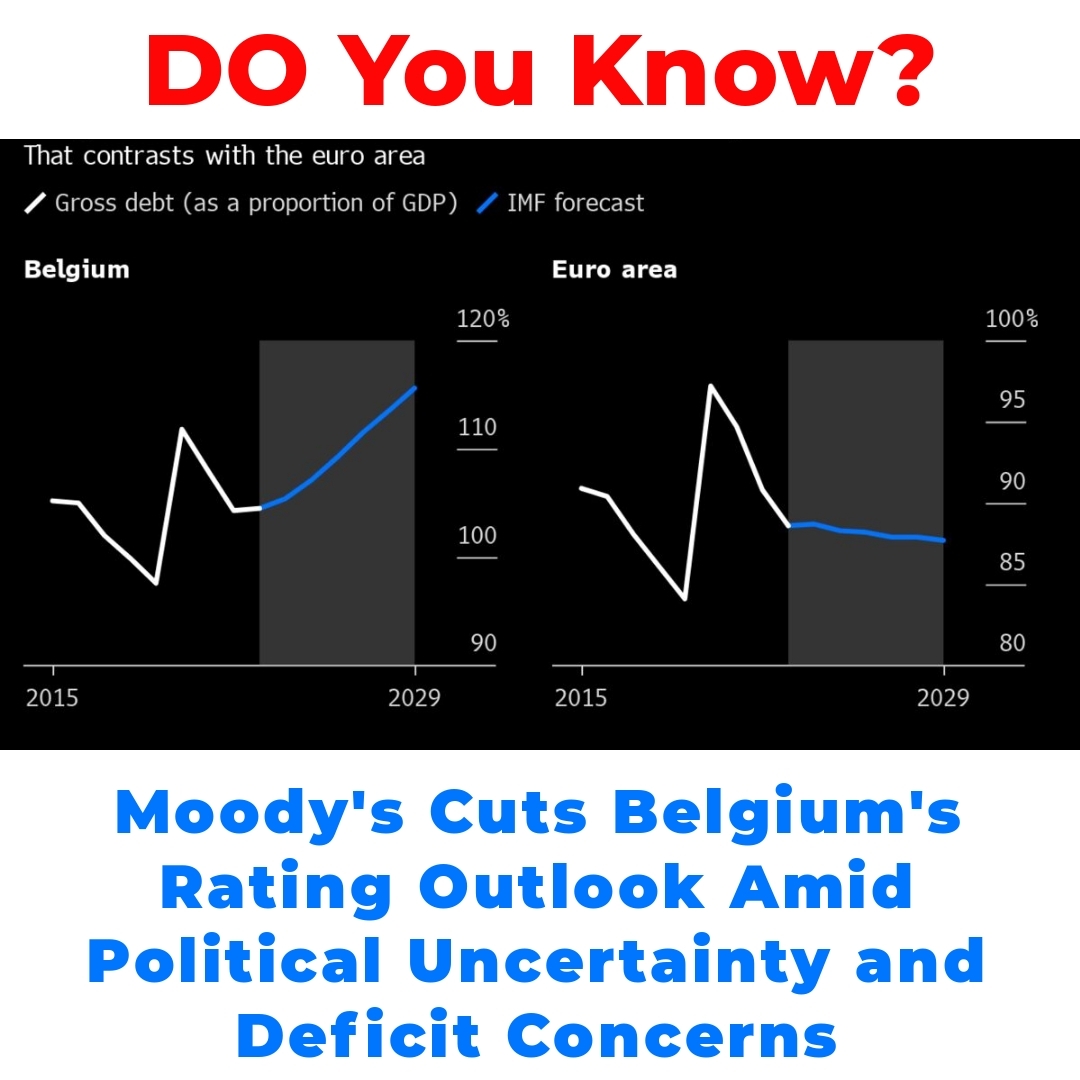

The Belgium rating outlook has recently attracted attention following a downgrade to a negative perspective by Moody’s Ratings. This development raises critical questions about the country’s deficit trajectory and the impact of political uncertainty amid upcoming general elections. Understanding these elements is essential for grasping Belgium’s financial stability and future economic policies.

Understanding Belgium’s Rating Outlook

Credit ratings play a crucial role when it comes to evaluating a country’s economic stability. They provide insights into how a nation is managing its finances and the overall health of its economy. Moody’s Ratings is one of the leading credit rating agencies, and its evaluations are significant for both investor confidence and market perceptions. When they revise a country’s rating, it can have far-reaching consequences, influencing everything from borrowing costs to international investments.

In the case of Belgium, the recent move to a negative outlook signals serious concerns. Moody’s assesses various factors when evaluating a country’s fiscal health, including economic performance and government policy. A lower rating can lead to increased borrowing costs, which further complicates fiscal planning and economic growth. This is why the **Belgium rating outlook** is something that both policymakers and investors need to monitor closely.

The Impact of Political Uncertainty on Belgium’s Rating

After the general elections in Belgium, the nation is experiencing a period of political uncertainty. This instability can have a direct impact on the country’s credit rating. When a government is unstable, it may struggle to implement effective economic policies, which can negatively affect its ability to manage the government deficit.

As a result, investors may become more cautious, leading to a potential decrease in confidence about Belgium’s economic future. This political uncertainty adds another layer of complexity to the **deficit trajectory** the country is currently facing, making it imperative for the new government to establish a solid plan to reassure investors.

Belgium’s Deficit Trajectory: Current Concerns

Belgium’s **deficit trajectory** has raised eyebrows in recent years. When looking at the statistics, it’s clear that the nation is grappling with increasing financial challenges. The government deficit has been on the rise, and if not addressed, it’s likely to elongate due to ongoing political factors.

Historically, Belgium has seen fluctuations in its fiscal health, but the current trajectory signals potential trouble ahead. As the government deficit expands, the implications for overall economic stability become more pronounced. A rising deficit can lead to a cascading series of financial problems, including higher interest rates and reduced public investments, which can ultimately hamper economic growth.

The Implications of a Negative Rating Outlook

What does a negative rating outlook mean for Belgium? Let’s break it down. A negative outlook can affect several economic indicators and fiscal policies. For one, it may lead to higher borrowing costs for the government. If investors perceive risk, they tend to demand higher returns on their investments, translating into increased interest rates.

Additionally, Belgium’s access to financial markets may be jeopardized. A negative **credit rating** can make it harder not just for the government, but also for businesses within the country to secure funding. This can stifle investments and slow down economic growth, which in turn exacerbates existing **deficit concerns**.

The Intersection of Economic Forecast and Election Impact

As Belgium heads into its general elections, the economic forecast is intricately connected to the political landscape. Different parties have varying approaches to fiscal policy, and these policies will be critical in defining how Belgium addresses its ongoing **deficit** issues.

Some candidates may propose austerity measures aimed at reducing the deficit, while others might focus on stimulating the economy through increased spending. The direction chosen by the electorate will undoubtedly impact Belgium’s credit rating and overall economic outlook.

Conclusion

In summary, Belgium’s credit rating outlook and political stability are currently under significant pressure. The recent downgrade to a negative perspective by Moody’s Ratings reflects ongoing challenges related to the **government deficit** and political uncertainty. It’s essential for policymakers to address these issues effectively to bolster Belgium’s economic standing.

As the nation navigates through these uncertain waters, keeping an eye on evolving political dynamics and economic strategies will be vital. The future of Belgium’s **rating outlook** depends on how well it manages the intersection of economic policies and political stability in the months ahead.

Call to Action

I encourage you to stay informed about Belgium’s economic and political developments, as these factors will significantly affect the **Belgium rating outlook**. Whether you’re an investor, a policy analyst, or simply someone interested in international finance, keeping track of how these elements play out could provide crucial insights for the future.

Frequently Asked Questions

What does Belgium’s negative rating outlook mean?

A negative rating outlook indicates that credit agencies like Moody’s have concerns about Belgium’s economic stability. This could lead to higher borrowing costs and impact investor confidence.

How does political uncertainty affect Belgium’s credit rating?

Political instability can hinder the government’s ability to implement effective economic policies. This may lead to a poor fiscal performance, further affecting Belgium’s credit rating.

What is the current status of Belgium’s deficit trajectory?

Belgium is currently facing a rising government deficit. This trend raises concerns about its fiscal health and may lead to increased financial problems if not addressed.

What are the implications of a negative credit rating for businesses in Belgium?

- Higher borrowing costs for both the government and businesses.

- Increased interest rates due to perceived risks.

- Difficulties in accessing financial markets.

- Potential slowdown in economic growth due to reduced investments.

How are elections impacting Belgium’s economic outlook?

The upcoming elections could significantly affect fiscal policy. Different political parties have varied approaches to handling the deficit which will consequently shape Belgium’s rating outlook.

What actions can policymakers take to improve Belgium’s credit rating?

Policymakers should focus on:

- Establishing effective economic policies.

- Addressing the government deficit through various strategies.

- Enhancing political stability to build investor confidence.