The recent decline of Chinese stocks has raised concerns as they underperform compared to their Asian peers. This downturn has sparked discussions on the potential impact of fiscal stimulus from Beijing, which could significantly influence market sentiment and the future trajectory of these financial markets in the region.

Understanding the Stock Market Decline

What Are Chinese Stocks?

Chinese stocks refer to shares that are listed on stock exchanges in China, including major companies like Alibaba, Tencent, and Baidu. These stocks are crucial indicators of the country’s economic health and are closely watched by investors around the world. Recently, we’ve seen a decline in the performance of Chinese stocks, which is raising eyebrows as they are underperforming compared to other Asian markets. As investors seek clarity on the market direction, it’s clear this trend is having a significant impact.

Factors Contributing to the Decline

Several factors are at play in the recent downturn of Chinese stocks. Economic indicators such as slowed manufacturing output and declining export growth have painted a worrying picture. Comparatively, the broader Asian markets are showing more resilience, making the underperformance of Chinese stocks even more evident. This divergence raises questions about the underlying economic conditions that are affecting investor sentiments.

Caution in Asian Markets Ahead of Beijing Briefing

What Causes Chinese Stocks to Underperform in Asia?

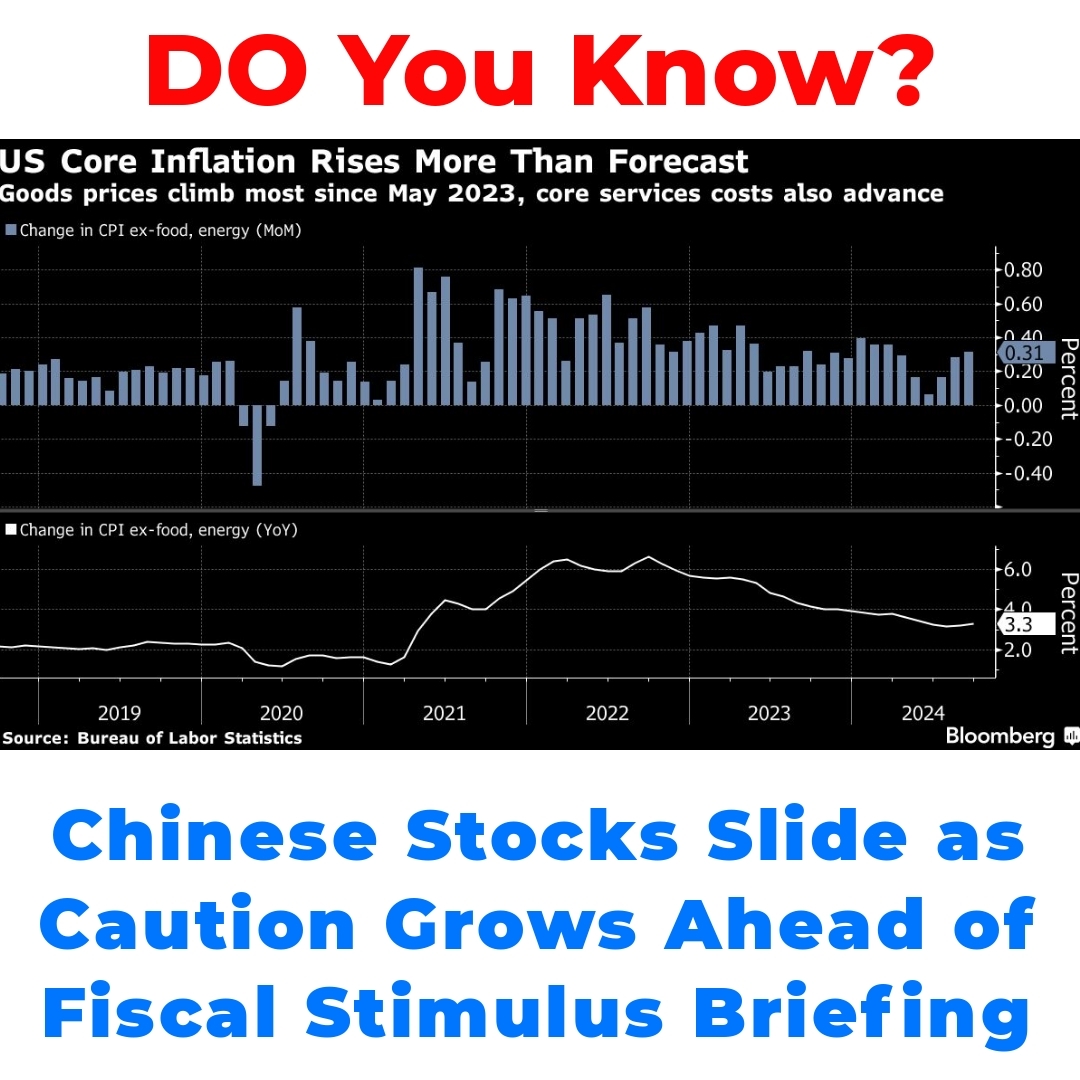

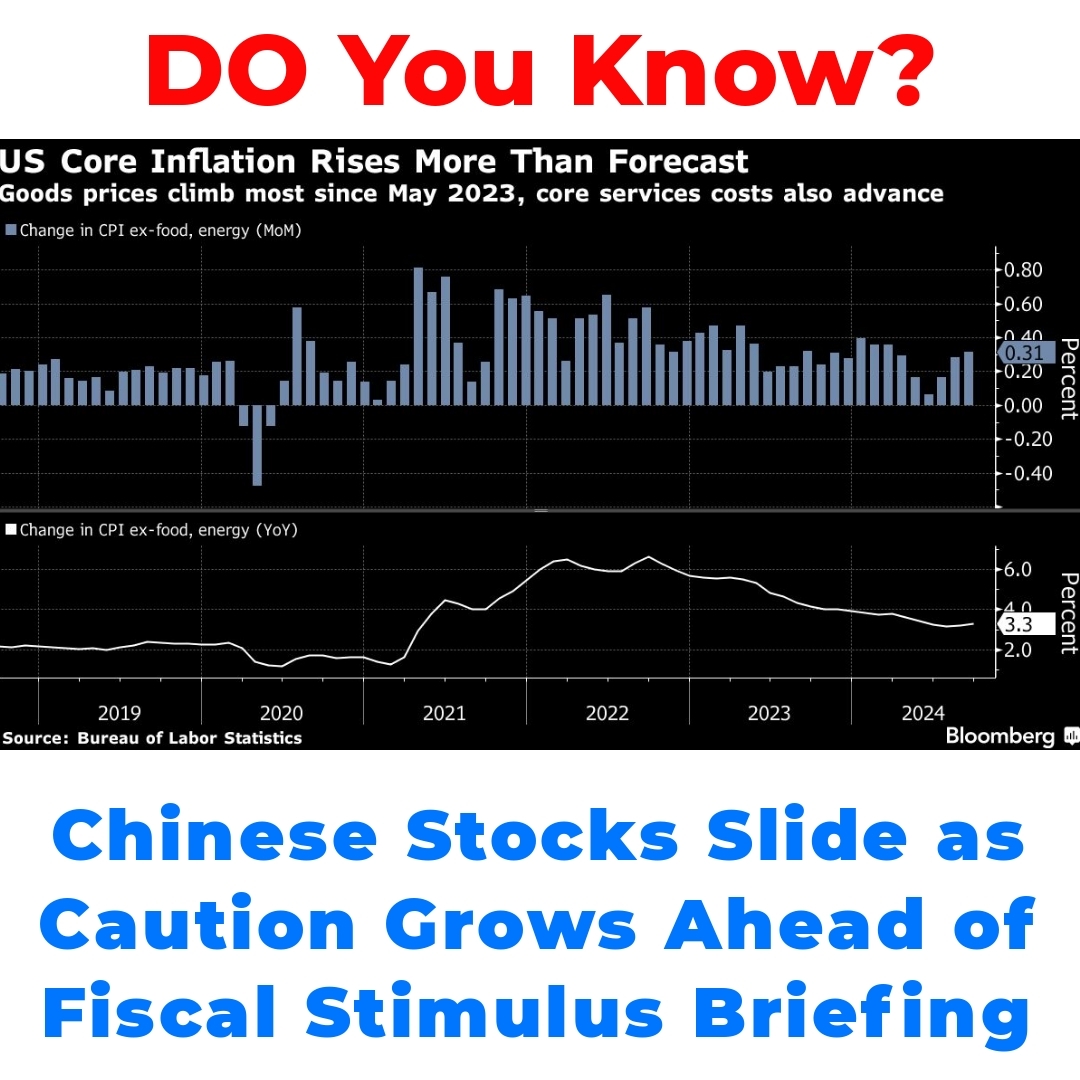

When we talk about the reasons behind Chinese stocks underperforming in Asia, we have to consider both external and internal pressures. Globally, economic uncertainties, including inflation and interest rate hikes, are creating a cautious atmosphere for investors. Additionally, internal factors such as regulatory crackdowns and concerns about economic recovery are intensifying these challenges for Chinese stocks.

Investment Caution: A Broader Perspective

Investment sentiment across the Asian markets is currently at a crossroads. With many market players adopting a wait-and-see approach, this caution is crucial in determining future performance. Investors are wary of the potential impacts of geopolitical tensions and local policy decisions, which leads to hesitancy in equity investments and can further affect the performance of Chinese stocks.

The Role of Fiscal Stimulus in Market Performance

Analysis of the Impact of Fiscal Stimulus on Chinese Stocks

Fiscal stimulus announced by Beijing plays a vital role in shaping the market outlook for Chinese stocks. Recent measures aimed at boosting economic activity, such as infrastructure investments and easing of monetary policies, could potentially restore investor confidence. Observing how these policies unfold can provide critical insights into the trajectory of these stocks.

Economic Outlook: What to Expect This Weekend

As we look ahead to the upcoming Beijing briefing this weekend, many are predicting a ripple effect on the stock market. Historical context shows that fiscal stimulus measures often have a positive short-term impact, but will they be enough to change the current trajectory of underperformance? Investors will be keenly watching for more detailed insights into economic policy adjustments and their likely repercussions on the financial markets.

Comparative Analysis with Asian Peers

How Are Other Asian Markets Performing?

When we analyze the performance of other Asian markets, they seem to be navigating challenges more effectively than their Chinese counterparts. Investors are favoring markets that show signs of stability and growth, leading to improved performance metrics. This comparative analysis highlights how economic conditions, including trade relationships and fiscal measures, shape the overall equity performance in the region.

Can Chinese Stocks Regain Their Strength?

The question on everyone’s mind is whether Chinese stocks can regain their strength. Several scenarios could unfold, depending on the upcoming signals from Beijing. Key indicators to watch include the government’s stance on supporting failing sectors and measures taken to boost domestic consumption. How these factors play out post-briefing will greatly influence recovery potential for Chinese stocks.

Conclusion

In conclusion, the upcoming Beijing briefing holds significant importance for the future of Chinese stocks. With the backdrop of recent declines and the impact of fiscal stimulus on market sentiment, investors should remain vigilant. As we move forward, keeping an eye on the developments in the financial markets will be crucial for understanding the path ahead for Chinese stocks.

What Are Chinese Stocks?

Chinese stocks are shares traded on exchanges in China, including well-known companies like Alibaba and Tencent. They are important for assessing China’s economic health and have been underperforming compared to other Asian markets recently.

What Factors Contribute to the Decline of Chinese Stocks?

Several factors influence the decline of Chinese stocks:

- Slower manufacturing output

- Declining export growth

- Global economic uncertainties, like inflation and interest rate hikes

- Internal issues, such as regulatory crackdowns

What Causes Chinese Stocks to Underperform in Asia?

Chinese stocks are facing challenges from both global and local factors:

- Global economic uncertainties impacting investor sentiment

- Regulatory issues within China

- Concerns about economic recovery

How Does Investment Sentiment Affect Chinese Stocks?

Current investment sentiment in Asian markets is cautious. Investors are concerned about:

- Geopolitical tensions

- Local policy decisions

What Is the Role of Fiscal Stimulus for Chinese Stocks?

The fiscal stimulus announced by Beijing can impact Chinese stock performance through:

- Infrastructure investments

- Easing monetary policies

What Can We Expect from the Upcoming Beijing Briefing?

The upcoming Beijing briefing is expected to influence the stock market. Investors will be looking for:

- Details on economic policy adjustments

- Potential ripple effects on financial markets

How Are Other Asian Markets Performing Compared to Chinese Stocks?

Other Asian markets are performing better due to:

- Stability and growth signs

- More favorable trade relationships

Can Chinese Stocks Regain Their Strength?

The possibility of recovery for Chinese stocks depends on:

- The government’s support for struggling sectors

- Measures to stimulate domestic consumption