Oil company ratings play a crucial role in guiding investors by offering insights into the health and future prospects of energy firms. These ratings serve as a barometer for the overall oil market outlook, especially during challenging times marked by declining crude prices. Understanding these dynamics is essential as firms like BNP Paribas Exane adjust their assessments, influencing investment strategies and market perceptions.

Current Landscape of Oil Company Ratings

Recent months have seen a shift in the landscape of oil company ratings, with several analysts making notable downgrades. This trend has gained traction amid declining crude prices. In particular, the decision by BNP Paribas Exane to adjust its ratings has become a significant talking point in the industry. Understanding how these ratings affect the energy sector is crucial for investors looking to navigate the current oil market dynamics.

Analysts play a vital role in shaping the perceptions surrounding oil companies. Their evaluations and recommendations can influence investor confidence, stock prices, and even market trends. As the oil market faces headwinds, keeping tabs on oil company ratings becomes increasingly important for making informed investment choices.

The Role of Analysts in Oil Industry Analysis

Analysts like those at BNP Paribas Exane impact market perceptions in significant ways. Their ratings are generally derived from a range of factors, including company financials, management decisions, and broader economic indicators. When they indicate an investment downgrade, it can send ripples through the industry.

This brings us to the importance of rating adjustments. For example, when an analyst downgrades an oil company’s rating, it often correlates with weak stock performance or adverse market trends. Investors need to pay close attention to these assessments and understand that they can be pivotal in identifying both risks and opportunities in the energy sector.

Case Study: Exxon Mobil Corp.

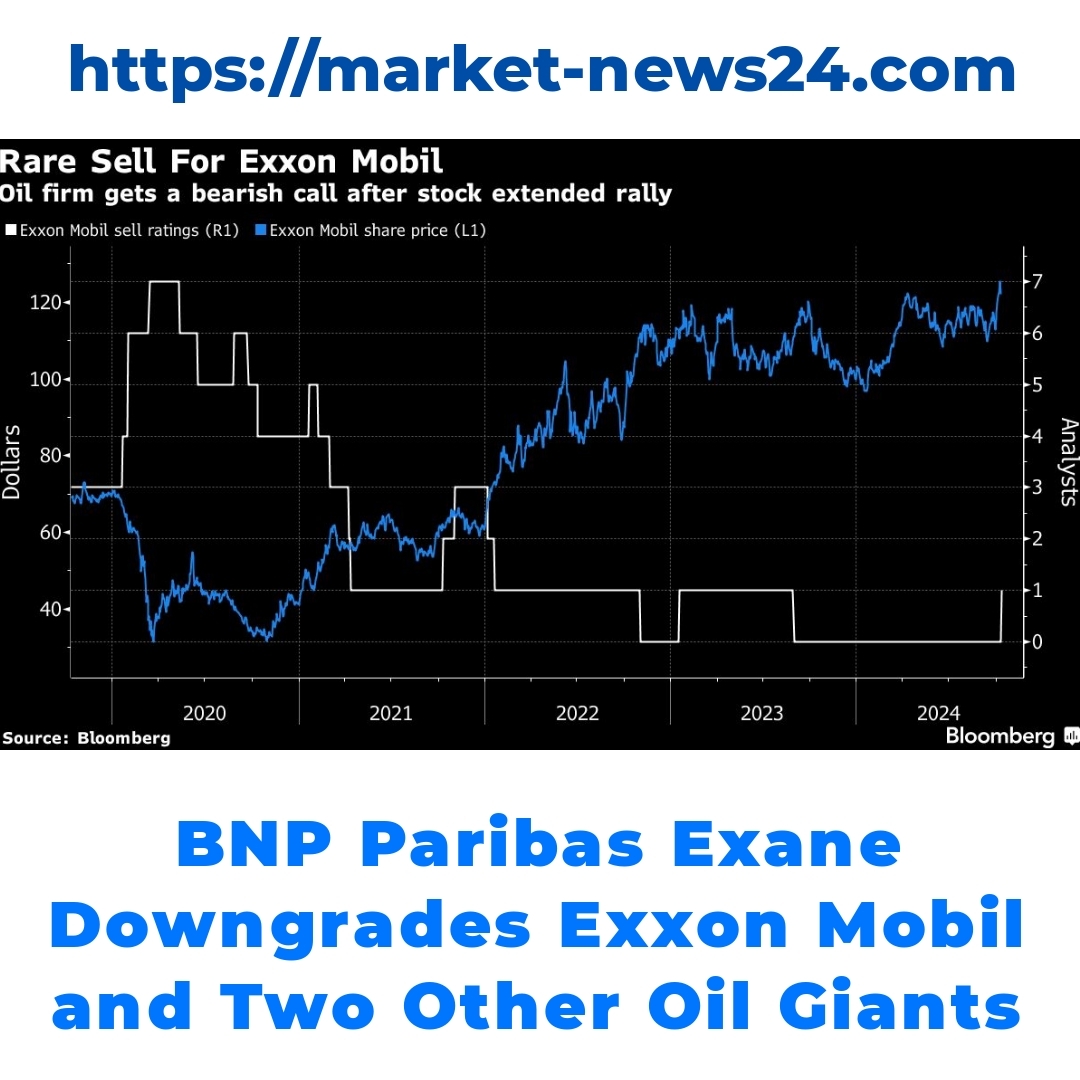

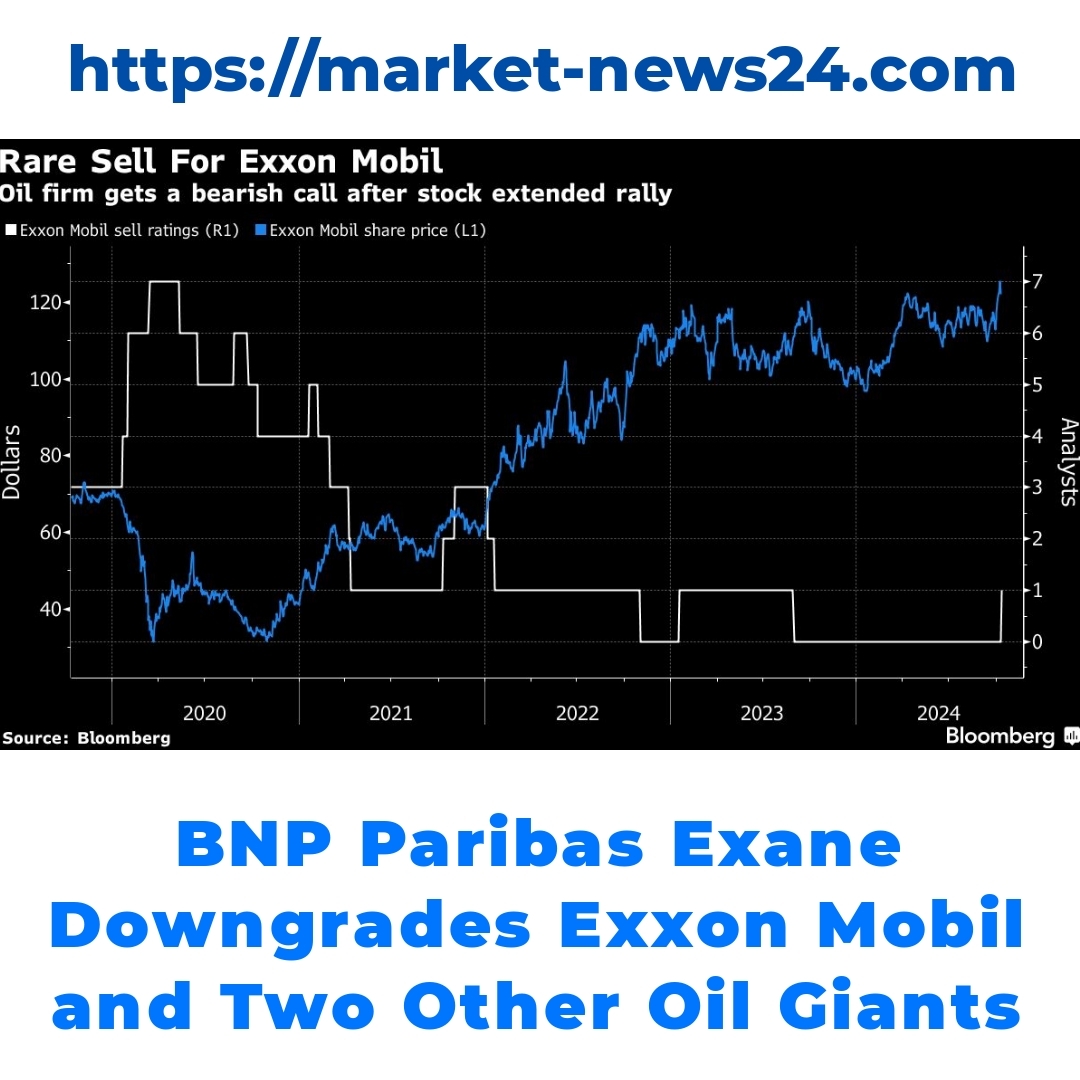

Taking a closer look at Exxon Mobil Corp., we can see a clear example of how oil company ratings impact investor sentiment. Leading up to its most recent downgrade, Exxon’s stock performance had begun to show signs of weakness, contributing to analysts reevaluating their outlook. Notably, Exxon received its first sell-equivalent rating from BNP Paribas Exane in over a year, signaling serious concerns about its future performance.

The implications of this rating downgrade are significant. For investors, this could mean rethinking their positions in Exxon Mobil Corp. and assessing the risks involved. The perception of Exxon has shifted, and understanding why this downgrade occurred is essential for making informed decisions moving forward.

Analyzing the Expected Decline in Crude Prices

Looking ahead, the expected decline in crude prices is another layer that investors must consider when evaluating oil company valuations. Typically, crude prices and oil company valuations are closely linked. If crude prices continue to decline, we will likely see further adjustments in oil company ratings.

The forecast for crude prices is leaning toward a downward trend, causing analysts to scrutinize the potential long-term impacts on oil stock valuations. Understanding the intricacies of the relationship between crude prices and oil companies is vital, especially if you are keeping an eye on market trends that may impact your investments.

Implications for Investors

As oil company ratings undergo changes, the implications for investors can be both complex and significant. The downgrading of these ratings may require you to rethink your investment strategy, especially in light of the ongoing volatility in crude prices. Recognizing the potential risks involved is just as important as identifying new opportunities.

Monitoring the oil market is a crucial step for investors aiming to mitigate risk and seize potential rewards. As analysts downgrade oil company ratings due to declining crude prices, being proactive can help you stay ahead in an unpredictable environment. Awareness of these ratings gives you insight into future market movements and the value of your investments.

Conclusion

In summary, rising concerns within the oil market have a significant impact on oil company ratings. As firms like BNP Paribas Exane adjust their analyses, it’s clear that staying informed about market trends is essential for making better investment decisions. For investors, being aware of the shifting ratings can provide a clearer pathway to navigate the complexities of the energy sector.

As you consider your next moves in the oil market, keep an eye on updates from credible sources like BNP Paribas Exane. It’s vital to remain informed and agile in a landscape where ratings can change quickly and influence financial outcomes dramatically.

Call to Action

Stay engaged with the evolving landscape of oil company ratings and crude prices. Follow industry updates and consider subscribing to financial news platforms for ongoing insights into oil industry analysis. Making informed decisions is your best strategy for navigating the challenges and opportunities in the oil market.

FAQ

What are oil company ratings and why do they matter?

Oil company ratings are evaluations made by analysts that reflect the financial health and market potential of oil companies. These ratings can influence investor confidence and stock prices, making them crucial for anyone looking to invest in the energy sector.

How do analysts impact oil company ratings?

Analysts assess various factors such as financial performance, management decisions, and economic conditions to determine their ratings. A downgrade can indicate potential risks, affecting investor perceptions and market trends.

What does a downgrade mean for investors?

A downgrade often suggests that an oil company’s stock may perform poorly, prompting investors to reconsider their positions. It signals a need for caution and can affect overall investment strategies in the oil market.

What are the implications of declining crude prices?

Declining crude prices typically lead to lower oil company valuations. Analysts may downgrade ratings in response, making it essential for investors to stay informed about market conditions that could affect their investments.

How should investors respond to rating changes?

- Reevaluate their investment positions based on the latest ratings.

- Monitor the oil market for potential risks and new opportunities.

- Stay informed about updates from reputable financial sources.

Why is the situation with Exxon Mobil Corp. noteworthy?

Exxon Mobil Corp. received a sell-equivalent rating from BNP Paribas Exane, the first in over a year, signaling serious concerns about its future performance. This case illustrates how changes in ratings can impact investor sentiment directly.

What should investors do to navigate the oil market effectively?

Investors should actively monitor oil company ratings and crude price trends to make informed decisions. Engaging with credible financial news sources can provide valuable insights into market dynamics.