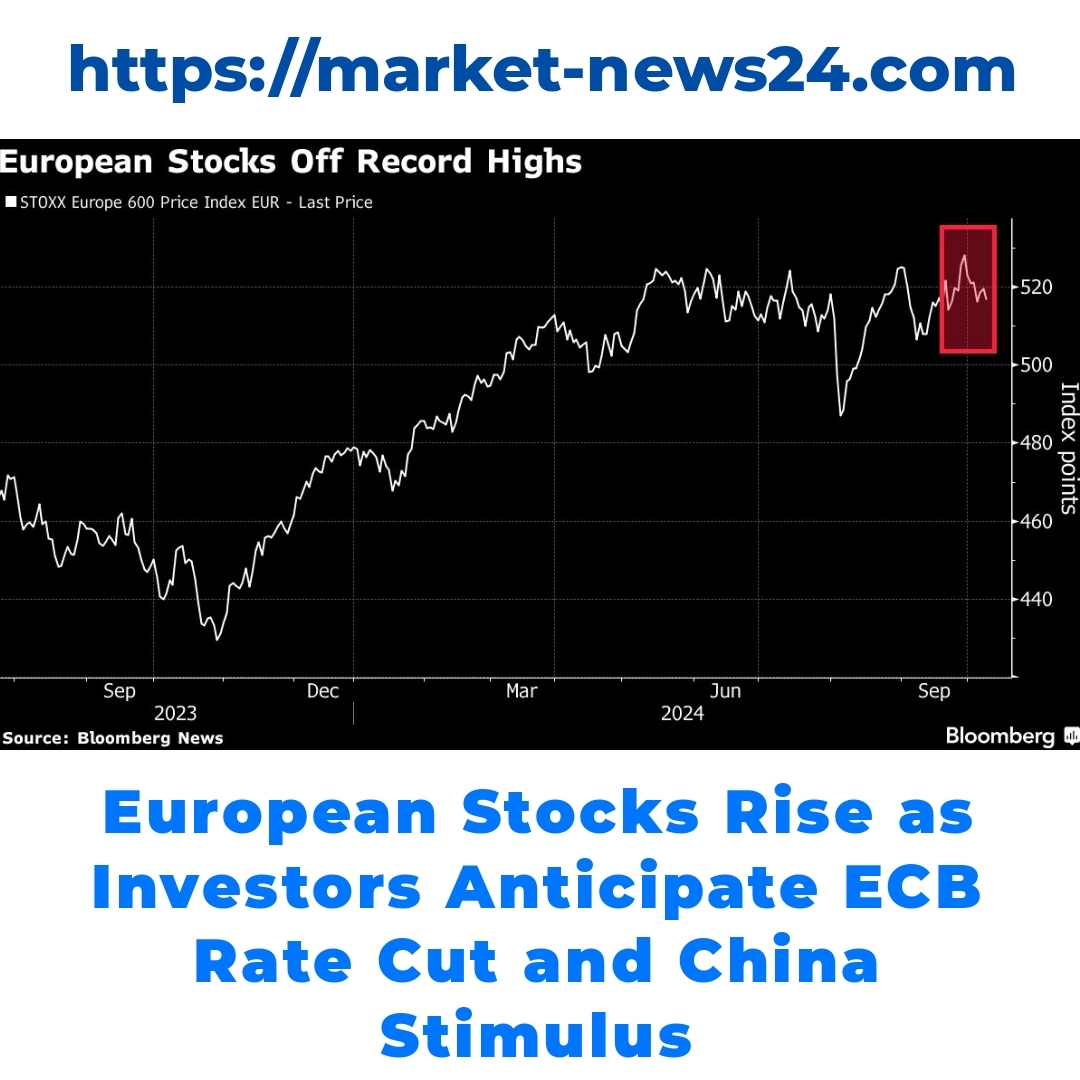

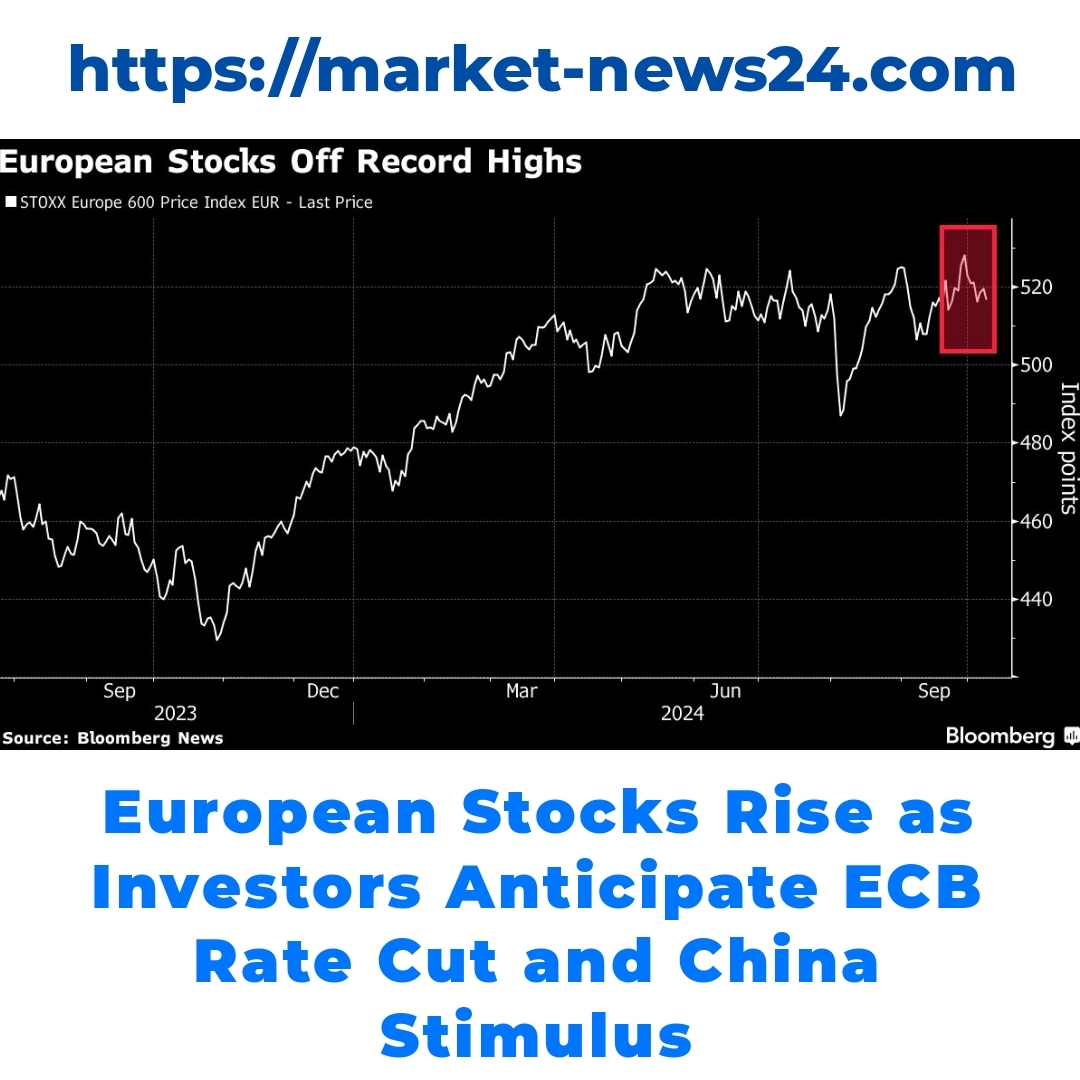

European stocks are currently experiencing a positive trend, driven by speculation surrounding potential interest rate cuts by the European Central Bank. Understanding the factors influencing European stocks is crucial for investors navigating this dynamic market, particularly in light of recent developments in global economic conditions, including stimulus measures from China.

Recent movements in European stocks have shown a positive trend, largely driven by speculation surrounding a potential interest rate cut by the European Central Bank. Investors are keenly watching these developments, as an interest rate cut can have significant implications for market performance. Lower interest rates generally lead to increased borrowing and spending, boosting economic activity. This speculated move by the Central Bank has certainly impacted investor sentiment positively, fueling optimism in the stock market.

The role of the European Central Bank can’t be overstated when assessing these market dynamics. Their policies directly influence the economic landscape within Europe. A potential interest rate cut could make financing more accessible for businesses and consumers, leading to higher investments and spending. Historically, when the European Central Bank has enacted rate cuts, European stocks have tended to respond favorably, as investors often interpret these moves as support for economic growth. It remains to be seen how this situation will unfold and whether the anticipated interest rate cut will occur soon.

Turning our attention to the global arena, China’s economic measures have started to create ripples in the financial markets, particularly in Europe. Recent stimulus packages introduced by the Chinese government aim to boost their economy amid ongoing challenges. These China stimulus measures affect European markets significantly, as many European companies rely on trade with China. For instance, recent reports indicate that increased demand for European goods from China has led to a positive outlook for several sectors, especially luxury goods and manufacturing.

Investor sentiment during this period remains a topic of keen interest. With changing economic conditions, many investors are adjusting their strategies regarding European stocks. The anticipation of an interest rate cut, coupled with positive news stemming from China, encourages a more optimistic outlook among investors. They are likely looking for opportunities in sectors that stand to benefit from increased consumer spending, such as travel, hospitality, and retail. Adjusting portfolios to capitalize on these trends can be crucial for maximizing returns in the current stock market environment.

When analyzing the overall economic prospects in light of these recent developments, it’s evident that European stocks could experience significant shifts in the coming weeks. Financial markets are closely monitoring news related to the European Central Bank and China’s economic policies. Investors and analysts are looking for signs of recovery and growth. Predictions suggest that if both the interest rate cut and China stimulus measures take effect, European stocks could see a substantial uptick. This might be an excellent time for investors to consider their positions within the market.

In summary, the current landscape for European stocks is evolving rapidly, influenced heavily by anticipated interest rate cuts from the European Central Bank and stimulating measures introduced by China. These factors serve to boost investor confidence and may contribute to positive stock performance in the near future. As the situation develops, it’s vital for investors to stay informed and be prepared to adjust their strategies accordingly. The financial markets remain dynamic, and knowing how to react to these changes can be the key to unlocking potential growth opportunities.

As we look forward, it’s essential to keep an eye on changes from the European Central Bank, as their policies will greatly impact European stocks. Subscribing to financial news sources will ensure that you are up to date with the latest developments, allowing you to navigate the stock market effectively. Understanding how the intricacies of interest rate cuts and China stimulus measures can influence your investments could provide a significant advantage in these uncertain times.

If you’re interested in further exploring these topics, consider reading more about how interest rate cuts and China stimulus projects impact European markets. The landscape is continuously shifting, and informed decisions are paramount for investors looking to thrive in the stock market.

FAQ

What is driving the recent positive trend in European stocks?

The positive trend in European stocks is primarily driven by speculation about a potential interest rate cut by the European Central Bank (ECB). Lower interest rates generally increase borrowing and spending, which boosts economic activity, leading to a more optimistic investor sentiment.

How does the European Central Bank influence the stock market?

The ECB’s policies significantly affect the economic landscape in Europe. An interest rate cut by the ECB is often seen as a move to support economic growth, which historically has led to favorable responses in European stocks. This makes financing more accessible for consumers and businesses.

What impact do China’s economic measures have on European markets?

China’s recent economic stimulus packages are positively affecting European markets. Many European companies rely on trade with China, and increased demand for European goods has improved outlooks for sectors like luxury goods and manufacturing.

What sectors should investors focus on amidst these developments?

Investors are likely to adjust their strategies to focus on sectors that may benefit from increased consumer spending, such as:

- Travel

- Hospitality

- Retail

What factors should investors monitor for future trends?

Investors should closely watch news regarding:

- The European Central Bank’s potential interest rate cuts

- China’s economic policies and stimulus measures

These developments could significantly impact the performance of European stocks in the coming weeks.

How can investors stay informed about market changes?

It’s important for investors to subscribe to financial news sources to keep updated with the latest developments. Understanding how interest rate changes and China’s stimulus measures can impact investments will provide a significant advantage in navigating the stock market.