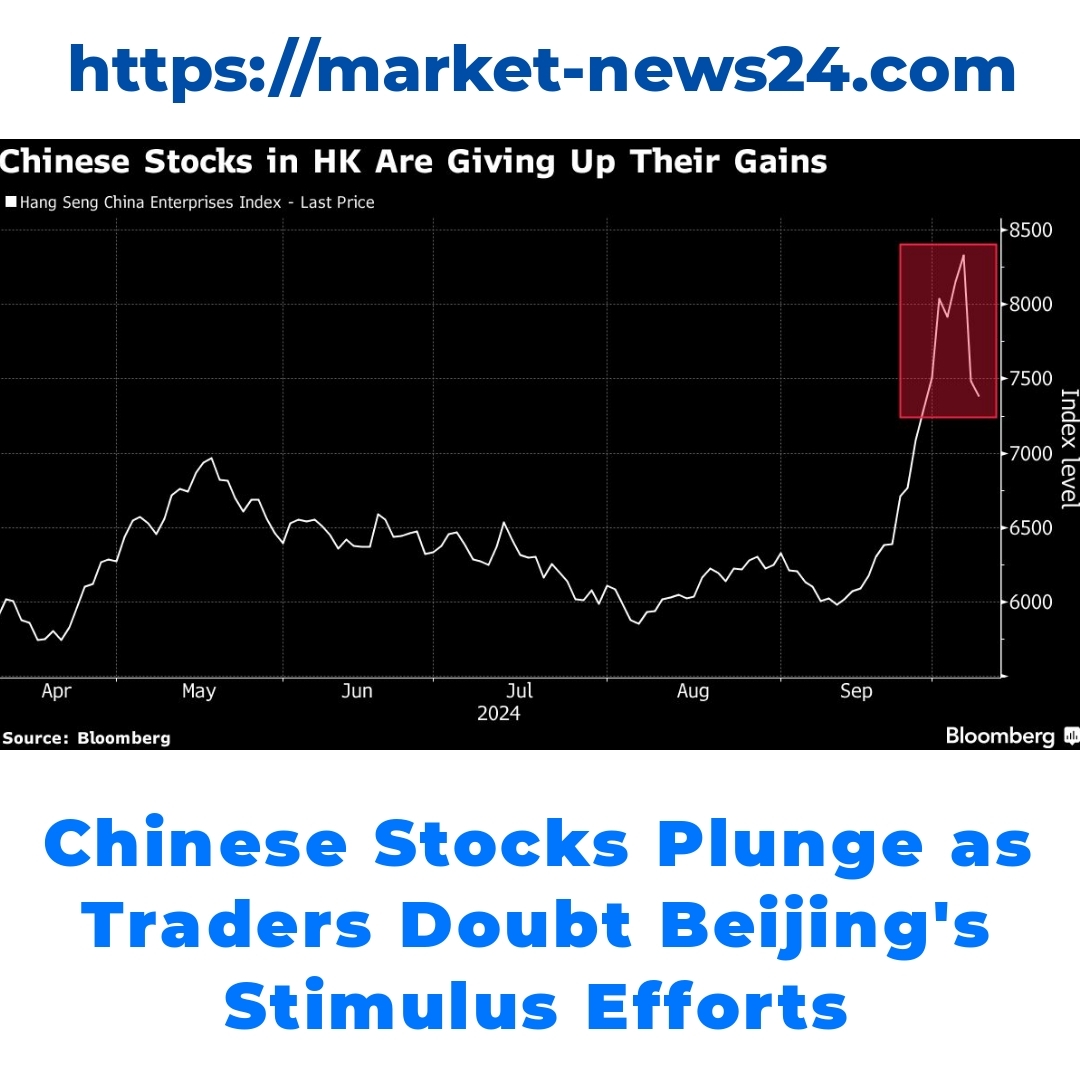

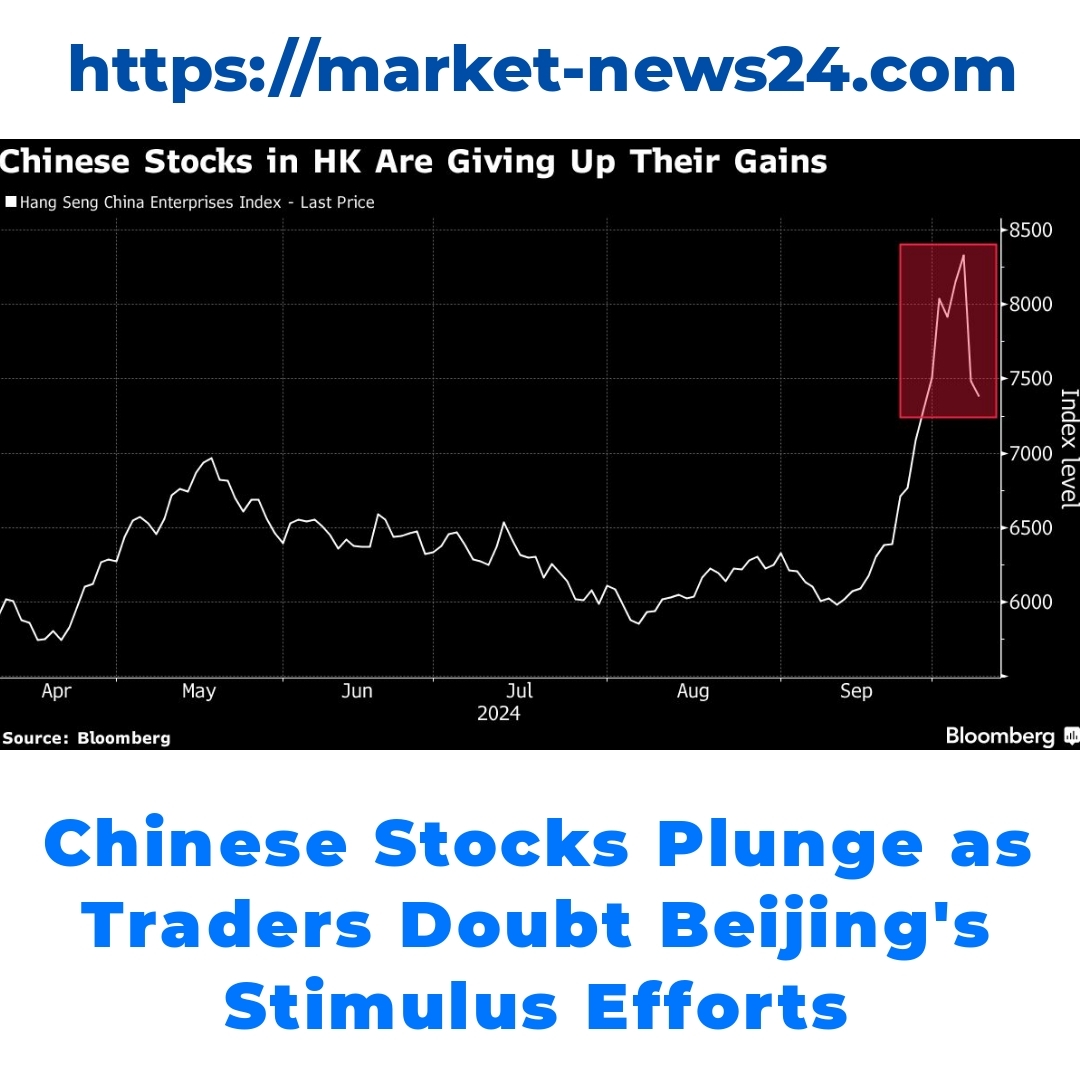

Chinese stocks have recently experienced their largest drop in four years, raising concerns among investors regarding the economic climate. Key factors contributing to this downturn include the effectiveness of Beijing stimulus measures and disappointing holiday-spending data. Understanding these dynamics is crucial for interpreting trader behavior and broader market trends.

The current state of Chinese stocks has been shaking investors, as onshore Chinese stocks have faced significant declines recently. If we take a step back and look at the performance over the past few months, we can see a noticeable downturn that aligns with historical trends of market volatility. Right now, market sentiment is playing a crucial role in determining how stock prices are moving up and down. What traders are feeling and thinking can often lead to dramatic shifts in the stock market.

Key Factors Contributing to the Stock Market Drop

Beijing Stimulus Measures

One of the main factors affecting Chinese stocks is the recent Beijing stimulus measures. The government rolled out these initiatives hoping to rejuvenate the economy. However, traders are showing clear signs of impatience. They’re not just waiting for announcements; they want to see effective implementation and tangible results. The perceived delays or ineffectiveness of these measures have only added fuel to the fire of uncertainty in the market.

Weak Holiday-Spending Data

Another factor that’s throwing a wrench into the works is the weak holiday-spending data that came out recently. Typically, during holidays, we expect a boost in consumer spending which signals economic growth. Unfortunately, the numbers were below expectations, which can cause concern about the short-term viability of the Chinese economy. This weak holiday spending has a direct impact on Chinese stocks, as it raises questions about consumer confidence and future economic stability.

Traders’ Reaction to Current Economic Policies

Traders are keeping a close eye on Beijing’s economic policies and are responding with a mix of skepticism and hope. Many are wondering what concrete actions the government will take to address these issues. There’s a significant amount of speculation about potential fiscal measures that could be implemented to stimulate growth. Right now, the sentiment among investors is a mixed bag; some are optimistic believing changes will come, while others are wary and opting to stay away from risky investments until they see more decisive action.

Broader Market Context

When we think about the current situation, it’s important to consider how onshore Chinese stocks are influenced by not just domestic pressures but international factors as well. The global economy and geopolitical tensions can have ripple effects that touch the Chinese market. Recent economic data has shifted overall market sentiment, creating a cautious atmosphere among investors. This caution can often lead to lower stock prices as traders become hesitant to put money into uncertain waters.

Future Outlook for Chinese Stocks

Looking ahead, what does the future hold for Chinese stocks? Many analysts are predicting a recovery, but this relies heavily on potential changes to the Beijing stimulus measures. If the government can respond effectively to concerns raised by traders and implement more impactful policies, we might see a rebound in onshore Chinese stocks. For investors navigating this tricky financial landscape, keeping a close watch on market sentiment, along with understanding the nuances of current economic events, will be key to making informed decisions.

Conclusion

In summary, the significant drop in Chinese stocks is tied closely to key factors like Beijing stimulus measures and holiday-spending data. The market’s reaction reflects a complex web of trader sentiment and economic indicators. Understanding these elements is crucial for predicting how the market may evolve in the future. As we move forward, it’s essential for investors to stay informed about economic indicators and government measures, as they can provide critical insights for trading decisions.

To remain successful in investing, keeping an eye on developments in the Chinese economy and stock market could make all the difference. Awareness and responsiveness to economic changes are vital for anyone looking to grow their investment portfolio in this volatile environment.

FAQ

What is causing the decline in Chinese stocks?

The decline in Chinese stocks is primarily attributed to:

- Beijing’s stimulus measures that are seen as ineffective or delayed.

- Weak holiday-spending data which raises concerns about consumer confidence and economic growth.

How are traders reacting to the current market conditions?

Traders are showing mixed reactions:

- Some remain optimistic, hoping for effective government actions.

- Others are skeptical and avoiding risky investments until clearer developments emerge.

What impact do international factors have on Chinese stocks?

International factors, including global economic shifts and geopolitical tensions, can influence Chinese stocks by creating a cautious investment atmosphere, which may lead to lower stock prices.

What should investors keep an eye on for future stock movement?

Investors should monitor:

- The effectiveness of Beijing’s stimulus measures.

- Economic indicators that affect consumer confidence.

- Market sentiment trends among traders.

Are analysts expecting a recovery in Chinese stocks?

Many analysts predict a potential recovery, but it largely depends on how well the government addresses current concerns through effective policies.