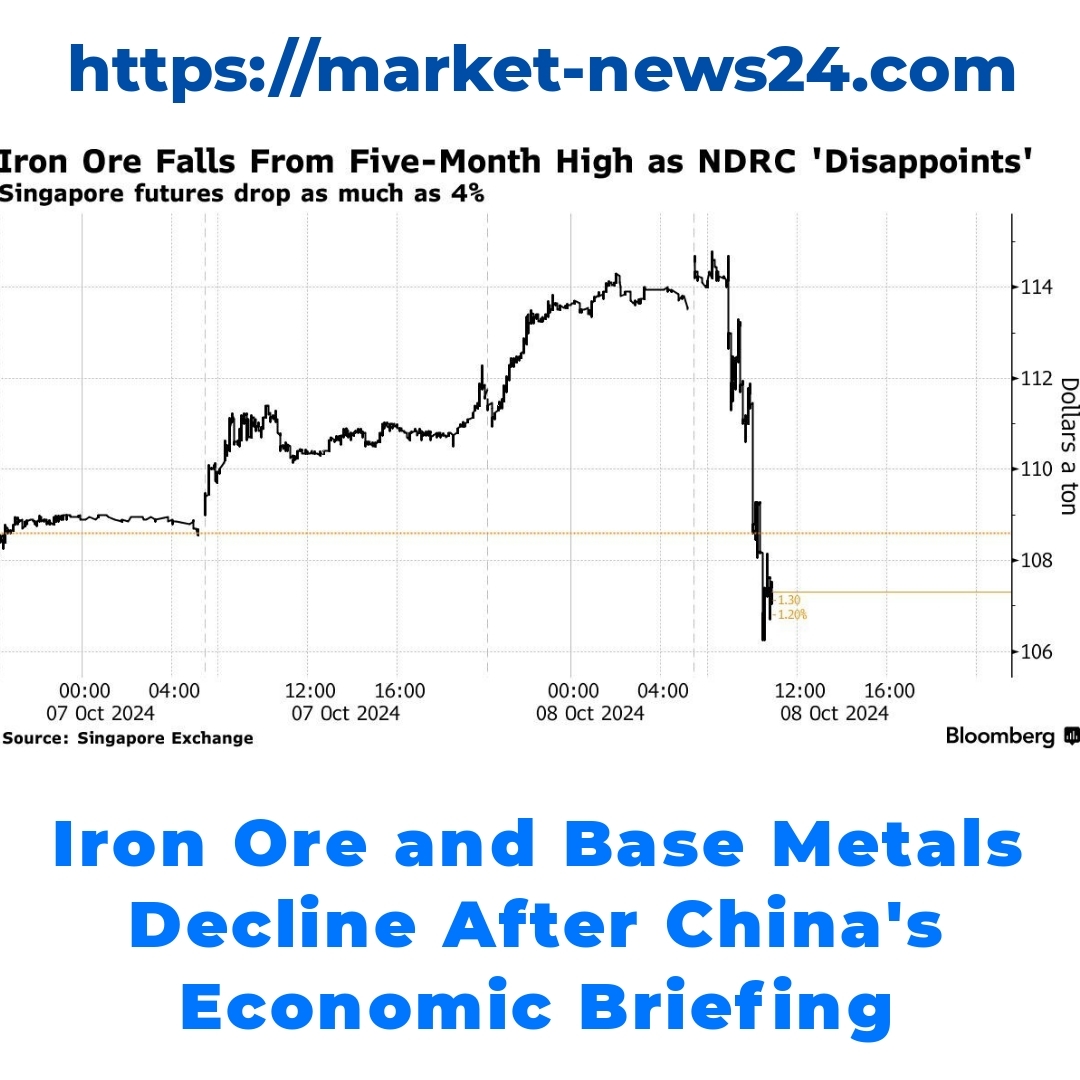

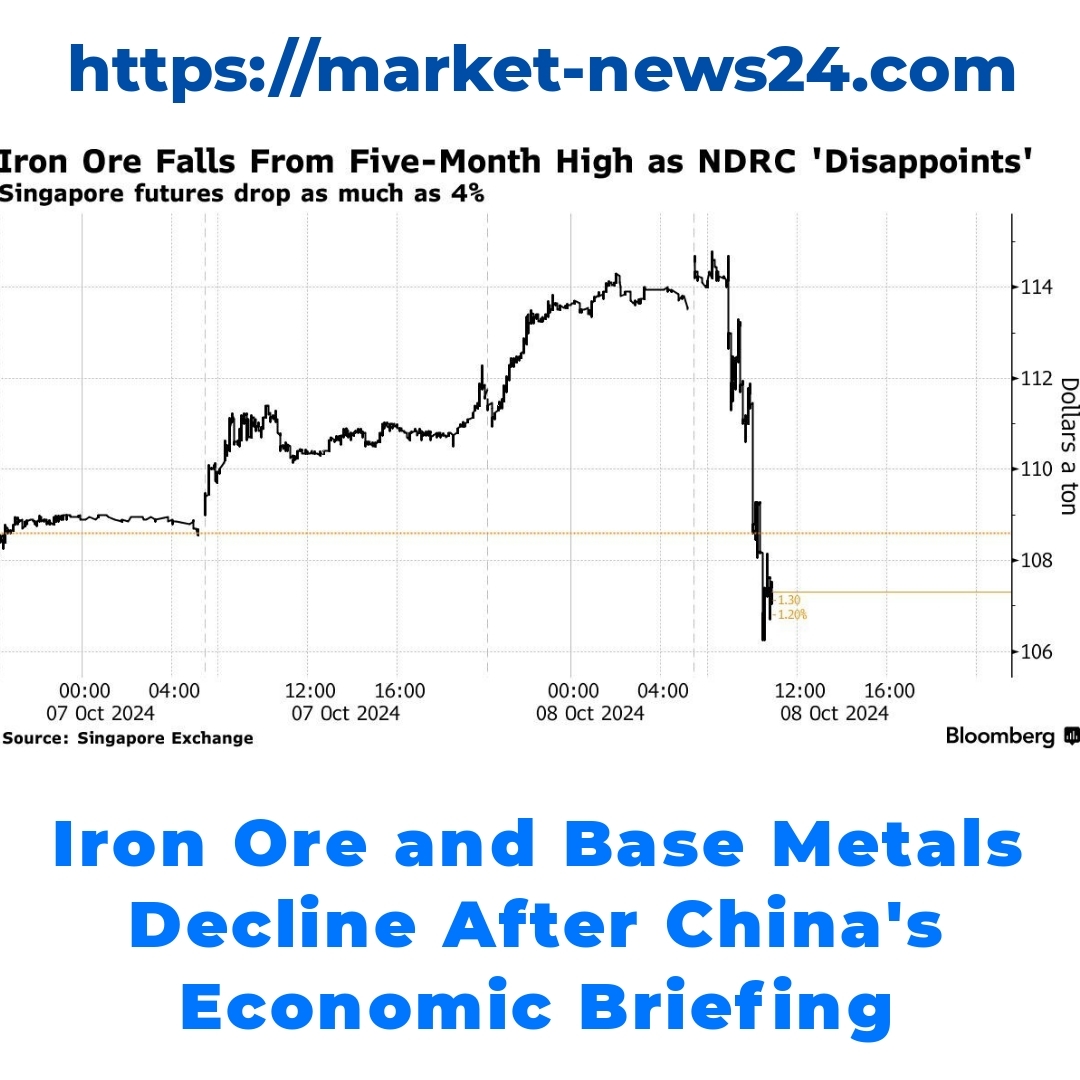

Recent fluctuations in Iron Ore Prices have captured market attention, particularly after reaching a five-month high before a sudden drop. This shift is significant, prompting a closer examination of various factors, including China’s economic policies and government spending, which play a crucial role in shaping both Iron Ore and Base Metals Market dynamics.

China’s Economic Briefing: A Turning Point

Recently, China’s top economic planner held a significant briefing that sent ripples through the market. One of the most notable aspects was the lack of new pledges aimed at boosting government spending. This announcement has serious implications for Iron Ore Prices, as any perceived weakness in government support often leads to market uncertainty.

After the briefing, the market reacted swiftly, with Iron Ore Prices experiencing a notable decline. Investors seemed to interpret the absence of new spending commitments as a potential slowdown in economic growth, which naturally affects demand for iron ore. Factors contributing to this price drop include diminished expectations for infrastructure projects and other industrial activities typically supported by government funding.

The Interconnectedness of Markets

Now, let’s transition to how these developments impact the Base Metals Market. When Iron Ore Prices fluctuate, they often set off a chain reaction throughout the base metals sector. This interconnectedness means that a downturn in iron ore can lead to a re-evaluation of demand for other metals as well.

Currently, the Base Metals Market is observing notable trends. For instance, with iron ore prices falling, some base metals like copper and aluminum might also experience price adjustments as investors reconsider their positions. Understanding these correlations is essential for anyone involved in trading or investing in metals.

Understanding China’s Economic Policies

Let’s dive into how China’s economic policies directly impact Iron Ore Prices. Specific policies such as production quotas, export tariffs, and investment in infrastructure play crucial roles in determining pricing trends. When the government adopts a more aggressive approach to stimulate growth, it typically leads to an increased demand for raw materials like iron ore.

Moreover, government spending holds a pivotal role in stabilizing the Base Metals Market. Historically, lower levels of government expenditure have corresponded with erratic price movements. As we look ahead, it’s vital to analyze historical data alongside current economic indicators to understand the projected effects of government spending on metal prices.

Recent Trends in the Commodity Market

Following China’s economic briefing, several noteworthy trends emerged in the commodity market. We’ve seen shifts in prices across various metals, with many investors reacting to the news. Notably, iron ore isn’t the only metal affected; commodities like copper and nickel are also experiencing volatility as market participants adjust their forecasts based on the new economic landscape.

Additionally, supply chain issues have further complicated the scenario. Disruptions in logistics and raw material sourcing are causing instability in metal prices. The links between iron ore prices, government spending, and supply chain conditions cannot be understated; these factors must be monitored to anticipate future market movements effectively.

Conclusion

In summary, the insights around Iron Ore Prices and the Base Metals Market reveal how vital it is to keep an eye on China’s economic policies and government spending. The recent fluctuations underscore that changes in one sector can cascade through interconnected markets, impacting prices and investment strategies.

Looking towards the future, the outlook for Iron Ore and base metals will depend largely on current economic indicators and policy decisions made by China. Investors would do well to remain vigilant, as these elements will shape the dynamics of the commodity market for months to come.

Call to Action

To stay ahead in this fast-paced environment, it’s important for readers to remain informed about commodity markets and continually track economic policies. By doing so, you can make more educated decisions regarding investments and understand the broader economic landscape.

Stay tuned for further detailed analyses and updates in the industry. Understanding the impact of China’s economic policies on Iron Ore Prices and the Base Metals Market is crucial for anyone looking to navigate this complex financial terrain.

FAQ

What happened during China’s recent economic briefing?

During the briefing, China’s top economic planner did not announce any new government spending commitments. This lack of support raised concerns about potential economic slowdown, particularly impacting iron ore prices.

How did the markets react to the briefing?

The markets reacted quickly, with iron ore prices falling significantly. Investors interpreted the absence of new spending pledges as a sign of decreased demand for iron ore, affecting overall market conditions.

Why are iron ore prices important for the base metals market?

Iron ore prices have a ripple effect on the base metals market. When iron ore prices drop, it often leads to reassessments of demand for other metals, such as copper and aluminum, resulting in price adjustments across the sector.

How do China’s economic policies affect iron ore prices?

China’s economic policies, including production quotas, export tariffs, and infrastructure investment, significantly influence iron ore pricing. A more aggressive approach to stimulating growth generally increases demand for raw materials like iron ore.

What trends have emerged in the commodity market since the briefing?

After the briefing, several trends surfaced, including price volatility in various metals. Besides iron ore, metals like copper and nickel are also experiencing fluctuations as investors adjust their outlook based on new economic conditions.

What role do supply chain issues play in the commodity market?

Supply chain disruptions are creating additional instability in metal prices. Issues with logistics and sourcing raw materials impact overall pricing, and the interconnectedness between iron ore prices and supply conditions is crucial to monitor.

What should investors do moving forward?

Investors should stay informed about China’s economic policies and monitor current economic indicators. Understanding the implications of these factors can help in making informed investment decisions in the commodity market.