Rio Tinto Group’s strategic focus on Arcadium Lithium Plc underscores its commitment to the evolving lithium sector, a crucial player in the energy-transition metals landscape. This partnership not only highlights the significance of lithium in renewable energy but also sets the stage for transformative industry developments.

Understanding the Lithium Market

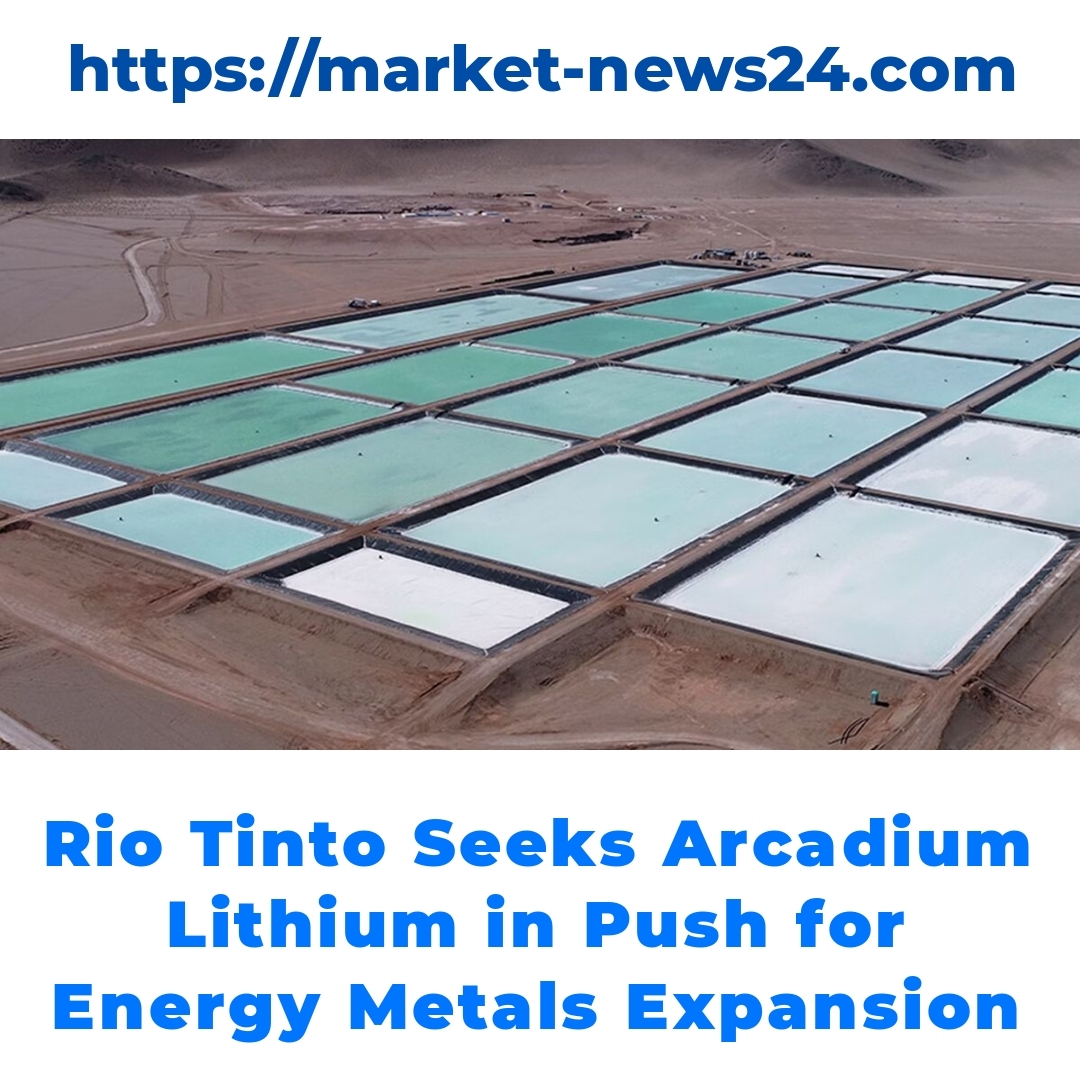

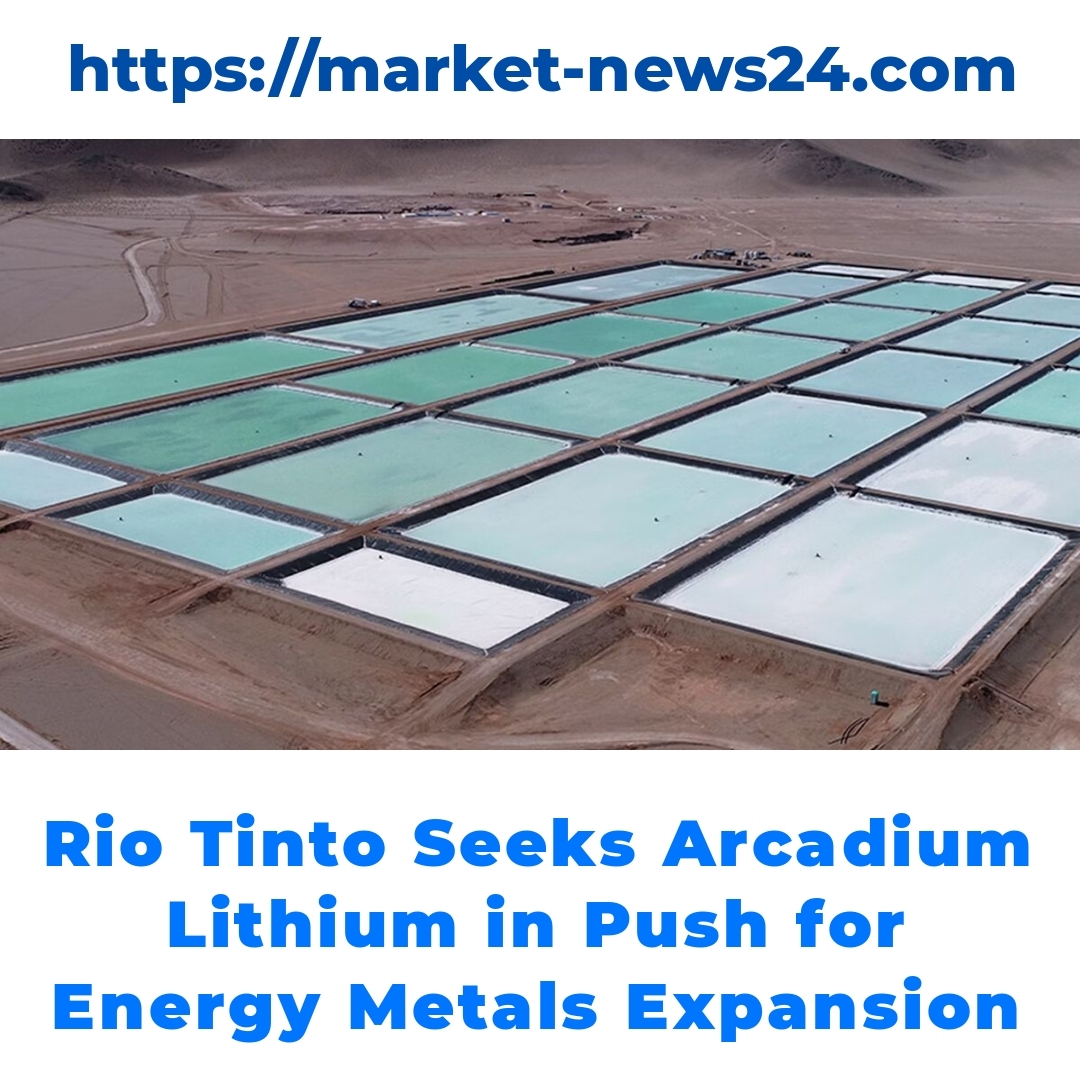

Overview of Lithium Mining

Lithium has gained incredible importance in recent years, especially given its vital role in renewable energy resources. From electric vehicles to energy storage systems, lithium is a key component in battery technology. The lithium market has been on the rise, fueled by increasing demand as countries shift toward cleaner energy solutions. This growth trend shows no signs of slowing down, making it a crucial focus for mining companies.

Energy-Transition Metals

Energy-transition metals are essential in the mining industry today. They include lithium, cobalt, nickel, and other metals that play significant roles in creating sustainable technologies. Lithium is right at the forefront of this category, as it’s seen as indispensable for the energy transition. As the world pivots to greener energy sources, understanding the relevance of lithium becomes even more critical for mining investors and companies alike.

Rio Tinto Group and Major Players in the Mining Industry

Profile of Rio Tinto Group

Rio Tinto Group is one of the giants in the mining industry, with a rich history and strong global presence. Over the years, Rio Tinto has been evolving its strategy to boost metal exposure, particularly in lithium. Given the rising demand for this metal, Rio Tinto’s strategic focus is not just a move for growth but a necessary step towards ensuring sustainability in its operations.

The Competitive Landscape

The competition in the lithium sector is heating up, with several major miners also seeking to increase their exposure to lithium. Companies are adjusting their acquisition strategies based on market demand. This competitive landscape means that players in the mining industry must continually innovate and adapt their strategies to keep up.

The Lithium Takeover Proposal: Rio Tinto and Arcadium Lithium

Details of the Lithium Takeover Proposal

Recently, Rio Tinto unveiled a lithium takeover proposal involving Arcadium Lithium Plc. This acquisition is set to be a game-changer for both companies involved. Key stakeholders are eager to see how this development will unfold, as it could have significant implications for their operations and the broader lithium market.

Implications for Mining Companies

The lithium takeover proposal carries wide-reaching implications for the future of mining companies. As major players like Rio Tinto explore acquisitions, it could signal a shift in how mining companies approach growth. This move not only reflects the surging demand for lithium but also may reshape industry dynamics as firms strive for metal exposure in an increasingly competitive environment.

Trends Shaping the Energy-Transition Metals Sector

Market Drivers

Several factors are driving the growing demand for lithium and other energy-transition metals. Government policies and incentives promoting renewable energy resources play pivotal roles in this dynamic. As countries implement stricter environmental regulations, the transition to renewable energy sources continues to accelerate, creating a pressing need for lithium.

How Major Miners are Increasing Lithium Exposure

Major miners are actively increasing their lithium exposure to capitalize on market trends. They are employing various strategies, including acquisitions and partnerships. For instance, Rio Tinto’s approach to the Arcadium Lithium acquisition showcases how serious these companies are about securing their future in the lithium sector. With the current push towards sustainability, other miners are likely to follow suit.

Conclusion

In summary, Rio Tinto’s approach to Arcadium Lithium highlights its commitment to the evolving lithium sector. This move could have lasting impacts on the mining industry as a whole. As the demand for energy-transition metals continues to grow, focusing on lithium is essential for companies looking to thrive in this new era. The partnership between Rio Tinto and Arcadium Lithium is more than just an acquisition; it’s a strategy for future growth in a rapidly changing landscape. The urgency to embrace energy-transition metals and leverage them for sustainable outcomes has never been more critical.

Frequently Asked Questions

1. Why is lithium important in today’s market?

Lithium is crucial because it’s a key component in battery technology, especially for electric vehicles and energy storage systems. As countries move towards cleaner energy sources, the demand for lithium has skyrocketed.

2. What are energy-transition metals?

Energy-transition metals include lithium, cobalt, nickel, and other metals that are essential for creating sustainable technologies. They play a significant role in the shift to greener energy solutions.

3. Who is Rio Tinto Group?

Rio Tinto Group is a major player in the mining industry with a strong global presence. They are focusing on increasing their lithium exposure to align with the rising demand for renewable energy resources.

4. What is the lithium takeover proposal involving Rio Tinto and Arcadium Lithium?

Rio Tinto has proposed an acquisition of Arcadium Lithium Plc. This move could significantly impact both companies and the broader lithium market.

5. How might the takeover proposal affect other mining companies?

The proposal could signal a shift in how mining companies pursue growth. As demand for lithium rises, firms may need to adapt their strategies to remain competitive.

6. What market drivers are contributing to the demand for lithium?

Key drivers include government policies and incentives supporting renewable energy, as well as stricter environmental regulations. These factors are accelerating the transition to cleaner energy sources.

7. How are major mining companies increasing their exposure to lithium?

Major miners are increasing their lithium exposure through acquisitions, partnerships, and innovative strategies, as demonstrated by Rio Tinto’s approach to acquiring Arcadium Lithium.