Fiscal support plays a critical role in stabilizing and driving growth in China’s economy. Recently, a prominent economist highlighted the potential for increased fiscal support, emphasizing opportunities for special debt and public spending as vital tools for economic advancement. This article delves into these aspects, focusing on *fiscal support China*.

Understanding China’s Fiscal Support Framework

Fiscal support is crucial for the stability and growth of China’s economy. It encompasses government policies aimed at stimulating economic activity through increased spending or tax cuts. This support helps cushion the economy during downturns and promotes recovery. Historically, the framework of fiscal support has evolved significantly in China, moving from a focus on simple spending to a more sophisticated approach that includes targeted investments and special programs.

In times of economic stress, fiscal support becomes even more critical to ensure that growth isn’t stunted. The Chinese government has often relied on expanding its budgetary expenditures to achieve economic stability. Such measures have played a vital role in steering the economy through turbulent times.

The Role of Special Debt in Economic Strategy

Special debt refers to the specific types of debt instruments used by local governments to fund infrastructure projects and public services. This mechanism is designed to stimulate economic activity and facilitate public spending. In the context of China, special debt has gained prominence as a tool for local governments seeking to enhance their economic contributions.

The use of special debt aligns well with Beijing’s broader economic strategies. By enabling local entities to finance large-scale projects, the government aims to enhance infrastructure, foster regional development, and create jobs. This could lead to a positive ripple effect on the economy, especially when considering the ongoing demand for public services and infrastructure improvements.

Analyzing the Expected Stimulus Package

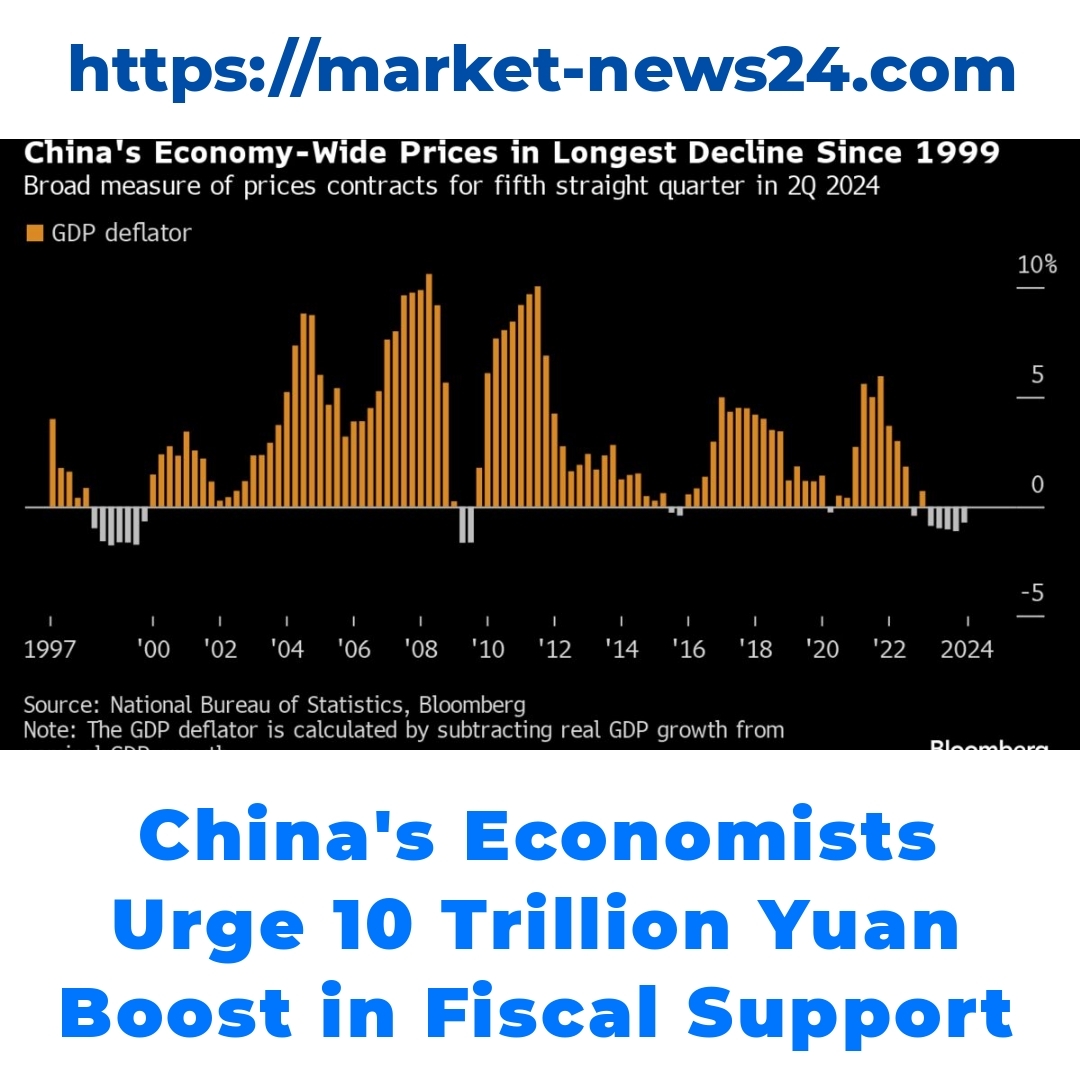

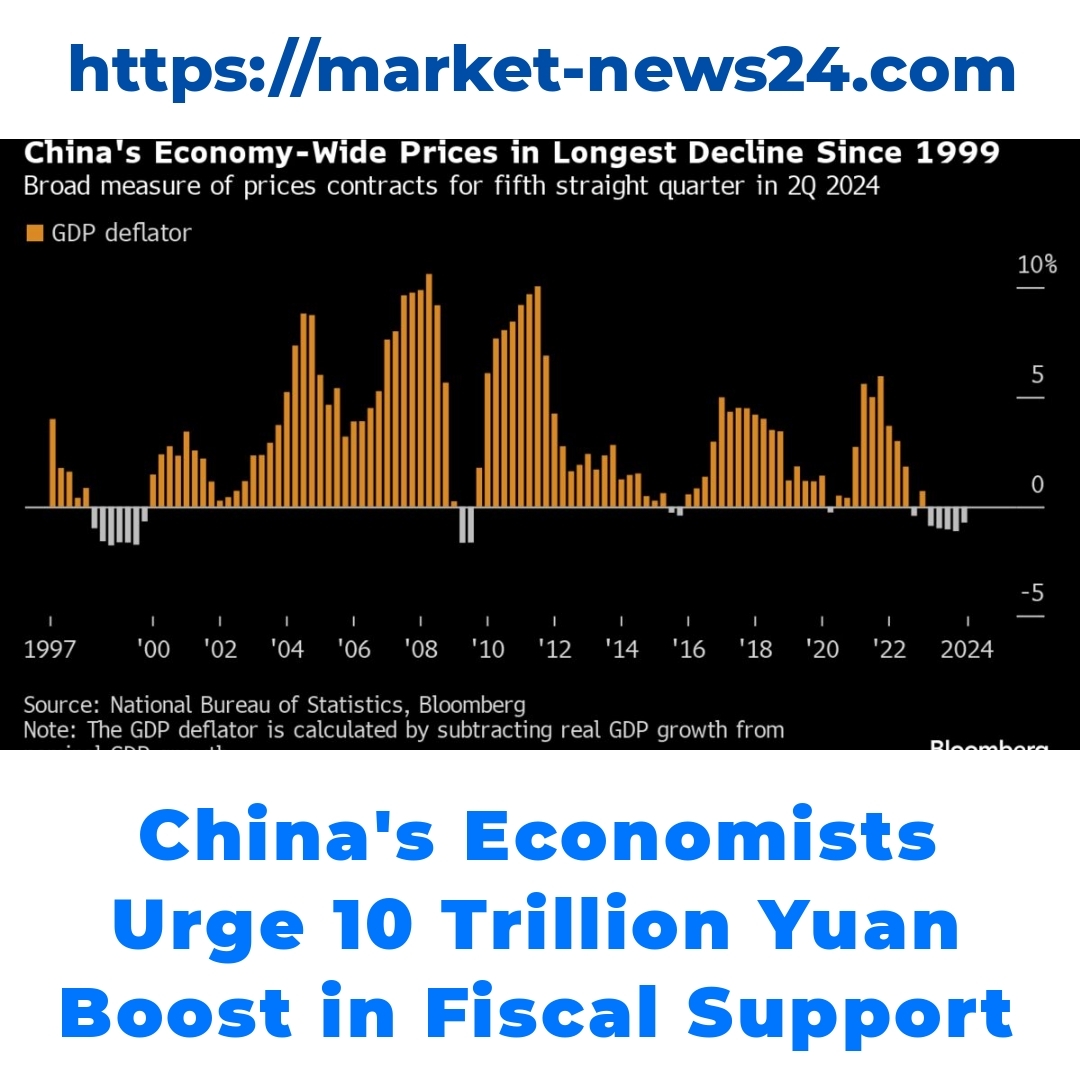

There is growing anticipation surrounding a new economic stimulus package in China. The objective of this package is to bolster economic growth, particularly in light of recent challenges such as global market fluctuations and domestic slowdowns. Experts have highlighted that increased fiscal support in China is necessary to navigate these complexities.

The expected outcomes from this stimulus package include enhanced consumer confidence, increased investments in infrastructure, and job creation across various sectors. These initiatives collectively form a robust strategy to rejuvenate China’s economy, allowing it to maintain a positive growth trajectory even amid uncertainties.

The Potential Impact on Economic Growth

Enhanced fiscal support has historically proven to spur economic growth in China. Looking back at previous instances, when Beijing’s fiscal policies were aggressive in adjusting expenditure, significant surges in economic activity followed. These policies often include a mix of both monetary and fiscal strategies designed to boost overall economic health.

Implementing large-scale public spending can lead to immediate job creation and increased consumer spending. As local governments engage in more ambitious projects, we can expect a surge in demand for materials and services, thereby stimulating broader economic activity and contributing to overall growth.

Risks and Challenges of Increased Fiscal Support

While the potential benefits of ramping up public spending are alluring, there are also risks involved. Increased fiscal support can lead to ballooning government debt if not properly managed. If local governments overextend themselves in debt issuance, the resulting financial strain could cause long-term economic issues.

Moreover, effective debt management becomes crucial in ensuring that this strategy translates into sustainable economic growth. If not handled with caution, excessive borrowing could undermine fiscal health and reduce the government’s ability to respond to future economic challenges.

Conclusion

In summary, there is significant potential for fiscal support in China, particularly through mechanisms like special debt and targeted public spending initiatives. As Beijing continues to refine its economic strategies, the implications of these policies will not only impact China’s economy but could also resonate on a global scale. The future of fiscal support in China is likely to play a crucial role in shaping economic environments both domestically and internationally.

Call to Action

Stay informed about developments in China’s economic policies and their broader implications. Consider subscribing to newsletters or following economic analysts to gain insights on fiscal strategies and how they might affect you. The landscape of fiscal support China is ever-changing, and keeping abreast of these changes can be crucial for understanding the global economy.

FAQ

What is China’s fiscal support framework?

China’s fiscal support framework includes government policies that aim to stimulate economic activity through increased spending or tax cuts. It’s essential for promoting stability and growth, especially during economic downturns.

How has the fiscal support framework evolved in China?

The framework has shifted from a focus on simple spending to a more sophisticated approach, which includes targeted investments and special programs tailored to specific economic challenges.

What role does special debt play in the economy?

Special debt allows local governments to borrow funds specifically for infrastructure projects and public services. This approach supports government objectives by stimulating economic activity and enhancing public spending.

What are the expected benefits of the upcoming stimulus package?

- Boosting economic growth

- Enhancing consumer confidence

- Increasing investments in infrastructure

- Creating jobs across various sectors

How does increased fiscal support impact economic growth?

Historically, enhanced fiscal support leads to economic growth by creating jobs and increasing consumer spending. It can trigger a demand for materials and services, stimulating broader economic activity.

What are the risks associated with increased fiscal support?

Increased fiscal support can lead to rising government debt if not managed properly. Overextending through excessive borrowing can create long-term financial strain and undermine the government’s ability to tackle future economic issues.

How important is debt management in fiscal support?

Effective debt management is crucial to ensure fiscal support leads to sustainable growth. Poor handling of debt can adversely affect fiscal health, creating challenges for the government’s future economic responses.