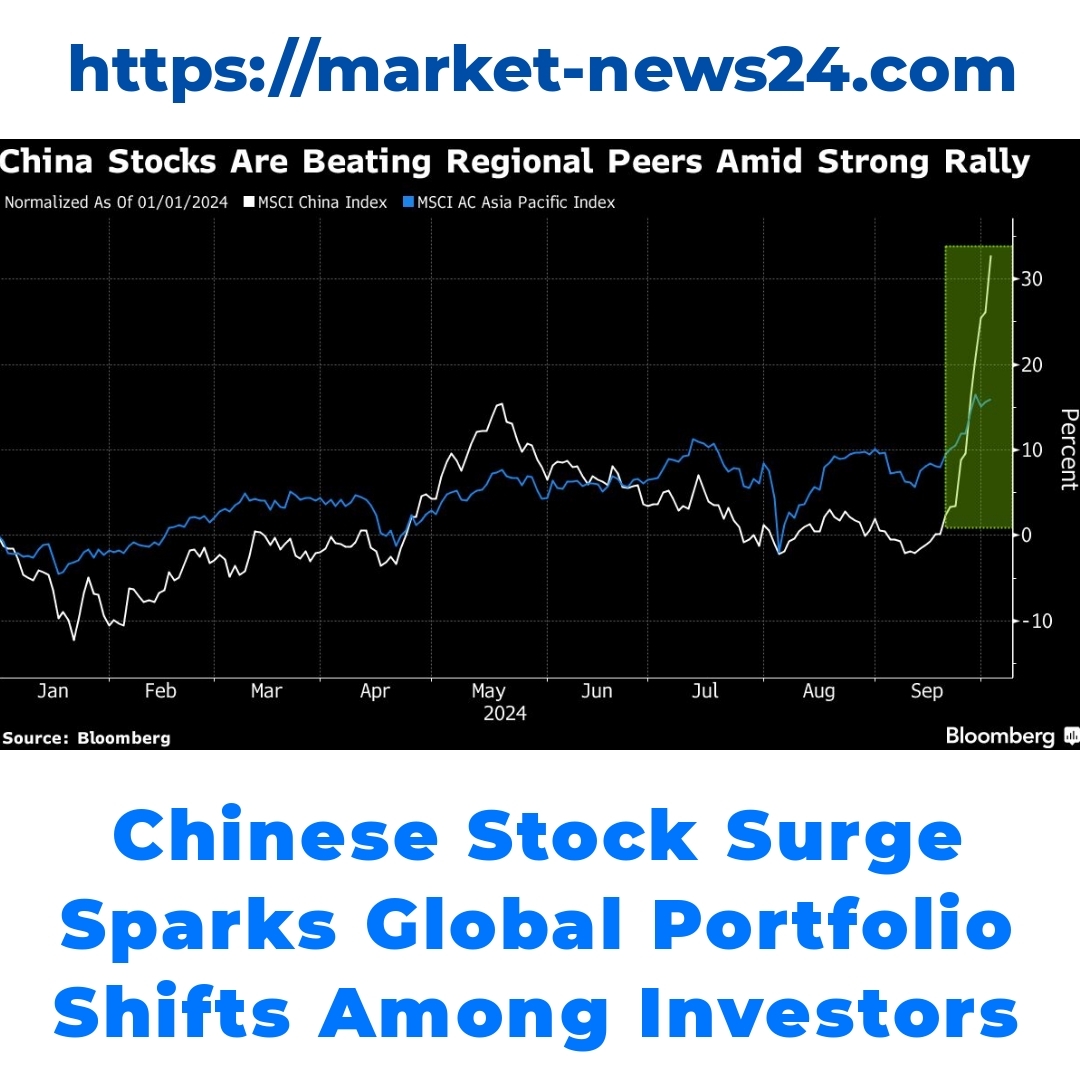

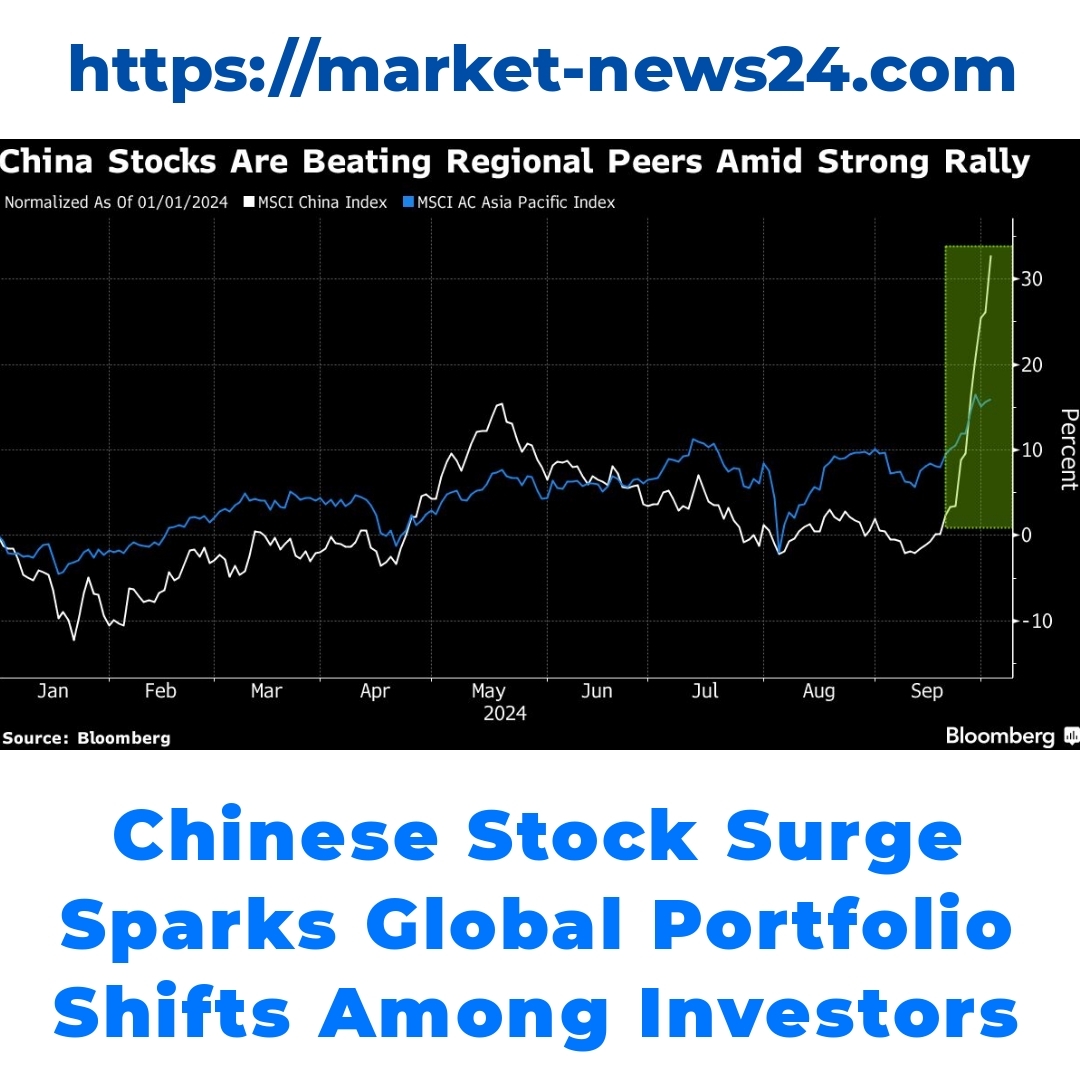

Recently, Chinese stocks have experienced a remarkable rally, capturing the attention of global investors. Understanding the factors behind this market rebound is crucial for those looking to adjust their investment strategies. As we explore this dynamic, the implications for global portfolios cannot be overlooked.

Chinese stocks recently showcased a robust rally that has piqued the interest of investors around the globe. This strong rebound is rooted in several underlying factors, including economic policy adjustments and positive corporate earnings reports. To fully grasp the implications of these developments, it’s vital for investors to stay informed about the current trends and statistics reflecting this stock market rally. As we delve deeper, we’ll explore how these movements in the Chinese market are influencing global portfolios.

Overview of the Chinese Market Rebound

The rebound in Chinese stocks can be attributed to various factors. First, the government has implemented supportive policies aimed at reviving economic growth. Additionally, strong corporate earnings have also played a significant role, lifting investor confidence. The current trends in the market show a notable increase in indices, with many stocks reaching new highs.

Some key statistics to note include:

- A surge in the Shanghai Composite Index by over 15% in the past quarter.

- Increased foreign investments, as international funds look to capitalize on the recovery.

- High trading volumes indicating strong market participation.

All these factors contribute to a significant outlook for the Chinese market rebound, making it an area of keen interest for investors worldwide.

Investor Sentiment and Chinese Stocks

Following the rally, investor sentiment has shifted positively toward Chinese stocks. Many investors who previously held back are now encouraged by the market’s upward trajectory. This change in perception is vital as it influences investment strategies significantly. Investors are starting to see the Chinese market as a viable option for growth, moving away from prior hesitations rooted in past uncertainties.

Impact of Chinese Stock Recovery on Global Investments

The recovery of Chinese stocks is sending ripples through global portfolios. Investors are re-evaluating their asset allocations, considering the potential risks and benefits associated with increased exposure to Chinese equities. On one hand, the rebound offers opportunities for increased returns; on the other, it comes with inherent risks related to China’s political and economic environment.

Some potential impacts include:

- Increased investment inflows into Chinese markets, benefiting global portfolio performance.

- The need for diversification strategies to mitigate risks associated with heavy reliance on a single market.

- Greater interest in sectors like technology and consumer goods, which are pivotal in China’s growth trajectory.

As investors assess these dynamics, it’s clear that understanding the implications of the Chinese stock recovery is essential for global portfolio management.

Strategies for Diversifying Portfolios with Chinese Stocks

Now that we’ve seen a strong rebound in Chinese stocks, it’s crucial for investors to adopt effective strategies for diversifying their portfolios. Here are several actionable tips:

- Start with sector analysis: Identify which sectors within the Chinese market are poised for growth, such as technology or green energy.

- Consider ETFs: Exchange-Traded Funds that focus on Chinese stocks can provide an easy and diversified entry point for global investors.

- Stay updated on government policies: Understanding how regulatory changes impact specific sectors will help in making informed investment decisions.

By following these strategies for diversifying portfolios with Chinese stocks, investors can better position themselves to take advantage of the ongoing market recovery.

How to Invest in Chinese Stocks After the Market Rebound

For those interested in diving into Chinese stocks after this market rebound, here are some guidelines and expert advice to consider:

- Start small: If you are new to Chinese investments, consider starting with a small portion of your portfolio and gradually increase your exposure as you become more comfortable.

- Research thoroughly: Examine individual companies, their financial health, and growth potential to find opportunities that align with your investment goals.

- Utilize financial advisors: Seeking guidance from investment professionals who understand the Chinese market can provide valuable insights.

These best practices for evaluating opportunities in the Chinese market will help guide investors as they navigate this recovery phase.

Future Outlook for Chinese Stocks and Global Portfolios

Looking ahead, the future outlook for Chinese stocks appears optimistic, though caution is warranted. Predictions indicate that continued policy support and economic recovery will likely drive further growth in this market. As the situation evolves, maintaining a diverse portfolio will become increasingly important for investors, allowing them to capitalize on the opportunities presented by the changing landscape.

In summary, the recovery of Chinese stocks carries significant implications for global portfolios. Investors must remain adaptable, and understanding the importance of ongoing portfolio diversification amid changing market conditions will be paramount as they navigate potential opportunities ahead.

In conclusion, we’ve explored how the recent rally in Chinese stocks impacts global portfolios. Investors are encouraged to adapt their strategies, taking into account the evolving investor sentiment and market opportunities. With Chinese stocks on a rebound, seizing these opportunities can be crucial for achieving effective portfolio growth.

Frequently Asked Questions

What is causing the rally in Chinese stocks?

The recent rally in Chinese stocks can be attributed to factors such as:

- Supportive government policies aimed at boosting economic growth.

- Strong corporate earnings that are boosting investor confidence.

- A significant increase in trading volumes and foreign investments.

How much has the Shanghai Composite Index risen?

The Shanghai Composite Index has surged by over 15% in the past quarter, indicating strong market performance.

What should investors consider regarding Chinese stocks?

Investors should consider the following:

- Current market trends and statistics indicating a recovery.

- The potential risks and rewards associated with investing in Chinese equities.

- Sector analysis to identify growth opportunities.

How can investors diversify their portfolios with Chinese stocks?

Here are some strategies for diversifying with Chinese stocks:

- Conduct sector analysis to find promising industries like technology or green energy.

- Consider Exchange-Traded Funds (ETFs) focused on Chinese equities for easier entry.

- Stay informed about changes in government policies that might affect investments.

What is the future outlook for Chinese stocks?

The future outlook for Chinese stocks is optimistic due to:

- Expected continued government policy support.

- Anticipated economic recovery which may fuel further growth.

However, investors should remain cautious and maintain diversification strategies.

How can beginners invest in Chinese stocks?

For those new to investing in Chinese stocks, consider these guidelines:

- Start with a small investment and gradually increase your exposure.

- Research individual companies thoroughly to find suitable opportunities.

- Seek advice from financial professionals familiar with the Chinese market.