Money Market Funds have become increasingly popular as safe investment vehicles, offering low-risk options for investors seeking to enhance their financial security. In recent times, these funds have experienced record cash inflows, drawing attention despite the looming regulatory overhaul. This article delves into the implications of these changes and explores how Money Market Funds continue to attract substantial investments amidst challenges.

The Rise of Money Market Funds

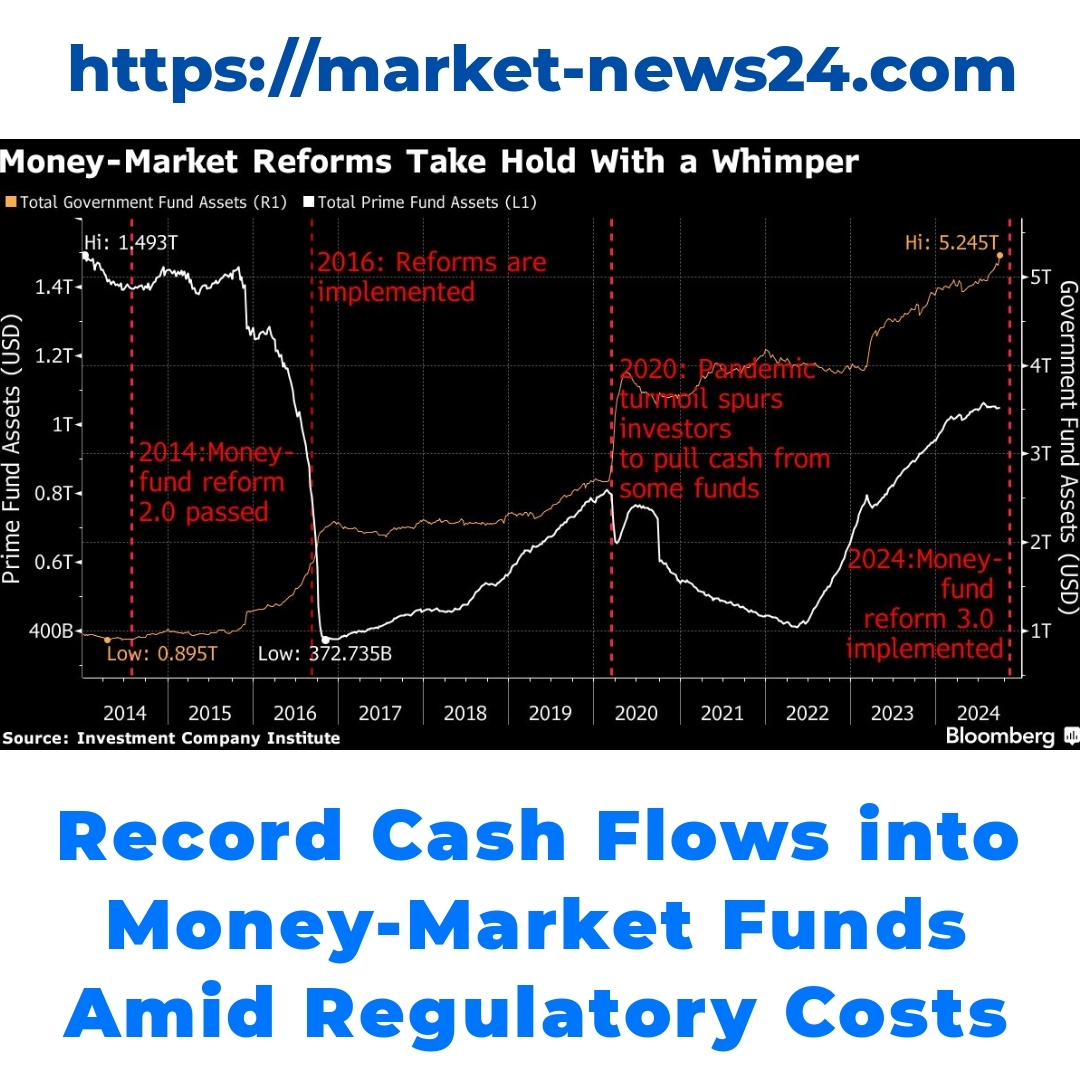

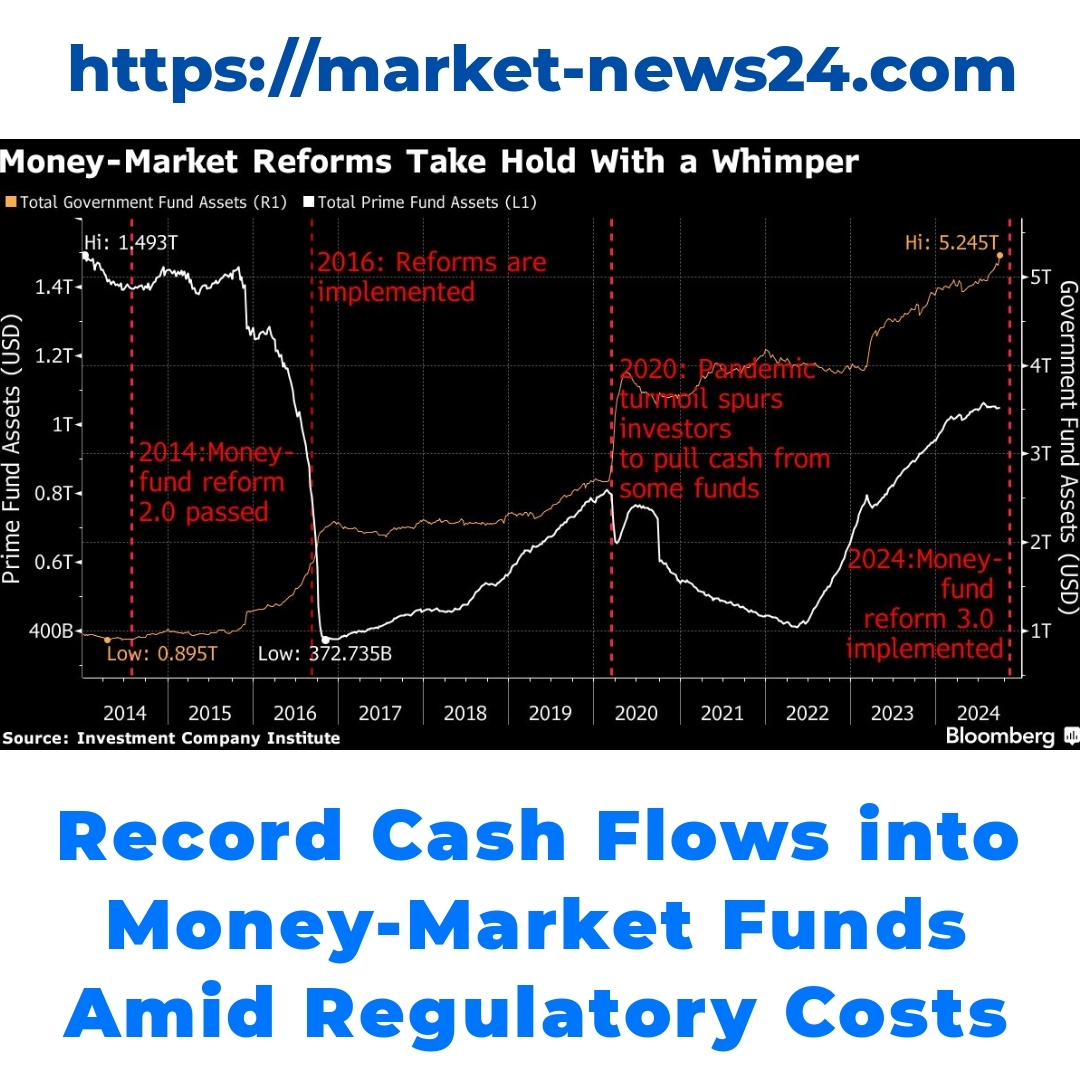

Money Market Funds are seeing an incredible surge in popularity, evidenced by record cash inflows. In just the past year, these funds have attracted billions of dollars, and it’s easy to see why. Investors are taking refuge in these low-risk investments amidst an uncertain economic landscape. Statistics tell the story; recent reports indicate that cash inflows into Money Market Funds have reached historic levels, with funds almost doubling their assets compared to previous years. Factors fueling this trend include rising interest rates, which enhance potential returns, and a growing desire for stability among investors.

Understanding Money Market Funds

So, what exactly are Money Market Funds? Essentially, these are investment vehicles that focus on short-term debt instruments, offering a safe place to park cash. They aim to provide liquidity, safety, and a modest yield, making them an attractive option for those looking to manage their cash effectively.

One of the crucial features of Money Market Funds is their low-risk nature. By investing in short-term, high-quality securities like treasury bills and commercial paper, they manage to maintain a stable value. This characteristic makes them invaluable in cash management strategies, as they help individuals and businesses maintain financial security without the risk typically associated with stock investments.

The Impact of Regulatory Overhaul on Money Market Funds

As the investment landscape evolves, a significant regulatory overhaul is underway. Authorities are proposing changes aimed at increasing transparency and stability within the financial markets. One of the key changes in the pipeline involves new mandatory fees that could impact both investors and fund managers. While these changes are designed to protect the market, they also raise questions about the future of Money Market Funds.

The implications of these regulatory changes may vary. While some fear that mandatory fees could reduce overall returns, other experts argue that these measures will instill greater investor confidence in the long run. Fund managers are bracing for adjustments, as navigating these new waters will be critical in maintaining their fund’s attractiveness.

Benefits of Investing in Money Market Funds in 2023

Investing in Money Market Funds presents several advantages as we navigate through 2023. For starters, these funds are relatively liquid; investors can access their money with ease when needed. Additionally, they provide a hedge against market volatility, making them an appealing option for risk-averse individuals.

When comparing Money Market Funds with other short-term investments, the stability and safety they offer stand out. While other options like stocks may give higher returns, they also come with higher risks. In the current environment of fluctuating interest rates, Money Market Funds can be a smart move for maintaining healthy returns while keeping risk at bay.

How Money Market Funds Are Attracting Record Cash Despite Regulatory Changes

Despite the challenges posed by the regulatory overhaul, fund managers have developed strategic approaches to attract investment. Many are focusing on enhancing communication with investors, clearly outlining the benefits of these funds and how they can fit into an overall investment strategy.

For instance, some successful case studies show Money Market Funds adapting to the regulatory environment by offering incentives or promoting unique features that offset potential fees. In doing so, they not only maintain their client base but also attract new investors looking for stability in uncertain times.

Conclusion

To sum it up, Money Market Funds are more popular than ever, drawing record cash inflows even amidst regulatory challenges. The combination of low-risk investment opportunities and the continued appeal of cash management solutions makes these funds a vital part of many investors’ portfolios.

As we look toward the future, it’s crucial to understand how these changes may impact the investment landscape. Many investors might want to consider adjusting their strategies to include Money Market Funds, particularly given the current trends and potential regulatory shifts.

What are Money Market Funds?

Money Market Funds are investment vehicles that primarily invest in short-term debt instruments. They provide a safe place for individuals to park cash while aiming for liquidity, safety, and a modest yield.

Why have Money Market Funds become so popular recently?

In recent times, Money Market Funds have gained significant popularity due to:

- Record cash inflows, attracting billions in investments.

- Rising interest rates enhancing potential returns.

- Increasing demand for stability amid economic uncertainty.

What are the benefits of investing in Money Market Funds?

Investing in Money Market Funds offers several advantages:

- Liquidity: Easy access to funds when needed.

- Low Risk: Helps mitigate risks compared to stocks.

- Stability: Ideal for risk-averse investors looking for steady returns.

How do regulatory changes impact Money Market Funds?

Recent regulatory changes aim to increase transparency and stability but may come with new mandatory fees impacting both investors and fund managers. While some fear reduced returns, others believe these changes will enhance investor confidence long-term.

How are fund managers attracting investment despite regulatory challenges?

Fund managers are employing various strategies, such as:

- Enhancing communication with investors to highlight the benefits of Money Market Funds.

- Offering incentives or unique features that mitigate the effects of potential fees.

Can I access my money easily in a Money Market Fund?

Yes, one of the key features of Money Market Funds is their liquidity, allowing investors to access their money relatively easily when necessary.

Are Money Market Funds a good option for cash management?

Absolutely! Money Market Funds are great for cash management, as they combine safety with the potential for modest returns, making them an important part of many investment strategies.