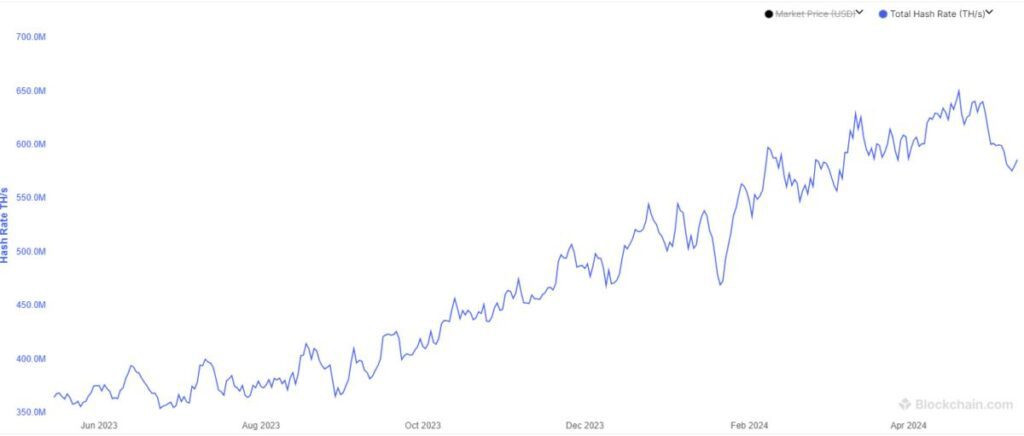

The Bitcoin hash rate has experienced a significant dip as miners switch off unprofitable ASICs following the recent halving event. This drop in computational power could potentially impact the network’s security and transaction processing capabilities. Stay updated on this developing story with TradingView News.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Bitcoin hash rate is taking a hit as mining firms switch off unprofitable rigs post the fourth Bitcoin halving. The network’s hash rate fell to a low of 575 exahash per second on May 10 before bouncing back slightly to 586 EH/s. This decline is due to miners shutting down rigs, as per a post by James Butterfill from CoinShares.

As per a report by CoinShares, the hash rate is expected to surge over the next year, despite the recent drop. The report forecasts a rise to 700 exahash by 2025, with a possible 10% decline post-halving. Increased costs of Bitcoin mining and rising electricity prices are contributing to this trend.

Infrastructure and energy costs play a crucial role in Bitcoin mining profitability. Smaller mining operations with older, less energy-efficient equipment are more at risk post-halving. TeraWulf, one of the largest mining firms, worth over $670 million, plans to expand operations despite the decrease in block rewards.

However, the key to mining profitability lies in electricity costs. Older ASIC models like S19 XP and M50S++ operate at a loss with electricity prices above $0.09/kWh. Miners need to optimize energy costs, improve mining efficiency, and secure hardware procurement to sustain profitability in this challenging environment.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Why is the Bitcoin hash rate dipping post-halving?

– Miners are turning off unprofitable ASICs due to reduced mining rewards.

2. What is causing miners to turn off their ASICs?

– The halving cut the block reward in half, reducing profitability for some miners.

3. How does a lower hash rate affect Bitcoin?

– A lower hash rate can result in slower transaction processing times and increased network congestion.

4. Is the dip in hash rate permanent?

– It’s possible that some miners will return once Bitcoin’s price increases or mining difficulty decreases.

5. How does the dip in hash rate impact the security of the Bitcoin network?

– A lower hash rate could potentially make the network more susceptible to 51% attacks, as there are fewer miners securing the network.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators