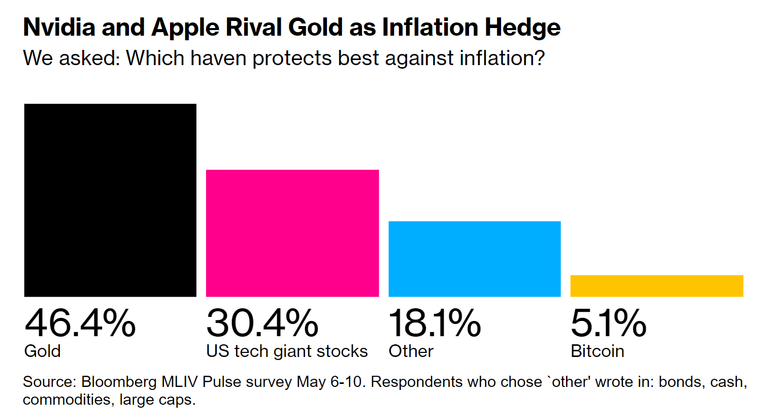

A recent Bloomberg poll revealed that tech stocks are increasingly overshadowing gold as a safe haven investment choice. Investors are flocking to tech stocks for their potential for high returns, leaving traditional safe-haven assets like gold in the dust. This shift in the Market reflects changing investor attitudes towards risk and reward in the current economic landscape.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

The latest Bloomberg Markets Live Pulse survey reveals that U.S. tech stocks are gaining ground as a hedge against inflation and currency depreciation, challenging gold’s traditional role. Survey participants showed a preference for American tech giants like Apple, Nvidia, Amazon, and Meta over gold when it comes to protecting against rising prices. Interestingly, Bitcoin, despite its recent price surge, was chosen by only 5% of respondents as their top choice for hedging against inflation.

With inflation being a top concern for 59% of respondents, the upcoming U.S. CPI report for April is eagerly awaited to gauge the direction of price pressures. While inflation has eased from its peak in 2022, it remains above the Federal Reserve’s target. In the event of a recession, survey respondents favored Treasury bonds over tech stocks as a safer investment option, reflecting a cautious outlook on the economy.

On the currency front, the U.S. dollar remains the preferred safe haven choice, with nearly 75% of respondents selecting it. Regionally, opinions varied, with the dollar receiving strong support in North America, Asia, and Europe. Spot gold prices are currently down, trading at $2,337.46 per ounce.

It’s essential to note that the views expressed in this article are solely those of the author and may not align with Kitco Metals Inc. The information provided is for informational purposes only and should not be considered as financial advice. Kitco Metals Inc. and the author do not accept responsibility for any losses incurred from acting on this information.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Why are tech stocks challenging gold’s safe haven status?

Tech stocks are becoming increasingly popular among investors as they offer the potential for high returns in a growing Market.

2. How are tech stocks impacting the value of gold?

Tech stocks are now seen as a more attractive investment option compared to gold, leading to a decrease in demand for the precious metal.

3. Is it safe to invest in tech stocks instead of gold?

Investing in tech stocks can be risky due to their volatile nature, so it’s important to research and understand the Market before making any investment decisions.

4. Can gold regain its safe haven status in the future?

It’s possible for gold to regain its safe haven status if there is a significant economic downturn or global crisis that causes investors to seek out more stable assets.

5. Should investors consider diversifying their portfolio to include both tech stocks and gold?

Diversifying your investment portfolio is generally a good strategy to reduce risk, so it may be beneficial to consider holding both tech stocks and gold to balance out your investments.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators