Cryptocurrency investing can be a risky game, and there are some dangers that many investors may not be fully prepared for. In this article, we will explore three potentially brutal risks that could impact your investments in the world of digital currencies. From Market volatility to security breaches, it’s important to be aware of the potential pitfalls before diving into the world of cryptocurrencies.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Investing in cryptocurrencies like Bitcoin, Solana, and Dogwifhat comes with a unique set of risks that even experienced stock investors may not be prepared for. While volatility, macroeconomic issues, and cybersecurity threats are common, there are other risks to consider as well.

One such risk is network congestion, where transactions can fail for days due to overloaded networks. This can trap investors in positions they may want to exit. To avoid this, long-term holding is recommended over short-term trading.

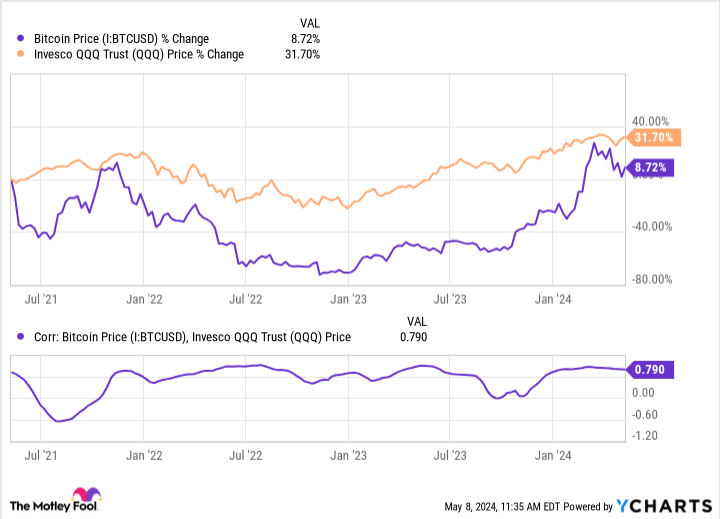

Another risk is unexpected correlations between cryptocurrencies and traditional assets like stocks. This can lead to limited diversification in a portfolio, making it vulnerable to downturns. It’s important to diversify with uncorrelated assets to mitigate this risk.

Additionally, poor liquidity and high slippage are concerns when trading smaller cryptocurrencies. Large buy or sell orders can significantly impact prices, resulting in reduced returns. To avoid this, consider avoiding cryptocurrencies with small Market caps and use dollar-cost averaging to minimize volatility impacts.

Overall, being aware of these less common risks in the cryptocurrency Market can help investors better prepare and protect their portfolios from potential losses.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What are the potential risks associated with investing in cryptocurrencies?

Cryptocurrencies are highly volatile and can experience sudden price fluctuations, regulatory changes, and security breaches.

2. Are my investments in cryptocurrencies secure?

Cryptocurrency investments are not insured like traditional bank deposits, so there is a risk of losing your investment due to hacking or fraud.

3. What is the risk of regulatory crackdowns on cryptocurrencies?

Governments around the world are starting to regulate cryptocurrencies, which could lead to restrictions on trading and investment, impacting the value of your holdings.

4. Can I lose all my money by investing in cryptocurrencies?

Yes, there is a possibility of losing all your investment in cryptocurrencies due to Market crashes, technological failures, or other unforeseen circumstances.

5. How can I protect myself from potential cryptocurrency risks?

It is important to do thorough research, diversify your investments, use secure wallets, and only invest money that you can afford to lose.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators